The last few years have been challenging for PGM miners and investors. Gold is an unsurprising exception. Gold is a monetary metal, unlike PGMs and silver, which are first industrial metals and then serve as assets. Accordingly, their prices depend on different variables.

Platinum and palladium are the more popular PGMs. The output of PGM mines is typically described using a format that equates to the sum of the metals extracted, such as 2E for platinum and palladium, 3E for 2E plus rhodium, 4E for 3E plus gold, and 6E for 4E plus osmium and ruthenium.

The chart below shows 5Y 4E performance.

Recently, palladium has hit record lows weekly but found support at $900/oz. Conversely, Platinum has failed several attempts to break out above $1,100/oz. Rhodium, too, has bottomed out at about $4,400/oz, significantly lower than its 2021 peak of $25,000/oz.

Supply

Releasing Russian above-ground inventories and record short positioning depressed platinum and palladium prices. However, above-ground stocks, especially in the West, are at a record low level.

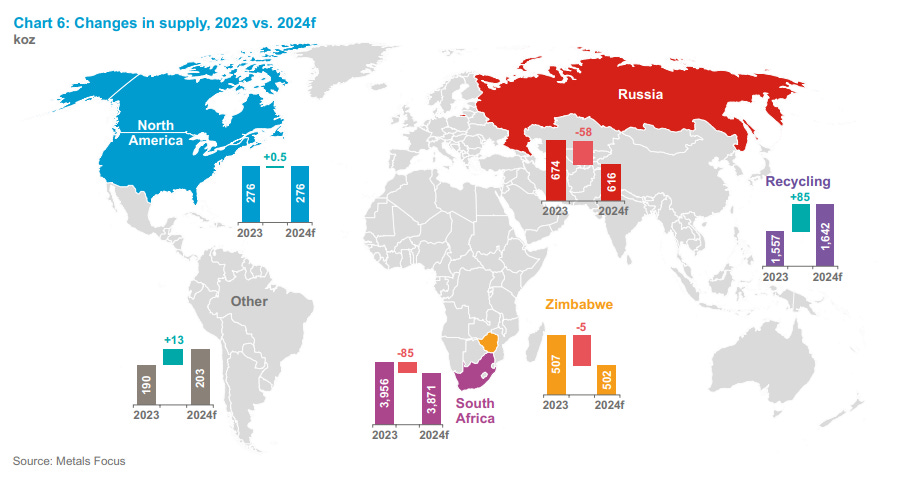

One-quarter of the platinum supply comes from recycling. Of the total 7,111 oz in FY24, recycling is projected to deliver 1,642 oz.

Recycling faces two headwinds:

· Higher interest rates resulting in higher car payments, leading to extended ownership per vehicle and fewer catalytic converters recycled

· Shift in lifestyle, more home office, less mileage, fewer catalytic converters recycled

Structural inflation keeps interest rates higher for longer. As a result, car payments have increased significantly over the years. Lifestyle changes also adversely impact recycling. The shift to the home office has reduced cars' annual mileage. Combining more expensive vehicles and declining mileage results in fewer catalytic converters to scrap, i.e., decreased recycling output.

YoY is expected to increase recycling by 85k oz. Nevertheless, the long-term trend is bearish. 80% of the recycling supply comes from catalytic converters removed from end-of-life vehicles. The following chart illustrates the platinum recycling supply for 2013-2024. Chart via WPIC.

Between 2021 and 2023, the recycled supply dropped by 30%. The decline is due to fewer recycled catalytic converters and platinum jewelry.

The imbalance between supply and demand has already started to materialize. The deficit for 2023 is 983 thousand ounces, and another 476 thousand ounces are projected for 2024. Data from World Platinum Investment Council.

Like all other metal mining industries, PGM mining follows the CAPEX cycle. Over the past decade, the lack of investments has shown its consequences. Supply is steadily declining, and the need for new deposits to replenish the declining reserves is squeezing companies. Investments to renew depleted reserves are necessary for every miner.

The basic heuristic in the mining industry is as follows:

The reserves growth rate must exceed the reserve depletion rate.

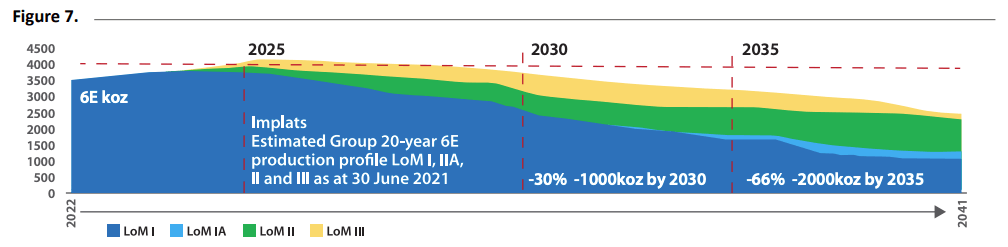

The following chart illustrates the steady decline in reserves of the major platinum mining companies (chart via Impala Platinum):

The reserves (blue) are part of the resource base (yellow and green). Converting resources into reserves requires time and capital, and there has been little investment in recent years. The chart presented is not the exception but the rule for mines producing PGMs.

The location of these deposits is a crucial factor, apart from the time it takes to discover, develop, and build a new mine. For every 100 ounces of platinum reserves, 90 are in South Africa, 6 in Russia, and 2 in Zimbabwe. The remaining two ounces are in North and Latin America.

The map below from WPIC shows the 2023 vs 2024 platinum supply.

As discussed, recycling is expected to grow year over year. Nevertheless, annual recycling figures are below the 10-year averages. The big three, South Africa, Zimbabwe, and Russia, will mine less platinum in 2024 vs 2023. The growth from recycled metal can not offset the decline in mining.

Demand

As the EV hype cools down, auto manufacturers are adjusting their strategies. It's becoming increasingly clear that the old ICE vehicles will last longer than projected. This is evident from the announcements of major players like Mercedes, GM, Toyota, and others, who have revealed their plans to maintain ICE production lines for the foreseeable future.

Platinum is among the critical metals for the transition to clean energy. In recent years, a low-cost alternative to PGMs has been sought, and silver has led the way. Time will tell whether it or some other metal will prove a suitable replacement.

I intentionally use the following chart from 2022. At that time, EVs were the present and the future, while ICE cars were already part of history.

So, there is still demand for PGMs. Despite the doom-and-gloom future for ICE, platinum demand is projected to grow. Fuel cells, chemicals, and PEM electrolyze demand will replace catalytic converters demand. Now, we are in June 2024. ICE made its comeback while the EV craze cooled down. The need for catalytic converters is back; hence, it is for platinum and PGMs.

Setting zero carbon targets requires measures that go beyond catalysts. Fuel cells powering cars are becoming increasingly relevant. Platinum's role in the cells is that of a catalyst, which accelerates the chemical processes.

Summary

With PGM production slowing down and weak spot prices leading South African miners to close their high-cost operations, the industry is under significant pressure. Power curtailments add to the companies' woes, resulting in higher AISC.

Russia is the big known unknown in the equation. Further sanctions on PGM exports to the EU enforced by the EU will act as a spark. Russia could, too, impose sanctions on PGM exports to the EU. The market's response will lead to a parabolic price move in PGMs.

Prices may reach March/April 2022 levels. The EV craze was intact then, and the PGMs were left for dead. Now, the tide has turned, and the PGM deficit is deepening. Limiting 45% of palladium and 10% of platinum exports will cause an exponential response from the market.

Another catalyst is putting in “care and maintenance” of the Stillwater mine in Montana, the sole PGM operating mine in US territory. Stillwater delivered a 427 k oz 2E (78% palladium and 22% platinum). If the mines go out of service, the global platinum supply will decline by 93k oz and the palladium supply by 333k oz. Consequently, the 2E deficit will grow.

FY24 palladium supply is estimated to reach 9.37 million oz, while demand is at 9.73 million oz, leading to a 358 k oz shortage. So, if Stillwater Mine goes into “care and maintenance,” the palladium deficit will almost double from 358 k oz to 691 k oz.

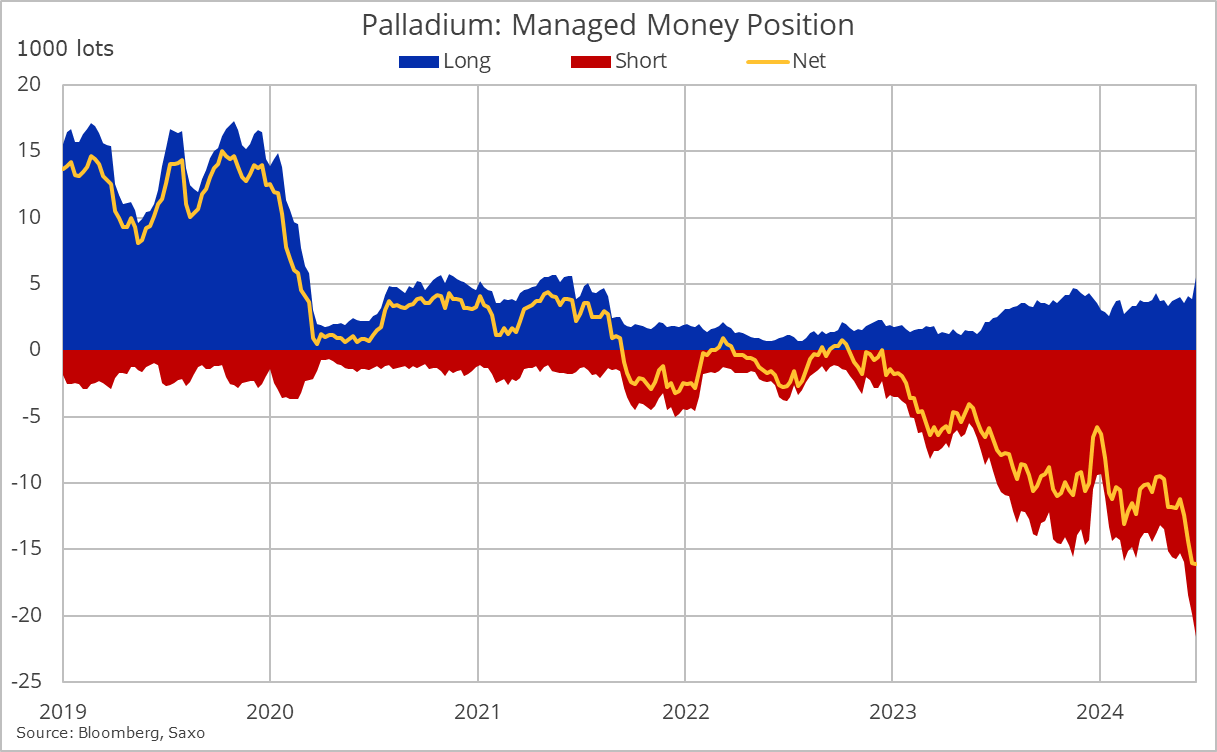

Last but not least, palladium's short positioning reached a record level.

PGM and palladium, in particular, may be the most asymmetric picks of the year, considering acute shortages and catalytic events acting as tailwinds.

This article is an excerpt from a quarterly report for institutional subscribers. What does it mean?

Every quarter, I dissect my investing themes for the present year. I start with the big picture (macro and geopolitics), then move to industry/region specifics, and eventually discuss the most enticing companies.

My goal is to help institutional investors make better decisions about obscure industries and regions. How do I achieve that goal?

By delivering comprehensive and, most importantly, actionable reports.

If you wish a sample report, feel free to contact me by DM.

I think you meant to say "Structural inflation keeps interest rates higher for longer. As a result, car payments have Increased (not decreased) decreased significantly over the years. Otherwise good article and a good contrarian bet on PGM for the next few years, especially if the EV craze dies down as people realize that this is a niche market.