Welcome to the Test Drive section. It answers the question: What will you miss if you do not become a paid subscriber?

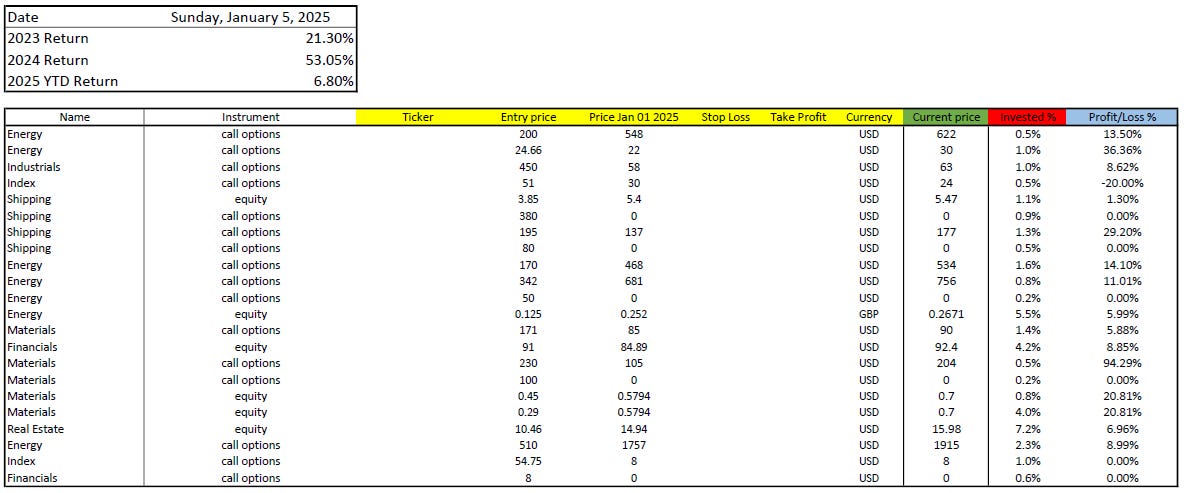

The table below shows my portfolio performance and its present composition.

Since its inception on January 1, 2023, the TheOldEconomy portfolio has achieved an 85.65% total return, or a 31.6% YTD CAGR.

The portfolio is quite eclectic, comprising a uranium miner, LPG carriers, Latin American banking, and a PGM play. There is no trendy stuff, only floating steel, ounces, barrels, and LatAm. Most importantly, the book includes all the essential execution data, such as size, stop-loss, take-profit, and notional value.

The portfolio illustrates my personal investing account. What principles do I follow in investing?

My approach is based on:

A blend of macro, fundamentals, and technical analysis. The macro tells why, i.e., the macroeconomic and geopolitical tailwinds behind my thesis. The fundamentals tell what, i.e., the quality of the investment idea based on finances, management, and business. The technical analysis simply tells when the least wrong time to buy is, i.e., the odds are skewed in our favor.

I use various tools to express my thesis. I usually combine LEAPS calls with equity or ETFs. The calls bring Alpha, while the ETF and equity bring Beta.

Less is more. I follow the diversified concentration principle. My focus is on the quality of ideas instead of quantity. I have a few big themes per year, so I make concentrated bets.

Adequate timing plus good enough analysis always beats mediocre timing plus brilliant analysis. An event-driven strategy comes to mind. I always seek a catalyst that leads to stock/commodity/index revaluation in the next 12-18 months.

Strict risk management. Cut losses decisively, let the profits grow patiently, and build positions gradually.

Paid subscribers will receive a weekly update every Sunday with my plans for the next week and a revised table with my positions. The weekly update will include all the required data: entry price, stop loss, take profit, and position sizing.

If you wish to get access to institutional-quality analysis on niche ideas and an actionable portfolio, TheOldEconomy paid subscription is for you.

Join the pack, and let’s make Old Economy investing great again.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Mihail, one doubt: If I do not have acess to options in my broker, is There a problem building position via equity?

I can't wait!👏👏