The interplay between supply and demand in any capital-intensive business can be illustrated by the fable “ The Hare and the Tortoise.” The supply side is the tortoise, and the demand is the hare. In other words, the supply is inelastic, unlike the demand.

Supply is always slow to respond to demand shifts, creating monumental bull runs and ruinous bear markets. For example, during a booming offshore market, shipowners go berserk ordering drillships…only to take delivery when the party is (almost ) over. Then, no one wants to hear about offshore equipment. This leads to a shortage of ships to cover oil companies' demands, resulting in a deficit. Drink, rinse, repeat.

This May Offshore Market Report. Focus is on drillships’ short-term headwinds and the long-term tailwinds.

Offshore Market May Review

The Hare and Tortoise fable perfectly describes the market dynamics of the oil rigs (drillships, semis, and jack-ups) market. Expanding further the analogy, offshore projects have at least a few years' lead time, while shale projects have a few quarters. So, offshore is the tortoise, while shale is the hare. Extended lead time makes offshore synonymous with boom-bust cycles, due to inelastic supply and erratic demand.

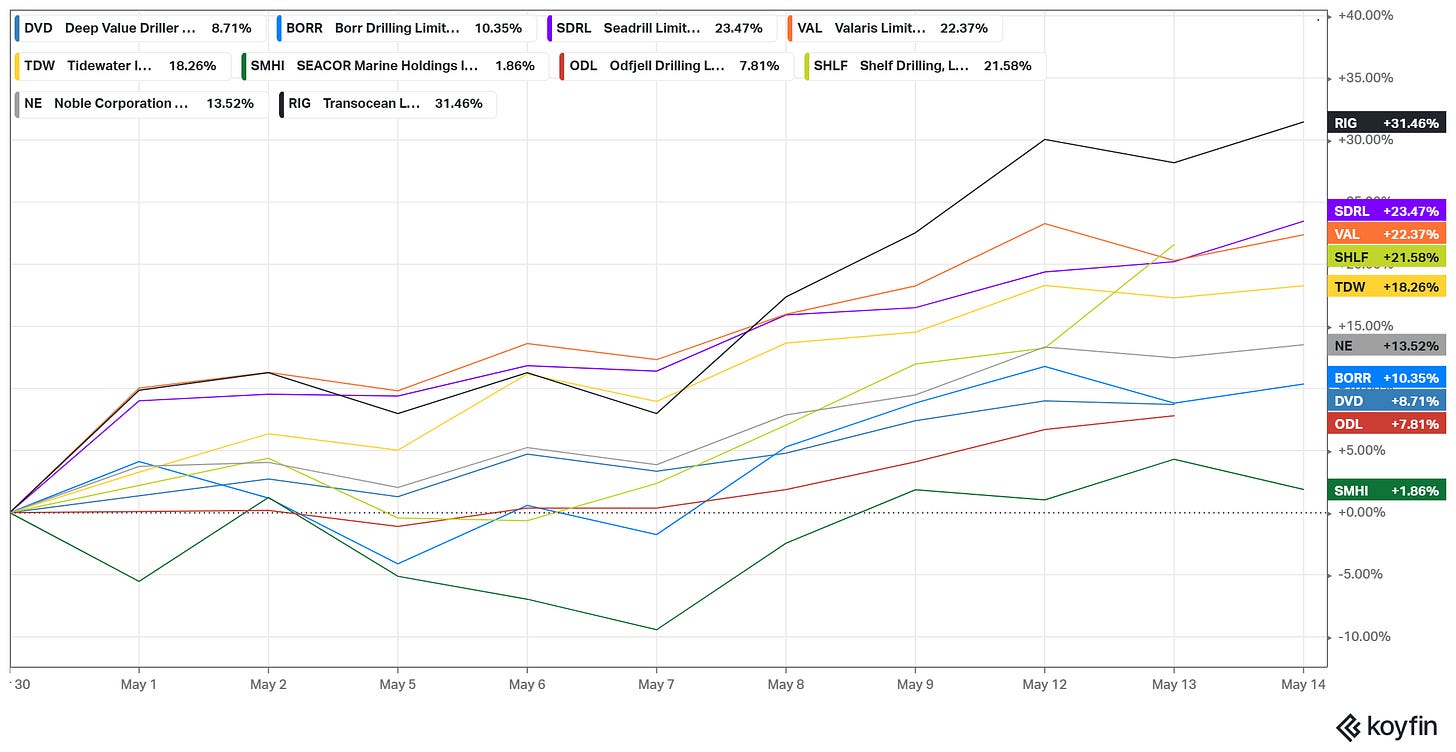

Now, let’s move on to the recent developments. It has been a tough quarter for energy investors, yet things were not too gloomy in May.

Transocean (NYSE:RIG) has gained a staggering 31.6% MTD. Even Deep Value Driller (OSL: DVD), the embodiment of offshore arcana, scored 6.7% gains.

Despite horrendous stock prices over the last two years, day rates have been trending up for high-spec drillers. As of May 2025, drillship rates remain at multi-year highs, reflecting robust long-term demand and limited supply: the Hare and the Tortoise fable in play.

The latest market data shows that 7G drillships owners secured day rates between $486,000 and $515,000 per day, with several contracts for the most advanced 8G units (Transocean’s Atlas and Titan), particularly those capable of 20,000-psi operations in the US Gulf of Mexico, exceeding $600,000 per day for specialized projects. 6G drillships generally earn $390,000 to $490,000 per day, while 7G units command $420,000 to $540,000 per day, depending on the specification.

Robust day rates translated into rising backlogs. The quote below is from a recent article by Offshore-energy.biz.

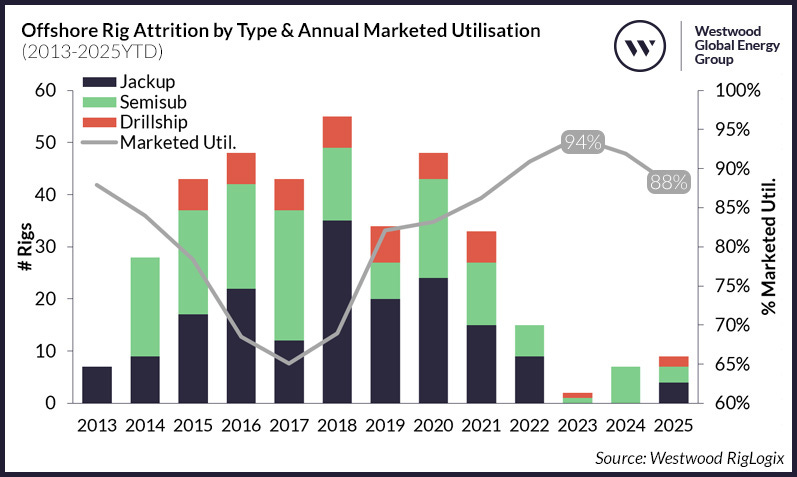

Six offshore drilling players – Transocean, Noble Corporation, Valaris, Seadrill, Shelf Drilling, and ADES – have reported a combined total backlog of $31.17 billion in the first quarter of 2025. This comes at a time when Westwood, an energy market intelligence research firm, paints a picture of a freeze in the rig demand and forecasts a ramp-up in the rig retirement trend, with marketed utilization said to be at the lowest levels since the start of the recovery period in 2021.

An extended CAPEX cycle leads to massive backlogs. For market participants, especially bond investors, the backlog provides predictable revenue and reduces the credit risk. However, not everything is rosy in the short term.

Recently, companies reported declining utilization. Chart via Westwood.

I attribute that to weaker oil prices, though still above DW/UDW breakeven cost, and the unknowns surrounding cold-stacked vessels. There are 14 cold-stacked drillships globally, representing more than 10% of the world fleet.

Most of the cold-stacked units were delivered in years ranging from 2009 to 2023. The majority is controlled by Transocean and Valaris (NYSE:VAL). RIG owns nine cold-stacked units, some of which have been idle for over seven years. Noble Corporation (NYSE: NE) recently exited the cold-stacked segment by divesting two legacy ships (Pacific Meltem and Pacific Sirocco) for non-drilling purposes. Reactivation of cold-stacked rigs is increasingly challenging due to high costs, in some cases, $100–$150 million per unit. On top of that, contract prospects for reactivated rigs are questionable due to unattractive specifications for older ships. Recycling or conversion is a more likely outcome for long-idle assets.

The relationship between utilization and the number of cold-stacked vessels forms a closed loop. The lower the utilization, the lower the motivation to reactivate vessels, and vice versa. This vicious cycle depends on day rates. If rates stay above $450,000/day for 6G, $550,000/day for 7G, and $650,000/day for 8G units, it indicates a persistent rig shortage and rising utilization. At that point, rig owners would reconsider restarting their idle units.

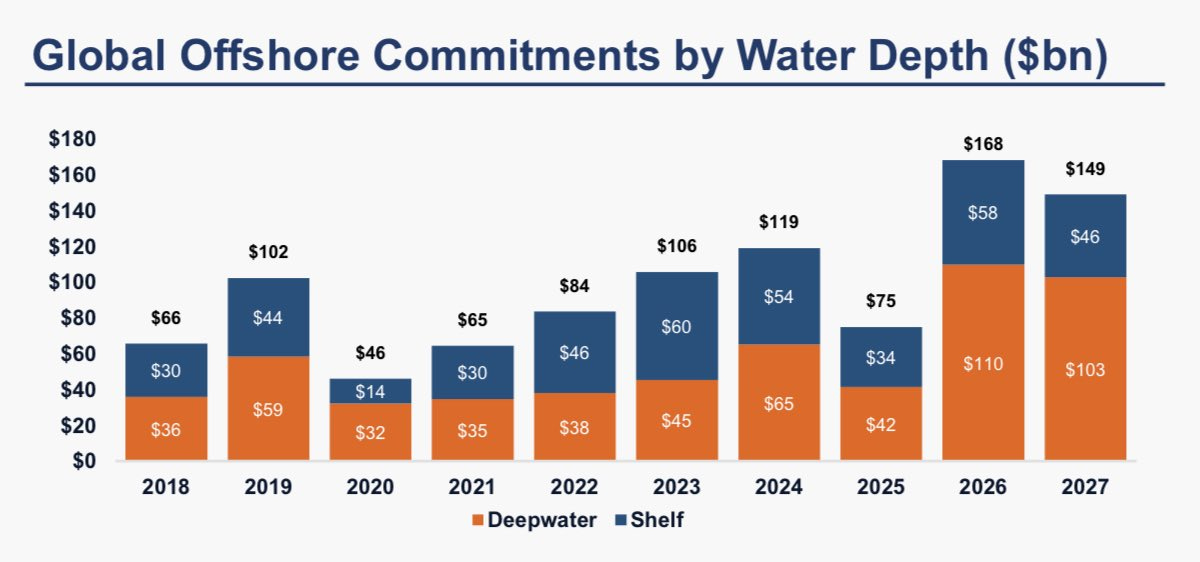

Day rates have been on the move, yet they are not completely reflecting the long-term fundamentals. For the next 24 months, I am bullish on DW/UDW projects and drillships in particular. The following chart (via Rystad Energy) explains why:

Drillship demand depends on growing UDW CAPEX, which is projected to exceed shelf commitments in relative and absolute terms in the coming years. On the other hand, the supply of drillships is explicitly constrained. A supply glut caused by restarted cold-stacked ships is highly unlikely due to the prohibitive cost of reactivation, even at higher day rates, and uncertainty about employment prospects. Newbuild supply is nearly nonexistent due to a single-digit order book for new units. To recap, the headwinds for drillers may persist in the coming months, but that fact does not cancel the long-term bull case.

The most important question is whether it is time to enter the market. I would say it depends on our goals, skills, and risk tolerance.

For highly asymmetric bets, present prices offer good entry points. RIG price action has recently become more constructive.

The price seems to have found temporary support. Monthly charts for Valaris and Seadrill are pretty similar.

For high-yield hunters, RIG offers a few senior secured debt issues and several senior unsecured issues, maturing between December 2025 and December 2041. Valaris and Seadrill (NYSE: SDRL) also offer HY bonds. However, the number of alternatives is limited compared to Transocean’s issuances.

For LEAPS connoisseurs, Transocean has the most attractive option chains given strike prices, tenors, and liquidity. The table below shows RIG calls with January 2027 expiration:

The next comes Valaris. Seadrill is a laggard in the group with a limited number of options, with the furthest expiration in December 2025.

This was the May Offshore Report. Next week, stay tuned for the May LatAm Report.

PS: Let me share some exciting news. New memberships are ready to rock.

Why New Membership Plans?

Investing is a journey: from exploring fresh ideas to deep research to building a winning portfolio. The Old Economy’s new membership structure is designed to guide you through each stage, adding more value at every step.

Choose the Plan That Matches Your Ambition

Explorer (Free)

Expand your investment horizons.

Get weekly insights into under-the-radar markets- shipping, mining, energy, and Latin America. Discover new ideas, broaden your perspective, and spark new opportunities, all at no cost.

Researcher (€217)

Go beyond ideas-turn them into action.

Receive two in-depth, actionable deep dives each month: one equity and one fixed income pick. Each report delivers thorough analysis, clear valuations, and step-by-step execution guidance, empowering you to invest confidently and efficiently.

Researcher Perks:

12 Fixed-Income reports per year

12 Equity reports per year

Full access to all Explorer content

Clear, actionable execution plans for each pick

Archive access to all past research

Strategist (€360 for a limited time, standard price is €450)

Integrate every insight into an actionable portfolio.

Gain full access to TheOldEconomy’s live model portfolio, including all research, trade execution, and portfolio management in one place. See how individual ideas fit together, track performance, and learn how to manage risk and allocation like a pro.

Strategist Perks:

Full access to TheOldEconomy’s live model portfolio

All Researcher and Explorer perks

Portfolio-level insights: allocation, risk management, and performance tracking

See not just what to buy, but how to build and manage a winning portfolio

Why Upgrade Now?

Save Time: Get the right information at the right moment- no more sifting through noise.

Act with Confidence: Every deep dive includes step-by-step execution guidance.

See the Big Picture: Strategists get a full portfolio framework, not just isolated ideas.

Robust Results: Since its inception in January 2023, The Old Economy’s portfolio has delivered a 106% total return (36% CAGR).

Community: Paid members receive priority for Q&A, direct feedback, and more.

In investing, timing is everything. Don’t miss your chance to upgrade your process and secure your edge at the year's lowest price.

Ready to Take the Next Step?

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.