How to Bet on LatAm and Offshore Revival at Once and Get Paid Handsomely (dividend yield>20%)?

Divide et Impera: PLSVs in Brazil and Jack-Ups in Mexico

Latin America embodies value investing at the regional level. The continent offers abundant resources, robust demographics…and almost zero geopolitical risk. In terms of valuation, Latin America provides genuine bargains. Think about Argentina in 2022-2023 or Brazil and Colombia now.

The offshore industry, on the other hand, is a favorite industry for value hunters. The recipe for asymmetric returns is ever-growing energy demand coupled with an acute lack of capital expenditure over the last decade. The outcome is scarce and expensive assets that are sold for cents on the dollar.

Then, the ultimate value gem is supposed to be a blend of Latin America and offshore energy. TheOldEconomy has something for you.

This is the June report for Researchers and Strategists. It explores the intersection between Latin America and the offshore industry. Our trip begins with the Mexican Jack-ups market and the Brazilian PLSV market.

The foundation of my thesis is the revival of the offshore industry. Today’s contender operates in two niches: jack-ups and PLSVs. Our adventure begins with a review of jack-ups and PLSV markets.

Jack Ups market

The global jack-up (JU) market is undergoing a period of transition as it enters 2025, with the sector expected to be valued at $3.71 billion. It is projected to reach $4.72 billion by 2029, representing a CAGR of 6.2%.

As of early 2025, the global jack-up fleet comprises approximately 380 active units, representing a slight decline from the 408 rigs recorded in late 2023. The current utilization rate is about 89%, down from the peak of 94% in 2024, indicating some softening in the market. Industry projections suggest the total jack-up count (active plus idle units) will drop to 405 by the end of 2025, with utilization shifting from 94% to 89%.

Utilization levels are a function of supply and demand dynamics. The supply constraints are well known: a low single-digit order book, an aging fleet, and a lack of yard capacity. New building costs have escalated dramatically, with estimates ranging from $180 to $ 190 million per rig, representing a 30% increase over the past two years. Delivery times for new JU rigs are currently 24-30 months. A sufficient ROI would require day rates of $200,000-230,000 over a 25-year useful life.

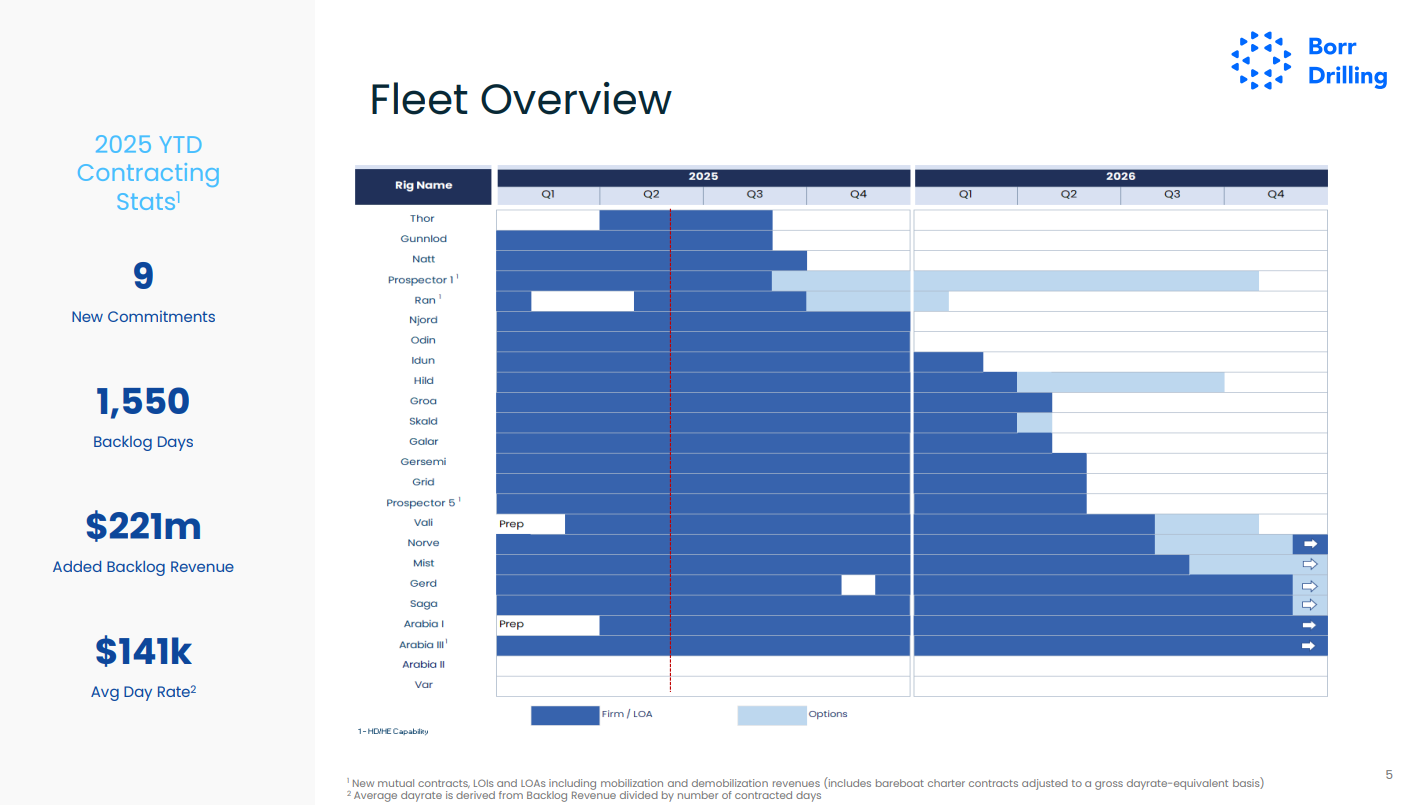

According to Borr Drilling's (NYSE: BORR) 1Q25 report, its fleet was contracted for an average of $141,000 per day.

Borr owns the fleet with the best average age, 7 years. So, if the best fleet can not score a $200,000/day contract, what remains for the older units? Simply, the incentives to order more JUs are far from sufficient.

Demand, on the other hand, is poised to grow. The primary markets for jack-up units are the Middle East, particularly the Kingdom of Saudi Arabia (KSA), and Mexico. For the purpose of today’s article, I will focus on the Mexican JU markets.

Mexican JU market

The Mexican offshore drilling market is dominated by state-owned Petróleos Mexicanos (Pemex) and characterized by shallow-water operations in the Gulf of Mexico, particularly the Bay of Campeche region.

As of May 2025, approximately 22 JUs operate in Mexico, up from 16 in 1Q25, demonstrating a recovery in activity levels. These rigs primarily serve shallow-water operations, where water depths typically range from 100 to 500 meters.

Why are major players in GoM?

Fontis Energy (formerly Seamex) operates five high-specification jack-up rigs, all of which are currently under long-term contracts. Borr Drilling maintains a significant presence with seven active jack-ups in Mexico, five of which are contracted to Pemex. However, the company has faced operational challenges, with three rigs (Galar, Gersemi, and Grid) experiencing temporary suspensions from February to March 2025 due to Pemex's financial difficulties.

While global jack-up day rates have shown regional variations, with rates in the Middle East exceeding $100,000 and those in Southeast Asia reaching $134,000, Mexican rates are facing downward pressure due to financial difficulties among operators.

Premium jack-up rigs typically command day rates between $100,000 and $150,000 globally; however, specific rates in Mexico are often subject to negotiated payment terms and extended collection periods. Despite current challenges, several factors support medium-term demand for jack-up rigs in Mexico:

Well Reactivation Programs: Pemex plans to reopen old wells to boost declining production, as Mexico has more than 31,000 wells, approximately one-third of which are currently inactive. Of these, around 4,800 are considered operational for hydrocarbon production.

Shallow Water Focus: Mexico's offshore strategy emphasizes shallow-water development in the Bay of Campeche, where jack-up rigs are most effective and cost-efficient. This focus aligns with global trends showing continued jack-up demand in brownfield projects, characterized by shorter cycles and low breakeven prices.

Infrastructure Development: Pemex is progressing with engineering, procurement, and construction of lightweight drilling marine platforms, including recent $160 million contracts for platforms in the Gulf of Mexico.

The Mexican jack-up market faces significant liquidity challenges stemming from Pemex's financial difficulties. Contractors report that the total debt from Pemex exceeds MX$400 billion ($19.7 billion), with MX$150 billion owed in Tabasco alone. These payment delays have forced some companies to operate with reduced staff, cut salaries, or shut down entirely.

The company's 2025 budget allocation of $22.75 billion represents a 7.5% decrease compared to 2024, raising concerns about the adequacy of funding to maintain or increase production. The financial strain has manifested in payment delays to contractors, with Paratus Energy Services reporting $283 million in unpaid receivables as of September 2024, with no payments received since 3Q24. Similarly, Borr Drilling secured a $125 million payment agreement with Pemex in early 2025, representing over 75% of outstanding receivables.

Summary

The Mexican jack-up market is expected to experience continued volatility through 2025-2026, with activity levels dependent on Pemex's financial recovery and normalization of payments.

Medium-term prospects appear more positive, driven by Pemex's 1.6 trillion peso ($70 billion) investment plan, spanning 2030, which includes federal subsidies and private partnerships aimed at reversing production declines.

PLSV Market

The global pipe laying support vessel (PLSV) market represents a critical segment of the offshore energy infrastructure sector. The global pipe laying vessel market was valued at USD 3.4 billion in 2024 and is projected to reach USD 5.7 billion by 2030, representing a compound annual growth rate (CAGR) of 8.8%.