Investing in energy with fixed-income securities

Capital gains and attractive yields for industrious investors

Take the opportunity to peek behind the curtain of TheOldEconomy Pro Membership.

This is the Beyond Equity report for Pro Members published in September 2024.

Fixed-income instruments are often associated with a low risk-reward ratio. Today’s pick is different. The bond trades at a 25% discount on par while coming with an 8.75% coupon. If we consider the best case vs. moderately bad scenario (company dissolution and 50% debt haircut), we get risk reward 2.0. This figure is not typical for fixed-income instruments.

The issuer is one of the most shorted companies in the energy space, New Fortress Energy Inc. In March, NFE issued senior secured notes with an 8.75% coupon and a maturity date of March 2029. If everything is good until maturity, we can realize a 76.3% total return and 16.6% Yield to Maturity.

This is the September non-equity monthly idea. In the following paragraphs, I review NFE assets, the company’s balance sheet, and NFE’s risks.

New Fortress Energy

First, what is New Fortress Energy? The company is involved in energy infrastructure, more specifically, LNG assets. Two primary revenue sources are Ships and LNG infrastructure. The ship segment includes floating storage and regasification units (FSRUs), floating storage units (FSUs), and LNG carriers.

The Infrastructure segment includes the entire production and delivery chain, from LNG procurement and liquefaction to logistics, shipping, facilities, and conversion or development of natural gas-fired power generation. NFE operations are concentrated in Latin America: Brazil, Mexico, Puerto Rico, and Jamaica.

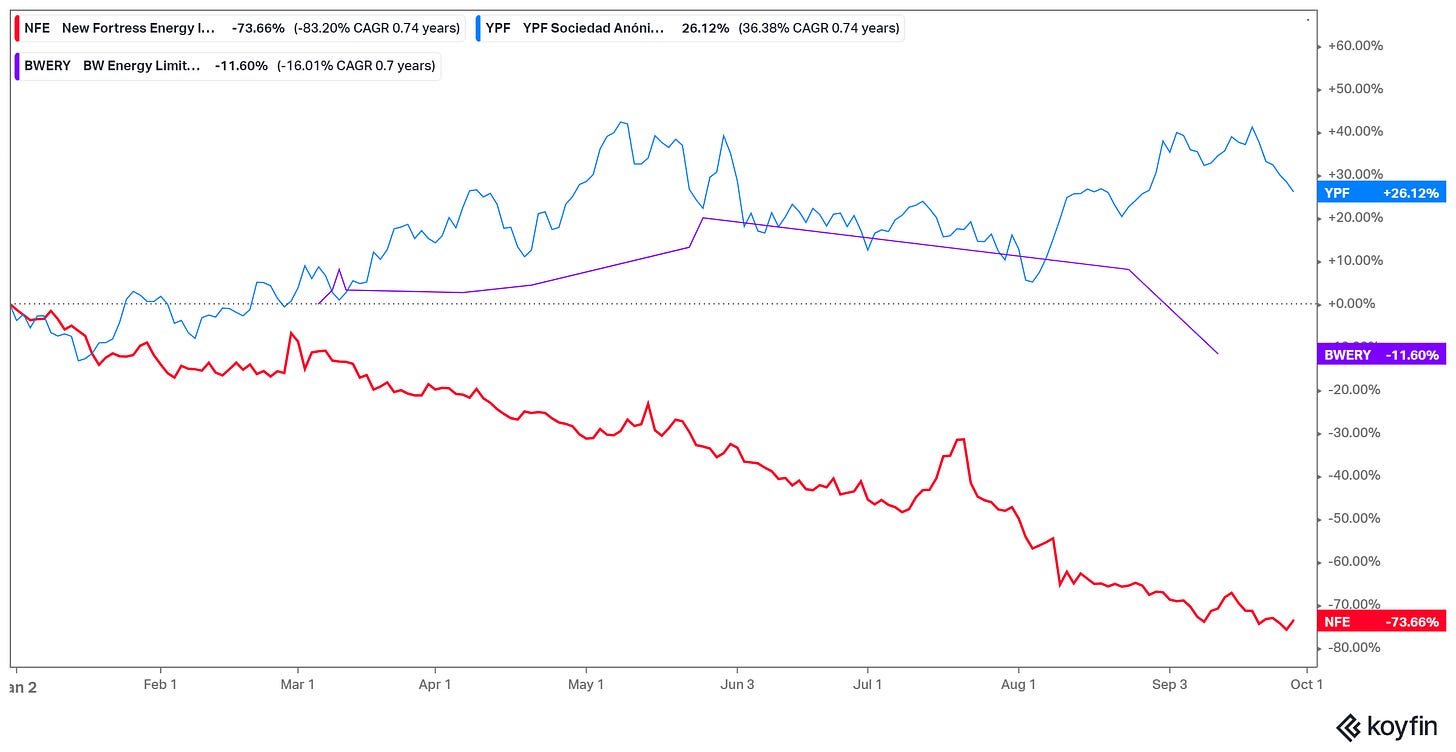

NFE’s shares have been slaughtered in recent quarters.

NFE’s performance is abysmal. The company’s shares lost 73.6% of their value YTD. I intentionally picked YPF Anonima and BW Energy because both companies offer attractive fixed-income instruments with maturity in 2029.

The company faces multiple challenges, including canceling its Puerto Rican contract and delaying the Fast LNG project in Mexico. Moreover, the company’s management has a bad habit of overpromising and underdelivering. That being said, NFE stocks are not for me. If I like to get an adrenaline rush, I buy Greek shipping companies with LEAPS calls. However, NFE’s bonds are an exciting opportunity to consider.

NFE is more of an integrated company. It occupies a vertical that includes buying US domestic LNG, liquefying, transporting, reclassifying, and even turning the gas into megawatt hours.

In July, NFE declared the successful launch of its first floating LNG unit in Altamira, Mexico, unlike most of the FLNGs in operation, which started life as LNG carriers, NFE’s asset is built from scratch. It is a fixed-offshore floating LNG, resembling a jack-up platform. Image via New Fortress website.

The unit's capacity is 1.4 mtpa, and the cost is $1.3 billion. NFE is looking to expand its liquefaction capacity in Mexico. It plans to build a 2.8 mtpa installation, which the company expects will cost $1.8 billion.

The closest competitor is Golar LNG, GLNG, which owns two operating FLNGs and expects FID on the third one. Golar buys old LNG carriers and then converts them into FLNGs, thus achieving cheaper cost per unit capacity. The two existing Golar FLNGs (Hilli and Gimi) have a capacity of 5.1 mtpa and cost nearly $2.5 billion. This is a $500 cost per unit capacity, almost 50% cheaper than NFE’s unit.

Fixed installations have one massive drawback: they are fixed. If things get ugly in economic and political contexts, the owner is stuck with assets subject to appropriation, extortion, corruption, and whatever any autocratic regime can decide.

Mexico has been under leftist rule for the last decade. The new president, Claudia Sheinbaum, has to prove she is not another caviar leftist or at least to subdue its party aspirations for resource nationalism.

The good thing about NFE is that it operates across a few countries in South America. Plus, the company has operations in the US. FY23, about 50% of the revenues came from its US operations and 50% from its South American division.

One remarkable asset on the NFE balance sheet is its long-term contract with Brazil for a 1.6 GW power plant next to NFE’s Barcarena LNG Terminal. The power plant will provide firm power capacity under the previously announced 15-year Capacity Reserve Contract (“Agreement”) that NFE acquired from Denham Capital. In summary, NFE Brazil has an average contract duration of 18 years, a $500 million run-rate EBITDA in 2026, 2.2 gigawatts of power plants, and 46 billion firm gas sales.

In July, the company announced its plans to sell its liquefaction and storage facility in Miami, Florida, to a U.S. middle-market infrastructure fund. The transaction is expected to close in 3Q24. The Miami Facility is a small-scale liquefaction facility with one liquefaction train capable of producing 8,300 MMBtu of LNG daily.

In March, NFE announced that it sold the emergency power plants it constructed on behalf of the U.S. Army Corps of Engineers in San Juan and Palo Seco to PREPA for $373 million in cash. NFE was awarded a new contract to supply 80 TBtu annually for four years.

At first glance, NFE is not that bad. The company owns scarce assets, shares, and trades like there is no tomorrow. As pointed out, NFE has some issues:

Delayed operation in Altamira

The start of the Altamira FLNG unit was postponed multiple times, totaling more than 18 months. The facility started operations in July and delivered its first cargo in August. The delay came at significant costs.

Overpromising combined with under-delivery

NFE management has made plenty of disputable decisions, to say the least. Until now, the top brass has failed to deliver its overtly ambitious plans. I prefer down-to-earth plans to bombastic ambitions. This is not to say the company-like business model is wrong. The issue is NFE’s management and its questionable decisions.

The 2023 dividend policy was absurdly generous. The company distributed $626 million as a special dividend or $3.4/share. For an enterprise with a Total Debt/Equity ratio above 300%, it is a dumb decision. It reminds me more of politicians trying to attract votes with populist measures such as excess public spending.

The reason for juicy dividends is evident in the shareholders’ list. Image via Market Screener.

Wesly Edens, the company’s CEO, owns 23.18% of company shares. Randal Nardone, one of the directors, owns 12%, too. Usually, stupid corporate decisions are taken from people without skin in the game. Simply because their wrongdoings do not impact their well-being. But NFE’s case is different. The incentives for Edens and Nardone to push for dividend extravaganza are apparent.

Now, let’s look at NFE financials.

Financials

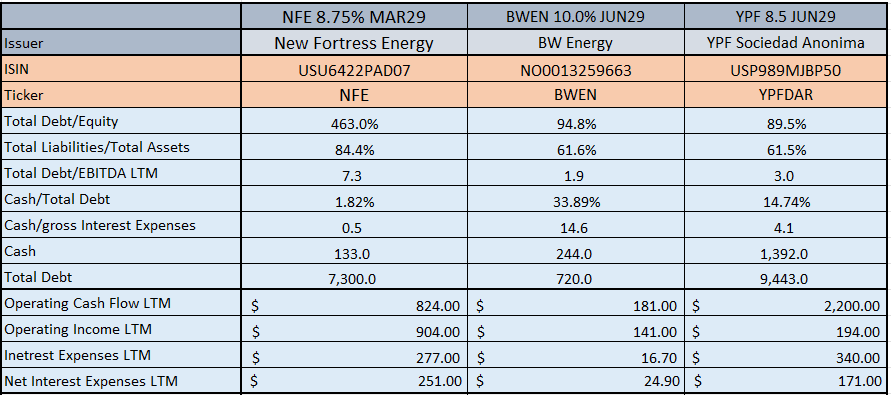

NFE reported $133 million cash and $7.3 billion total debt in its 2Q24 report. The company has a 463% Total Debt/Equity ratio and 84.4% Total Liabilities/Total Assets.

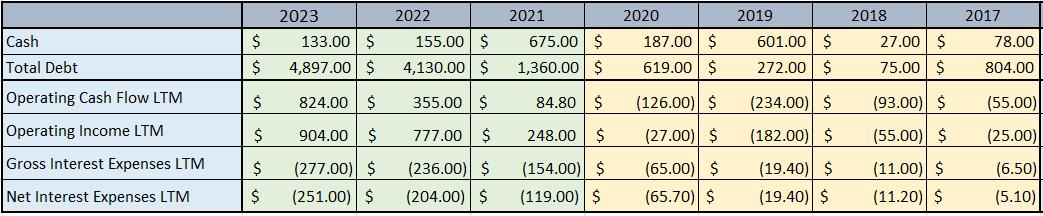

Over the last three years, NFE consistently delivered strong operating cash flow and income, exceeding gross interest expenses multiple times. Operating losses marked the period between 2016 and 2020. The table below shows NFE operating figures, cash reserves, and interest expenses for the 2017-2023 period.

The cells marked with green indicate the years when operating income was higher than gross interest expenses. The cells in yellow mark years when operating figures were insufficient, yet NFE had enough cash reserves to cover its interest expenses. That being said, NFE had sufficient liquidity over the last seven years. Far from the best, but good enough to cover its interest expenses.

In the next two years, NFE will have to repay a massive chunk of its debt. In 2025, $875 senior secured notes mature, and in 2026, $1.5 billion. The plan for 2025 notes is to extend their maturity. NFE reported that it has a backstop agreement in place to refinance 2025 notes, which comes with new covenants.

A quote below:

The Amended Credit Agreements, among other things, suspend the application of the maximum Debt to Total Capitalization Ratio (as defined in the Existing Credit Agreements) for the quarterly covenant tests conducted as of the last day of the fiscal quarter ending September 30, 2024, December 31, 2024, and March 31, 2025. The Amended Credit Agreements also add a financial covenant that requires minimum consolidated liquidity (generally defined as unrestricted cash and cash equivalents plus available commitments under the Amended RCF) of $100.0 million as of the last day of any fiscal quarter, commencing as of September 30, 2024 (or in case of the Amended TLA, commencing December 31, 2024).

The Amended Credit Agreements also prohibit the Company from making certain restricted payments, including dividends on the Company’s common stock in excess of $0.10 per share per fiscal quarter, incurring liens on certain collateral, engaging in affiliate transactions involving certain collateral and consummating asset sales involving certain collateral.

The most significant changes are the minimum $100 million consolidated liquidity in cash and cash equivalents and the limitation of dividend distributions up to $0.10/share. The dividend cap is crucial. It prevents NFE management from voting for another dividend self-indulgence round.

In July, NFE announced a $700 million term loan for its second FLNG unit (FLNG 2). The Term Loan will mature on July 19, 2027, and is payable in full on the maturity date.

Let’s look at loan covenants:

If the Company’s existing 6.750% Senior Secured Notes due 2025 (the “2025 Notes”) or 6.50% Senior Secured Notes due 2026 (the “2026 Notes”) are not refinanced or repaid at least 60 days before their respective maturities, the Term Loans will become due and payable on such date.

The obligations under the Credit Agreement are guaranteed, jointly and severally, on a senior secured basis by each subsidiary that is a guarantor under the 2025 Notes, 2026 Notes, the Company’s 8.750% Senior Secured Notes due 2029 Notes (the “2029 Notes”), the Company’s senior secured revolving credit facility (the “Revolving Facility”), the Company’s letter of credit facility (the “Letter of Credit Facility”) and the Company’s existing term loan facility (the “FLNG1 Term Loan”), other than the guarantors comprising the FLNG1 Project (who guarantee the Revolving Facility, the Letter of Credit Facility, and the FLNG1 Term Loan).

The obligations under the Credit Agreement are secured by substantially the same collateral as the collateral securing such facilities, except the collateral comprising the FLNG1 Project (which secures the Revolving Facility, the Letter of Credit Facility, and the FLNG1 Term Loan). Additionally, the Term Loans are guaranteed by the entities, and secured by the assets, comprising the Project. An equal priority intercreditor agreement governs the treatment of the collateral.

The first paragraph is essential. NFE must repay or refinance its 2025 and 2026 bonds fully. Otherwise, the term loan will become payable immediately. The loan comes with attractive interest SOFR plus 3.75% or a base rate plus 2.75%.

In summary, NFE has a busy debt repayment schedule for the next three years. I expect the company to refinance its 2026 bonds with another round of bond issuance with maturity beyond 2030. If the FLNG2 project goes into production on time (1H26), that will improve the company’s profitability, thus increasing the odds of repaying its term loan on maturity without further refinancing. Then, a timely 2029 bond redemption becomes a highly plausible scenario.

Now, let's say a few words about 2029 bonds. In March 2024, NFE announced a private offering of $750 million of senior secured notes due 2029. The Notes carry 8.750% interest. Like NFE's existing notes, the issuance falls in the first lien obligations category. Part of the proceeds will be used to redeem $375 million of 2025 notes.

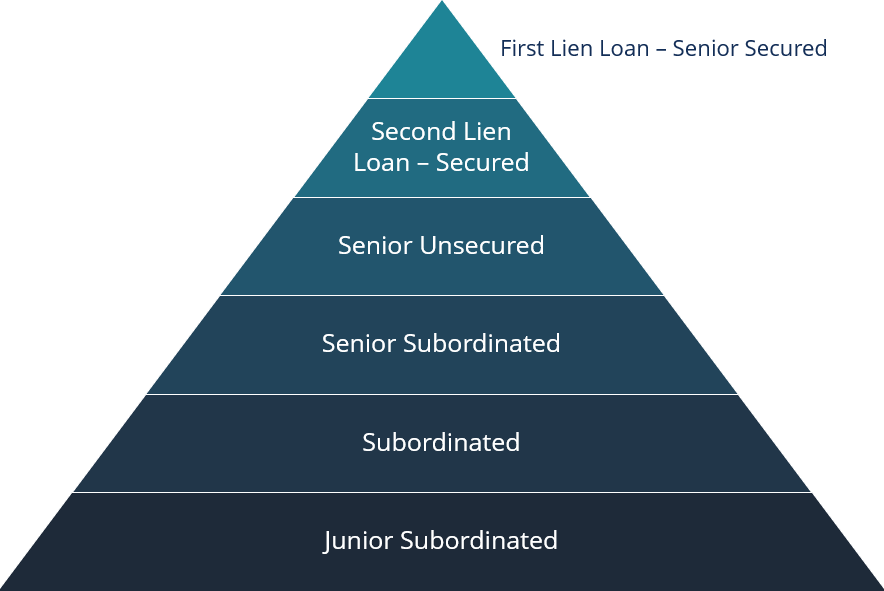

Senior secured notes are first-lien debt. In the case of company liquidation, senior debt holders are first in line. The pyramid shows the debt hierarchy. Chart via Corporate Finance Institute.

NFE 2029 bonds are at the top. Even in the worst-case scenario, a company dissolution, the odds of getting some of the principal back are not low.

Thesis

NFE's idea is to hold 2029 bonds till maturity. That said, I consider four scenarios:

NFE repay its 2029 bonds successfully without refinancing (probability 10-20%)

NFE repay its 2029 bonds with refinancing successfully (probability 30-40%)

NFE delays 2029 bond redemption by at least 12 months (probability 20-30%)

NFE files for bankruptcy before 2029 (probability 20-30%)

As you can see, the probabilities are imprecise. It is simply impossible to be otherwise. I am betting on the unknown future. Moreover, the markets are open-ended self-emerging systems, so estimating probabilities with precision is a fool's errand.

Our goal is to measure the relative weight of the probabilities. According to my scenarios, I expect a 40-60% chance of complete success (timely redemption and regular interest payments), a 20-30% chance of delayed redemption, and a 20-30% chance of default.

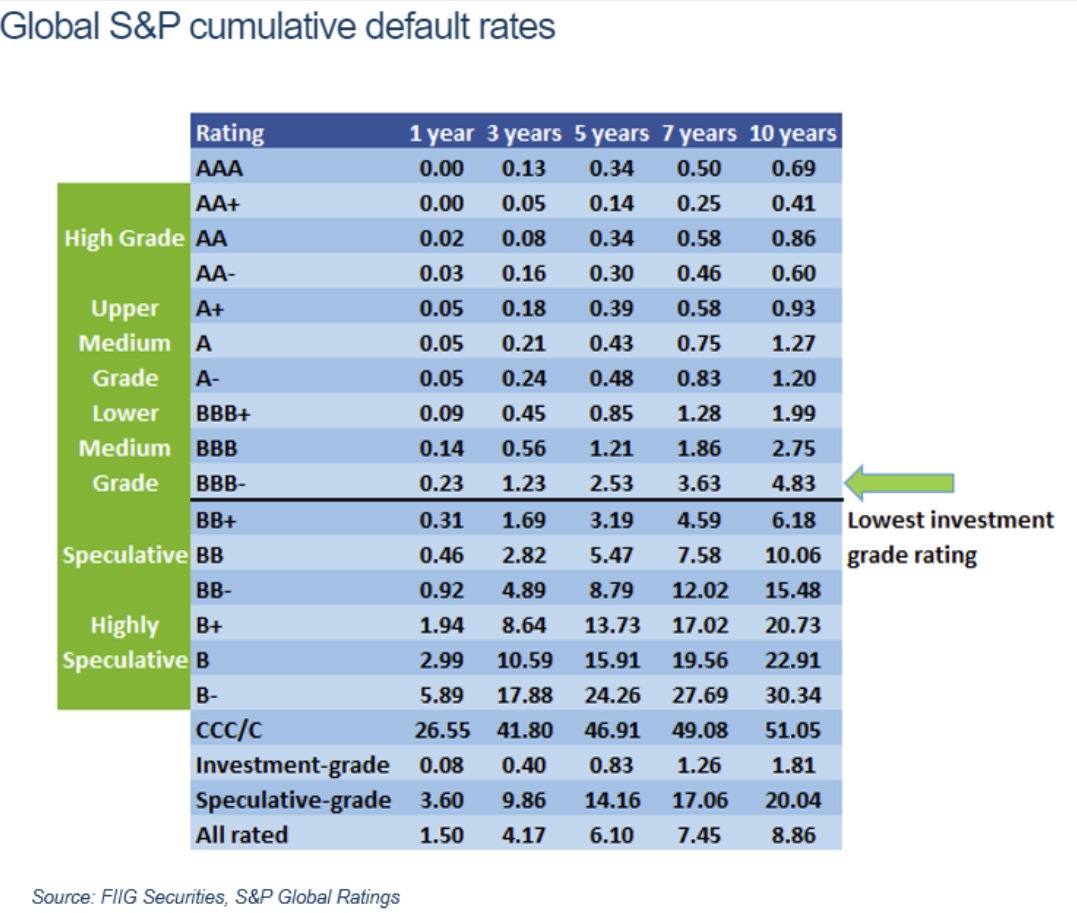

When discussing default rate probabilities, it is vital to talk about credit ratings. The chart below from S&P Intelligence shows the default rate per credit rating and bond tenor.

NFE has a “B+” rating by S&P. This implies that the default rate for its 2029 notes is 13.7%. Do not treat this number as 100% foolproof. Use as a guideline for relative probabilities, i.e., default probability growth rate between various credit ratings and tenors.

Simply, how the default rate changes when we move between different credit quality and tenors. I prefer to be conservative, so I doubled the probability of default. Thus, I stay aware of the downside risk.

Frankly, a 20-30% chance of default (or 70-80% chance of being correct) combined with a 76% total return for five years is a really good deal. NFE 29 bonds' current price is 75%. So, the risk-reward based on the best-case vs. worst-case scenario is 1.00. If we consider the best case vs. moderately bad scenario (company dissolution and 50% debt haircut), we get risk reward 2.0. For non-distressed debt, NFE 2029 bonds are a truly attractive idea.

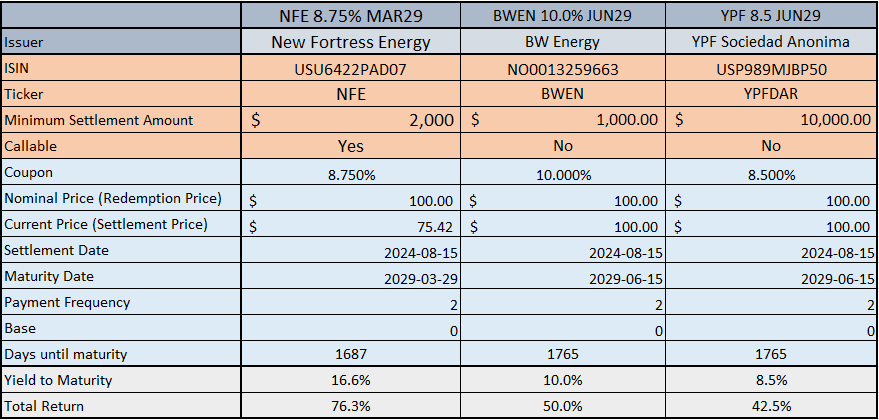

We have to look for similar opportunities to estimate how good or bad NFE 29 bonds are. For that purpose, I seek ideas in energy sectors that mature in 2029 and pay similar coupons. Two issuances caught my attention:

YPF 8.5% June 2029 senior unsecured bonds

BW Energy 10.0% June 2029 senior unsecured bonds

First, let’s look at the financials:

From the here contenders, BW Energy is the undisputed leader. The company generates impressive operating figures far exceeding its interest expenses. YPF also has a solid balance sheet and generates sufficient liquidity. Even during Alberto Fernandez's term, YPF was profitable, as measured by operating income.

My favorite on the list as pure fixed-income play is BW Energy. However, there is a catch. Its bonds are subject to the 144 rule for Qualified Institutional Buyers.

Below is a quote about what it means:

A qualified institutional buyer (QIB) is a class of investor that can safely be assumed to be a sophisticated investor and, hence, does not require the regulatory protection that the Securities Act's registration provisions give investors. In broad terms, QIBs are institutional investors that own or manage at least $100 million worth of securities on a discretionary basis.

The SEC allows only QIBs to trade Rule 144A securities, which are specific securities deemed to be restricted or control securities, such as private placement securities.

Unfortunately, mere mortals like me can not access BW Energy bonds. Curiously, the minimum settlement amount is $1,000. Despite its attractive bonds and excellent financial health, the BW bond issue is not the most appealing. The missing component is the potential capital returns. NFE 2029 bonds are the only ones on the list offering attractive yields and lucrative returns.

The following table shows NFE, YPF, and BW Energy bonds specs:

As Yield to maturity (YTM), I consider a long-term bond yield expressed as an annual rate if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate.

The total return (TR) tells how much I can gain at the end of the period if bonds are redeemed as planned and all payments are made on time. Here, I do not consider reinvesting interest payments.

NFE is the undisputed leader in YTM and TR. The reason is the considerable discount to par.

Let’s elaborate more on default rates. YPF and BW Energy have lower default rates based on their liquidity and solvency figures, not solely on their credit ratings. YPF has a CCC rating (S&P), which suggests a 46.1% probability of default in five years. Over the last several years, credit ratings have transformed from risk-measuring tools into ESG/DEI scoreboards. Companies in emerging markets are perceived as not so ESG/DEI aspiring, so they get lower ratings despite their financials.

That said, I estimate the YPF default rate is considerably lower than that implied by its rating. Given company financials and Argentina's improved political and economic environment, I would put a 10-15% probability of default in the next five years. In summary, use bond issuers’ “mortality rate” tables by S&P, Moody’s, and Fitch with a grain of salt.

Risks

Investing in bonds is not boring or riskless. At worst, it can be a return-free investment with considerable risk. Ask investors who held US government bonds in the 2022-2023 period.

So, investing in bonds comes with the flowing risks:

Market risk: if bonds are held to maturity (HTM), this risk is close to zero simply because I am not planning to sell before the redemption date, and market volatility does not bother me.

Interest rate risk: The lower the rates, the higher the bond prices, and vice versa. The HTM approach is immune to interest rate fluctuations and their first-order effects. Considering second-order effects, interest rate shifts also impact the HTM strategy.

Reinvestment risk: The higher the interest rates, the more motivated the investors are to reinvest payments, and vice versa. NFE bonds offer excellent yields, so reinvesting at that price is a no-brainer.

Prepayment risk: earlier redemption is not a mandatory negative thing, especially for bonds acquired at a double-digit-digit discount. On the other hand, for fixed-income instruments purchased because of attractive yields, prepayment risk is a bitch. In NFE’s case, I do not expect early redemption, even though 2029 bonds are callable.

Credit risk: this is the bond issuer's default risk. As can be seen, the NFE default rate is not as low as the S&P chart implies. Nevertheless, NFE’s default risk is not that high to say “no.” In the last few years, NFE management has moved in the right direction (or in less wrong). Operating results confirm that observation. With FLNG 1 in operation and attractive contracts in Brazil, NFE provides good revenue visibility.

Inflation risk: I am long structural inflation. So, I expect higher inflation figures in the 3.0-6.5 % range until 2029. Moreover, I anticipate rising inflation volatility. The coupon rate on NFE bonds is 8.75%, while the yield is 11.6% at the current bond price. Even at 7.0% inflation, I will get real returns on NFE bonds.

Liquidity risk: This risk is almost nonexistent for the NFE 2029 issuance. The issue amount is $750 million, there are no trading restrictions, and the minimum settlement is $2,000.

Those are the instrument-specific risks. NFE carries political risk because its operations are in Mexico, Brazil, Puerto Rico, and Jamaica. The leftist presidents in Brazil and Mexico represent some risk. Leftist governments do not have enough support in both countries, at least for now. Therefore, drastic changes in economic and political policies in an anti-business direction are less likely.

In my opinion, the most significant risk for NFE comes from its management. In the coming years, they must focus on developing FLNG projects instead of chasing new hot trends like they did a couple of years ago with liquid hydrogen. A large percentage of insider ownership raises questions and explains the generous dividend policy in 2023. Luckily, new debt covenants restrict further generous dividend payments.

Final Thoughts

Bondholders have different motivations compared to equity holders. As a shareholder, I seek attractive growth prospects. As a bond investor, I focus on company survivability. Growth is a nice-to-have bonus, but when it does not come at the expense of the company’s ability to service its debt obligations.

Today’s idea perfectly encapsulates the above. NFE’s managers’ goal number one is to reduce the number of wrong decisions at the expense of the right ones. This is the only way to ensure the company’s ability to survive, i.e., to pay its debts promptly.

What I like the most about NFE bonds is that they cover two of our ultimate goals as investors:

Preservation of capital

Income generation

Growth potential

NFE is the intersection between attractive yields and lucrative capital returns combined with reasonable probabilities for success.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.