How to Earn 50 % on NFE, Without the Stock Volatility

Mr. Market Goes Crazy, And NFE Bonds Are the Bargain

Introduction

Last week presented a lucrative opportunity to invest in New Fortress Energy’s distressed debt. We estimate that the September 2026 bonds could deliver a yield to maturity of roughly 50 percent, while the 2029 bonds may offer a comparable return, albeit in a slightly more speculative, catalyst-driven trade.

After the company’s 1Q25 report revealed a sizable net loss and a quarter-on-quarter revenue decline, investor sentiment soured and NFE’s share price plunged by 60 percent. History shows that when there is blood in the streets, opportunity often follows. The sell-off quickly spread to the company’s bonds, boosting their yields to enticing levels. In this note, we explain why we see little to no default risk in the 2026 notes and an attractive, opportunistic upside in the 2029 notes.

2026 bonds (my favorite ones) fell 28%.

2029 bonds fell 42% and they now look really interesting.

Q1 update and 2026 investment case

To open the next section, Hugo Navarro of Undervalued & Undercovered will dig into the most recent quarterly results, scrutinize the refinancing plan, and update our investment thesis on the 2026 notes.

First, it is prudent to examine the first-quarter results and assess their implications for both the equity and the bonds over the long term. We will analyze all the information that is has been presented in the investor presentation, the SEC filing, the earnings call and we have also investigated Puerto Rican press and found out some interesting news.

The company badly missed consensus on both the top and bottom lines, reporting revenue of $470.5 million versus the Street’s $507 million estimate and a loss of $0.76 per share versus the expected loss of $0.16. Management also announced an agreement to sell its Jamaican assets for roughly $1 billion, a transaction we will address later.

Puerto Rico

Operational troubles in Puerto Rico continue to mount. The company has yet to receive the $110 million Genera payment—revenue it swapped for a performance-based contract last quarter. Puerto Rico’s Public–Private Partnerships Authority (AAPP) has raised concerns about NFE’s financial position and is now demanding a guarantee to protect the government should NFE, Genera’s parent, default. Providing such collateral would further constrain the company’s already limited unrestricted cash.

Public sentiment on the island is turning sharply negative. The Puerto Rico Energy Bureau recently voiced concern that NFE is gaining a monopolistic foothold as Genera prepares to operate the former AEE plants. Although NFE intends to convert these aging diesel units to natural gas, regulators fear the creation of a captive NG market and have ordered Genera to halt conversion trials. The divergence between management’s narrative and the tone of local media and regulators is striking, and one of the company’s key growth levers is effectively on hold. Despite data suggesting that LNG-to-NG conversions could benefit Puerto Rico, widespread opposition—exacerbated by last month’s island-wide blackout—remains a headwind.

On a more positive note, NFE has filed a claim for up to $659 million in FEMA reimbursements and expects to collect between $500 million and $659 million in the second quarter. Nevertheless, uncertainty persists, especially after the Trump administration signaled an intent to scale back FEMA and recently removed its acting administrator.

Nicaragua

Management reports that the power-purchase agreement with the Nicaraguan government is in its final stages of renegotiation. Using the Norsk Hydro contract at HH + $7.45 as a benchmark, they are targeting a modest premium—say HH + $9.00—to compensate for Nicaragua’s weaker credit profile. If the company keeps its HH + $2.50 cost base, that would leave a margin of roughly $6.50 per MMBtu, in line with management’s $7.00/MMBtu projection. At an expected throughput of about 25 TBtu a year, the project could generate roughly $162 million of adjusted EBITDA, with room for expansion.

Once the contract is signed, only minor work remains. The power plant itself is virtually complete, and the terminal needs just a bit more finishing work. With the agreement finalized, the project should move quickly to commissioning.

Sub-chartering

In December, NFE sub-chartered the Eskimo FSRU to EGAS, and, as of this week, the Freeze to Energia 2000. Management values those two deals at roughly $200 million of future earnings. Beyond that, the company is in late-stage talks for two additional FSRU charters that could add another $100 million to the portfolio. All told, the four re-lets could lift recurring cash flow by up to $50 million in incremental EBITDA each year. Given the strong appetite for floating regas units, NFE could also novate or sell these contracts, capturing an estimated upfront payment of about $200 million.

Brazil

In Brazil, NFE’s flagship LNG terminal at Barcarena underpins three major power plants: two NFE-owned combined-cycle units totaling roughly 2.2 GW and a third contract with Norsk Hydro. Phase I (≈630 MW) should start throwing off cash by mid-2025, and the larger Phase II (≈1.6 GW) is scheduled for mid-2026—both meaningful catalysts for revenue and free cash flow.

The bigger swing factor is the federal power-capacity auction still slated for later this year. NFE has already registered another 2 GW of in-house projects and has been asked by third-party developers to supply gas for roughly 3 GW more. Locking in long-term PPAs at that auction would be a game-changer, effectively turning Barcarena into a multi-decade cash machine.

For a deeper dive into the FLNG units, the Mexico project, and other key assets, see my full write-up.

Debt restructuring

Management has shifted its 12-month playbook toward replacing unsecured, corporate-level borrowings with project-level financing. The reasoning is straightforward: most of NFE’s large terminals and power assets now sit on long-dated offtake or PPA contracts backed by BB-class counterparties, so the associated cash flows should qualify for non-recourse debt raised directly at the project companies.

Although management still markets a $7-per-MMBtu gross margin, a more realistic run-rate on fully contracted volumes is closer to $4.5–5.0, which equates to roughly $500 million of annual operating margin.

In the project-finance market, lenders typically require a debt-service-coverage ratio between 1.3- and 1.5-times for BB-grade borrowers. Using the midpoint of 1.4 times and a conservative 10 percent coupon, NFE could service about $357 million of annual interest expense, implying a theoretical debt capacity of roughly $3.6 billion. That headline figure, however, needs adjustment for weaker credits within the portfolio: Puerto Rico accounts for about thirty percent of the projected margin and faces political push-back, while CFE’s Mexican contract—roughly ten percent of the margin—has only eight years left. Stress-testing those two buckets narrows the realistic refinancing window to somewhere between $2 billion and $3.6 billion.

If NFE manages even the lower end of that range, corporate leverage would drop sharply and the company could retire a significant portion of its outstanding notes at distressed prices, a move that would likely re-rate both the 2026 and 2029 bonds almost immediately and most importantly use all of this proceeds to finance the CAPEX that it is still needed in some operations.

2026 bonds

These 6.50 % senior notes, first issued in 2021 at a face amount of $1.5 billion, have since been whittled down to just $510.9 million through refinancing. They now change hands at roughly 57 cents on the dollar, implying a yield to maturity north of 50 percent—pricing that looks wildly misaligned with their true default risk.

Between now and September 2026 NFE must retire the $515 million principal on these notes, cover roughly $800–900 million in interest expense, and satisfy $432 million of current maturities and other short-term liabilities. Even after penciling in a conservative $200 million for capex, the total cash outlay over the next fourteen months should land near $2.0 billion.

Against that, the company already holds $448 million of unrestricted cash and has booked $1.055 billion for the Jamaica asset sale—$270 million of which paid down the revolver and $55 million the Term A loan—leaving about $393 million net. That brings available liquidity to roughly $841 million, of which $379 million is restricted under bond covenants. Management also expects to raise roughly $1 billion from partial asset sales (Brazil stakes, FLNG equity, or vessel disposals). Layer on a cautious $1 billion in adjusted EBITDA over the period, plus a potential $400–659 million PREPA receivable, and the funding stack reaches a comfortable $2.2–2.5 billion—enough to clear every obligation through the 2026 maturity.

For these notes to be impaired, NFE would have to miss entirely on the $1 billion asset-sale target, collect nothing from PREPA, fail to raise any new financing, and simultaneously let EBITDA collapse below $300 million over the next eighteen months. That combination of setbacks feels remote. Far more likely, the company refinances at the project level, buys back some paper at distressed prices, and sees the 2026s trade sharply higher—as Mihail’s section on the 2029s will underscore.

The 2029 bond investment case

Now Mihail Stoyanov from the OldEconomy Substack will take a deep dive into the speculative opportunity presented by the 2029 bonds and explain how we can position ourselves to profit from this debt play.

The 2026 bonds were a major part of New Fortress Energy’s capital structure, but the majority have now been exchanged for 2029 notes as part of a comprehensive refinancing. The remaining 2026 bonds are senior secured, carry standard high-yield covenants (limiting debt, liens, asset sales, and restricted payments), and are protected by a first-priority lien on key assets.

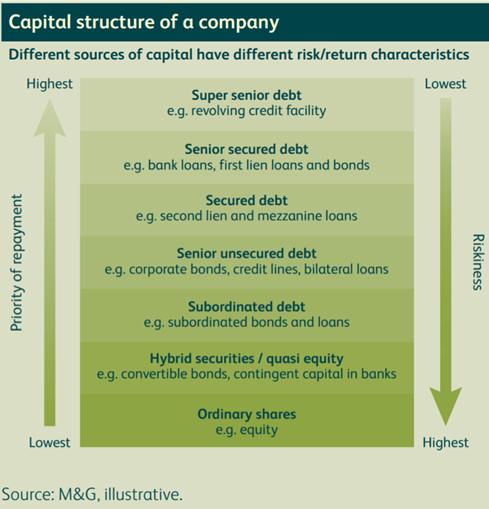

The image shows where the 2026 and the 2029 bonds stand:

Both issues are secured, but the 2026 bonds are higher in the debt hierarchy. I like the 2026 debt more as a hold-to-mature play. However, the 2029 bonds (the legacy ones with ISIN USU6422PAD07) are a lucrative tactical wager on distressed debt.

Before I move on to how I execute the 2029 debt idea, let's talk about debt specifications. The total outstanding amount for all 2029 bonds (legacy and new ones) is $2.29 billion. The outstanding amount of the legacy 2029s is $237 million. The issued amount was $750 million, but $513 million of the legacy 2029s were swapped for the new 2029 issue.

The collateral is a first priority lien on the following assets:

All assets of NFE Financing (including intercompany promissory notes and equity interests in key subsidiaries)

100% of the equity in the New Notes Guarantor (Bradford County Real Estate Partners LLC, which owns the Bradford County Property in Pennsylvania)

All assets of the New Notes Guarantor.

The 2029 bonds are guaranteed by NFE Financing’s wholly owned subsidiary, Bradford County Real Estate Partners LLC.

Other key aspects are:

Restrictions on granting additional liens on collateral, except for “permitted liens” as defined in the indenture.

Limits on selling, transferring, or disposing of collateral assets.

Proceeds from permitted asset sales must generally be used to repay the bonds or reinvested in the business, subject to thresholds and exceptions.

Restrictions on incurring additional debt, except for permitted categories (e.g., refinancing, working capital, or as otherwise defined in the indenture).

Limits on dividends, share repurchases, and other restricted payments to equity holders, especially if specific financial ratios or liquidity thresholds are not met.

I treat my 2029 idea as a speculative play. So, a covenant breach in the long term is not a crucial factor. On the other hand, given the precarious situation in NFE currently, debt restrictions may be violated.

NFE may issue new debt to refinance its ongoing debt obligation and capital investments, depending on how things are going with FEMA payments and Brazilian assets. In that case, the downside pressure on the 2029 bonds will continue, and a price of 25.00 would not be shocking.

Counterintuitively, such adverse developments offer attractive asymmetry. The average LGD (loss given default) or, in jargon, bonds haircut in case of bankruptcy, is 75% for HY issues. Using napkin estimates, the downside of the 2029 bonds is 16% to the current market price of 30.0. Simply put, the 2029 bonds may be repaid at 25% on face value (75% haircut).

Let’s put a worse scenario, an 80% haircut. In that case, my stop loss is 20.0.

What about the upside?

NFE will probably repay its 2026 debt successfully. The company has cash on hand and, in the worst case, can refinance (in adverse terms). If that happens, NFE bonds will look less unattractive. As a result, the 2029 bonds may trade between the 50.0-70.0 range.

At an entry price of 30.0 and the downside (roughly) capped to 20.00, a target price of 50.0 means more than a reasonable risk reward of 1:2. If we put a more optimistic take profit, let’s say 60.0, the risk reward moves to 1:3.

This calculation excludes the yield, which at a 30.0 price is 29.0%. The 2029 bonds have an 8.75% coupon. For the curious, YTM is currently at 49%. However, the idea here is not to hold till maturity but to speculate on a temporary relief run due to the successful repayment of the 2026 bonds.

Execution and risks

Now, let’s move on to the technical side: expected value (EV) and position sizing (R). To calculate EV and R, we need scenarios with assigned probabilities, defined consequences, and a time horizon.

For the 2029 issue, the scenarios for the next 12 months are:

Complete loss of investments: 10% probability; potential loss of 100% or 30 points

An 80% haircut to face value: 30% probability; potential loss of 33% or 10 points

A 50% haircut to face value: 20% probability; potential gain of 66% or 20 points

Price reaching 50.0 driven by successful 2026 redemption: 20% probability; potential gain of 66% or 20 points.

Successful redemption at face value: 20% probability; potential gain of 233% or 70 points

The base for the above estimates is the entry price of 30.00. For example, a 75% haircut means a 16% loss in relative terms to the entry price of 30.00 or a 5.0 points loss in absolute terms.

In summary, we have three base scenarios for the 2029 bonds: total loss, haircut, and successful redemption at par value. The most probable case is price reaching 50.0 as a result of a haircut or driven by successful 2026 repayment. However, these figures are not set in stone. In a more adverse case, we can see a haircut of 80%, and in a not-so-bad situation, a haircut of 30%.

Those scenarios have a predefined outcome and estimated probabilities. Why is it like that?

Fixed-income instruments are contracts. They have terms, i.e., face value, coupon, maturity, and covenants. Bond face value is the center of gravity. The closer the maturity, the closer the bond price is to its face value (all else being equal). Equities do not offer such a perk. Exceptions are preferred shares and litigation cases.

A fixed-income instrument, aka the contract, obligates the issuer to repay its debt and interest per a predefined schedule. This significantly reduces the odds of complete loss of the principal, even in distressed debt plays.

As you can see, I attribute the highest probability to a price moving to 50.0 due to a 50% haircut or the 2026 bond redemption. At a 30.00 price, this equals 20 points upside or 66% gains. In other words, the most credible scenario still brings adequate risk-reward.

Two reminders:

Regardless of the relatively low probability of total loss of the principal, it never reaches zero. Therefore, beware of the importance of position sizing.

Assigned probabilities are not precise. They serve to show the relative credibility of each scenario.

Now, back to EV and R estimates. The expected value of the trade is 17.5 points, indicating that the average outcome of this bet is 17.5. In other words, this wager is worth the risk.

The next step is to estimate the position size. The inputs for the Kelly formula are as follows:

Risk Reward: 2.0, based on stop loss at 20.0 and take profit of 50.0

Probability of Winning (price reaching 50.0): 40%

Probability of Losing (bonds being redeemed at 20.0): 30%

The stop loss here is not fixed, as with equity trades. I consider an adverse scenario where NFE redeems the 2029 at 20.0-25.0 probable. In that case, bond redemption will trigger my stop loss.

Suggested bet size is 25%. Applying fractional Kelly, the optimal risk per trade is between 1.25% and 2.5%.

As I pointed out, I like the 2026 and 2029 issues for distinct reasons: 2026 is a Held-to-Maturity play, while 2029 is a speculative bet. Therefore, I distributed the weight between both issues using the 80/20 model. The 2026 bonds are the main position, the 80%, while the 2029 bonds are the opportunistic boosters, the 20%. Of course, depending on the investor’s goals and risk tolerance, he or she can shift the weight between the issuances.

Risks

Market risk: 2029 bonds are an opportunistic play. So, Mr. Market and market risk represent a huge factor (and opportunity) here. Market overreaction brought that opportunity. In case of a covenant breach, another fire sale would follow. Therefore, be mindful of your position size and, in the meantime, consider panic sales as a moment to add size.

Interest rate risk: Duration risk is a big thing for regular HY bonds. In distressed debt cases, other factors carry greater weight.

Reinvestment risk: for HTM plays, this is a big one. However, the reinvestment risk is not a deal breaker for a speculative position.

Prepayment risk: Early prepayment could be good for speculative positions. Of course, in our situation, NFE may buy the 2029 bonds at a massive discount on par. However, this is not a bad thing, given that the 2029 bond is trading at 30.0. In other words, the downside is relatively capped while the upside is attractive enough to consider that bet.

Credit risk: In the distressed debt universe, this is the risk to consider the most. NFE default risk in the next 12 months is high, but not as high as market reaction suggests. The company still has some aces that could help it recover its financial position.

Liquidity risk: Liquidity always matters, especially for speculative trades. Sometimes, the difference between losers and winners is the speed of entry/exit. For NFE bonds, this is not an issue. They offer sufficient liquidity that guarantees quick enough trades.

To recap, NFE bonds are a classic distressed debt play. Treat it as such.

Conclusion and final thoughts

Markets are often inefficient, and we aim to capitalize on such distortions. Here, behavioral biases—uncertainty perceived as risk and volatility perceived as danger—have driven the stock’s wild swings and spilled over into the bond market. We believe these bonds offer a sizable, calculated opportunity with several catalysts that could yield outsized gains for discerning investors.

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Do you have any estimate of recovery rates upon default? There is a large market for these infrastructure assets. If their book isn’t overstated this seems like a killer opportunity

are any of the bonds registered or are they all 144a/regs QIB only ??