Cyclicality is most pronounced in old-economy businesses (mines, energy, transport). Supply exhibits minimal elasticity with respect to demand.

This is due to the time required to develop a mine, build a nuclear power plant, or construct an oil rig, which is measured in years. The slowly changing supply acts as a center of gravity. While constantly fluctuating, demand gravitates around the center, resulting in the cyclicality mentioned above.

There are two additional factors, in addition to the dissonance between supply and demand elasticities. One has been with us since the world began—our irrationality. The other is the growing quantity of money relative to the rate of productivity growth.

How do these two variables relate to supply and demand?

Irrationality swings between two extremes: extreme optimism and extreme pessimism. Both states have in common that they are based on a distorted perception of reality.

The situation is not as good as we think (in a bull market) nor as bad as we believe (in a bear market). And the role of the increasing amount of money in circulation is like the fuel of the triangle of fire. The more money (liquidity) in the system, the more fuel for extreme market movements.

So, where in this cycle is the offshore industry today?

On the above chart, we are somewhere between late pessimism and early skepticism. The first innings of recovery were from 2020 to 2023. Then came the painful range of 2024 and 1Q25.

Now, the offshore players seem to show a will for recovery. Since April, the tide has turned.

Odfjell Drilling (OSL: ODL) is the top performer in the offshore universe, boasting 33% YTD gains. ODL owns a fleet of high-spec NCS (Norwegian Continental Shelf Rig) eligible rigs.

The NCS rigs are a special niche in the offshore oil and gas industry.

Let’s add some details. The Norwegian Continental Shelf is one of the world’s most challenging environments for oil drillers. Thus, it requires regulated and technically advanced equipment, which necessitates that all mobile offshore units (MOUs)— jack-ups, semisubs, and drillships—hold an Acknowledgement of Compliance (AoC) from the Norwegian Ocean Industry Authority (Havtil). AoC confirms MOUs comply with all Norwegian regulatory, technical, and safety standards. The AoC is a mandatory requirement for any company wishing to operate on the Norwegian Continental Shelf.

As of 2025, there are approximately 26 NCS-eligible rigs (units with a valid AoC), though the number physically present in Norwegian waters at any given time is closer to 20, depending on contract cycles and rig mobility.

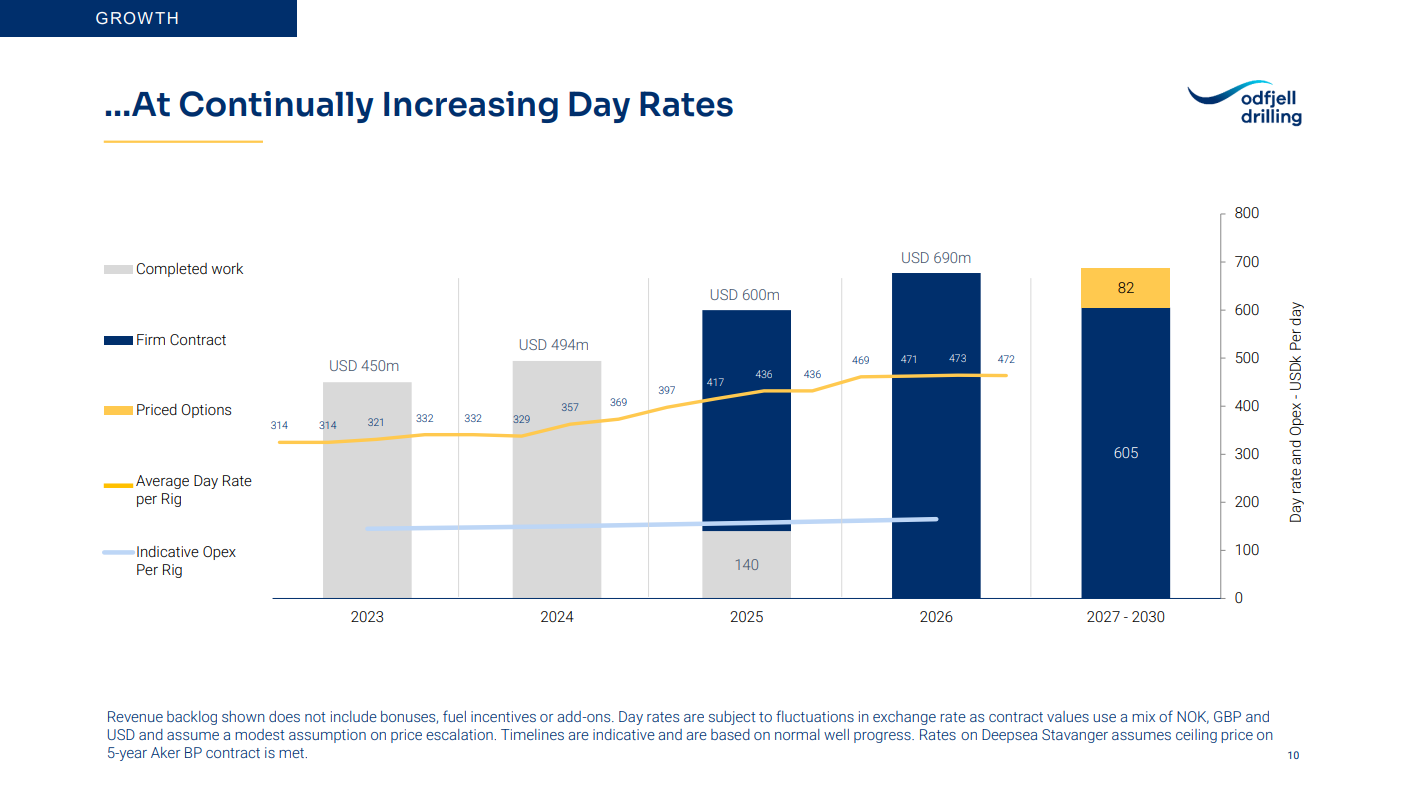

Demand for NCS-eligible rigs remains high, with utilization rates at or near 100%. Operators are locking in 6G, harsh-environment semisubmersibles for multi-year contracts, thus keeping the rigs in Norway. In 2024–2025, most new contracts are awarded at day rates between $440,000 and $517,000, reflecting both high demand and the technical sophistication required for NCS operations. Chart via Odfjell Drilling.

Major operators on the NCS units include Equinor, Aker BP, TotalEnergies, Shell, and ExxonMobil, while the leading contractors supplying eligible rigs are Transocean, Odfjell Drilling, Seadrill, and Noble.

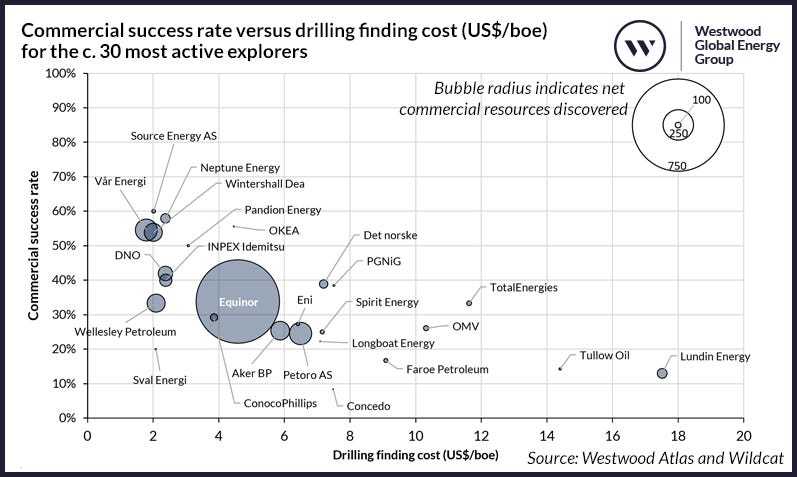

Equinor is among the top-performing Oil and Gas players, given the drilling finding cost and success rate. Chart via Westwood Global Energy Group.

Equinor provides about 70% of Norway's oil and gas. As a result, the company is the largest tenant of NCS units. On average, Equinor requires about 25 rigs in simultaneous operation at any given time to meet its production, exploration, and well intervention goals. This rig capacity enables Equinor to deliver 50–70 increased oil recovery wells and 20–30 exploration wells annually, supporting its ambition to sustain high production levels on the NCS through at least 2035.

To achieve its targets, Equinor contracts a mix of 6G harsh-environment semisubmersibles, jack-ups, and specialized units for plugging and abandonment (P&A) work. For example, the company recently awarded a two-year contract (with five one-year options) for the Deepsea Bollsta rig, owned by Odfjell Drilling, to expand its drilling portfolio. Additionally, Equinor has contracted the Island Innovator for a three-year P&A program, with the rig expected to plug 15–20 wells annually.

Despite all the trash talk about fossil fuels, the North Sea will come back as a vital energy source for the EU. NCS rigs are a critical part of the value chain. They are scarce and expensive assets. The average cost of a new NCS rig is over $700 million, and the lead time is approximately 36 months. In other words, the supply will be slow to respond to the rising demand for companies like Equinor.

Compared to other offshore infrastructure, NCS rigs are ahead in the cycle, compared to jack-ups, non-NCS semi-subs, and drillships.

In that matter, NCS rigs share similarities with drillships. They are contracted for several quarters, and their day rates are comparable to those of the 6G/7G drillships. The image below shows the typical length of NCS rig employment. Chart via Odfjell Drilling.

The extended backlog provides revenue visibility, hence stability for equity investors and bondholders.

Unlike the Big Four, where we can choose from equity, bonds, and options, for NCS bets, we have limited alternatives. Odfjell Drilling, as the single NCS pure play, offers equity. ODL stock has been outperforming the broad indexes and its offshore peers.

The stock appears too expensive, given its impulsive move and its valuation on a NAV basis. What about the EV multiples?

Look at the chart below:

ODL scores competitive EV/EBITDA, which implies attractive upside potential. On top of that, there is a dissonance between robust day rates and asset values. Implied values are close to C19 levels, when the industry's outlook was tremendously negative. Now, the situation is vastly different; fossil fuels and the offshore industry are back in vogue. So, the decoupling between asset values and day rates will diminish, i.e., the values will rise again. The result would be higher NAV, hence better discount (all else being equal).

This was the June offshore report. It was focused on NCS eligible rigs. Next month, I will delve deeper, covering jack-ups and OSVs.

PS: For more actionable and asymmetric ideas on LatAm and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.