Brazil offers many opportunities for industrious investors, not limited to equity or commodities. One of the country's peculiarities is its sustainable real rates, which are the perfect starting point for yield seekers.

As highlighted here, investing in credit instruments is widely popular in Brazil due to that specific. The best thing is that robust real rates are not kept only for Brazilian investors. Brazilian corporations offer liquid bonds denominated in US dollars and traded in global markets.

This is the second Beyond Equity report for 2025. The theme is Brazilian corporate bonds.

Inflation, rates, and yield

Last year was tough for investors in Brazilian equities. Questionable fiscal policy and a weaker Real were the prime factors impacting investors’ expectations and actions. Both variables are cause and effect, simultaneously enforcing each other and leading to weak equity performance.

Since the beginning of the year, Real gained traction along with Brazilian 1Y government bonds. Look at the chart below:

BR1Y dropped by 3.9% and USDBRL by 4.75%. Brazilian equities have responded accordingly; IBOVESPA is one of the best-performing indexes YTD. During all the turmoil in 2024, corporate bonds have been steady. Vale's 3.75% July 2030 issue is a good example.

Despite the turbulent equity markets, Vale bond gradually climbed up, reducing the discount window and yield. The lower the yield, the lower the perceived risk.

Investing in bonds is all about interest rates. Even if we play the HTM strategy, where the interest rate risk is reduced, the rates matter. Their impact is tangible on reinvestment risk and the number of attractive issues out there.

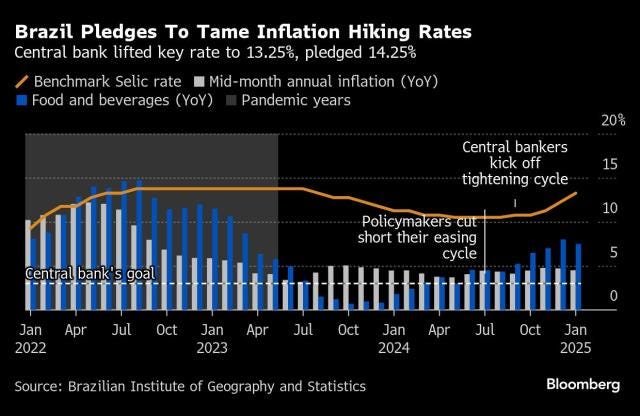

When talking about rates, we must start with inflation. As of January 2025, Brazil's annual inflation softened to 4.56%, down from 4.83% in December 2024. While this marks the lowest inflation rate since September of the previous year, it remains above the central bank's upper limit of 4.5%.

The Central Bank of Brazil has implemented a series of interest rate hikes in response to inflationary pressures. In January 2025, the Selic rate was raised by 100 basis points to 13.25%.

This marks the fourth consecutive rate hike since September 2024. The Central Bank has signaled further tightening, expecting another 100 bps hike in March, bringing the Selic rate to 14.25%.

The yield curve in Brazil is steepening, as seen in the chart below.

As of March 2025, Brazil's 10-year government bond yield stood at 14.92%. This represents a significant premium over shorter-term rates, with the 3-month yield at 13.51% and the 2-year yield at 14.84%. A steepening curve suggests market expectations for continued economic growth and potentially higher inflation in the medium term.

Brazil's bond market has become increasingly attractive to investors seeking higher yields. The yield of 10Y government bonds has jumped by more than 40% compared to a year ago, offering one of the highest real interest rates across all government bond markets. The same is true for Brazilian corporate bonds. They offer quite an attractive spread over similar-rated US and EU issues. In turn, Brazil has become a hot spot for yield hunters.

However, the high-yield environment is not without its challenges. The elevated interest rates increase borrowing costs, potentially slowing economic growth. Additionally, there are concerns about the sustainability of Brazil's public debt, which currently stands at 76.1% of GDP. The government's fiscal splurge has raised questions about budgetary prudence, adding an element of risk to the otherwise attractive yields.

Banks are among the industries that actively use bonds to finance their operations. Brazilian banks have a lot to offer in that case. So, today, I will not discuss shipping and mining but banking. I will present you with three fixed-income issues by prominent Brazilian banks. Before I proceed with the issuers, let’s review the Brazilian corporate fixed-income landscape.

Brazilian bonds for real yields

Investment banking in Brazil has seen significant growth, particularly in the fixed-income market. As equity markets have struggled, they have become a cornerstone of revenue generation for Brazilian investment banks, particularly in recent years.

In 2024, corporate bond deals accounted for nearly half of Brazil's total investment banking fees, generating R$2.1 billion in revenue—an unprecedented figure and a 60% increase from 2023. This surge was fueled by record corporate debt issuances, totaling R$608.1 billion between January and December, marking a 76% year-over-year increase.

Some of the most significant EM corporate bond issuances were from Brazilian enterprises. The table below shows 3Q24 corporate bonds issued by EM companies.

As seen above, South American companies generally actively use bonds to finance their businesses. Two Mexican and one Peruvian enterprise are among the top five issuers.