The dollar will soon be replaced by a new currency backed by gold. The US is no longer in charge. The BRICS are defining the new world order. All three statements are too far from the truth.

Yes, the BRICS alliance can potentially transform geopolitics, and it is making bids to do so. However, this is not enough to write off the current world order. Ultimately, it all comes down to tangible variables, i.e., energy, demography, and geography.

There is no eternal empire and no eternal world currency. The United States is no exception to this rule. A hegemon's decline is always painful and followed by many conflicts: the more influential the dominant empire, the more prolonged and intense the turmoil accompanying its decline.

Those who like China/BRICS focus on their advantages and the US/NATO disadvantages. Those who like the US/NATO focus on their advantages and China/BRICS disadvantages, often without arguments for either side. In most cases, these statements only illustrate personal preferences, nothing more.

Change is the only constant. The US and China, like any empire, will inevitably experience the waning of their power. The question is not if but when this will occur. It is a process that unfolds over the course of human life, yet in the grand scheme of history, it is but a fleeting moment. There is one catalyst that could hasten this process—global war.

Every complex system has a tipping point at which an intervention of sufficient intensity would instantaneously change the entire system's qualitative and quantitative state. In this case, that intervention is a Great Power war. No matter who wins, it will radically transform the geopolitical map.

The possibility of direct military conflict is always on the table. However, this scenario is possible—low enough that it cannot be accurately assessed but not so low as to be ignored.

The continuation of the economic war in combination with the proxy wars is much more plausible. The US Grand Strategy is based not on dominating territories on all continents but on deterring the emergence of another intercontinental power with a strong navy. Why precisely a strong navy?

Alfred Mahan, in the late 19th century, defined the role of the seas and navies in international relations and warfare. One of his conclusions is that the state with the strongest navy can project power globally without engaging in direct military conflict.

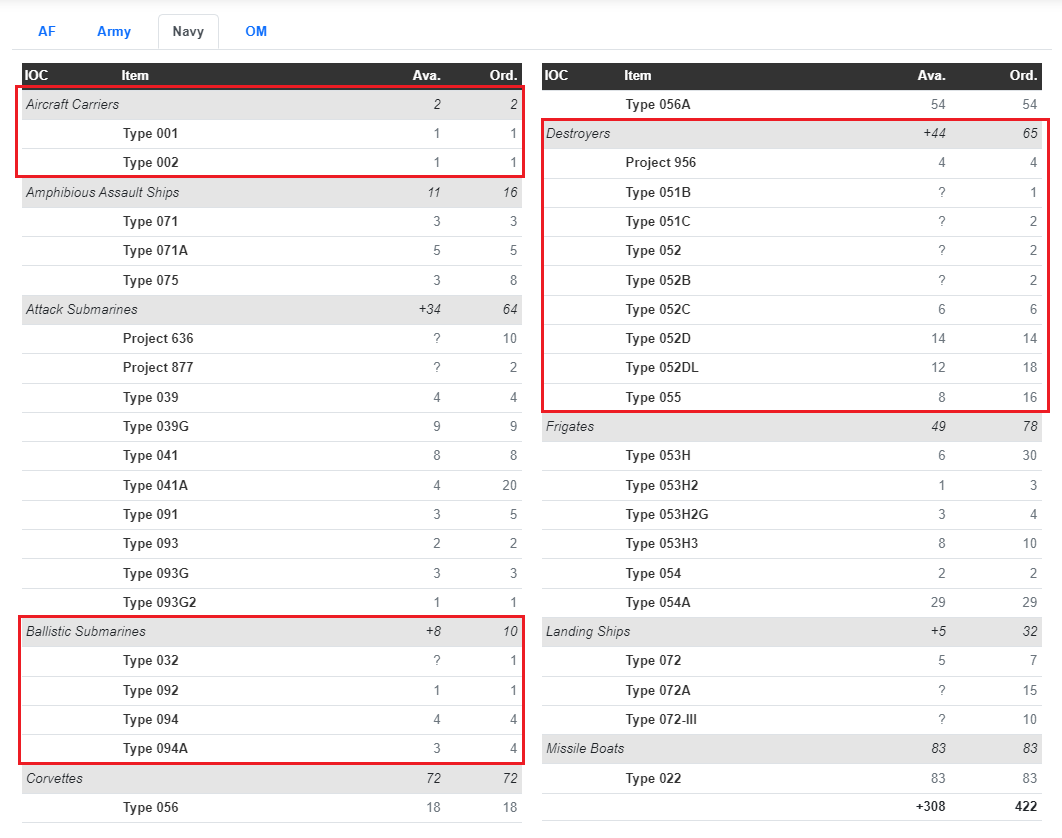

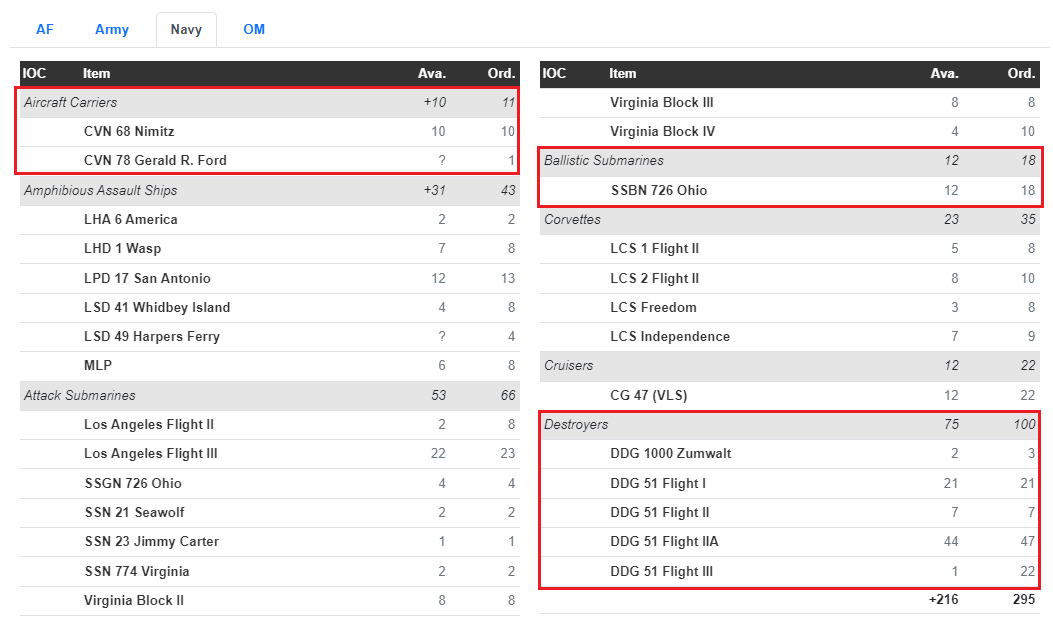

While China is intensely building warships, its navy is still far from that of the US. China's fleet is more of a green water navy, while the US's is blue. The difference is in the quality characteristics: the type of vessels each fleet includes. The US has significantly more aircraft carriers, nuclear submarines, and destroyers.

The following charts show the structure of the US and Chinese fleets. The strategic vessels, i.e., the blue water navy, are enclosed in red rectangles. The chart below shows the Chinese Navy; the second is the US Navy.

These three classes of vessels—aircraft carriers, nuclear submarines, and destroyers—give a strategic advantage anywhere in the world. Greenwater navy vessels have a short range, that is, within a few hundred nautical miles. In other words, unlike the US, China cannot yet project power globally through its navy.

Thanks to shipping, the world is a global village. Whoever has the most potent navy rules the seas. And he who rules the seas has control over the blood system of the global economy.

The US, as a Great Power, has no interest in ruling Ukraine, Iran, or Vietnam. Its intervention in all three countries aims to prevent the emergence of a Great Power with sufficient potential to challenge the present status quo.

In the first case, we discuss Russia and its expansion into former Soviet territories. In the second case, we discuss the emergence of a strong Shi'ite Muslim country like Iran as the center of gravity in the region. In the third case, we return to the Cold War and Vietnam. The US had no problem losing the war in Vietnam. Eventually, it achieved its goal to prevent the expansion of Soviet influence in South Asia.

If we ignore direct war, the sunset of the US and the ascension of a new hegemon to the throne will be a protracted process.

Why do I think so?

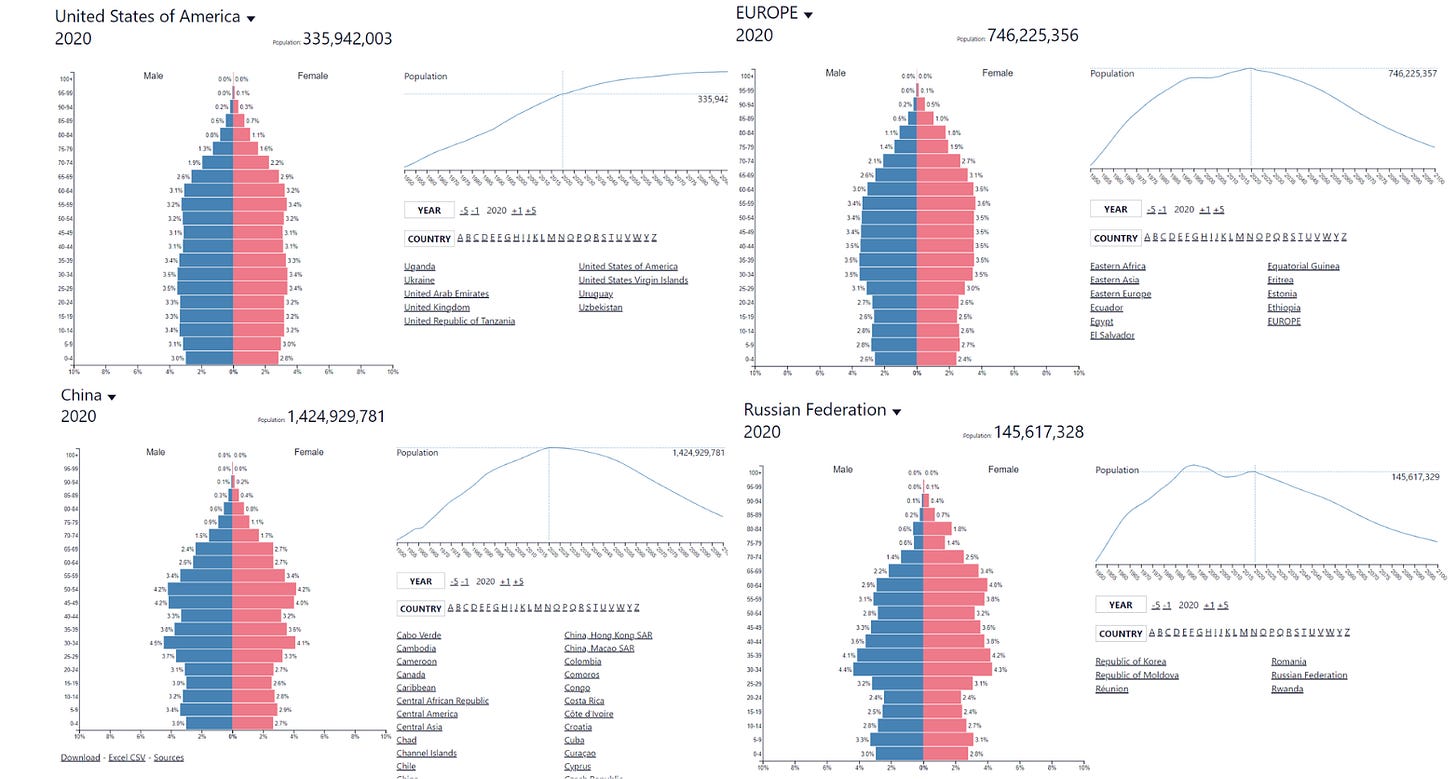

Demography is destiny. The US/NATO and China/BRICS have qualitatively different demographics. The US is the only G7 country with solid demographics, while its NATO allies have serious demographic problems. The economic center of the BRICS, China, is facing a severe demographic crisis. The same applies to the military engine of the BRICS, Russia, whose demographics have been bottoming out for several decades.

Geographically, the two alliances have qualitatively different characteristics. The United States has the most pronounced geographic advantage of all the dominant empires to date. It is surrounded by two oceans and friendly countries, Mexico and Canada. The same cannot be said for other NATO countries or BRICS countries.

Accounting for geopolitical analysts

China has qualitatively different problems, i.e., liabilities, than the US or Europe. The same applies to the advantages, i.e., the assets. I divide the parameters (pre)determining a country's ability to prosper into two categories:

· Tangible assets/liabilities are all parameters that are first derivatives of geography. This category includes access to energy, availability of minerals, natural constraints to external invasion, amount of fertile land per capita, size and quality of the transportation network, and demographic structure. What these have in common is that they are quantifiable and (almost) unchangeable.

· Intangible assets/liabilities. These parameters depend more on culture and anthropology. They also appear to be derivative of geography but to a much higher degree. I place work ethic, collectivism vs. individualism, family structure, and dominant values in this category. All of these characteristics provide a qualitative description of countries and, as such, are not measurable. They, unlike material parameters, transform over time.

Tangible and intangible variables differ in the extent to which they are reversible. If tangibles are on the liability side, they are (almost) irreversible. This means going against physics - the lack of navigable rivers, minerals, or natural barriers such as mountains and water bodies is impossible to overcome. Natural resources are not created by a party decree, a CEO's signature, or a few keyboard clicks. Either they are in the ground, or they are not.

Demography is an exception. However, its changes take decades of focused action. Correspondingly, intangible variables are solvable, but only under one condition - a positive outcome occurs after decades of concerted change efforts.

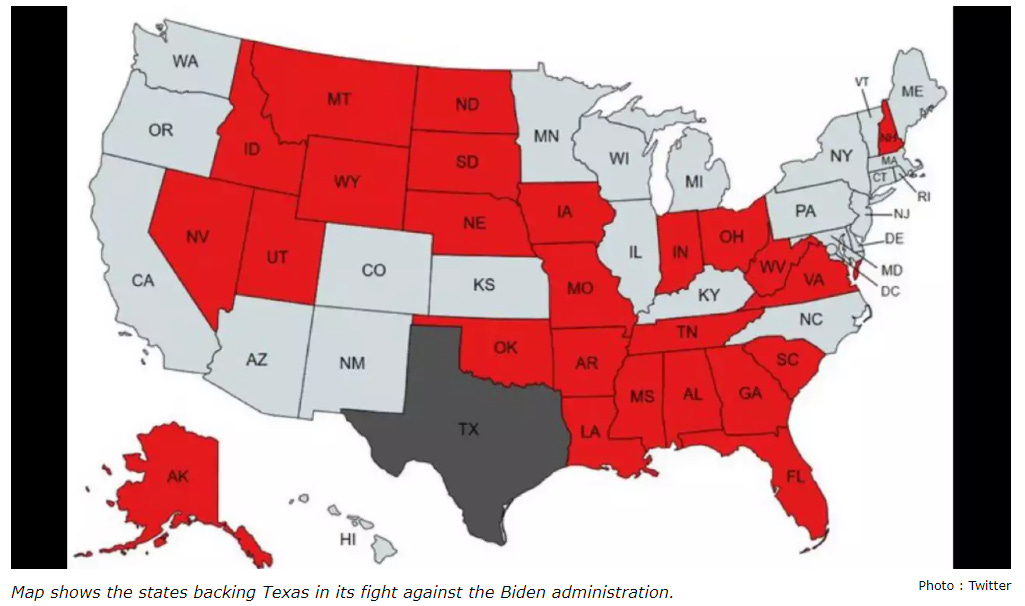

China and the US have domestic issues in common. The civil war in the US is a possible scenario that is gradually becoming plausible. The absurd policies of the Biden administration are leading to an increasingly clear division between Democrats and Republicans in the country. The immigrant crisis is another catalyst.

Joe Biden will be remembered as the most absurd US head of state in 50 years. Separately, cultural Marxism, aka “social justice” in the US, is taking on inadequate proportions, especially in big cities that Democrats dominate. At the same time, states dominated by Republicans are successfully opposing these policies. In this line of thought, the polarisation between the two political factions is becoming more apparent.

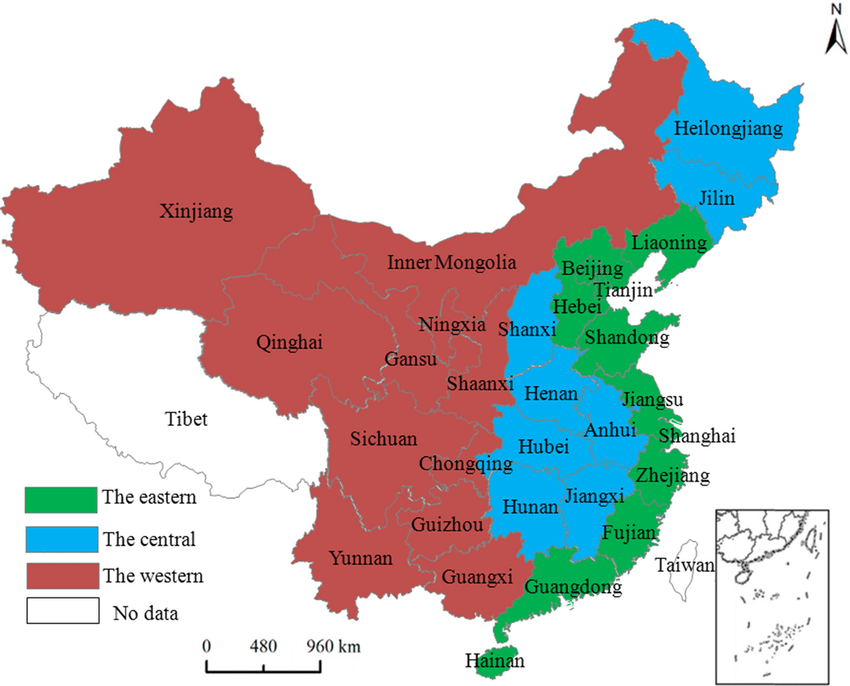

China is divided economically, demographically, and ideologically into three parts.

The economic strength and desire for an open market economy are found along the coast, while Beijing is the state and military center. At the same time, two-thirds of China's territory lags radically behind economically and demographically.

The current line of the CCP is diligently following Mao's postulates, i.e., ever-stronger central power and control over the population. Thanks to new technology, population micromanagement has reached new heights. As I mentioned, the coastal cities, which are economically and politically progressive, are resisting the extreme centralized power in Beijing.

China is energy-dependent and in a demographic crisis. Energy and demography are like the tide. They have a slow and imperceptible impact until we realize we have passed the point of no return. I believe China has passed that point in its demography, and its energy dependence makes the situation even more serious.

The US's material advantages successfully (so far) compensate for its domestic problems. Energy independence and perfect geography allow the US to make numerous geopolitical mistakes without significant consequences. Let us not forget that the US still controls the world's reserve currency.

Yes, the dollar is not backed by gold. However, its strength is supported by something else—the US Navy and, over the last two decades, the country's energy independence.

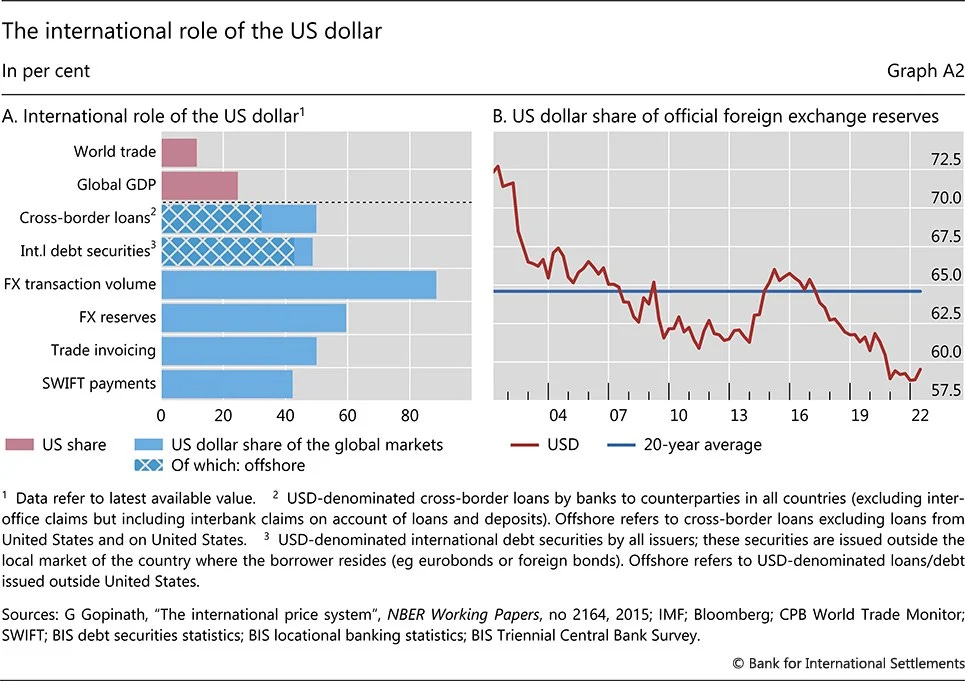

The dollar's share of global transactions is declining, but not enough to be displaced. Moreover, the share of competing currencies is far from sufficient to take the lead. The following chart from BIS shows the role of the US dollar.

Although the dollar will cease to exist (like every other fiat currency), it will remain a reserve currency for longer than most of the talking heads say. The reason is that the US is the only country among the Great Powers (the US, China, Russia, EU) that owns:

Energy independence

Geographical inaccessibility

Good demography

They are prerequisites for building the most complex financial system and the strongest army—the latter backs the U.S. dollar.

No matter how much gold the BRICS countries have, they lack three essentials. First, they do not have the hardware to conduct economic transactions, i.e., the undersea fiber optic cables and satellites. Second, they do not have the software that serves the architecture of the global financial system. Third, the BRICS countries do not have big enough blue water navies.

One hundred years from now, today's Great Powers will be yesterday's Great Powers. The same is true of the world's reserve currency. One thing is sure: the degree of global uncertainty is growing—as it has always been.

The US and China will continue to play geopolitical chess, fighting alongside their domestic problems, until one of the two countries falls under their weight first. In my view, that will be China within the next ten years. The US's tangible assets (resources, geography, demographics) give them a considerable advantage. They can make domestic and foreign policy mistakes without significant material consequences. At the same time, China does not have that luxury. Every mistake the CCP makes has direct repercussions.

At this stage, a bet against the US (in the broad sense, not a short position in the S&P500) carries asymmetric risk, but not in our favor. I'm not saying that the current bull market will last forever or that it won't experience a correction. On the contrary, both will happen sooner or later.

From a bird' s-eye view, the US still has the potential for economic expansion. Now, the growth engine is artificial intelligence. And I am not saying invest only in microchips. AI needs a lot of energy and metals to power and produce.

A reminder that the (likely) absence of a direct war between the US and China does not mean it will be boring in the coming years. On the contrary, geopolitical volatility will increase. And that means new investment opportunities – energy and commodities, the military-industrial complex, transport, and logistics - antifragile industries benefiting from increased entropy.