Shipping stocks are genuine Alpha generators. Yet investing in shipping is far from easy, and profits are anything but guaranteed.

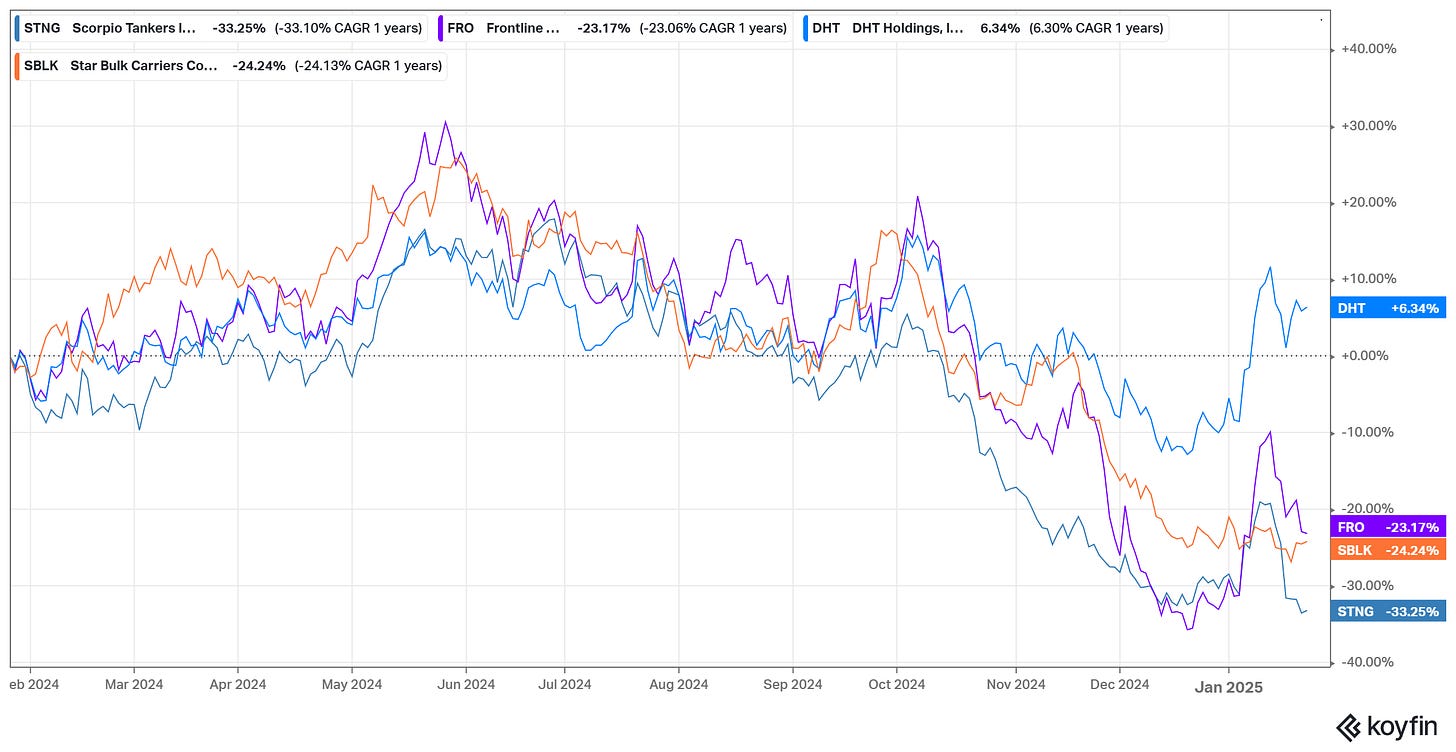

Ask investors in floating steel in 2024. The first half delivered impressive gains, only to decimate them in 2H24. Look at the chart below:

Such market behavior is a norm, not an exception, for shipping equities. That said, for well-heeled investors, inherent volatility is a feature, not a bug. The key is to avoid the traps.

The better way, or I would say the less complicated one, is to seek an acute vessel deficit driven by declining vessel supply and robust tonne-mile demand growth. This is a supply-driven market. In other words, the best-case scenario. The next best option is stable supply and strong demand growth.

The worst variant is to rely on a higher tonne-mile demand growth rate than the fleet growth rate. This is a purely demand-driven market, which is significantly more fragile because it depends solely on resilient demand. A short-lived blip in demand can turn the present vessel deficit into a future supply glut, which means weak day rates for the foreseeable future.

Why is explicit demand-supply imbalance such a powerful tool for gaining an analytical edge?

The Hare and the Tortoise

The interplay between supply and demand in shipping (and in any capital-intensive business) can be illustrated by the fable “ The Hare and the Tortoise.” The supply side in shipping is the tortoise, and the demand side is the hare. Supply is slow to respond to demand shifts, creating monumental bull runs and ruinous bear markets.

During a booming shipping market, shipowners go berserk ordering vessels…only to take delivery when the party is (almost ) over. Then, no one wants to hear about shipping. This leads to a shortage of ships to cover the characters' demands, resulting in a deficit. Drink, rinse, repeat.

Tortoise is predictably predictable, while the Hare is predictably unpredictable. And here lies our analytical edge. First, focus on the tortoise (supply) and then analyze the hare (demand).

But the question is how to apply it in practice.

The shipping industry is not homogenous. Each segment has its own subsegments and distinct market dynamics. Therefore, we must dig deeper.

For example, LPG carriers are a demand-driven market. Yet, not all LPG carriers are equally unattractive. VLGC market is demand-driven, while the Small/Handy market is supply-driven. As seen, details matter. We have to go on the subsegment level to figure out demand-supply dynamics.

Now, it’s time for practice. Let’s look at one of the most attractive shipping themes: crude oil tankers. Dirty tankers offer decreasing vessel supply and robust tone mile demand growth, a supply-driven story at its best.

Crude oil tankers

Since Ludvig Nobel ordered the first petrol tanker, Zoroaster, tankers have been synonymous with shipping wealth. Despite the delusional “green” energy hype, fossil fuels and crude oil tankers are here to stay. In other words, transporting hydrocarbon molecules across the seven seas will continue to create more wealth.

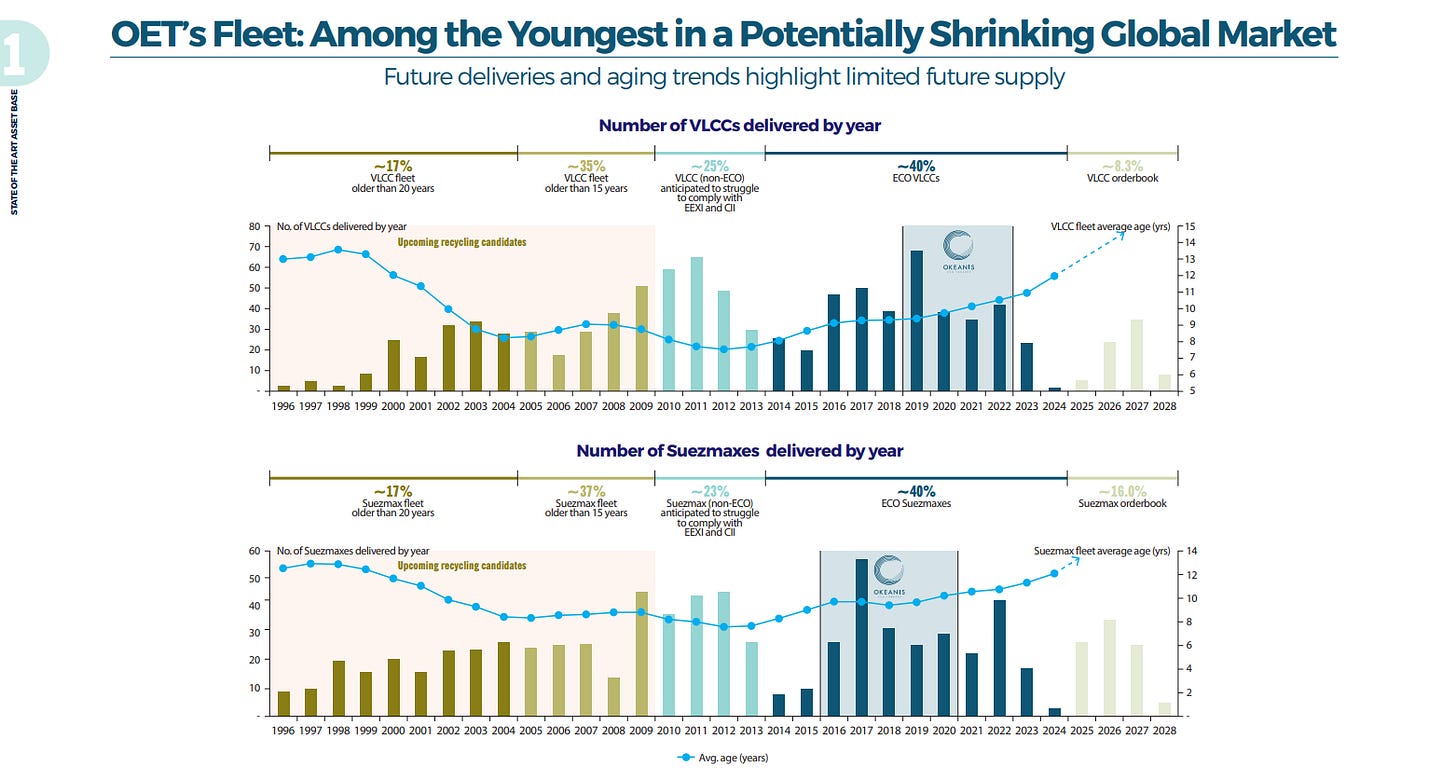

Crude oil tanker stocks are a good place to seek double-digit Alpha in the coming quarters. So let’s look at the supply side. Chart via Okeanis Eco Tankers.

The VLCC order book is 8.3%; meanwhile, the global VLCC fleet is aging rapidly. 35% of the vessels are above 15 years old. A cargo ship's life span is usually 20 years. However, there is a crucial nuance for tankers.

Crude oil tankers carry an inherent risk of oil spillage. Imagine a VLCC transporting 2 million barrels of crude oil spilling its cargo. In the past, we have had such an example in the Exxon Valdez disaster in 1989.

That’s why trading houses like Vitol and Trafigura charter Tier 1 tankers. These ships are under 15 years old and have environmentally compliant propulsions (scrubber fitted or/and dual fuel engines). The older vessels with outdated engines cover secondary routes and often end up in shadow fleets.

The Suezmax supply story is more balanced yet still favorable. The Suezmax order book is 16%, while vessels older than 15 years are 37%. Aframax tankers are often used as product tankers (marked as LR2 tankers in that case). So, their market fundamentals are the interplay between clean and dirty tanker markets.

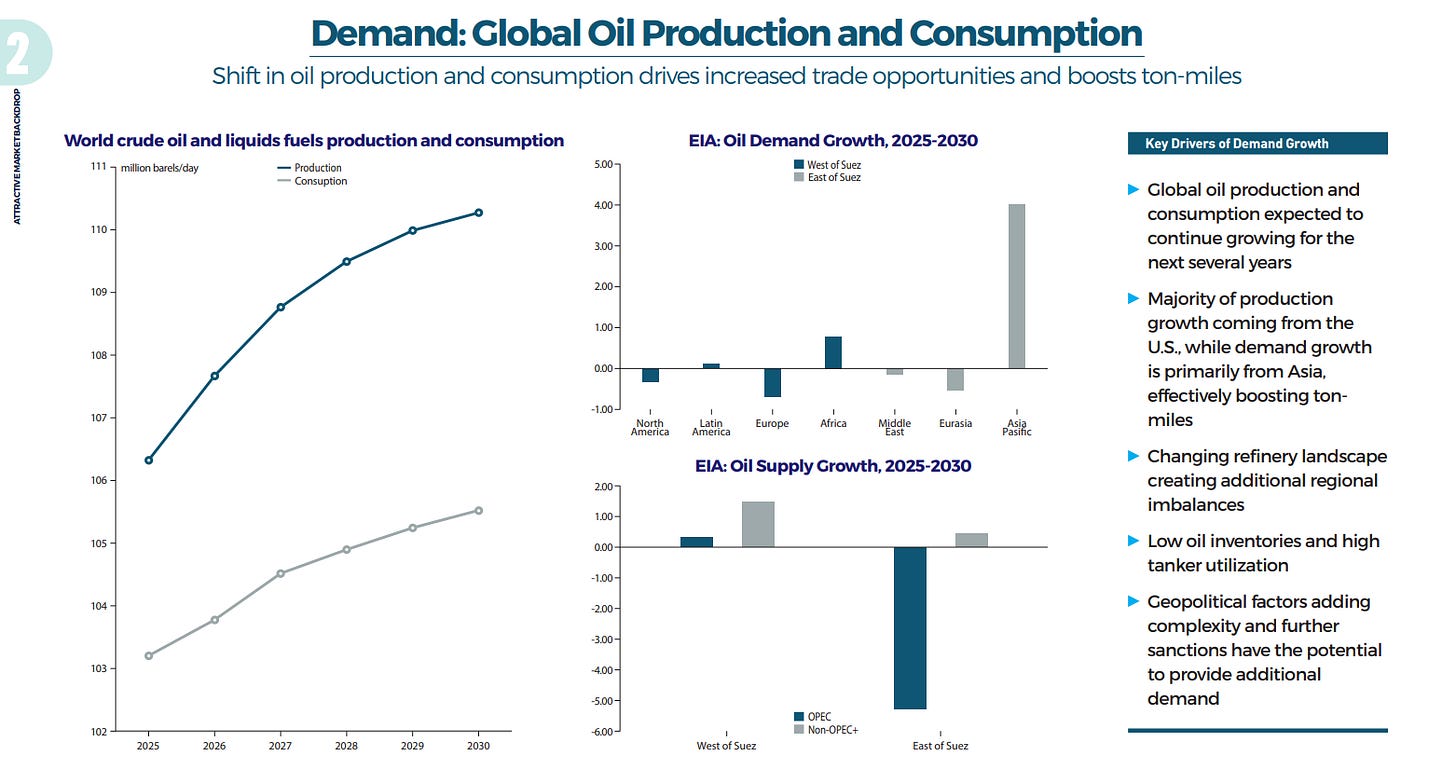

Considering the supply, VLCC tankers are the most favorable niche in the tanker segment. But this is half of the equation. Let’s look at the demand. Chart via Okeanis Eco Tankers.

Global energy needs (the left graph) are projected to grow significantly in the coming years. The drivers are:

Energy transition: A successful “clean” energy shift first requires astounding quantities of “dirty” energy

Big data and AI: bytes have an insatiable hunger for atoms

Global South demographics: An increasing percentage of India, Nigeria, and Indonesia's population is climbing the S-curve of economic growth. This means energy consumption growth per capita will accelerate further.

Those are the macro tailwinds that drive global demand for energy and commodities. For crude oil tankers, two more factors matter:

Geographic dislocation between oil wells and refineries. Oil production grows faster in the West of Suez while refining capacity grows in the East of Suez.

Shadow fleet sanctions as a catalyst. The shadow fleet is about 10% of the world tanker fleet, and sanctioned vessels are about 4-5%. In a market with two out of two - rising demand and shrinking supply, sanctioning 5% of supply will exacerbate the already glaring tonnage shortage.

In summary, crude oil tankers and VLCCs, in particular, offer three of three: stagnating supply, strong demand, and catalysts on the horizon.

That’s good news; dirty tankers are a supply-driven market, and there is Alpha. Then, how to become Onassis reincarnation?

It is not as easy as it sounds.

Shipping stocks can be weapons for mass account annihilation for unprepared investors. Meanwhile, for prudent market participants, shipping equities can deliver immense gains.

So, how to spot potential winners…and avoid losers?

The first mandatory step is to have access to shipping data. But there is a problem. Shipping data is hidden behind a steep paywall.

TheOldEconomy has the solution.

ShipSmart is here to save you time and money by providing curated and actionable shipping data at an affordable price.

ShipSmart

ShipSmart covers 31 shipping stocks and their vital metrics: fleet specs, operational figures, valuation multiples, capital structure, efficiency, and shareholder returns policy.

ShipSmart is for if you want to:

💰 Generate Alpha from shipping stocks

🚢 Make investing in shipping less complicated

⏲️ Save money, time, and efforts gathering all the data

📈 Spot the next potential winner…or at least filter the big losers.

Besides crude oil tankers, ShipSmart covers product tankers, LNG and LPG carriers, and dry bulk carriers.

ShipSmart first issue for 2025 is out and ready to rock.

If you do not want to miss the next big winners in shipping, consider ShipSmart, your trusted partner.

And there is more. By getting ShipSmart, you receive a special discount for TheOldEconomy Annual Membership.

On the markets, we are wrong until proven otherwise. So, take the above thoughts with a grain of salt.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.