A good enough analysis with adequate timing and sizing always beats a brilliant analysis with poor timing and sizing. Timing and position sizing distinguish winners and losers in the long term.

It is impossible to time the market precisely, but picking a good enough time (or less wrong) is achievable. Technical Analysis is an excellent tool for market timing, but it is not the only one.

And here comes event-driven (ED) investing. A highly anticipated event is our spark. It tells us two things. First, we know that there is a spark, i.e., there is an event that will lead to stock revaluation. Second, it tells us when that will happen. This is the proverbial timing.

Of course, not all sparks are the same. There are two major types:

Fixed events are those with a known exact date, such as elections, court decisions, or corporate actions.

Broad event: events with a known time frame, i.e., months or weeks, such as demand/supply shifts in commodities, anticipated political decisions, or military conflict.

Event-driven investing is the foundation of my process. With that intro, I just scratched the surface. One of my favorite hunting fields is the embodiment of ED investing.

This is LatAm, the continent with the lowest geopolitical risk and the most volatile internal politics. The proverbial catalyst resides in the abrupt political pendulum swings typical of South America.

This is the LatAm Overview for May. Today we are going to the Far Far East and the Brazilian Empire.

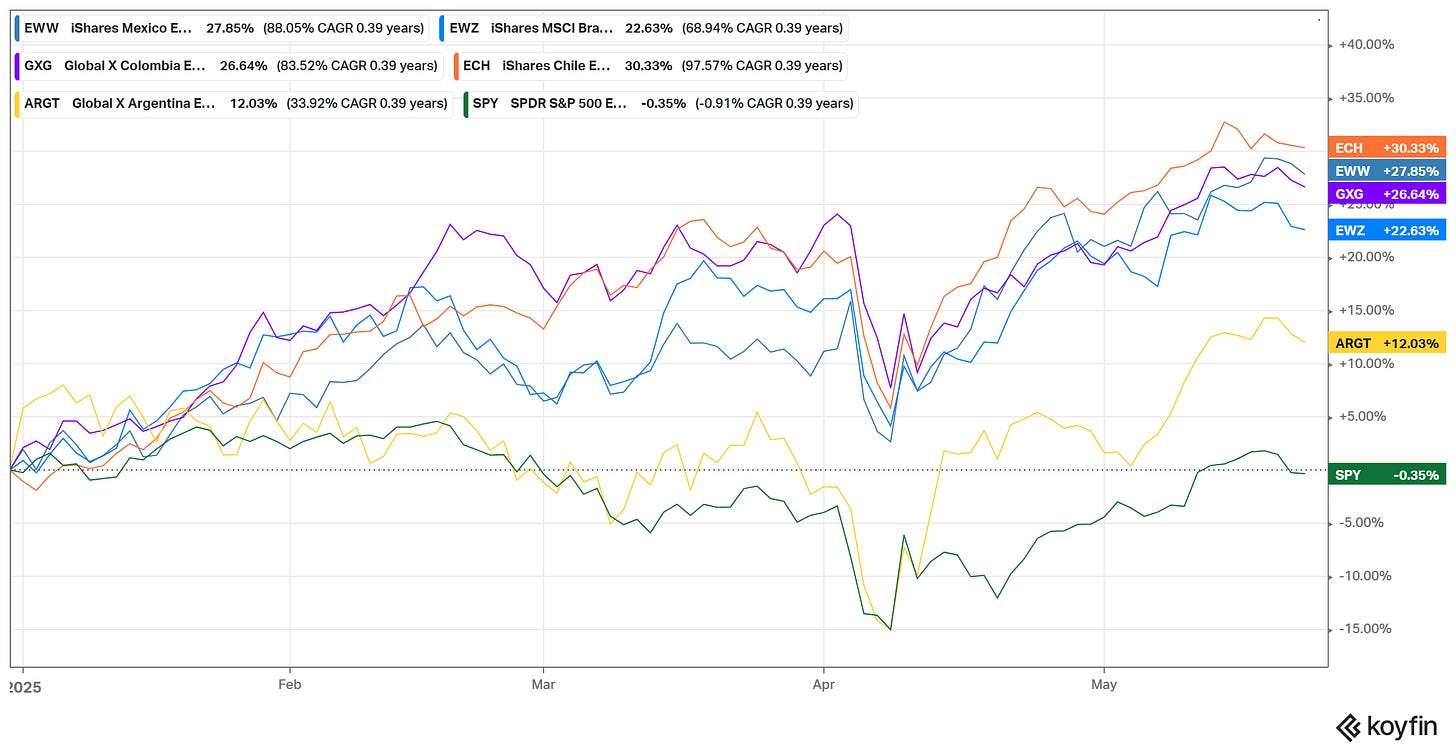

The first months of 2025 were generous for LatAm investors. Chile smashed the charts, followed by Argentina, Brazil, Colombia, and Mexico.

In 2025, Chile holds presidential elections, while in 2026, Colombia and Brazil hold elections. The polls are the mandatory catalysts. The closer the voting day, the more the hype.

A case in point is Argentina in 2023. Now, Chile follows a similar path, although it starts from a much better position than Argentina. Unsurprisingly, Chile's fastest horses are the largest banks. The banking industry is an early indicator of ongoing political and economic changes.

Banco de Chile (NYSE: BCH) reached an ATH recently. Banco Santander Chile (NYSE: BSAC) is closely following.

The elections are on November 16, 2025. I expect the bull trend to remain intact in the next two quarters. If the next president is pro-market-oriented, the game will enter its second phase. Argentina is an excellent reference again.

Now, let’s shift attention to the largest economy in the region: Brazil. The country is a leading exporter of energy, ore, and soft commodities. Depending on the economic cycle, this might be a blessing or an omen. In addition, China is Brazil's top trade partner. In investors' parlance, Brazil is top-heavy in longs on China. Considering the Chinese fiscal and monetary bazooka, I bet that emerging markets and Brazil will do well in the coming quarters.

On top of that, Brazilian equities are dirt cheap even compared to their LatAm peers.

The Brazilian market trades close to the lower limit of the 15-year PE range.

Unlike Chile, Brazil offers plenty of options for US and EU investors. For example, several Brazilian banks issued US-listed ADR. Let’s check how they are doing.

The largest names, such as ITAU Corpbanca (NYSE: ITUB), NU Bank (NYSE: NU), and Banco do Brasil (US OTC: BDORY), climbed above the 12-month moving average. Laggards in the game are Banco Santander Brasil (NYSE: BSBR) and Banco Bradesco (NYSE: BBD).

Brazilian utilities deserve special mention. Some of them claimed ATH prices recently.

Brazil is undergoing massive energy and transport infrastructure renewal. Utilities' robust price action suggests that the future is promising, or at least not bleak.

Going truly esoteric, consider the number of doctors per 10,000 people. Brazil is lagging behind its neighbors and the WHO recommendations. Look at the map below.

Brazil’s doctors per capita are comparable to those in Africa and the Middle East. With robust demographics, a growing economy, and macro tailwinds, the Brazilian population will demand better health care. That said, the country will need more and better-qualified doctors.

However, during a gold rush, do not follow the crowd into the mine but sell picks and shovels. In that case, seek exposure to the medical education industry.

A hint: check out Afya Limited (NYSE: AFYA).

Brazilian elections are in 18 months, so plenty of opportunities will come to build a position.

A shortcoming of LatAm equities is a shortage of attractive options. Only Brazilian and, to some degree, Argentine equities have liquid options. On my radar as long-term plays are the two Brazilian household names, Gerdau (NYSE: GGB) and Vale (NYSE: VALE). Both enterprises come with pros and cons.

The first difference is that Vale offers a reasonable variety of options while Gerdau does not. Vale’s performance is the first derivative of the Dragons' health. The happier the Chinese economy, the merrier Vale. Gerdau operates under the Monroe Doctrine only in the Western hemisphere. Brazil and the US are renewing their infrastructure, and they need an enormous amount of steel. Gerdau’s prime markets are those two countries.

Vale and Gerdau are trading near long-term support/resistance levels. A confirmed breakout will signal improved profits and odds.

Currently, I am eyeing Vale’s January 2027 call option.

GGB is not competitive in that matter. There are only a handful of illiquid contracts.

This was the May LatAm Overview. Next week, I will dive into my favorite industry, shipping.

PS: For more actionable and asymmetric ideas on LatAm and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.