Leon Trotsky was assassinated in Mexico City. Diego Rivera and Frida Kahlo are among the most famous left-wing artists. To make things even more intriguing, Diego Rivera has painted a massive mural named “Man at the Crossroads.”

The name of the art piece is not a curiosity; the location and the characters painted are. The fresco, which contains images of Lenin, Trotsky, and Marx, is installed in 30 Rockefeller Plaza. The oil tycoons and communist leaders in one setting.

Yes, we live in a more absurd world than we wish to assume. This is not a political philosophy essay, but the introduction to an article that I have been postponing for a long time.

It's time for a trip to Mexico, the largest silver producer and once a leading exporter of the most expensive paint in the world, the cochineal. To write about LatAm is not unusual for me. But my focus was on Argentina, Brazil, Chile, and Colombia. Today, that is going to change.

This April report for TheOldEconomy paid members covers Mexico and presents airports as an investment opportunity to wager on the growing Mexican economy. Like banks, airports are superconductors for economic changes. Their performance serves as a leading indicator for economic conditions.

Mexico possesses the traits of a typical South American state, yet it is different from the others. For example, its economy no longer relies on commodity exports but on manufacturing. That Mexico is still a commodity powerhouse. The country holds massive offshore oil, silver, gold, and copper reserves. Besides that, it shares a border with one of the present-day Great Powers, the US.

All economic peculiarities make Mexico an interesting investment case. Another distinction is the lack of extreme political shifts in recent years. As you know, political changes are among the most potent catalysts when we invest in emerging markets. Manuel Andres Lopez Obrador (AMLO) served as president for one term between 2018 and 2024. He is a centrist politician with some leftist inspirations. AMLO’s successor, Claudia Scheinbaum, follows his political legacy. This means we cannot expect a drastic swing from left to right or vice versa, at least in the coming years.

The catalyst for my Mexican thesis is a long-term economic growth driven by the friend/near/onshoring trend. Global fragmentation pushes all state actors to secure their supply chains. Therefore, the closer the energy/commodity/manufacturing source, the lower the risk. Hence, countries like Mexico, which have abundant energy, commodities, and cheap labor, are at the top of the list.

Let’s start our trip with a big picture: Mexico's economy.

Mexican Economy

One of globalization's major traits is outsourcing low-value-added manufacturing activities. The deal breaker is the cost of labour. The following chart from the latest JP Morgan report on LatAm compares leading emerging markets regarding manufacturing wages, manufacturing output, and infrastructure investments.

Annual salaries for production workers in Mexico share the bottom with India. For reference, the other LatAm behemoth, Brazil, has nearly fivefold higher wages. China is even more expensive.

Now, consider Mexico's location. It shares a border with the US, which means the condition of global supply chains has a decreasing impact compared to imports from the Far East. This means faster and cheaper transportation of goods.

The next interesting point is the Mexican export structure. Chart via OEC.world.

Mexico is a manufacturing giant, and more than 80% of its exports go to the US. The latter is a blessing and a curse, depending on how the US economy behaves. To illustrate the thought codependence of both economies, think about the correlation between the FED interest rates and Mexican rates. It is close to 0.9. Simply put, Mexican entrepreneurs' capital costs closely follow the cost of capital for their American counterparts.

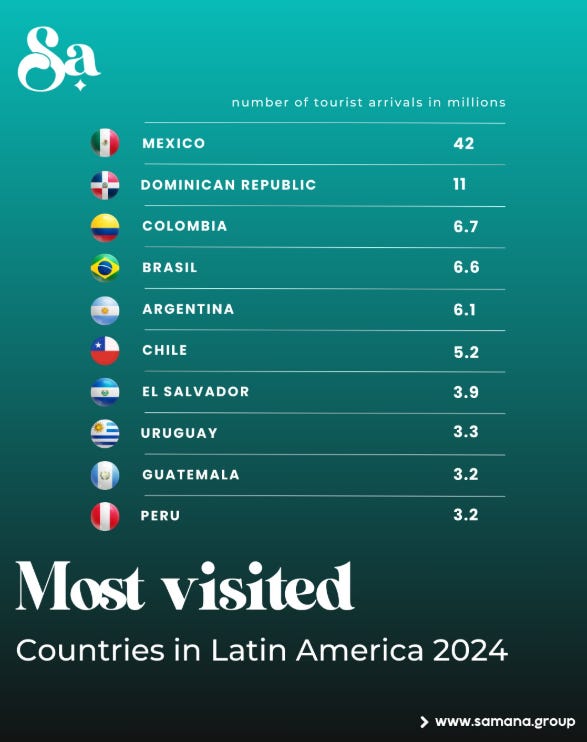

Besides its growing manufacturing industry, Mexico is an alluring tourist destination. The image below from Samana Group shows to what degree Mexico leads the pack.

In 2024, Mexico attracted almost the same number of tourists as all other Latin American countries combined.

Mexico's tourist and manufacturing industries make it a unique proposition compared to the other South American countries that rely heavily on commodity exports. Of course, depending on the commodity cycle, this could be a good or a bad thing. The Mexican economy may lag during inflationary booms, characterized by rising commodity prices. Conversely, manufacturing and tourism will pay off when commodity prices are weaker, combined with economic growth.

Nonetheless, Mexico is not only a manufacturing and tourist hub. The country remains the number one silver miner and the fourth largest oil producer in the Western hemisphere, next to the US, Canada, and Brazil. For food connoisseurs, Mexico is the top producer and exporter of avocados. Let’s look at the geographic distribution of the leading Mexican industries.

Mexico’s northern states have become the nation’s manufacturing hub, driven by their proximity to the United States, developed infrastructure, and a skilled workforce. This region, comprising states such as Baja California, Nuevo León, Chihuahua, Sonora, Tamaulipas, Coahuila, and Durango, forms the “Northern Industrial Corridor. “ The corridor is vital to North American supply chains in sectors like automotive, aerospace, electronics, and medical devices. This growth is fueled by tax incentives, trade agreements, and the nearshoring trend, as companies seek to optimize supply chains and reduce logistical risks.

The Mexican oil industry deserves a few paragraphs. State oil company Pemex continues to dominate the sector, accounting for the vast majority of production, yet its output has declined steadily for decades. In early 2025, Pemex’s crude production averaged just 1.42 million barrels per day- a four-decade low- while overall liquid hydrocarbons, including private sector contributions, reached 1.78 million b/d. Persistent declines are attributed to aging fields, suspended drilling rigs, and delayed new projects. Notably, nearly half of Pemex’s output comes from seven mature fields, all in decline, and the company is projected to lose 100,000 b/d of production annually without major discoveries or investments.

The Zama offshore field is the wild card that may revive the Mexican oil industry. It was discovered in 2017 in Mexico’s Sureste Basin, and is one of the world’s largest shallow-water fields discovered in the past two decades. Now operated by Pemex with partners Talos Energy and Harbour Energy, Zama holds an estimated 600–800 million barrels of oil equivalent. Development plans include two production platforms and 46 wells, with peak output expected to reach 180,000 barrels per day-about 10% of Mexico’s current oil production.

Let’s say a few lines about the tourism industry in the country. One chart tells it all:

The chart (via Future Market Insights) shows impressive CAGR projections. Are they feasible?

In 2024, Mexico welcomed over 45 million international visitors, a 7.4% increase from the previous year, and generated a historic $32.96 billion in tourism revenue, surpassing pre-pandemic levels. Tourism now contributes 8.6% to Mexico’s GDP and supports nearly five million jobs, representing more than 9% of national employment.

Mexico’s diverse offerings- from ancient ruins and vibrant cultural festivals to luxury resorts and natural wonders- attract a wide range of travelers. Key drivers include the continued appeal of iconic destinations such as Cancún, Mexico City, and Los Cabos, and the rise of new segments like medical tourism, adventure travel, and eco-tourism. The influx of Canadian tourists has grown notably, while the United States and Colombia remain the primary source markets.

To recap the section about the Mexican economy, my long Mexico thesis is based on economic growth propelled by the onshoring trend. The country has established itself as a manufacturing giant, so the preconditions to benefit from that trend are already here. In addition, Mexico has a thriving tourism industry and a developed mining and energy sector.

All sounds good, but let’s not forget that the economy is not the market. In the next chapter, I examine the Mexican market compared to the developed and emerging markets and estimate its upside potential and downside risk.

Mexican Equity Market

Our first stop is the basics: the performance of Mexican government bonds, the peso, and the iShare Mexico ETF (EWW) index.

Since the beginning of the year, Mexican gov bond yields have fallen by 12%. Meanwhile, YTD EWW has gained 20.7%. The Mexican Peso took advantage of the weak US dollar, and USDMXN has fallen by 5.5%. Based on dropping yields, bond traders seem to sniff the declining downside risk. Equity traders did not think twice. EWW and iShares Chile (ECH) are among the best-performing indices YTD.

Then, is it too late to join the party?

Look at the EWW/SPY ratio.

The ratio just broke above the 12-month moving average (MMA) and has made three consecutive bull candles. This is not a zero-fail-rate signal but increases the odds of a confirmed trend reversal.

The next relevant question is, how cheap is the Mexican market?

The short answer is that it is cheap enough to consider it attractive. Based on Price to Earnings (NTM), Mexican stocks trade at the bottom limit of a 15-year range and well below their 15-year average value. This implies decreasing downside risk coupled with increasing upside potential. Mexico (with Chile, Colombia, and Brazil) offers enormously attractive risk-reward for adventurous investors.

Last but not least, let’s discuss the performance of Mexican equities.

Unsurprisingly, not all Mexican equities move in sync. Index concentration in several names is not a patent for NASDAQ and S&P 500. In Mexico, the leading sectors are telecoms and food and beverage. Airports follow closely. Energy stocks have lagged considerably in recent quarters. Take, for example, Vista Energy. To clarify, the company is not a Mexican pure play. It exploits assets in Argentina. Thus, by investing in VIST, we get exposure to energy prices and Argentina's political and economic climate.

Banks are the first to sense changes during bull markets in emerging economies. The big three, Banco Bilbao Argentaria, Grupo Banorte, and Grupo Inbursa delivered attractive gains YTD.

However, they are not the only ones. Airports are a leading indicator of underlying economic shifts, and their performance signals what the future may bring.

That said, let’s move to the core of today’s report, the Mexican airports industry.