Take the opportunity to peek behind the curtain of TheOldEconomy paid membership.

It is time to introduce First Quantum Minerals, a major copper miner with assets in Panama. The article was initially published for TheOldEconomy Paid Member in May 2024.

Mining is one of the toughest businesses. A mining company faces legal constraints, environmental restrictions, labor issues, inflationary pressures, and political uncertanity. However, those challenges also bring high-risk reward opportunities.

An Event-driven strategy is one approach to transforming this opportunity into actionable trades. In today's report, I present an asymmetric bet in copper mining. The idea is pure Event-driven play.

Before I jump into details, I like to present you with a checklist for event-driven ideas.

Event-Driven Checklist Ideas

Event-driven plays are one of the simplest (not the easiest) ways to gain the proverbial Alpha. However, before jumping into the rabbit hole of searching for such opportunities, we must know what we are looking for.

In a few paragraphs, I outline the criteria for selecting such ideas:

· An adequate balance sheet ensures the company's ability to survive. In this case, liquidity is more critical than solvency. The company's ability to cover its debts has more weight than its capital structure. The 150% debt-to-equity limit does not apply when looking for event-driven ideas.

· The company owns high-quality tangible assets. Examples are Rockhopper's Sea Lion oil field, Gabriel Resources' Rosia Montana, Northern Dynasty's Pebble, and Braskem's industrial facilities. All these assets share the common trait of being among the top ten in their segment and located in a niche dominated by scarcity. These assets will become increasingly valuable.

· Low cost relative to net assets and competition. In more cases, I am looking to buy dollars for cents based on net assets. Of course, there are rare exceptions that generate cash flow. Today’s stock pick is such.

· The presence of at least one catalyst event with a defined timeframe. The deadline does not have to be a specific day, but within a few months, it should be specific enough. Examples are General elections (Argentina and Argentine equities), new sets of sanctions (shipping and energy), or court decisions (Burford Capital vs Argentina).

Having an event catalyst is an absolute must in all positions I hold. In event-driven trades, its weight is even greater. Not infrequently, these are companies on the brink of bankruptcy. They often do not generate cash flow, have significant debt, and operate in challenging jurisdictions, and in some cases, all of the above.

In other words, this type of investment carries significant risks, and the longer we are in a position, the more exposed we are to these risks. Therefore, selecting such trades depends mainly on catalyst events' availability (and quality). By having defined time frames, we can plan to make a few entries, mitigating the risk.

Resource Nationalism 101

First Quantum Minerals is one of the world's largest copper miners. Until it closed its mine in Panama, Cobre Panama, it ranked among the top mines by annual production. In November 2023, the Panamanian government reminded of growing global entropy by closing the Cobre Panama mine, owned by First Quantum. This event reminds us of the rise of resource nationalism.

The current elites in countries rich in natural resources exploit this theme to attract an electorate. It works exceptionally well in Latin America, where populism, regardless of the political spectrum, has a centuries-old tradition. Recent years have reminded us of this again.

The cost of resource nationalism is indeed high, not just for the mining conglomerates but also for the country's population. The closure of mines, such as Cobre Panama, not only results in the loss of highly skilled jobs but also hampers regional infrastructure development. The countries attacking mining companies often lack a skilled workforce and adequate infrastructure. The result is stagnating economic growth and development potential, directly impacting the lives of the local population.

However, when these same countries attempt to exploit their mineral deposits, they often cause significantly more environmental damage than foreign mining companies would. This is primarily due to the lack of trained local personnel and adequate infrastructure.

Resource nationalism, like all low-cost populist measures, is primarily aimed at one thing—the popularity of those implementing it. Unfortunately, its long-term economic viability is often disregarded.

The situation in Panama is textbook leftist populism. Protests led by the trade unions have blockaded the country. The latter gives enormous power to their benefactors. Argentina before the election of Javier Milei is also a case in point.

Panama's complete 25-day blockade cost $1.7 billion. By comparison, Panama's GDP is about $75 billion per year. The revenue flowing into Panama's coffers from the operation of the Cobre mine is about 3.0% of GDP. At the end of the day, the price will be paid by the same ones who blocked the roads through higher taxes and/or declining quality of public services.

First Quantum, Cobre Mine, and Panama

The outcome of the First Quantum idea depends on the relationship between the company, Panama, and the Cobre Panama mine. I think Cobre is at least as necessary to Panama as it is to First Quantum. In other words, finding a way out of the situation is (will be) among the priorities of the Panamanian government.

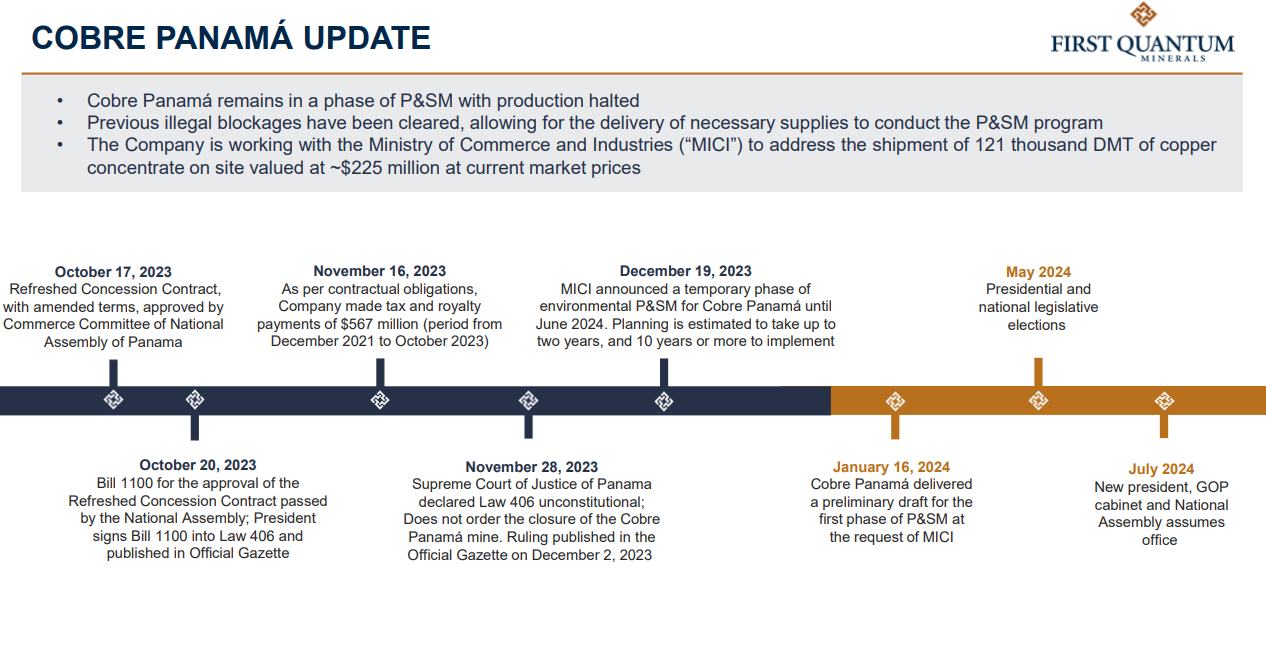

The following graph shows the chronology of the closure of Cobre Panama.

Step three shows precisely how much First Quantum contributes to the Panamanian economy. From October 2021 to December 2023, the company contributed $567 million in taxes and royalty levies.

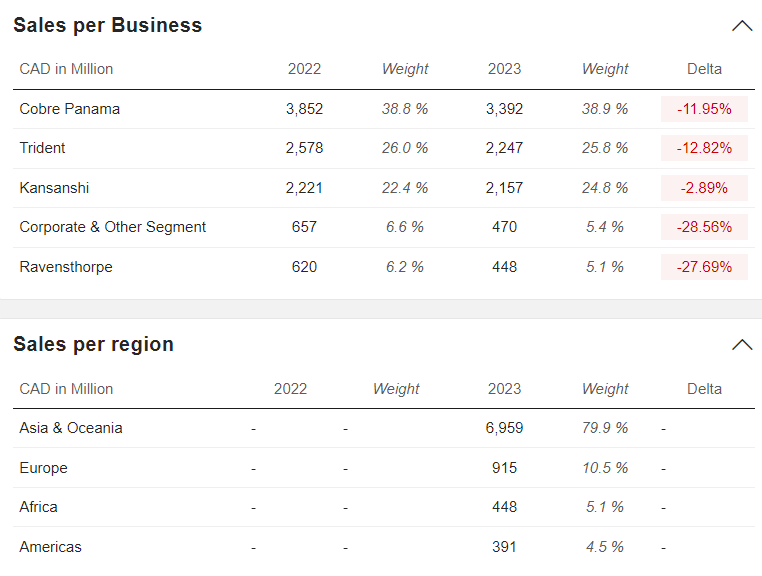

Now, let's see how vital the Cobre mine is to FM. It is responsible for about 40% of the company's revenue.

The closure of Cobre squeezed FM's revenues and profits. The company has other operating mines and several projects in progress, but these cannot compensate for the 40% revenue drop. Also, FM will need capital to develop the remaining mines, which will become increasingly scarce.

Shrinking revenues and profits reduce the capital available for reinvestment, plus FM's attractiveness as a borrower. The enterprise will find raising capital on favorable terms more challenging.

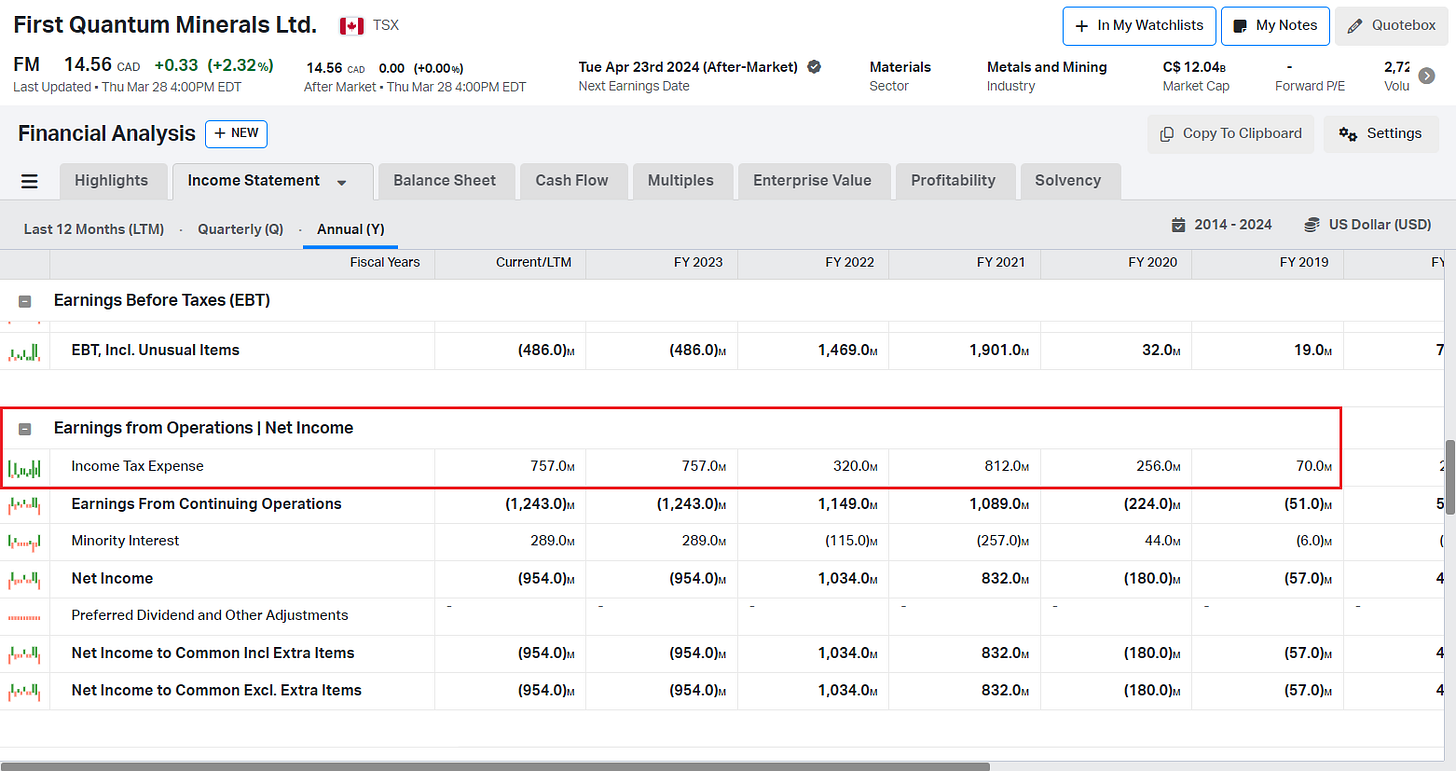

The following graph shows the amount of taxes paid by the company for the last four years.

For 2023, the company paid $757 million in taxes, and for 2021, $812 million. FM has spent $2,209 million in taxes over the past four years, and a portion of those taxes go into Panama's coffers.

The state is deprived of a relatively secure and significant revenue stream. The euphoria of the mine's closure will pass into a hangover phase when officials realize the opportunity costs of this whole circus. The Panamanian government's enthusiasm to find a solution is proportional to the intensity of the hangover.

However, this is not a necessary or sufficient condition for the mine to open. We need a catalyst: the elections in Panama on May 5, 2024.

The Catalyst: Election 2024

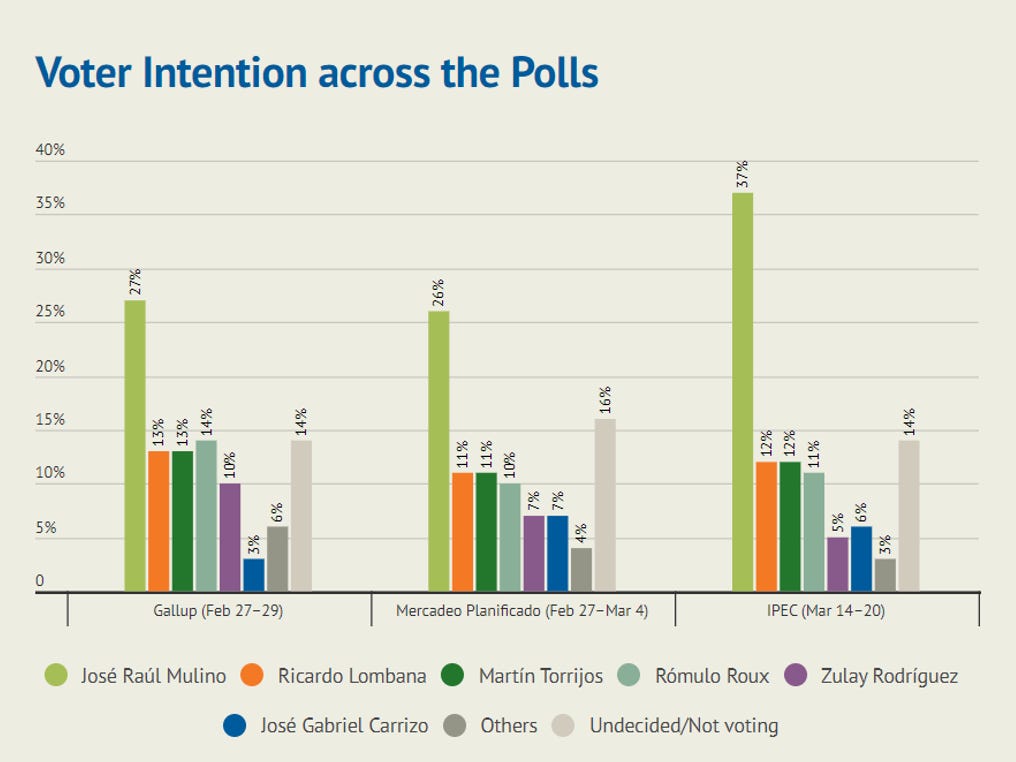

The chances of the mine reopening depend primarily on the next elections in Panama. The following chart shows the current ranking of the presidential candidates.

The top contender is Jose Raul Molino. As a political and economic orientation, he is center-right and business-minded. In several public statements, he has delicately voiced his opposition to the closure of the mine. Opening the mine is not on the official agenda.

Molino's election will change investor attitudes towards FM because Cobre's opening chances will increase. That doesn't mean it will happen quickly. In my opinion, it will be at least 12 months until (if) it comes up for a vote.

It is not so much the opening of the mine that is important but the expectation that this will happen. Let us not forget that markets discount expectations, not facts.

First Quantum finances

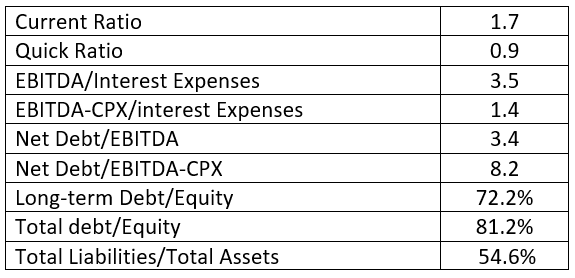

FM has an excellent balance sheet despite the turmoil in Panama. The following table shows the metrics reporting the company's liquidity and solvency.

Even after the revenue decline due to Cobre's closure, FM has maintained healthy net debt to EBITDA levels. The capital structure also meets my criteria.

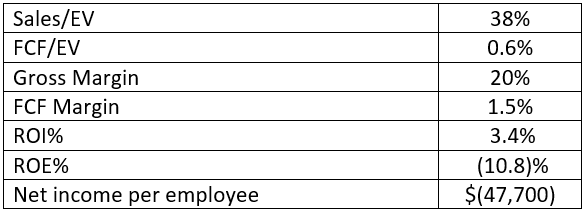

The company's performance suffered significantly from the Panama crisis. The following table shows the company's profit margins and returns.

First, Quantum is an event-driven idea. As such, its profitability is not that important. Quite a few of these ideas are not generating profits. Examples include companies in my portfolio, such as Rockhopper Exploration and Northern Dynasty. The fact that FM generates revenue and free cash flow significantly reduces the downside risk of the idea.

Valuation

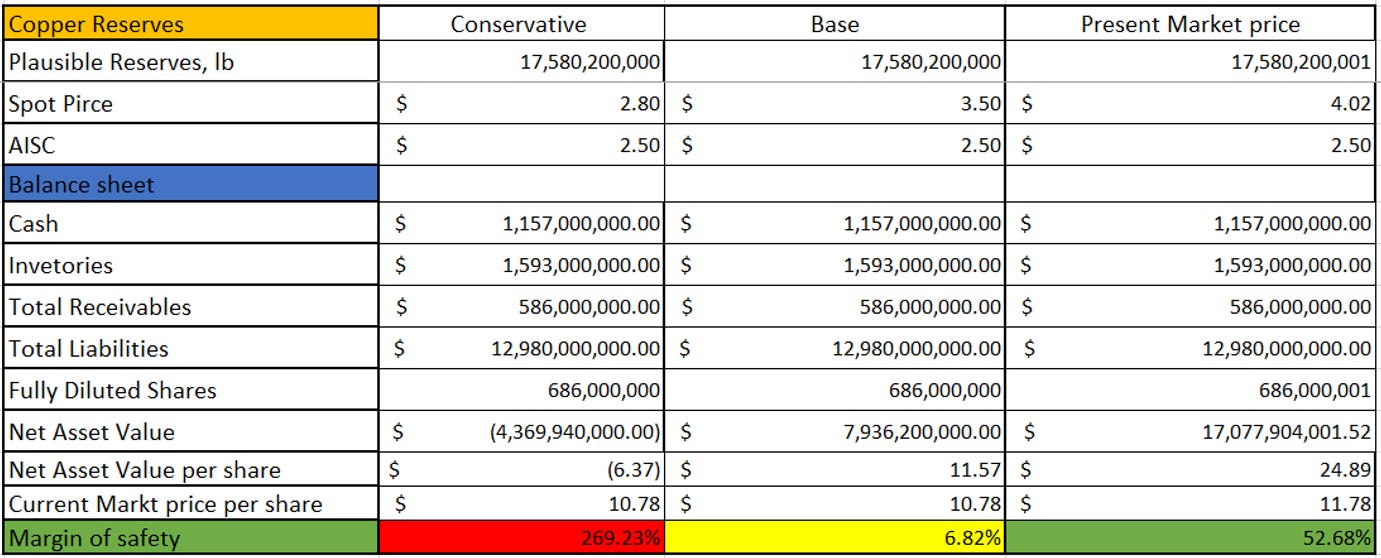

FM generates value through the exploitation of tangible assets. The most appropriate valuation method for such companies is Net Asset Value. For this purpose, I must calculate FM's Plausible reserves.

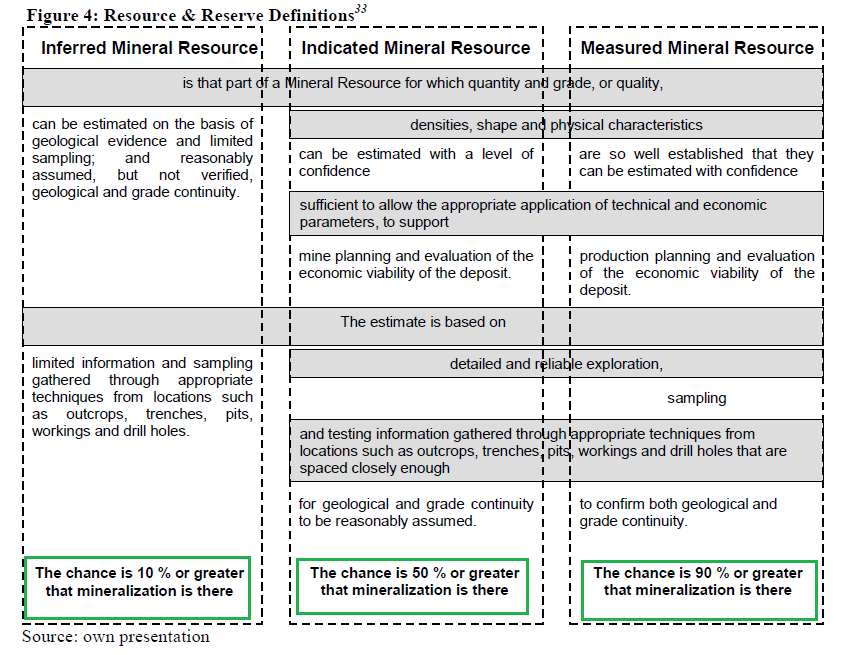

Plausible Reserves = 100%*Reserves + 50%*Measured and Indicated + 10%*Inferred

The formula is based on the probability that the resources found are actually there and have the identified properties (ore concentration, cut-off grade, recovery). The following table illustrates the difference between the resource types.

In the case of reserves, the chances are 99% that they are in the ground and meet the parameters specified in the geological and metallurgical studies. I discount by 50%, Measured and Indicated resources, though Measured, have a 90% probability of being there.

Following the above formula for FM, I get 7.991 million metric tons or 17.58 billion pounds of copper plausible reserves.

The following table presents three scenarios: a conservative one at a copper price of $2.8/lb, a base one at $3.5/lb, and a current one at the current market price of $4.02/lb.

In the calculations, I have excluded the Company's nickel reserves and reserves and resources from projects in the development phase. In the first scenario, with a copper price of $2.8/lb, we have no Margin of Safety as net assets are negative. In the base case scenario, we get a 6.8% margin; at the current copper price, we get 52.7%.

Judging by the growing copper deficit, the price is likely to reach $6-$8/lb levels in the next 36 months. Since this is a hypothesis about the future, I am sticking with the base case, i.e., for $3.5/lb, the company's net assets are objectively valued.

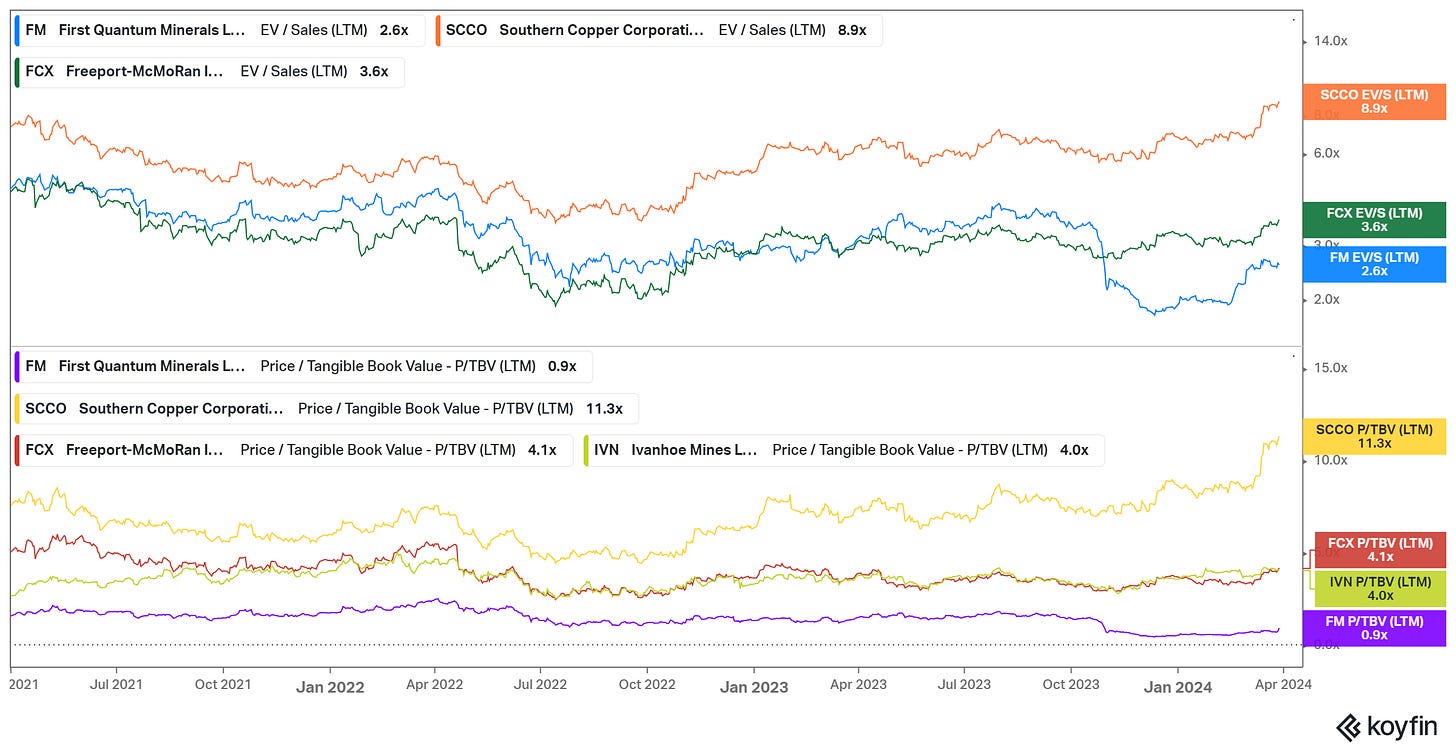

Now, let's compare FM with other large copper mining companies. I have chosen Southern Copper (SCO), Freeport McMoRan (FCX), and Ivanhoe Mines (IVN) because they are copper-focused producers. FCX is an exception because it generates about 15% of revenue from gold mining. BHP, Rio Tinto, and Glencore produce more copper annually; however, copper revenues are no more than 50% of total sales. At the same time, the remaining sales come from coal, iron ore, and bauxite mining.

FM trades at significantly lower multiples relative to the FCX, SCCO, and IVN. The company held the lowest price-to-tangible book value ratios even before the Cobre Panama mine crisis. At the same time, FM stock traded at a higher EV/Sales than FCX before the crisis. Currently, FM is significantly undervalued relative to its peers and relative to its 10-year averages.

Price Action

The FM price formed a temporary bottom after the crash in the last months of 2023. The following chart shows the weekly price change.

The price completed a Cup and Handle as a reversal formation. We have a confirmed breakout and subsequent correction. In other words, it is a classic combination with high asymmetry that is in our favor.

The power of technical analysis is that it shows when the least inappropriate time to trade. Judging by FM's price movement, that moment is approaching. Even the current price is reasonable for entry (up to 30% of the amount set aside for FM). Subsequent additions depend on the strength of the copper market and Panama's developments.

Risks

The closure of the Cobre Panama mine reminded me of the role of political risk, even in relatively stable countries. Panama is among the top countries in the rankings of conditions for doing business. That being said, the Panamanian Parliament's decision surprised me as well.

FM is a financially sound company based on its capital structure and liquidity. Unlike other event-driven ideas, FM generates cash flow. In other words, FM's survival is pretty much assured, even if Cobre Panama remains closed.

The risk of recession is always on the table. However, I classify it as possible but not probable at this stage. The fiscal policies of the world's two largest economies, the US and China ensure that liquidity in the global economy remains intact. As I have said more than once, we are entering a stage dominated by Keynesian principles.

The reason is simple: the monetary extravaganza around the C19 event sharply increased the public debt to GDP of the G20 countries. The money supply in circulation has reached absurd levels, which are, by definition, inflationary.

For the last twenty years, central bankers have been mediocre economists who make ridiculous decisions too often. Government officials, however, are even worse. The crisis in the quality of ruling elites is pervasive throughout the developed world. The US and the EU are leaders in this regard. What does all this have to do with recession risk and First Quantum?

The US and Chinese governments will try to postpone the recession through fiscal stimulus. Meanwhile, inflation is a perceived enemy. In the long run, they profit from it. Inflation steadily reduces the value of public liabilities. Much of this fiscal stimulus has been targeted at infrastructure, defense, and energy, which means growing demand for copper.

Inflation will stay with us for longer. Factors such as monetary/fiscal policy, demographics, wars, and the capital cycle are the preconditions for structural inflation. At the same time, the disruption of global supply chains is further intensifying already inflationary trends. The following equation shows the relationship between Houthis, inflation, and interest rates:

geopolitical volatility -> supply line volatility -> inflation volatility -> higher interest rates

And tangible assets love inflation:

Inflation -> rising cost of capital, raw materials, and labor -> rising cost of new projects (mines, energy, ships, oil rigs) -> higher secondary market prices -> rising valuation of companies' net assets

As an old economy company, FM will benefit from structural inflation.

The most significant risk to my hypothesis is the Panamanian government. The elections in the coming months are crucial because, depending on who wins, the chances of the mine reopening will either rise or evaporate.

On the other hand, FM has filed a lawsuit with the International Chamber of Commerce (ICC) against Panama for unconstitutionally closing the Cobre Panama mine. I assume the company will also file a claim with the World Bank Arbitration (ICSID).

First Quantum Summary

Where to invest?

· Macro–fiscal policy is the new lever to control inflation. Government spending is directed toward defense, energy, and infrastructure. Demand for metals is poised to grow. The current decade is a mix between the 40s (massive debt to GDP and dominance of fiscal policy) and the 70s (structural inflation). Mining companies will be among the big winners.

· Industry—the copper shortage is widely discussed. Supply stagnates due to a lack of personnel, capital investment, and declining ore grade. Demand is growing steadily due to the energy transition, artificial intelligence, and infrastructure upgrades, with energy being the main driver. Besides the Green Deal, AI penetration is a major factor influencing global energy needs. The world relies increasingly on AI, which needs larger data centers that consume colossal amounts of energy and metals.

· Company—First Quantum was a profitable company and ranked among the top ten copper producers in the world before the closure of Cobre. At the same time, this crisis provides the opportunity to extract alpha by betting on a change in the political climate and an ICC decision leading to the opening of the Cobre mine.

Why invest in First Quantum?

· Balance sheet - despite the Cobre crisis, FM remains financially sound. The company has excellent liquidity and a conservative capital structure.

· Efficiency—Cobre Panama is responsible for 40% of the company's revenue. After its closure, FM's efficiency dropped significantly. FM falls into the category of event-driven deals. In these positions, it is common for companies not to generate walkthroughs. FM is a positive exception.

· Managers - Managers have skin in the game and industry experience.

· Shareholders—FM's largest shareholder is China's copper producer, Jiangxi Copper, which holds 22.1%. I assume China will step in one way or another because copper is among the strategic metals. The Cobre Panama mine is one of the critical assets in their portfolio.

How much do I pay for First Quantum's business?

· Business valuation - FM trades around its net asset value in a base case scenario with a copper price of $3.5/lb.

· Benchmarking - FM is trading at a significant discount to its peers and average over the last ten years.

When to buy?

· Technical analysis: The price has stabilized over the last few months. We have a confirmed break of a cup-and-handle formation.

· Presence of a catalyst event - we have three events that have the potential to accelerate FM revaluation. First is the election in Panama on May 5 this year. The chances of Cobre reopening will drop to zero or go up depending on who wins. The next catalyst event is the ruling on the lawsuit against Panama. The ICC decision will take at least 18-24 months. In the meantime, I expect FM to file a claim with ICSID. In that case, the outcome can be expected in at least two years. The growing copper deficit is the third variable. Rising shortages mean rising prices. High prices will motivate all stakeholders (First Quantum, Jiangxi Copper, and the Panamanian government) to put the Cobre mine back into operation. I have an 18–24-month horizon for the FM bet to play out.

· When to buy (summarized) - having multiple catalyst events with only one fixed date (the May 5th election) requires gradually building a position. The current price allows for a first entry with up to 30% of the amount set aside for FM. The price will likely be volatile in the coming weeks due to the upcoming election and the strong copper market. I would add the next third on a more significant decline (at least 15-20%) in FM shares due to a lower copper price and general weakness in the broad indices. I would save the last two tranches for after the Panama elections.

How much to buy?

· Kelly formula - risk/reward 2.5 at $15 purchase price, $9.0 stop loss and $30 take profit; 18-24 months; portfolio share 8-10%; position risk 1.5-2.5%.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Is this a 24-Jan-2024 article mistakenly posted today?

The Panamanian elections already happened on 5-May-2024 (as you rightly state) and are not in the "coming months" as you mistakenly state.

Confused!