Can we acquire a top-notch fleet and a zero-debt balance sheet at a double-digit discount to NAV?

The impossible triad of shipping is here to help. As investors, we seek a high-spec fleet, low LTV, and a reasonable discount to NAV. However, it is impossible to get all three.

In most cases, the game is more nuanced. We get a so-so fleet, a moderately leveraged balance sheet, and a reasonable discount. In other words, nothing excessive.

At best, sacrifice one to get two. We can purchase a top-quality fleet at a relatively low LTV, albeit at a steep price, as measured in PNAV. Alternatively, we can opt for a low LTV and a substantial discount to NAV, albeit at the expense of fleet quality.

This is the May Shipping Report. The focus is on the VLCC market.

The first months of 2025 were not kind to shipping investors, except for those invested in crude tankers.

Frontline Plc (NYSE: FRO) gained YTD a respectable 33%. On the other hand, Scorpio Tankers (NYSE: STNG), a leading product tanker operator, delivered a 16% YTD loss. LPG and LNG carriers are a mixed bag. Both segments have been struggling due to softer day rates. StarBulk (NYSE: SBLK), the largest dry bulk operator, scored an adequate performance.

Shipping is far from a homogeneous industry. Each segment has its subsegments with distinct dynamics. For example, the small/handy size LPG carriers market is supply-driven due to low order books, aging fleets, and a lack of shipyard capacity. In addition, tonne-mile demand for such vessels remains intact.

Conversely, the market for VLGC, the largest LPG carriers, is demand-driven. In other words, to have a stable day rate, the tonne-mile demand growth rate must surpass the fleet growth rate. The VLGC order book is about 27%. A short-lived perturbation in demand would transform the mild VLGC shortage into an apparent supply glut. Consequently, day rates will sink.

Following the above, the best shipping markets from the investors’ perspective are those where demand and supply move in opposite directions: demand grows, while supply declines.

That said, the most interesting niches are crude oil tankers (VLCCs in particular), Small/Handy LPG carriers, and Capesize bulkers. As you can see, the details, size, and type of cargo matter a great deal.

Let’s move to today’s topic: the VLCC market.

Crude oil tankers had a strong start to the year. FRO and DHT Holdings (NYSE: DHT) scored impressive gains YTD. DHT is the ultimate VLCC-only play with its fleet of 21 vessels (ex., four newbuilds).

Okeanis ECO Tankers (NYSE: ECO) owns 8 VLCCs and 6 Suezmax tankers. It is the company with the best fleet considering its age and scrubber penetration. International Seaways (NYSE: INSW) is not a VLCC-only play, either. The company owns various types of tankers, including product tankers. However, it owns 11 VLCCs, a sufficient reason to be on the list.

The long-term tailwinds for the VLCC market are intact, though the market has faced downward pressure over the past two months, primarily due to declining demand despite a vessel shortage.

Freight rates have been mixed but generally subdued. In April, VLCC spot rates on the Middle East-to-East route rose 2% month-on-month, averaging WS61, but remained 2% lower year-on-year. Rates on the Middle East-to-West route declined by 3% month-on-month, averaging WS33, and were down 21% year-on-year. Despite occasional weekly upticks, overall momentum has trended downward, with the Middle East Gulf to China (TD3) route rates hovering around WS60 by late May, reflecting only a slight weekly increase despite the broader decline.

Softer demand led to vessel oversupply. Net supply remains elevated, with around 128 spot-relevant VLCCs available to load from Ras Tanura within 30 days, following a peak of 190 vessels in mid-March. This oversupply has kept freight rates under pressure, and a recovery is unlikely until net supply drops below 100 vessels.

Now, let’s consider the big picture. Long-term supply constraints are well known: an 8% order book, an aging fleet, and a lack of shipyards' capacity. Besides cyclical deficit driven by low order book and aging fleet factors, like sanctions, add pressure to the VLCC availability. The number of sanctioned vessels is 102, while the estimated size of the shadow fleet is up to 17% of the total VLCC supply.

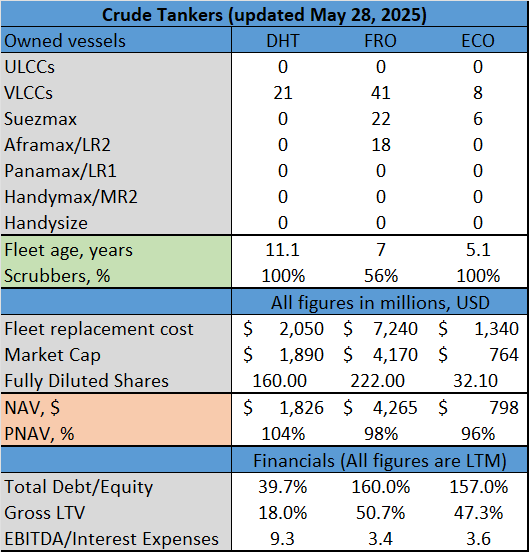

Today’s report started with the impossible triad. Let’s see how our contenders, DHT, FRO, and ECO, perform:

It’s all about tradeoffs. DHT offers the best balance sheet, based on LTV and Total Debt/Equity. A drawback is the older fleet. On the other hand, ECO owns the newest ships, but it comes with a leveraged capital structure. FRO comes with a good enough fleet and leveraged balance sheet. That said, all three companies trade at about 100% PNAV.

Traditionally, for Market reports, I will end up with an idea discussion. For option traders, FRO and DHT are the only viable alternatives.

FRO offers multiple strikes and adequate liquidity. The table below shows the option chain for FRO calls with January 2026 expiration.

One drawback of Frontline calls is the lack of options expiring in January 2027. DHT covers that gap, although its option chain is pretty limited in terms of strike prices, and most of the contracts are relatively illiquid.

For equity traders, DHT is the better proposition. The price action is supportive of an extended bull run.

If May candles close above the 12-month moving average (MMA), it will signal that odds and payoffs are in our favor. With a tight stop just below the MMA and an open take-profit, we can end up with a profitable asymmetric bet.

This was the May Shipping Overview. Next week, I will dive into obscure corners of the critical minerals.

PS: For more actionable and asymmetric ideas on LatAm and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.