This is an excerpt from Weekly Update for TheOldEconomy paid subscribers. It concerns a relevant subject: the situation in the Middle East.

As a reminder, do not treat the discussed scenarios as foolproof because they are not.

Geopolitics is another persistent factor that can reignite cyclical inflation. An essential nuance is the Iran-Israel war dynamics. Let’s discuss a potential retaliation attack on Iranian oil infrastructure.

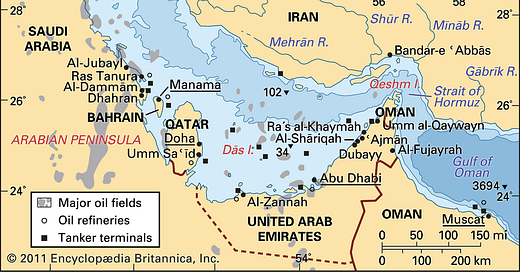

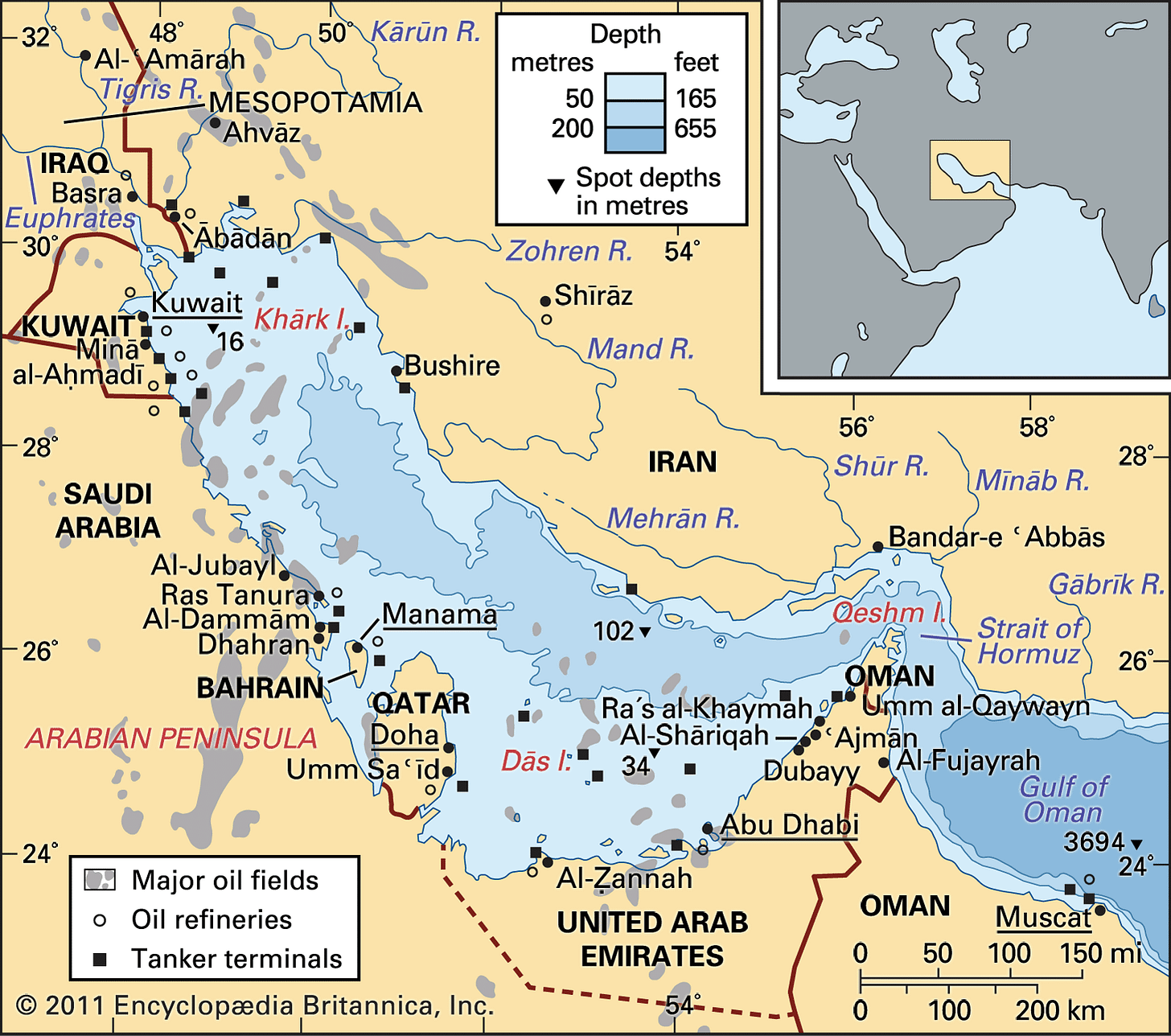

We must be familiar with the Iranian oil landscape to develop credible scenarios. The following two maps show the oil infrastructure:

Here are the major terminals involved in Iranian oil exports:

Kharg Island Terminal

Location: Kharg Island, Persian Gulf, approximately 25 kilometers off the Iranian coast.

Facilities: The terminal features both eastern and western docks, with the western dock undergoing rehabilitation to enhance its capacity further.

Importance: Iran's primary oil export terminal handles over 90% of the country's crude oil exports. It has a loading capacity of up to 7,000,000 barrels per day and can accommodate very large crude carriers (VLCCs).

Jask Oil Terminal

Location: Near the port city of Jask in the Gulf of Oman.

Capacity: The terminal is connected to a 1,000 km pipeline from Goureh in Bushehr province. Its initial capacity is 300,000 barrels per day, and it will gradually reach 1 million barrels per day.

Importance: This terminal allows Iran to export oil directly into the Arabian Sea, reducing reliance on Kharg Island and mitigating risks associated with potential military confrontations in the Persian Gulf.

Goureh Terminal

Location: Goureh is in Bushehr province and is the starting point for the pipeline that feeds into the Jask terminal.

Importance: It primarily facilitates the transfer of crude oil from inland production areas to Jask for export

The Strait of Hormuz is a critical chokepoint through which about 20% of global oil passes. Iran has threatened to close this strait during heightened tensions, which would have severe implications for global oil supply and prices.

However, Iran will pay a steep price if it obstructs Hormuz. Considering Kharg's location deep in the Persian Gulf, Iran would have to sacrifice 90% of its crude oil revenue. Jask terminal has insufficient capacity to take Kharg’s exports. In other words, the geopolitical rewards for Iran of a partial blockade of Hormuz must exceed the economic costs of lost crude oil revenue. This, at least to say, is disputable.

Nevertheless, let’s return to today’s topic, the Israel-Iran war.

Shooting oil infrastructure nor new neither unthinkable

Middle East is not simply Israel vs the Arabs. Each side has multiple factions with its interests, often in conflict with the interest of the group as a whole.

First, Iran is the largest Shia country in the world, surrounded by Sunni Muslim states. Yemen and Iraq also have a Shia population. And this is only one detail.

Attacks on oil facilities are nothing new. Both belligerents stroke enemy oil infrastructure during the Iran-Iraq war in the 80s.

Notable attacks included the bombing of the Abadan refinery, one of the largest in Iran, which was subjected to air strikes from the outset of the war. The Iraqi Air Force targeted oil and gas tanks, causing significant damage to this crucial facility.

Kharg Island faced extensive bombardment from Iraqi forces. This facility was critical for Iran’s oil exports, accounting for a significant portion of its income. The attacks led to substantial reductions in Iranian oil exports.

The conflict significantly reduced global oil supplies as both nations halted exports at various times during the war. By September 1980, both countries effectively removed about 2.7 mbbl per day from international markets due to hostilities. Daily oil production in the 1980s was much lower than today’s, ranging from 66 to 74 mbbl per day. Today, it is about 102 mbbl per day.

Strikes on oil infrastructure were also part of the Kuwait-Iraq war. In summary, attacks on oil fields and terminals are nothing new in the Middle East. That being said, let’s look at my scenarios.

A few (most probably wrong) scenarios

As individuals, we have goals, and those goals have a price. Moreover, we need the proper tools to execute the required tasks and achieve our goals. The same is true in geopolitics.

For Israel, attacking Iranian facilities is a tool to achieve its goal that comes with a price. The latter is not the price paid for bombs and missiles. Here, I mean the geopolitical and geoeconomic cost of attacks.

Let’s look at the following table, which represents three different scenarios.

Number two is the scenario with the highest credibility. By attacking insignificant facilities, Israel will project power without paying too high a cost. Scenario 1 is plausible, but it has a dear price. If Israel engages in a mass-scale attack on Iranian facilities or at least strikes Kharg, it would spark a fierce diplomatic response by everyone in the region and its allies.

The table is not exhaustive. Moreover, the scenarios are related. It can start with Scenario 3 and then escalate directly to number 1. This is just one variant. The table is a snapshot of potential scenarios and does not show the (probable) sequence of events.

In conclusion, I am not saying that an Israeli attack on Iranian oil fields is imminent. The point is that it is not unthinkable and, most importantly, is not a discrete event but a multistage process.

Final Thoughts

The US administration will do its best to avoid Scenario 1. The consensus will probably be a cart balance for Scenario 2, an attack on Tier 3 infrastructure. Of course, the Middle East is infamous for surprising even the most astute analysts.

Talking about forecasts and the Middle East, the following interview did not age well:

What are the takeaways for investors? With high conviction, I can say that in any case:

Oil prices will stay volatile.

The Red Sea remains a Houthi domain.

Tankers and LPG/LNG carriers will stay away from the Red Sea.

The last point applies to all ships. However, a potential escalation in the Persian Gulf would most impact tankers and LPG/LNG carriers.

If Israel plays safe, oil and tankers will continue to move in range. Conversely, oil prices will soar if Tier 1 infrastructure is subject to attacks. In that case, tanker rates may decline for a while because attacking Kharg (for example) would shut down nearly 0.7% of daily oil production.

Let’s see how the crisis develops.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.