Freeport McMoRan: asymmetric bet on copper with LEAPS

Strong balance sheet, attractive valuation, and cheap calls

It is time for one stock pick in the mining industry: How to play the looming copper deficit?

This is the test drive section. It answers the following question: What will you miss if you do not become a paid subscriber?

In four separate articles, I present reports on energy, mining, shipping, and banking companies. My goal is to introduce my analytical framework for each industry. The analyses were published on Seeking Alfa and Investo.bg (my Bulgarian website) and my LinkedIn profile. In one additional article, I will show a portfolio example.

The second company is Freeport McMoRan, FCX, one of the major copper miners. The article was published on Investo.bg in October 2023 and on my LinkedIn (part 1 one and part 2).

The Grasberg mine in Papua, Indonesia, is one of the greatest engineering miracles of the last century. This is one of the largest copper mines globally, located above 4000 meters altitude in a region with nonexistent infrastructure. Developing such a project is a remarkable endeavor. The company behind it is Freeport McMoran (FCX).

Freeport is among the largest producers of copper. In addition, the company mines gold and molybdenum. Gold mining contributes 13.3% of revenue, and molybdenum mining contributes 5.8%. Besides Grasberg, FCX has other Tier 1 mines: the Morenci in Arizona and Cerro Verde in Peru.

FCX has excellent financial metrics and better CAPEX ratios than its peers. In addition, it offers attractive LEAPS call options expiring in more than 12 months. Even under conservative gold and copper price assumptions, FCX is highly undervalued and provides an ample margin of safety.

The FCX thesis represents my favorite approach to investing: event-driven macro combined with LEAPS options. I look for an event whose occurrence may cause a phase change in the system, i.e., parabolic price growth. I use LEAPS options to exploit the bet's asymmetry.

Today's article will present my investment process in a synthesized form:

· What are the supply/demand dynamic and the potential spark?

· How risky is Freeport measured, and what is your growth potential?

· What do I pay, and what do I get?

· How to play the idea?

Why copper?

Three factors contribute to the growing copper deficit: lack of significant discoveries, steadily declining ore grades, and an increasingly apparent shortage of mining engineers.

Lack of discoveries

Oil, copper, and iron ore are the material foundations of industrial civilization. Without one of these components, our world can not exist. Today, we will discuss copper. The entire extraction and processing sector suffers from supply destruction, and copper mining is no exception.

Copper combines characteristics that make it almost impossible to replace with another metal. The mind-blowing quantities required, its low cost, and its exceptional conductivity make it irreplaceable for now.

Rare earth elements are sought after for their specific qualities but are not used in quantities like copper. Moreover, in recent years, their substitutes have been successfully developed. Unlike copper, rare earths are used in minuscule quantities; thus, implementing alternatives is relatively easy.

The alternative to copper must meet the following conditions: abundant quantities, high conductivity, and low cost. Silver is the only metal with a higher conductivity than copper (about 15%). However, its price is tens of times higher than that of copper. Silver's slightly higher conductivity cannot compensate for its many times higher price.

This does not mean we must stop looking for a better alternative to copper, but we must develop new copper deposits in parallel. In the graph below, we can see that these are almost disappearing.

The Escondida mine in Chile is the largest operating copper mine in the world. It was discovered in the 1980s and began operating in 1991. Since then, several significant discoveries have been made, but on a smaller scale.

Only the Kamoa Kakuala mine in the Republic of Congo is worth mentioning for its exceptional grade and huge reserves. However, even Kamoa will not be sufficient to meet the ever-increasing demand for copper.

In 2022, the world needed 24 million tonnes of copper. The World Bank estimates that 2030 it will need 30 million tonnes. 2025 is expected to be the first deficit year—more copper will be consumed than produced. And most probably, it will not be the last.

The gap between supply and demand is widening. The market will steadily grow while supply stagnates and even falls. Discoveries, such as Escondida, are increasingly urgent.

It takes over ten years, from the exploration phase to the first production. At best, this period can be shortened to 7-8 years. This means that even if deposits containing enough copper are found today, they will start production after 2030 at the earliest.

Declining ore grades

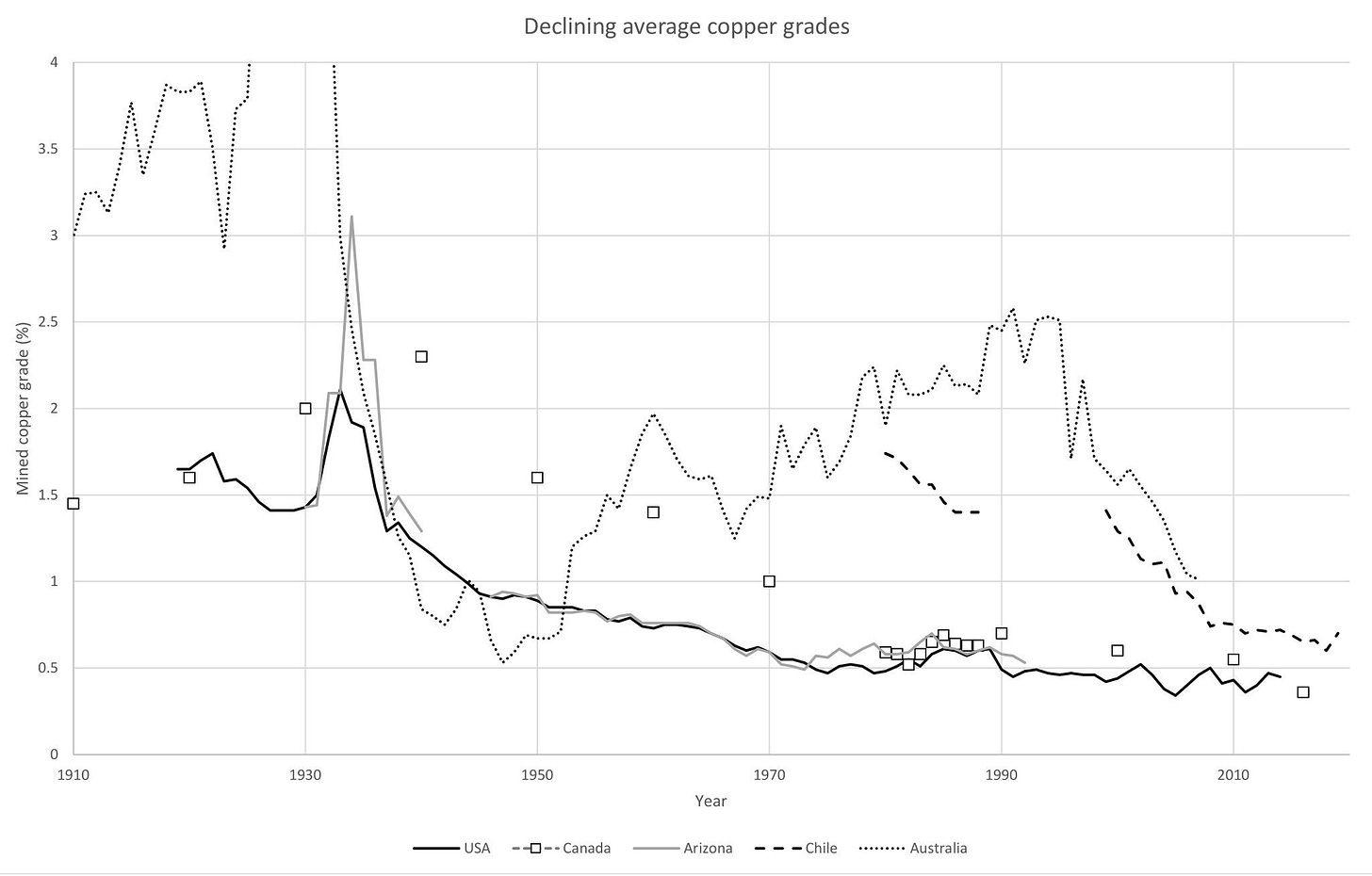

The second reason for the stagnating supply is the declining ore grades, as seen in the chart below.

Ever-declining copper ore grades undermine the future supply. Ore grade determines how economically viable it is to extract and process the ore.

The Cut-off grade describes the relation between cost per ton and ore grade. It indicates the minimum concentration that makes ore extraction economically viable. The price of copper contained in one ton of ore must exceed the cost of extracting and processing it.

Cut off grade > extraction and processing cost per unit/spot price per unit

The lower the ore grade, the higher the metal extraction cost. Consequently, the cut-off grade also grows. At one point, the deposit becomes uneconomical relative to the current spot price.

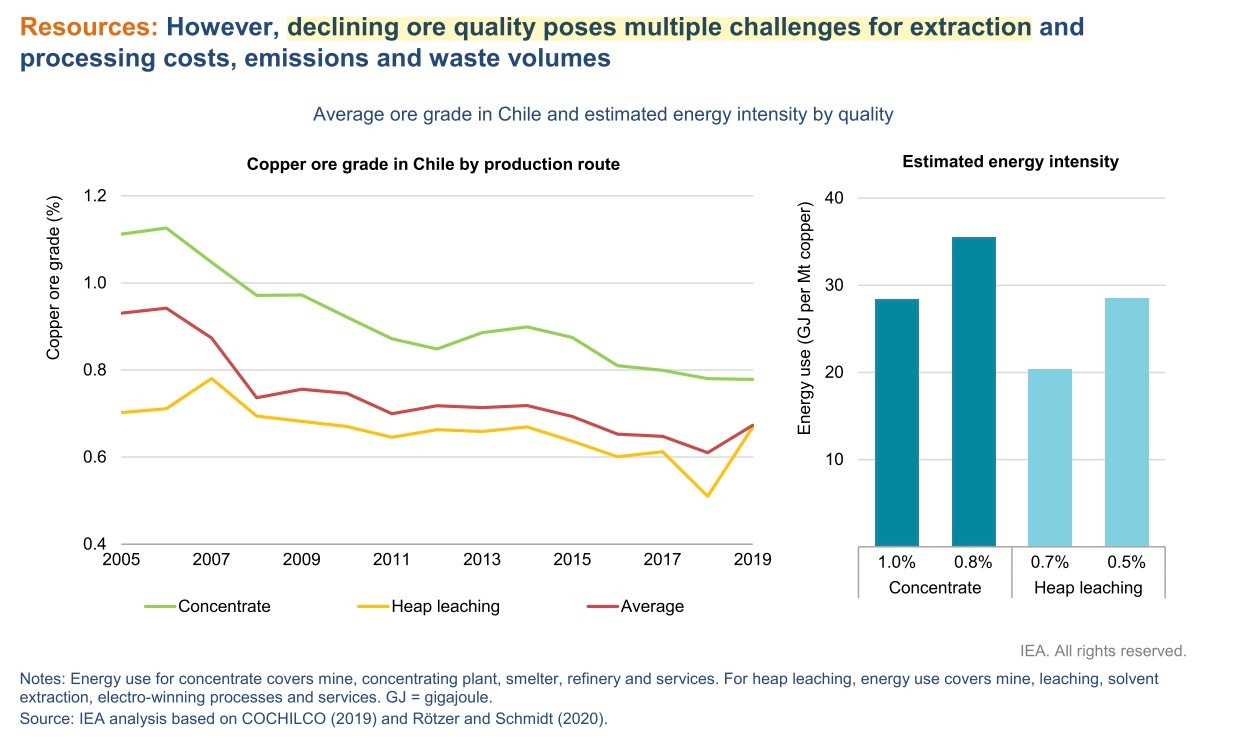

With declining ore concentrations, even deposits that were economically viable until recently will become a drag for mining companies. The following graph illustrates this process.

The relationships between the concentration and the energy required to extract a unit of raw material are shown on the right. A decrease in grade increases the power necessary to extract an ore unit.

How can we increase the deposit cutoff grade while the ore grades decline? There are two ways:

· Increase investment in discovering deposits to find economically viable high-grade ore, even at current spot prices.

· Increase in the spot price of copper due to the imbalance between supply and demand. Thus, even deposits with low concentrations will become economically attractive because the cut-off grade will rise. The rising spot price will also stimulate investments in new projects.

Capital investments in new copper mines are past due. Furthermore, it takes a long time—it often takes 15 years from the deposit's discovery to the first copper ingots coming out of the mine.

The higher spot price is the only way to lower the cut-off grade without waiting 15 years. This will make even low-grade deposits economically attractive.

The lack of investment and the declining grade of copper ore severely constrain copper supply. However, one more profound limitation is the lack of skilled mining personnel.

Who wants to be a mining engineer?

The CAPEX cycle is the big driver behind the new commodities bull market. We have supply destruction in action. Unlike the demand side, which is controlled through monetary and fiscal measures with a short feedback loop, increasing supply is a prolonged process. The first discoveries and production are at least ten years apart.

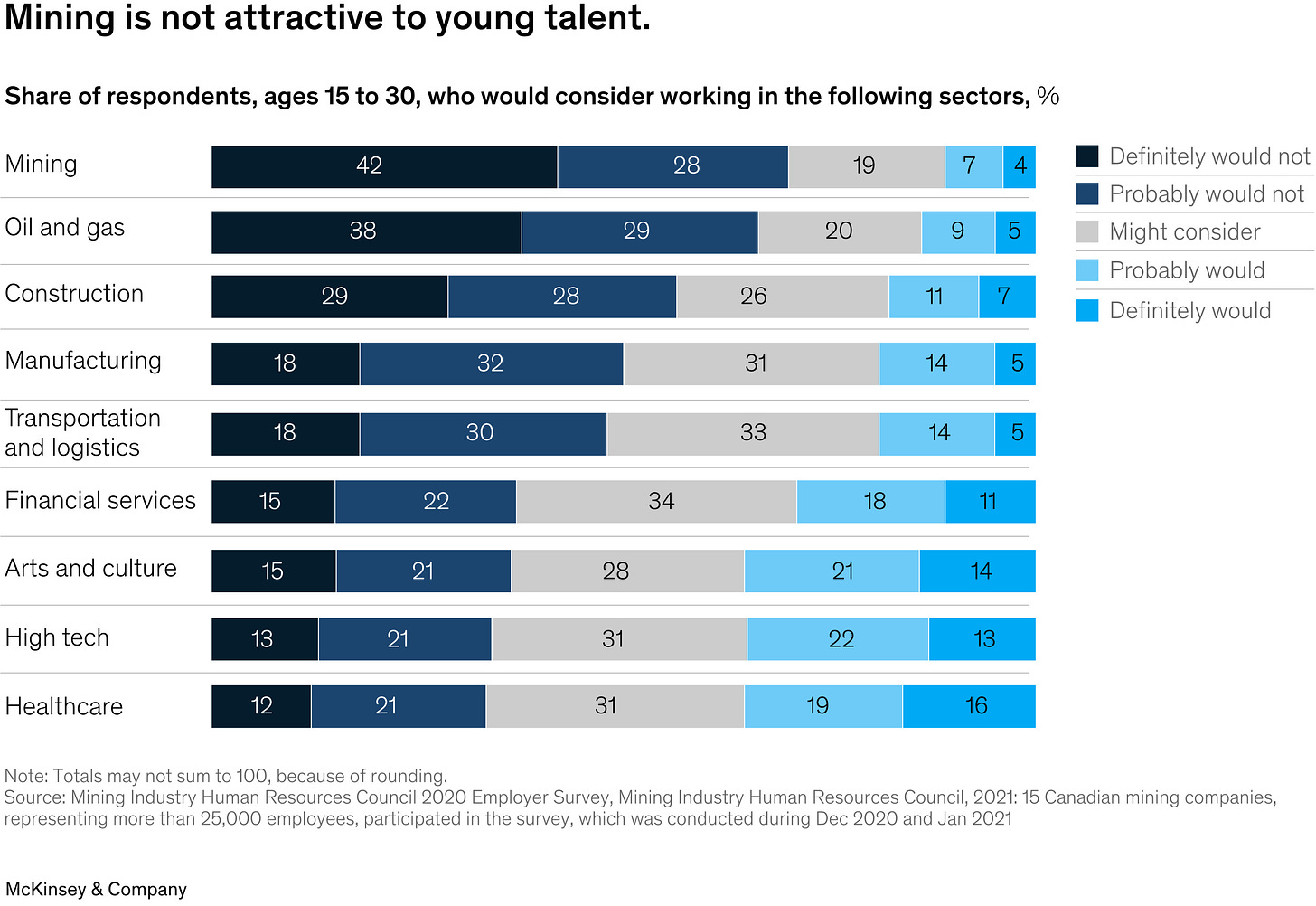

The lack of personnel for the mining and processing industry is a significant issue. Mining engineering has long been out of fashion. The graph below clearly shows this trend. It presents the survey results conducted among Canada's largest mining companies.

The lack of interest in the industry is very pronounced. The problem is common for all extractive businesses: oil and gas, precious metals, and base metals. Besides that, it is not unique to Canada.

The major players in the industry are Australian and Canadian companies, which operate worldwide. Their universities train highly skilled personnel. The declining number of mining graduates will have long-term adverse effects on the industry.

Unlike money, mines and engineers cannot be created from thin air. Finding and developing a new deposit and creating skilled personnel takes years. Until then, the shortage of mining engineers will significantly impact the supply of raw materials.

Even if we have all the money to develop new mines, if we do not have enough people, the mine's output will remain limited by personnel shortage. Limited capacity means limited supply.

Copper demand

In several publications, I discuss factors that impact supply/demand dynamics in commodities. The major drivers are:

· The Green Deal,

· Demographics.

· Energy independence.

One picture equals 1000 words. Following this cliché, I will tag each factor with a graphic and a brief description.

The Green Deal

The quantity of metals needed for an EV dramatically exceeds that of an ICE car. Let's extrapolate this to a new power grid infrastructure and generation capacity.

Demographics

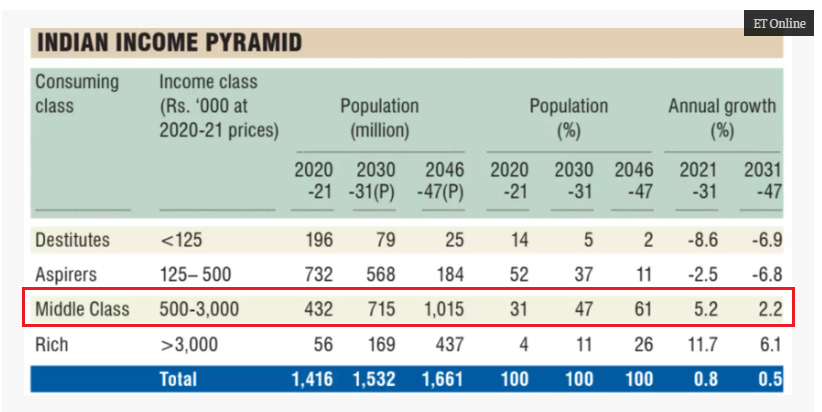

The population of India and much of Africa is growing exponentially. The only way to meet the energy needs of more people is to increase energy capacity. The required quantities to complete the transition to clean energy are staggering.

The population of India and Africa grows exponentially. Besides that, India is climbing up the S curve (GDP per capita passes $3,300), increasing consumption of goods and services.

India`s middle class will grow to 280 million people by 2030. Those people will demand higher standards of living, i.e., more resources.

The only way to satisfy the growing demand is to build more power plants, which means more copper will be needed.

Energy independence

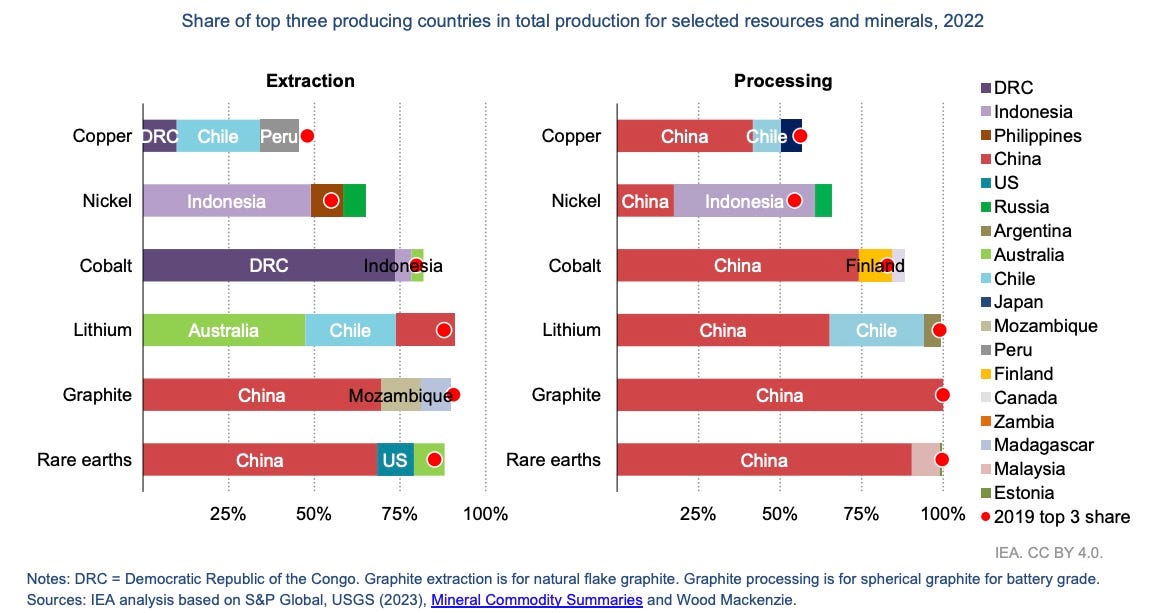

Energy independence is crucial. I am not talking only about fossil fuels. China dominates the extraction and processing of metals required to build power plants and infrastructure. The following graph shows how dependent the world is on China.

I conclude this point by sharing the following graphic:

The upper half shows the copper price, and the lower half shows the available stock reserves measured in inventory days to cover. This is the catalyst event – record low stocks at the major exchanges and suppliers.

This is a consequence of everything described in the preceding paragraphs. Accordingly, these record lows mark the beginning of a new bull market in copper. Time will tell if "this time is different."

Unlike money, mines and engineers cannot be created from thin air. Finding and developing a new deposit and creating skilled personnel takes years. The shortage of mining engineers will significantly impact the supply of raw materials. On the other hand, the demand will continue to grow in the foreseeable future.

We have various tools at our disposal to bet on rising commodity prices. I like to use LEAPS options on major miners to play expected bull runs. Freeport McMoRan is the company in question. In the following sections, I will dissect its financials and discuss how I apply LEAPS calls.

Freeport McMoRan

Mining companies have a common feature—they prosper together when commodity prices rise but fail in solitude when the price is low. The bull market lifts even the shabby companies, while the bear market tests companies' survival skills. Those with excessive leverage go underwater, while those with robust balance sheets weather the storm.

Liquidity and solvency are the first metrics I look at when I pick mining companies. Even small shocks to the commodity's price without a solid balance sheet can prematurely take a company out of the game. At the same time, companies with solid financials survive the crisis and thrive in the next bull run.

Solvency, liquidity, and profitability

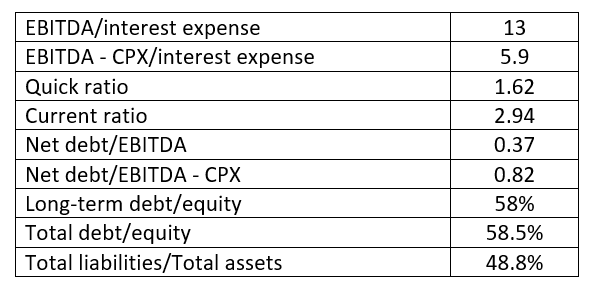

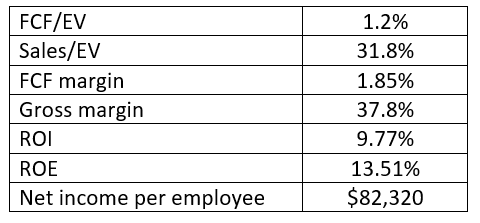

Freeport has a balance sheet with excellent liquidity to cover liabilities and develop new projects. The table below shows some metrics I use to measure the company's health. The data is from the company's most recent financial statement.

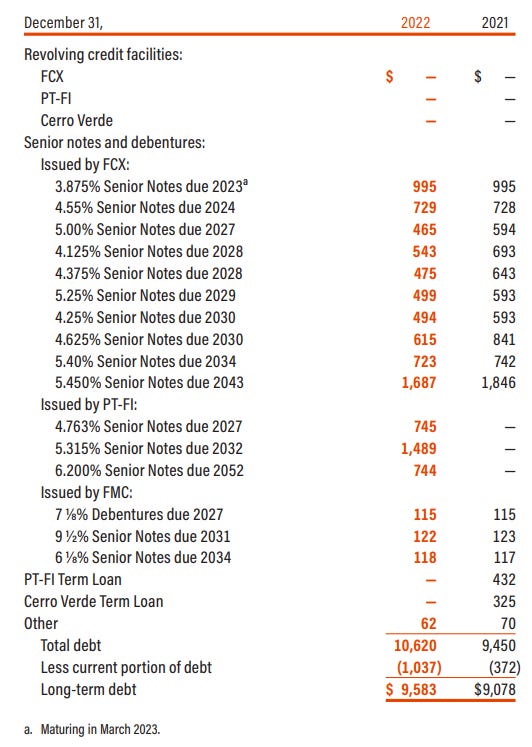

Freeport's debt is well distributed, as seen in the chart below. The company's credit rating from Fitch is BBB-, i.e., investment grade (the lower bound).

Over the next year, $729 million is due, representing 11% of FCX's current cash or 95% of the company's free cash flow. I don't expect any liquidity issues for FCX.

The success of a mining company depends on capital investment. They determine the company's long-term profitability or lack thereof. Every mining company adheres to the mantra: the reserve replenishment rate must exceed the reserve depletion rate.

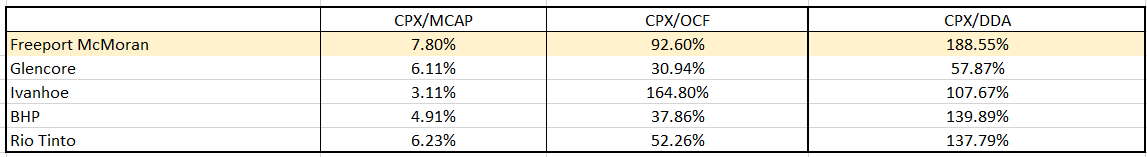

The company must invest in projects to maintain its reserves. In the following table, I compare FCX to a few major copper producers.

MCAP market capitalization

DDA Depletion, depreciation, amortization

OCF operational cash flows

Freeport is the undisputed leader in all three indicators. Despite a good CPX/DDA metric, the company still invests over 90% of its OCF. Only Ivanhoe exceeds this figure with a CAPEX/OCF of 164%.

Despite lower copper prices, FCX remains profitable. The table below illustrates several metrics I use to evaluate a company's performance. The data is taken from the most recent financial report.

ROIC and ROE are higher than industry averages, while the latter have fallen below FCX's 5-year average. Net income per employee is much higher than that of FCX peers.

Freeport pays dividends with a mediocre yield compared to its major peers, as seen in the image below.

Glencore, for example, distributes dividends with a yield of 7.7%. BHP, RIO, and SCCO maintain yields of around 5.5%. For mining companies, I often prefer higher CAPEX over dividends. Over the long term, equity investment will boost company profits. Combined with the right macro situation, stock prices can rise exponentially.

Valuation

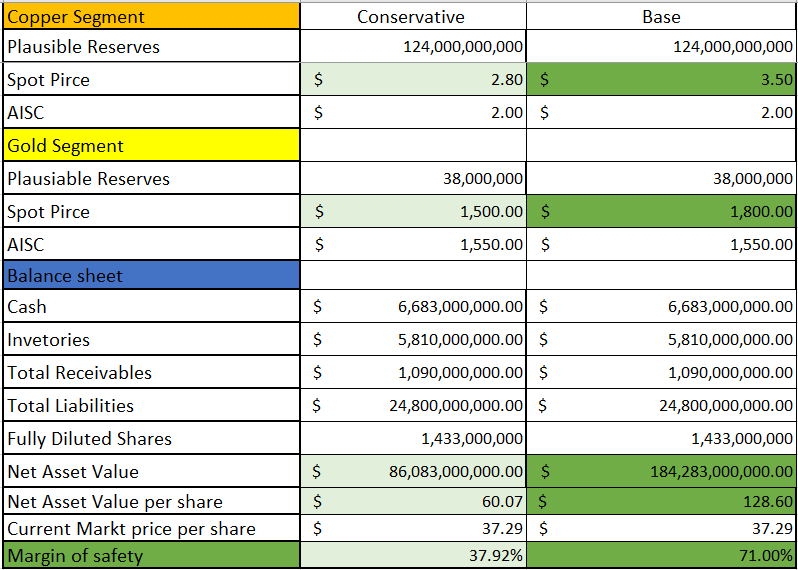

Freeport runs a capital-intensive and highly cyclical business. A cash flow-based valuation would, therefore, be misleading. Instead, I use the following methods to determine the fair value of the company:

· Net asset value based on the company's reserves, current assets, and total liabilities.

· Relative valuation using EV/Sales and Price/Cash Flow

I calculate net assets as follows:

NAV = PR*(SP-AISC) + cash + inventory + total receivables - total liabilities

PR (Plausible reserves) = 100% * P&P reserves + 50%*M&I resources + 10%*resources

I consider two scenarios. One is conservative, with a copper price of $2.8 per pound and a gold price of $1,500 per ounce. The other is the base case, with a copper price of $3.5 per pound and a gold price of $1,800 per ounce. I assume a 15% higher AISC and deliberately exclude molybdenum production.

Conservative scenario NAV per share = $60.07

Underlying NAV per share = $128.6

Current market price = $36.41 (09 October 2023)

Although both scenarios bet lower than current spot prices, FCX offers a significant margin of safety, 38% and 71%, respectively.

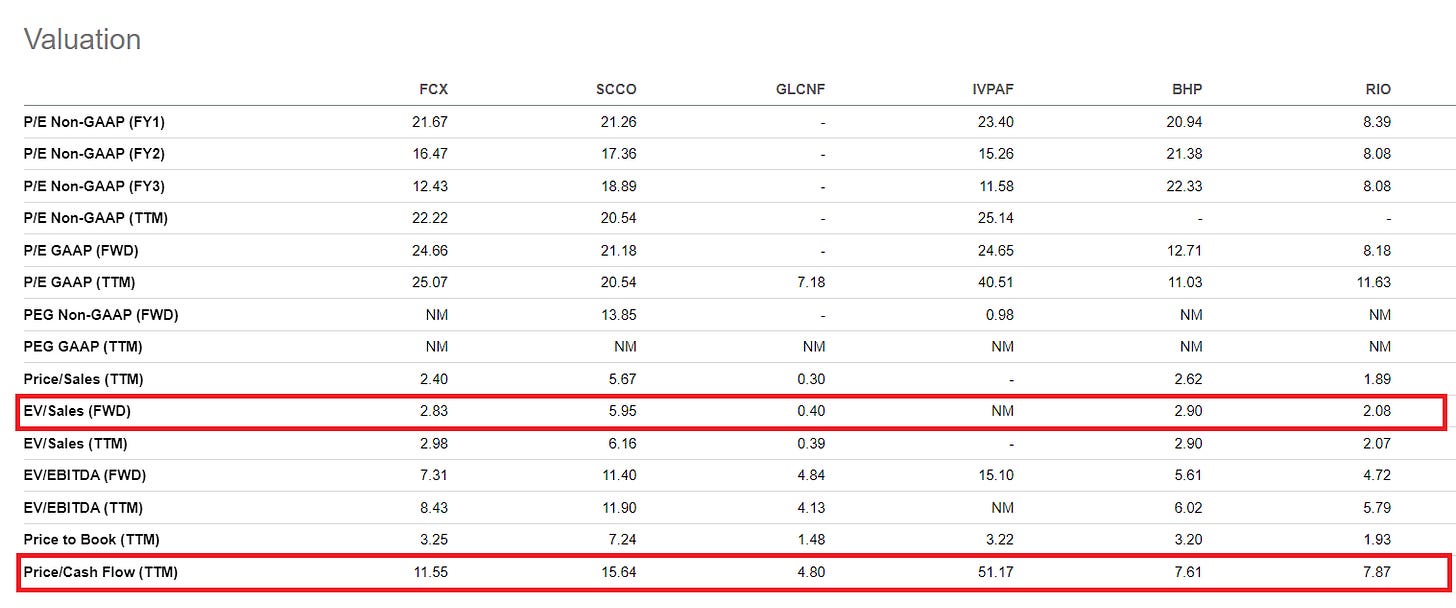

I determine FCX's relative valuation relative to the following companies:

· Southern Copper Corporation (SCCO)

· Glencore Plc (GLCNF)

· Ivanhoe Mines (IVPAF)

· BHP Group Limited (BHP)

· Rio Tinto (RIO)

I use the EV/Sales and Price/Cash Flow metrics to assess FCX's relative position. Freeport is in the middle using the parameters indicated. That is, the company has the potential to be overvalued relative to its peers.

How to play the copper thesis?

I use LEAPS options in situations with growing deficits over the next 12-24 months, as with copper and uranium. The growing deficit is the spark pushing the price north. On the way up, I expect high volatility. LEAPS options allow me to take advantage of not only the rising price but also rising volatility.

Major producers carry lower risk but have less growth potential than mid-size and junior miners. Junior miners can realize parabolic returns but are much riskier than mining majors. LEAPS options solve those problems.

Other considerations when buying options are liquidity, i.e., Open interest and volume. The volume is usually low or even zero for LEAPS, but the volume increases as the expiration date approaches. With less than a few months remaining, open interest reaches at least 1000 contracts. This way, I am sure I will have a buyer to buy my options when I want to exit the position.

Important reminder: options are complex instruments and should be treated as such. Buying options does not guarantee profits.

Risk

FCX, like any mining company, carries the following risks:

Metallurgy and geology

Financial

Politically

Operative

Economic

Freeport primarily bears operational, market, and economic risks that are typical for major miners. Geological, metallurgical, and financial risks are more pronounced for small and medium-sized companies in the industry.

Operational risk arises from the complexity of running a multinational company. Freeport has mines in several countries and is thus exposed to country-specific peculiarities. On the positive side, FCX owns and operates assets in three countries: Peru, the US, and Indonesia. Simply put, the company`s operations are not spread across several countries.

Market risk is always present, given the bear market in bonds and the chaotic price action of equity indices. No matter how good a business is in the short term, major market shifts affect all companies. In a force majeure event, all stock prices fall no matter the sector, region, or business behind them. In other words, a likely downturn will not invalidate my hypothesis. Instead, it will give a better entry price.

Conclusion

In the long term, I'm bullish on the price of copper. The lack of significant discoveries, declining ore grade, and a growing personnel deficit will irreversibly impact supply. On the other hand, demand is steadily increasing, driven by the transition to clean energy, infrastructure renewal in the US, and growing affluent populations in India, Indonesia, and Nigeria.

Higher demand and limited supply are a recipe for a looming deficit. I chose Freeport in combination with LEAPS options to bet on this hypothesis. FCX is among the largest producers of copper. In addition to copper, FCX mines gold and molybdenum. The company has a solid balance sheet with additive liquidity and well-structured debt maturities. Freeport is deeply undervalued based on NAV. I have set conservative assumptions for gold and copper prices in the accounts, which are well below current levels.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Full disclosure: I hold a position in Freeport McMoRan when publishing this article. Note that this is a disclosure, not a recommendation to buy or sell.