Investing in commodities is the highway to hell for unprepared investors. Conversely, playing the commodities market could be a very profitable endeavor if you know the game. The rules are simple, but that does not imply it is easy to end up a winner.

The legend says there is supposed to be a secret to win in markets. There is no secret. Markets offer only three things: uncertainty, effort, and pain. Never forget that profits are optional, despite the time, money, and effort we devote to them. So, our prime goal in this game is survival.

We cannot achieve it without knowing the game's field. In today's article, I examine commodities from an unexpected angle and provide a map of the commodity universe.

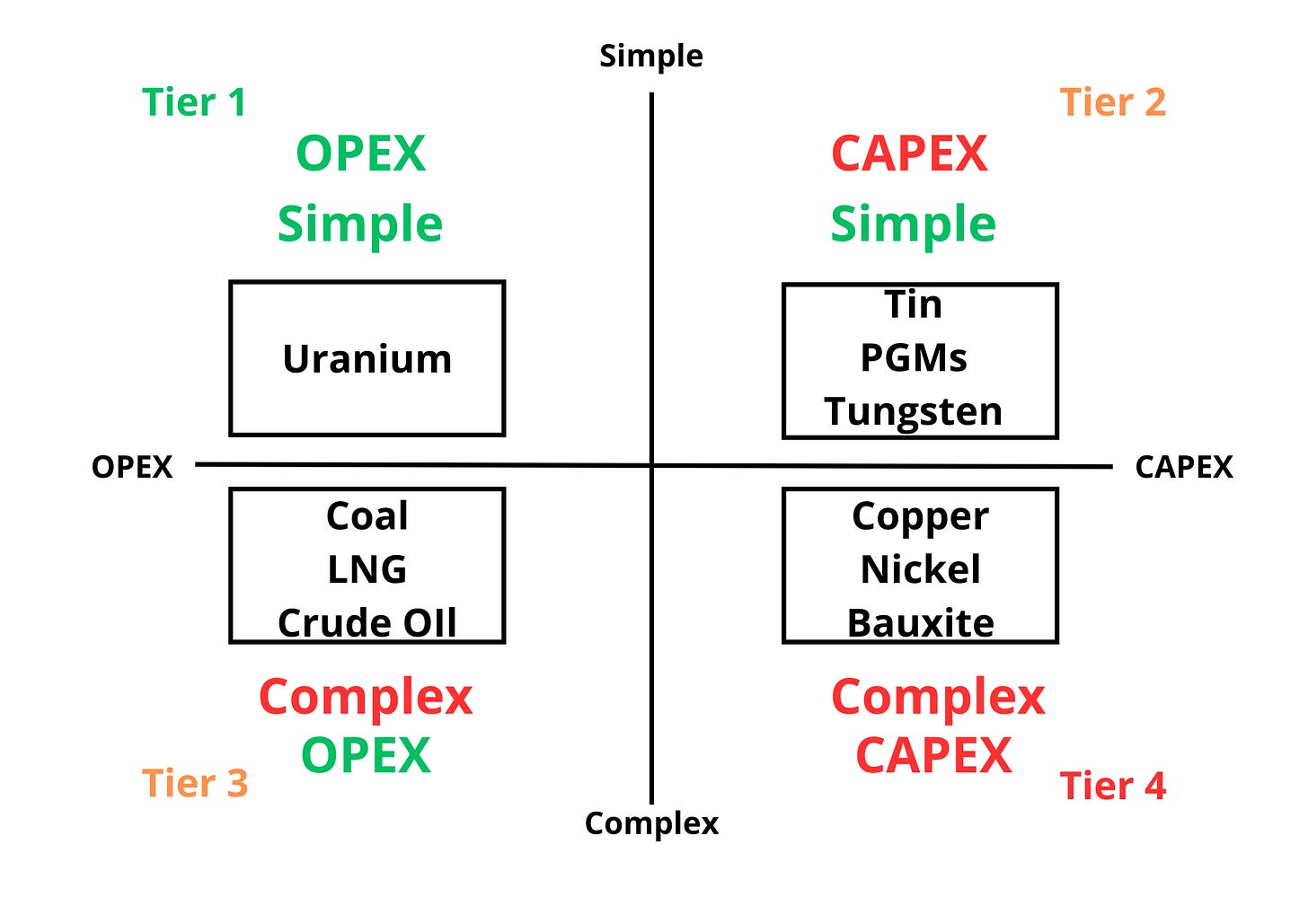

Commodities could be classified into four categories:

· Complex

· Simple

· OPEX

· CAPEX

In the following two sections, I briefly overview what each definition means.

Simple vs Complex

Simple commodities mean a handful of participants dominate the supply, and demand is highly concentrated in a few industries. Uranium, PGMs, and tin are such markets. Most of the uranium is produced by four countries (Kazakhstan, Namibia, Australia, and Canada), PGMs by two (South Africa and Russia), and tin by four (China, Myanmar, Indonesia, and Peru). Taking out one mine of the supply equation quickly leads to shortages. A case in point is the Cameco uranium mine Cigar Lake in 2006.

On the other hand, uranium demand depends on NPPs and, most importantly, does not correlate with the global economy. Even in a steep bear market, the world still needs electricity. PGM is primarily used in the auto industry. Unlike the NPPs, the auto industry, hence PGM demand, closely follows the global economy. Nevertheless, knowing who the prime buyer is gives better visibility to future demand.

Predicting supply and demand balance in a market with fewer running parts is less complicated (not easier). And so are future commodity prices.

A complex commodity is one with multiple actors on both the supply and demand sides (compared to simple commodities). Fossil fuels are a prime example. Crude oil, LNG, and coal supply are not as concentrated as PGMs or uranium. Even at the time of Seven Sisters, oil production was more diversified than that of PGM or uranium mining nowadays.

Fossil fuel demand has a high Beta to the global economy. Going deeper, the picture gets even more complex. Demand for LNG and crude oil is rising in the East while production is in the West. Coal demand can be divided into steel production and energy generation. That being said, there are many variables to consider, hence it is easy to reach deceptively convincing conclusions.

Copper is another relatively complex commodity. Five countries control most of the production: Chile, China, Peru, DRC, and the US. However, copper demand is tightly correlated with the state of the global economy because it is needed everywhere. Simply put, unlike uranium and PGMs, where one or two industries lead the market, copper demand depends on diverse consumers.

This is not to say that investing in fossil fuels or copper is not worth it. My point is to show the game's complexity so we, as investors, can choose the right tools to increase the odds in our favor.

OPEX vs CAPEX

OPEX commodity is gasoline. Once you spend on CAPEX (a vehicle), you must top the fuel tank to utilize the car. An empty tank means no utility. Another example is uranium. Building an NPP costs several billion. OPEX commodity, in that case, is uranium. No uranium, no GWh.

CAPEX commodities are optional (to a certain degree). It is not mandatory to invest in NPP or buy a new vehicle. Coal-fired plants and our old car will do the job. In other words, capital investments can be postponed…until they can’t.

OPEX commodities are not optional, nor are they subject to our wishes. Running a car or utilizing an NPP requires fuel. If we disregard them, our assets decay, losing the CAPEX.

Let’s share one more perspective. Oil rigs are CAPEX, while offshore supply vessels (OSVs) are OPEX. Rigs are good to have but not mandatory. Once the rig is there, it must be serviced and maintained. OSVs take that task. Optional CAPEX (rigs) leads to inevitable OPEX (OSVs).

The world reached a point when the CAPEX became overdue, considering the state of asset-heavy businesses such as mining and energy. Accordingly, investing in CAPEX commodities is a lucrative bet. However, this means the ever-growing need for OPEX commodities to feed the new projects (mines, oil rigs, power plants, etc.).

Now, let’s bring it all together.

Final thoughts

Based on the above, there are four categories of commodities:

· Tier 1 (OPEX and simple): uranium

· Tier 2 (CAPEX and simple): tin, PGMs, tungsten

· Tier 3 (OPEX and complex): coal, LNG, crude oil

· Tier 4 (CAPEX and complex): copper, zinc, bauxite, nickel

The graph below summarizes it all:

The chart does not represent all commodities. It aims to illustrate the framework I discuss today. I included those commodities I am interested in.

Preferably stick to Tier 1 and 2. Tiers 3 and 4 are under more consideration, given their complex markets. This is not to say there is no way to get Alpha from oil, copper, or their corresponding equities. Definitely, they provide tons of Alpha. However, doing so is more complicated than relatively simple markets in Tier 1/Tier 2.

The more running parts in the system, the more challenging it is to forecast the outcome with plausible accuracy. Hence, our thesis is more prone to errors.

To remind you, I do not state that investing in uranium is superior to investing in oil. This framework is a map of commodity markets. It guides me on where to go and how to prepare if I want to reach the desired destination. That classification is not a fail-proof approach, yet it helps simplify my investing process. Consider today’s write-up as another idea generator.