Capesize Bulk carriers market overview

Major bulk supply is rising in the West, while demand is growing in the East.

Capesize vessels may be the best bulk carrier segment in the coming years. They have the lowest order book and an aging fleet. On the other hand, the demand for major bulks is poised to grow.

The supply-side dynamics in Capesize are similar to those of VLCCs. The table below shows the current fleet order book and shipyard capacity reduction.

The Capesize order book is 6.2%, while active shipyards dropped from 320 in 2008 to 135 in 2023. For reference, the order book in 2007 was a staggering 110%. The shipyards are preoccupied with building LNG/LPG carriers, car carriers, and container ships. More slots for new Capes are coming in 2025. That being said, those slots are still insufficient to cover the growing need for major bulk transportation.

The third variable in the supply-side equation is the fleet age profile. 9.5% of the global Capesize fleet is older than 20 years, and this metric will reach 31% in 2030.

15% of the fleet was built before 2009, 51% between 2009 and 2015, and 35% post-2016. The number of vessels approaching 20Y is much higher than the current order book.

Order book and fleet age are long-term factors impacting the supply side. Like the tide, they lift all boats. However, we have a short-term constraint, too. Reduced speed and port congestion are two factors affecting the supply of Capesize vessels.

The slower the speed, the longer the voyage. The more congested the port, the longer the voyage, measured in time. As a result, the same number of vessels are employed for extended periods. The ships could be reemployed only once they completed the contract. Simply put, this limits the supply.

Capesize demand is a function of major bulk consumption, which depends on the state of the global economy.

Since the accession of the World Trade Organization, China has become a global growth engine. The country drove the previous commodity super cycle in the 00s. As the Chinese economy matured, the growth rate declined. Despite that, China remains a decisive factor in commodity demand.

The fiscal extravaganza restarted the stranded Chinese economy after severe lockdowns. The outcomes are visible. Iron ore and coal imports rebounded higher than in 2021/2022.

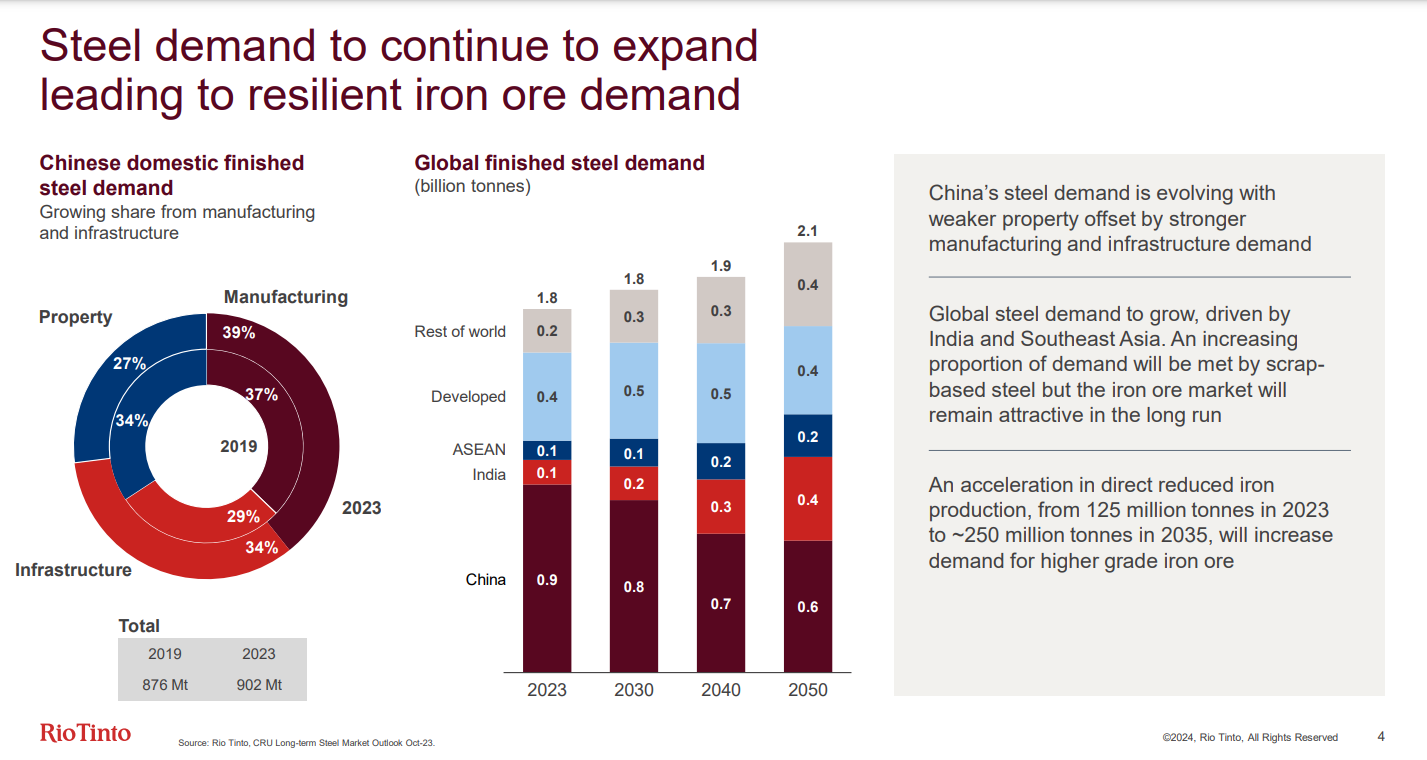

Global steel consumption is one of the best indicators for future Capesize demand. The chart below from the last Rio Tinto presentation shows that the demand for steel will increase in the coming decades. Emerging markets lead the pack.

Rio Tinto’s Simandou mine is expected to come online in 2025 and gradually ramp up production, reaching 60 Mt annually. Only Vale's new projects and Simandou will add almost 100 Mt iron ore production per year. China is the largest importer of iron ore, and YoY, the imports grew from 194 Mt to 209 Mt.

The last chart of the chapters tells precisely why I like Capes.

The Simandou project, located in Guinea, may become one of the largest iron ore mines in the world.

Remember, the largest consumers of iron ore are in the East (China, India, Japan, and South Korea). Iron ore has to travel 11 k nautical miles to reach China. It’s more than twice as long compared to Western Australia (where the Pilbara mine, another significant iron mine) to China. When Simandou goes operational, it will require 170 Capesize to transport the iron ore. The present order book includes 96 ships.

In summary, the ingredients for an asymmetric bet skewed in our favor are here:

· Constrained supply: low order book, aging fleet, limited shipyard capacity.

· Growing demand: China and India as the main major bulk consumers.

· Catalysts: rising geopolitical entropy disrupting the supply chains and projects of Simandou scale going into operation.

This article is an excerpt from a quarterly report for institutional subscribers. What does it mean? The short answer is an unreadably long and boring report on overlooked investing ideas.

Every quarter, I dissect my investing themes for the present year. I start with the big picture (macro and geopolitics), then move to industry/region specifics, and eventually discuss the most enticing companies.

If you wish a sample report, feel free to contact me by DM or email at office@investo.bg.