Banking in South Africa

I despise boring writing, living, and investing. Yes, investing is not to entertain yourself but to become more prosperous. However, on the way to financial wealth, building your cultural capital is an overlooked benefit of the investing process.

I read a lot, but not as the pundits say, focusing on financial reports. They come last. Picking a company I am interested in is a long trip. It is often sparked by some curious article or book unrelated to investing. My reading list primarily contains books on history. The more esoteric the topic, the better. Over the last weeks, I have read about Africa and the Middle East.

The African continent is larger than it looks on the map. It is the second largest continent after Asia. Moreover, considering its ethnic, cultural, and anthropological diversity, it is far from homogenous.

Africa's natural resource riches are undisputable. The Bushveld Complex in South Africa contains the largest PGM reserve base. The Birimian Greenstone belt in the Sahel is one of the most significant gold belts in the world. The Congo is home to substantial copper, cobalt, and gold deposits. Those are only a few of Africa's extensive natural riches.

As a goal for the coming months, I want to expand my knowledge of Africa through investors' perspectives. Today is the first chapter of that trip. I confess it starts in the most possibly boring way with South Africa.

I visited Cape Town multiple times. I have experienced firsthand the South African health care system as a patient of Christiaan Bernard Hospital, named after the man who did the first heart transplant. So, writing this report is more personal.

That being said, Western Cape Province has been the only one ruled by the Democratic Alliance, DA, for more than ten years. The difference compared to ANC-ruled provinces is staggering.

South Africa in 1094 words

The last election brought an expected surprise. For the first time since the 1994 election, ANC will not rule single-handedly. On June 30, Cyril Ramaphosa announced the new Government of National Unity, GNU.ANC holds 22 ministerial seats, DA 6, and a few smaller parties share the remaining 6. Among those are not included are EFF and MK leftist parties.

The week before the announcement was tense because EEF and MK opposed the ANC/DA coalition. EFF stands for Economic Freedom Fighters. It is the Marxist-Leninist party promoting violence, nationalization, and segregation. MK is the party of ex-president Jacob Zuma. It is a softer version of EFF, nevertheless supporting radical measures. Both parties are spin-offs of the ANC. At one point, ousting DA became plausible. Luckily, Ramaphosa made a levelheaded decision excluding the radical lefts and following the initial plan.

Why does all that politics matter?

In developing countries, the political pendulum swing is a powerful tool for assessing a country's potential from an investor perspective. Argentina is a case in point. Since 2010, LatAm ruling elites have been primarily leftist. Nayb Bukele in Slavador broke the trend, yet Milei made it probably unstoppable. To underline, a political shift does not guarantee economic prosperity.

However, it tells us something valuable to us as investors, i.e., the expectation shift. Let’s not forget that the market discounts expectations in the next 12-18 months. The fundamentals prevail in the long term. Hence, following a political pendulum swing is a lucrative way to gain Alpha.

The DA does not have enough political power alone to take decisive action. However, it has enough to constrain the ANC from moving in the wrong direction. Simply put, DA seats are insufficient to spark progress, yet they are enough to prevent further regress. If the coalition's first mandate is successful, the DA may secure more seats in the next election.

Nevertheless, it is too early for such plans. As I said, I play expectations shift, not the facts. When the latter become widely known, they are calculated in the price. At that stage, it is usually too late to join the party.

Political changes predetermine investors’ expectations. However, this is not a sufficient prerequisite for making a well-argued decision. The next step is to examine the country’s economy and the industry we are interested in.

South Africa ranks nine by territory, first by GDP, and sixths by GDP per capita in Africa.

It is unexpected to see tiny nations like Gabon or war-torn countries like Libya take the lead in South Africa. The explanation is straightforward: a plentiful supply of fossil fuels and a relatively small population. Besides that, China is Gabon's primary export, while Italy, Spain, and Germany are for Libya. On the other hand, South African exports are more diversified despite being focused on commodities, too. Chart via OEC.

PGM represents 28% of the country's exports, followed by coal and iron ore. South Africa is one of the top exporters globally of manganese, yet it represents 2% of the country's total exports. As expected, China takes center stage as a primary trading partner. However, this is below 20% of the total. The United States and Germany come as second and third on the list. South African exports are well diversified compared to other developing countries. Being heavily exposed to one country's economy is more of a curse than bliss. When the Dragon coughs, its export partners get sick. South Africa is relatively immune to that syndrome.

A country's GDP is unevenly distributed between its provinces. Chart via South African government.

South Africa’s economic capital, Johannesburg, is in Gauteng. Gauteng and the Western Cape are the country's financial centers. Mining is concentrated in the northern provinces: the Northern Cape, Limpopo, Mpumalanga, and the North West. Unemployment is a massive issue and an opportunity. Gauteng has the highest unemployment rate, at 35%, while the Western Cape is the best performer, with 14.2%.

Higher unemployment means that once the unemployed join the workforce, they will improve their financial standing. Using banking services becomes a priority. The vast mass of unemployed is an untapped customer base for banks.

Going further, South African youth gradually turn the tide of discouragement about joining the workforce.

For the last twenty years, young people have become less demotivated to work. It is not enough to boost the economy, yet it is the first mandatory step to achieving prosperity. The youth population is another unexploited group of customers. Compared to G20 countries, South Africa has many young people, though it is way below the average of Sub-Saharan Africa. In summary, the unemployed and the young are a vast customer base for the banking system to tap into in the future.

Internet penetration is another determining factor for banks. Africa has the lowest internet penetration, at about 50%, compared to 67% worldwide. On the other hand, in Southern Africa, where there are more prosperous countries like South Africa, Botswana, and Namibia, Internet penetration is 75%. South Africa ranks above that, with 79% internet penetration.

It is good enough to indicate that banks already have a customer base to attract, yet it shows growth potential. For reference, South America’s rate is 82.9%, and South Europe's is 90%.

To recap, the banking system in South Africa has a few macro tailwinds:

Decreasing youth discouragement to participate in the economy

Unemployment is high at 33%, so it has a long way to go down.

Rising internet penetration. A curious fact: South Africa ranks first as the most internet-addicted country, with nine hours and 24 minutes of internet consumption per day.

Unbanked population is 23.5%, while Africa’s median is 52%.

In summary, improving employment, rising internet penetration, and declining unbanked population create a vast pool of new opportunities for South African banks.

South African banking system landscape

Banks love inflation. Like asset-heavy businesses, banks' valuations grow in an inflationary environment. The following equation describes the tender relationship between asset-heavy and banking companies with inflation.

Inflation -> rising cost of labor, funding, and materials -> rising cost of newbuilds (ships, oil rigs, mines, power plants) -> rising cost on second-hand market -> rising company’s Net Asset Value

Inflation -> rising interest rates -> rising bank’s profit margins -> rising return on equity -> rising bank’s valuation

For the last several quarters, South Africa has maintained relatively stable inflation at 5.2% and interest rates at 8.25%. Compared to other developing countries, South Africa fares well. The following table shows inflation, interest rates, NPL, credit rating, and currency YTD performance. Chart via Author’s database.

The country's credit rating is adequate, falling in the upper noninvestment grade section. All significant banks gravitate toward BB- rating (S&P scale), as shown in the chart below:

South Africa’s NPL is good enough to put the country in the top percentile in Africa. The political and economic situation directly affects the population’s ability to service its debts. Moreover, NPL is a vital metric for banks' credit risk. I like banks with NPLs below the country's average. It is not a 100% bankruptcy-resistant recipe; nevertheless, it considerably reduces the downside risk.

The South African Rand fared well compared to currencies like the Brazilian Real and Japanese yen, which experienced a double-digit YTD decline. Remarkably, South Africa surpassed Japan in exports as a percentage of GDP. The former scored 33%, while the latter scored 21%. I attribute that to shifting economic and political alliances, resulting in new export partners for South Africa. On the other hand, Japan has been shadowed by China as a global tech exporter for the last two decades.

A weak currency is usually advantageous for exporting countries. However, it depends on exports. Japan exports manufactured items, and Japanese conglomerates have pricing power. On the other hand, South Africa exports commodities. There is zero pricing power. Unlike goods, commodities are quoted in USD, so buyers cannot find the same good quoted in a weaker currency. Maintaining a weak currency in that case may have more cons than pros.

All those factors contributed to a stable environment (in a developing market context) for South African banks. Moreover, South Africa has the most developed banking system and financial markets on the African continent and the lowest percentage of unbanked people. The chart below shows how South Africa scores compared to other developing countries.

The chart is from 2021, so the number of people using banking services has grown for three years, but not enough to invalidate the graph. The point is to compare South Africa with its peers in Asia, South America, and Europe. Chile, India, and Saudi Arabia are good examples of improving banking penetration. On the side of the scale are Marrocco, Vietnam, and Egypt.

Digital transformation is the top priority of traditional banks (or at least it has to be) if they do not want to become extinct. According to the Boston Consulting chart, South Africans are open to digital banking services.

In summary, 86% of the respondents prefer remote banking via app or web, which signals a positive trend for banks. In the same report, Boston investigated customer opinion about digital banking by age. 54% of the people in the 45-60 age bracket and 56% of those older than 60 feel comfortable using fully digital banking services.

Banking branches have become outdated. In a poll conducted by Boston Consulting, respondents in South Africa, Germany, Brazil, and the UK were asked if the bank’s branch was not available and what alternative they would choose. 73% of South Africans picked a digital/mobile alternative, 64% of Brazilians, 56% of Germans, and 45% of Brits did so.

In summary, South African banks exist on fertile soil to attract customers, considering the number of unbanked people and customer openness to digital banking.

Traditional banks in the country have multiple options to pursue digital success. We have illustrious examples from LatAm. Grupo Galicia, one of the largest Argentine banks, created a subsidiary, Naranja X. Its app competes successfully with the Mercado Libre app. Besides that, Galicia's traditional bank subsidiary, Banco Galicia, does an excellent job, too; its app ranks seventh. South African banks have a role model to follow up with, and they do pretty well.

The largest banks by assets in South Africa are:

· Standard Bank Group

· FirstRand

· Absa Bank

· Nedbank

· Investec Bank

· Capitec Bank

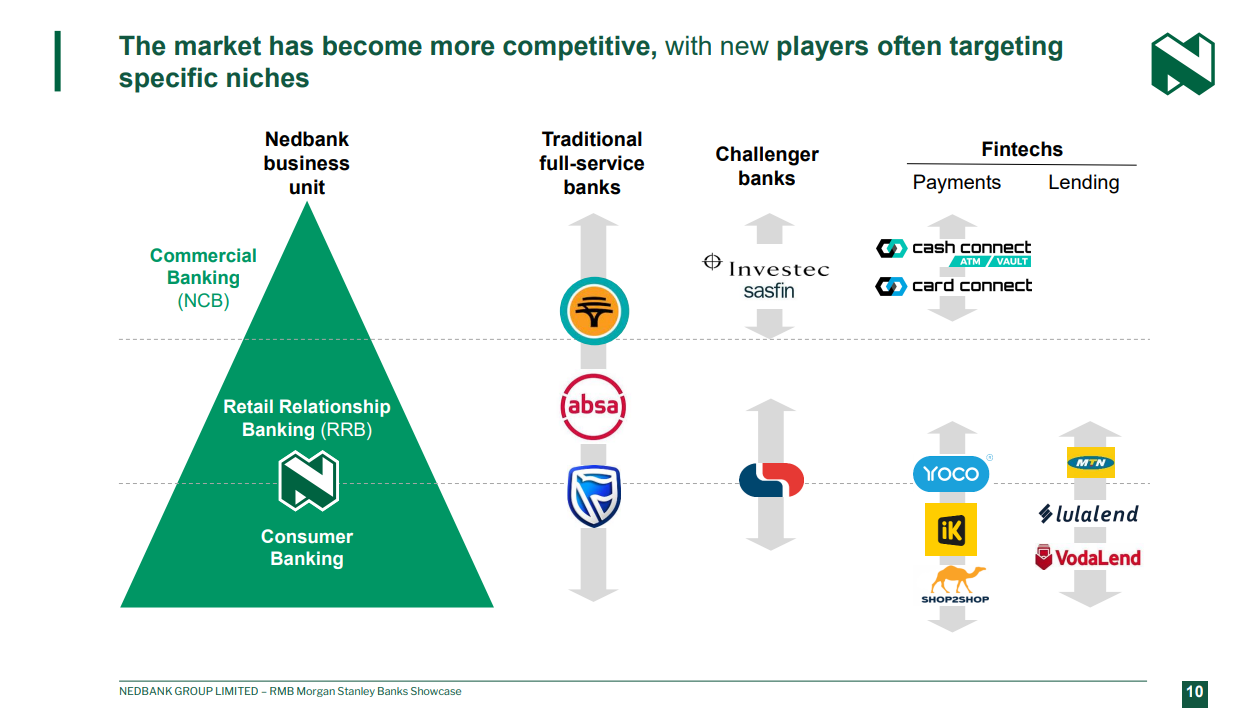

Standard Bank owns the same number of assets as the second and third contenders combined. The chart below via Nedbank shows South Africa's banking ecosystem:

FirstRand, Absa, and Standard dominate the traditional banking segment. Investec and Capitec are newcomers challenging the status quo. Capitec has achieved impressive progress over the last several years. Its banking app has become the country's number one.

South African fintech universe has been growing in recent years. Dominant players are Tymebank and Yoco. They cover various baking services for retail customers. Tyme is an exclusively digital bank founded in 2018. It is one of the largest fundraising rounds in Africa for 2023. Yoco is a payment and ATM alternative. It offers services to retail and small enterprises. Despite the intense competition from Tyme and the others, the big six hold their leading position in digital banking, as measured by banking app popularity.

Tyme app ranks six, while traditional banks occupy the first five slots.

Investec app falls behind its competitors. It ranks 24th in the list.

The following two charts from the S&P intelligence report on South Africa paint a positive picture of the country’s banking industry:

The first chart shows stable progress in digital banking. There are 18.5 million customers, representing 30% of the country's population. This is sufficient to affirm my belief in South Africa's digital banking strength. Moreover, it indicates that growth potential is far from exhausted.

The second chart summarizes the banking business in essence: ROE must exceed COC. In the long term, this guarantees banks' ability to survive and then flourish. Judging by ROE> COC, South African banks have become profitable since 2021.

South African banks comparison

I compare South African banks in this section based on their balance sheets, efficiency, digital presence, and valuation. Before I move on, I would like to address some specifics about banking valuation.

When we value a bank, we must consider a few pitfalls. EV and FCF ratios do not work for banking stocks because banks’ liabilities are not as clearly defined as in other industries. Banks finance their operations through customer deposits, debt securities, and interbank debt. Estimating free cash flows is also confusing. Back to the basics is the solution. P/E, P/S, and P/B ratios work well enough for banking stocks.

Let's look at the big picture before I examine the South African Bank's valuation. The following table compares South Africa's banking equities valuation to that of another G20 country. Chart via Author’s database.

I picked the Price/Sales 10Y average vs. Price/Sales present value and applied the same to Price/Earnings. I aim to estimate which markets are cheap relative to their 10Y averages. The multiples vary widely. South Africa and China are the cheapest markets measured with P/S, while the UK and Mexico trade at the most attractive P/E.

To determine where I get more value per dollar, I weighted present multiples vs. their 10Y averages. Colored cells indicate how cheap/expensive the country's banking industry is in relative terms. The more red the color, the more expensive, and vice versa. Japan and Singapore command higher multiples. China and South Africa bring more value based on the present vs. 10Y average figures.

To have a comprehensive view of the most critical metrics, I created a table that consists of the following:

Balance sheet quality

Banks’ efficiency

Basel III metrics

Banks’ app popularity

The table represents South African banks traded on the US OTC market. Chart via Author’s database.

The table includes the following banks (all tickers are for OTC):

Absa Group, AGRPY

FirstRand, FANDY

Investec, ITCF

Nedbank, NDBKY

Standard Bank Group, SGBLY

Capitec Bank, CKHG

The table section illustrates banking business aspects: solvency, liquidity, efficiency, penetration, and valuation. The variables I included are not exhaustive but cover critical points for any bank.

As a side note, information quantity is not equal to information quality, hence the quality of our analysis. I strive to collect sufficient data to develop a well-argued thesis, but no more than necessary. Collecting as many inputs as possible is tempting, assuming the more information, the better the analysis. This is a dangerous fallacy.

Once Return on Information (ROI) reaches an inflection point, it dissipates. Simply put, information is also subject to the Law of Diminishing Returns. That being said, in my analytical approach, I strive for comprehensive and actionable results. I achieve this by emphasizing quality over quantity.

When considered in isolation, neither of those banks scores the best ROA, NPL, or Tier 1 ratio. The big picture is more critical than a detail considered in isolation, so I prefer a bank that performs well enough on all metrics than one that excels in a few and fails in others.

There is one exception to the rule: banking apps. A bank failing to move digital would undermine its long-term performance. If the banking app is not in the top 10, regardless of how good other metrics are, the bank in question gets a Hold rating. The app must rank in the top five for banking stock to score a Strong Buy.

Conversely, a Hold rating is given to banks with poor-ranking apps and red flags in the balance sheets. It is worth mentioning that none of the banks mentioned above have poor Basel III metrics. None of the banks have Tier 1 capital below 10% and LCR below 110%. Investec, however, fails to deliver, given its poor banking app rank. Other red flags are Nedbank and Capitec NPLs. It is higher than South Africa’s average of 5.4%.

To recap, balance sheet quality tells us about banks’ downside risk; efficiency and app ranking signifies the upside potential; banks’ valuation quantifies that potential.

Only Standard Bank is my favorite. The company has it all: ROE far exceeding the cost of capital, a baking app in the top three, a robust balance sheet and superior Basell III metrics, sufficient upside potential, and an attractive dividend yield. FirstRand is almost there, too.

The article is an excerpt from the July report for paid subscribers. Standard Banks has gained 18% since the report was released.

If you do not want to miss asymmetric ideas combined with meticulous execution, the following offer awaits you.

Thanksgiving Special Offer

Upgrade to Annual now and receive:

20% off the regular Pro subscription price

Save $90, Regular Annual Price: $450/year

Your Black Friday Price: $360 for 12 months

Lock the discounted price. You save $90/year forever.

Ready to upgrade?

Don't miss this chance to supercharge your investment strategy!

This offer is only available until midnight on Cyber Monday. Upgrade now and join the ranks of our most successful investors!

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Full disclosure: I do not hold a position in Standard Bank when publishing this article. Note that this is a disclosure, not a recommendation to buy or sell.

Thanks for the interesting read.

As someone with a bit of perspective I kindly ask permission to add a grain of salt.

We choose Mauritius for a second home and some Investment too.

General hint: the Mo Ibrahim Report (annualy) with an excellent overview on all 53 african states. Even the CIA Factbook relies and refers to their data.

Contrary to your approach I see digital banking with serious reservations.

In a well functioning Environment with stable governmental and law abiding structures that might be beneficial (or at least low risk), while the last four years surfaced such enormous breaches in governmental reliability towards its citizenry that the huge pressure to erase cash forecasts nothing good.

Especially SA represents additional physical risks to such banking in having a vastly corrupted Energy supply with permanent brown outs who often linger very close to blackouts.

Additional note on the BCG poll:

Germany looks high in the possible adoption of Digital banking in case there's no branch available, although that ist highly theoretical as GER has by far the most branches per capita in Europe, maybe even ww.

Apologies for any miswriting, no native speaker

Best regards Petra