LPG carriers market review

Not all LPG carriers are equal. Macro tailwinds plus low order book and aging fleet

It’s time for a write-up on another esoteric investing theme: LPG marine freight. The article is a primer on LPG carriers' demand and supply.

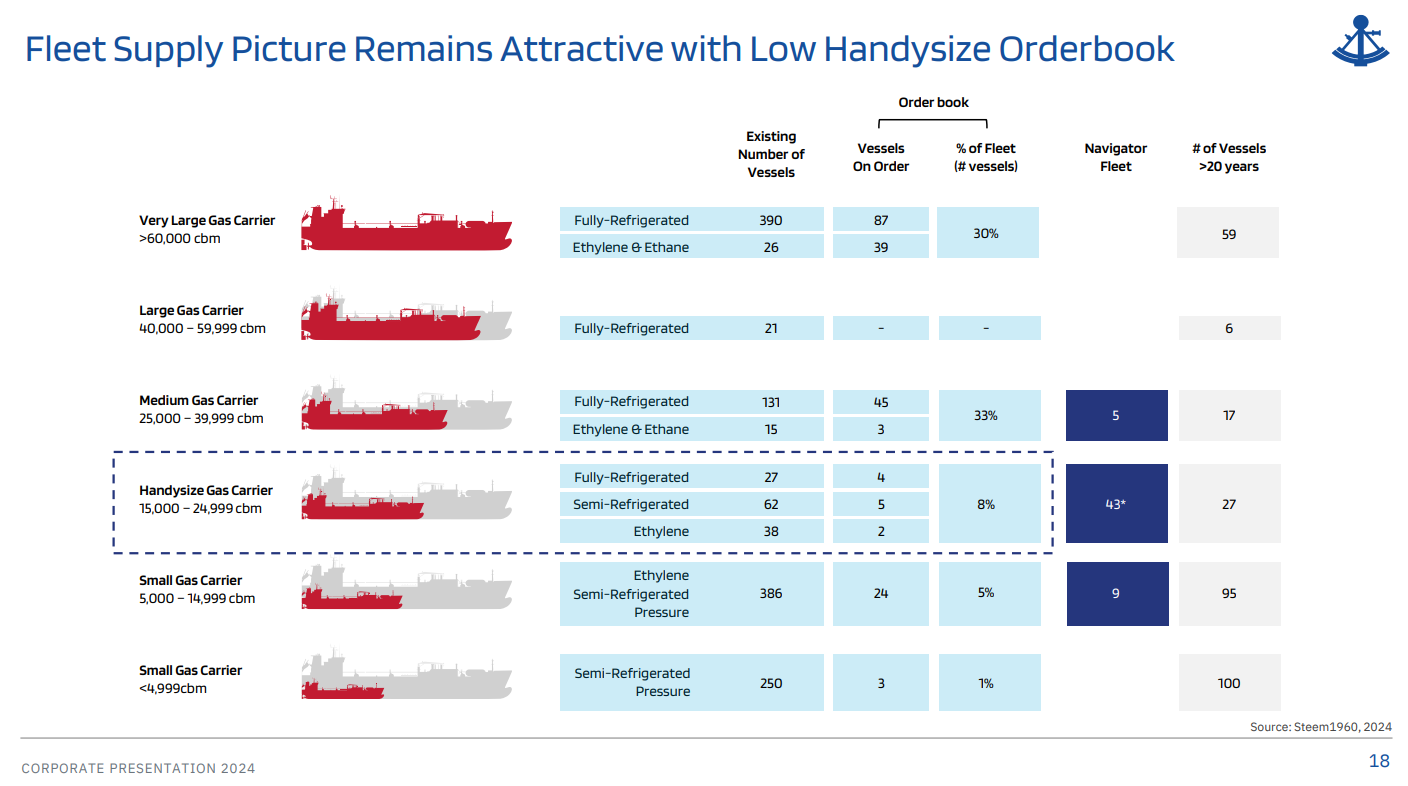

The supply of LPG carriers seems oversaturated, considering the composite order book of 23%. However, we must look closer. The VLGCs (Very Large Gas carriers) have a higher order book (30%) than the number of ships older than 20Y (14%).

20Y is the average economic life of a cargo ship. Of course, that number fluctuates. During the expansion phase of the shipping cycle, the ships are exploited some longer. Conversely, the vessels are scrapped even earlier in the contraction phase times.

In other words, the VLGC supply is not skewed in the investor's favor. So, in that case, we rely on growing LPG demand. Simply put, the LPG demand growth rate must exceed the VLGC supply growth rate.

The supply of Handysize and small gas carriers is much more favorable from an investors' perspective. Handysize's order book is 8%, while the percentage of ships older than 20 years is 21%. The small gas carrier segment has similar figures: 6% vs. 24%.

As their name suggests, Handys are the most versatile size. They can carry ethylene, LPG, and ammonia. Small Gas carriers are mostly semi-refrigerated and primarily carry LPG (propylene and propane).

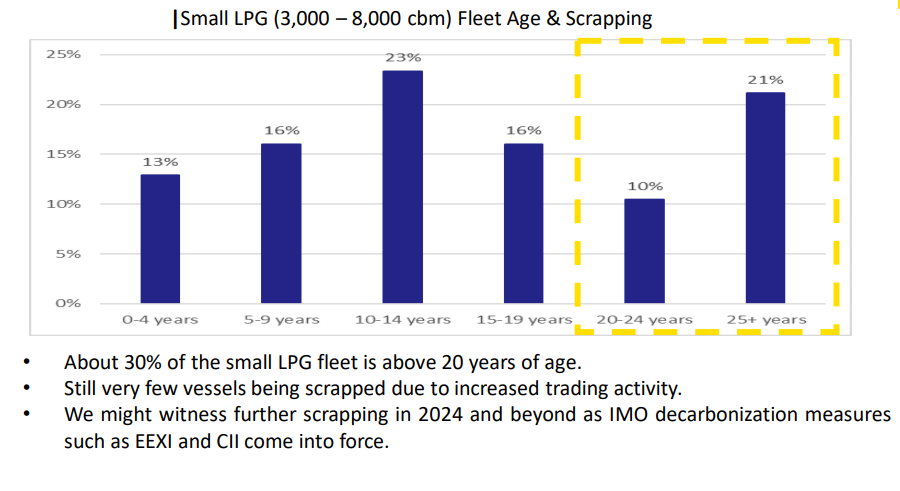

The charts below from the Stealth Gas presentation show small LPG carriers' average fleet age and order book.

The small gas carriers have similar to Handysize vessels figures, 5% for 5,000-14,999 cbm and 1% for <4,999 cbm. About 30% of the fleet (3,000-8,000 cbm) is above 20 years.

The global thirst for LPG is growing at a rapid pace. Between 2024 and 2030, the LPG market is expected to increase by 6.5% annually, as shown in the chart below.

Looking at US LPG export figures, I expect a strong market for LPG freight in the coming 12 months.

Below is a quote from the Stealth Gas, GASS 4Q23 earnings call discussing US LPG exports.

The U.S. reported 210 million barrels of natural gas liquids production at year-end, up 10 million barrels since the last earnings call. This is a meaningful increase, but why is it important?

Remember, one barrel of natural gas liquids consists, on average, of 42% ethane, 45% LPG, and the remaining natural gas liquids.

U.S. domestic consumption of ethane and LPG is relatively flat. And therefore, any additional production is more or less solely aimed at export markets. As a consequence, American midstream companies are investing in additional gas processing plants, fractionators, and terminal expansions to allow for an increase in production. This is good for gas transportation.

The US is a major player in the LPG market, so robust exports mean robust demand for LPG freight. The two graphs below illustrate US LPG exports for the last four years (left graph) and US exports by destination (right graph).

Gatun Lake level started to recover. Although the Panama Canal remains a decisive factor for small and handysize LPG carriers. Most of the vessels were rerouted via the Cape of Good Hope, increasing the trip duration from Houston to Asia by 50%.

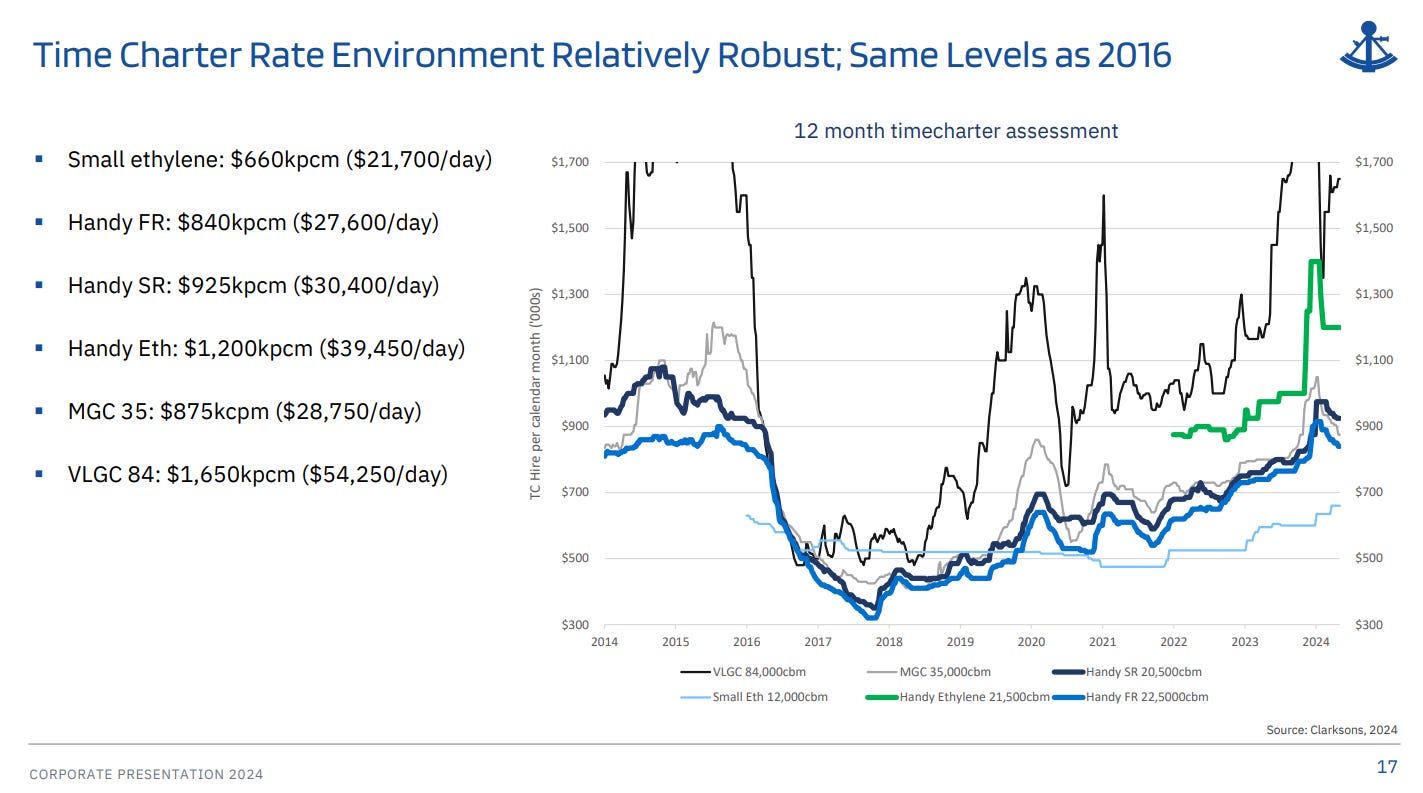

These factors paint a positive picture for LPG carriers' demand. The graph below shows that the day rates have been on the move.

Handy TC rates have increased more than 130% since 2018, with lower volatility than VLGC. The Panama Canal drought is one of the reasons for the lower volatility. Small vessels <12,000 cbm are the laggards in the group, realizing 25% growth for the last five years. Considering the ongoing supply chain disruptions, regional shipping routes will resurface as essential lifelines for the economy.

I expect strong day rates for Small and Handysize LPG carriers. All ingredients are present: low order book and aging fleet limit the supply; growing LPG demand and strong US exports boost LPG freight needs. VLGC day rates, too, may increase. At least for now, the LPG demand growth rate exceeds the VLGC fleet growth rate. In summary, LPG marine transport is a theme to follow for the coming 12-18 months.

How to bet on that theme?

Look no further than the impossible triad of shipping investing. There is no way to obtain all three: top-notch fleet, low LTV, and low P/NAV. There is always a tradeoff. To get two of those, we must sacrifice the remaining one. We can buy a top-quality fleet with a relatively low LTV at a high PNAV. Or we can pick low LTV and a considerable margin of safety, though we sacrifice the fleet quality.

The table below compares the major players in the industry:

Dorian LPG, LPG

StealthGas, GASS

Navigator Holdings, NVGS

Avance Gas Holdings, AVACF

BW LPG Limited, BWLLY

The top section shows the fleet specs, types of vessels, and average fleet age. The following lines are dedicated to NAV and LTV formula inputs. The bottom part gives the company’s PNAV and Gross LTV.

LPG is not the only exciting shipping theme. In the coming weeks, I will share articles on other shipping segments with potential. Stay tuned.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Could you elaborate on the competitive advantages/disadvantages of the Handysize segment? If they are the most versatile, why is the orderbook for that segment the lowest?

Great companies, making lots of money. I own BW LPG right now.