The floating LNG market: a promising opportunity on the horizon

An obscure investing theme in mid-stream segment

As promised yesterday, it's time to dig into one of the most esoteric niches in the energy midstream segment.

The transition to clean energy is a stage in our civilization's development. The problem is that politicians, not engineers, lead it. Accordingly, politicians' motives are not as idealistic as the media portrays them. At the end of the day, it all comes down to money and power. Let's not forget that green is the new red.

In recent months, however, physics has begun to trump propaganda. An example is the widespread acceptance of nuclear power. So far, NPPs (nuclear power plants) meet all requirements—zero carbon emissions, low required area, and materials per unit of power produced. Also, they can maintain the baseload. However, building an NPP is a lengthy and expensive process. A 1 GW reactor costs about 5.0 billion dollars to date. The time from design to commissioning is 7-10 years.

Natural gas, or LNG, presents a compelling alternative to nuclear power. LNG-generated power plants offer distinct advantages over nuclear power plants, and they are notably more cost-effective and straightforward to construct. That said, LNG will not replace NPPs as the best solution but will help build a resilient and cleaner energy base.

LNG is important not only as an energy source for power generation but also for fertilizer production. The population of the Global South is booming, especially in Africa and the Far East. Therefore, the demand for food will keep growing, resulting in increased fertilizer consumption. Simply put, more LNG will be needed.

The primary gas exporters are the US, Australia, Qatar, and Russia. India, China, and Europe are the largest importers. The green cultists have turned Europe into an energy-poor and regulation-making machine. The cost of these decisions has become apparent.

However, the situation is not hopeless. Nuclear power is returning to fashion, and more European energy companies are investing in developing new fossil fuel deposits. And here come the floating LNGs.

Floating LNG market overview

For most market participants, the shipping industry is too arcane to consider. It is also not homogeneous. Every ship type has multiple variants according to the cargo it carries, its size, and its propulsion plant, leading to significant differences in the economics of operation. The outcome is a complex and challenging industry for everyday investors to decipher.

As I promised, my goal is to decode obscure industries in a simple and actionable way. It's time to introduce you to one of the most exciting business models in the midstream: natural gas liquefaction as a service.

Let’s jump into the rabbit hole examining natural gas extraction's economics. The following chart shows the LNG extraction value chain:

The rigs extract natural gas from the seabed and then transfer it into FLNG, where the gas is liquified (the second stage, the liquefaction plant, is shown on the chart) and prepared for transportation. The next step is to transfer the liquified LNG to an LNG carrier. Once the ship arrives at the receiving terminal, the gas is regasified. The economics of extracting and processing one tonne of extracted gas are highly competitive compared to gas extracted from shale basins such as the Permian Basin and Vaca Muerta.

West Africa became one of the most attractive regions for oil and gas projects. The region’s FLNG capacity is around eight mtpa (million tonnes per annum), and it is expected to double in 2028.

Why Africa?

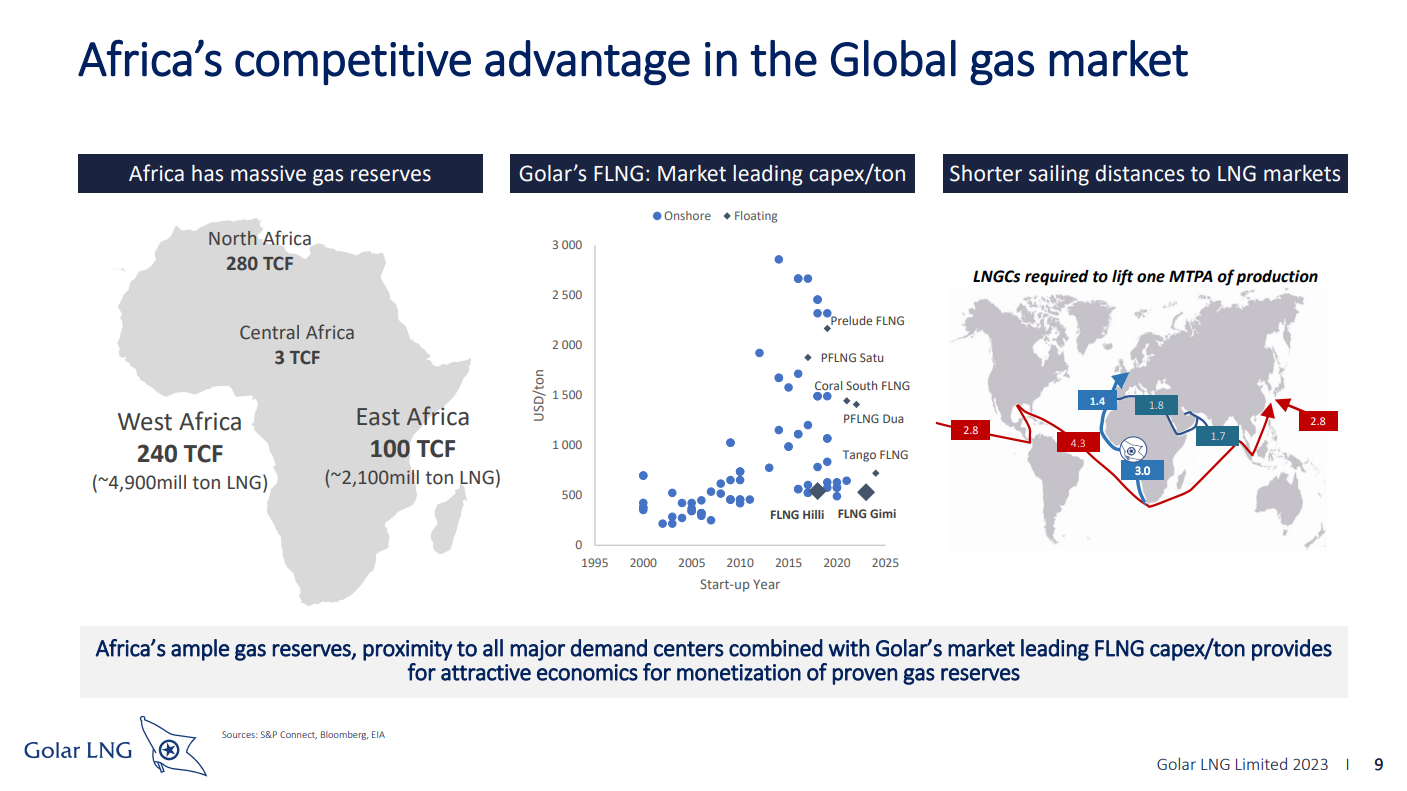

The bottom graph shows three things - the natural gas reserves around Africa and the distance between natural gas supply and demand.

The world is increasingly fragmented. Energy independence is striking back as one of the paramount geopolitical variables. Let us not forget that energy is at the heart of any country's prosperity. The EU is the most energy-poor of the four great powers (US, China, Russia, and the EU). Greenwashing in Europe has reached heights (or bottoms). Germany has gone from being the industrial powerhouse of the EU to being a champion of energy suicide.

Another mistake of the EU is its heavy energy dependence on Russia. Europe has become an energy vassal of the Russian Federation, betting on eternal peace. This was the second factor after the Green Deal that stopped the EU from developing its fossil fuel deposits. After the war in Ukraine, the EU realized how costly this mistake was.

There is hope. The revival of nuclear energy and the willingness of EU countries to develop their fossil fuel deposits are positive signs.

West Africa is perfectly positioned. Its coastline lies in the Atlantic Ocean, where the US and Europe have complete control. The Russian and Chinese navies cannot project power into the Atlantic. At the same time, the gas/oil from West Africa does not pass through any choke point outside Europe's control. The Strait of Hormuz, Bab El Mandeb/Suez, Malacca, and Panama Canal are out of the equation. This means that fuel supplies from West Africa are immune to geopolitical volatility in the Middle East.

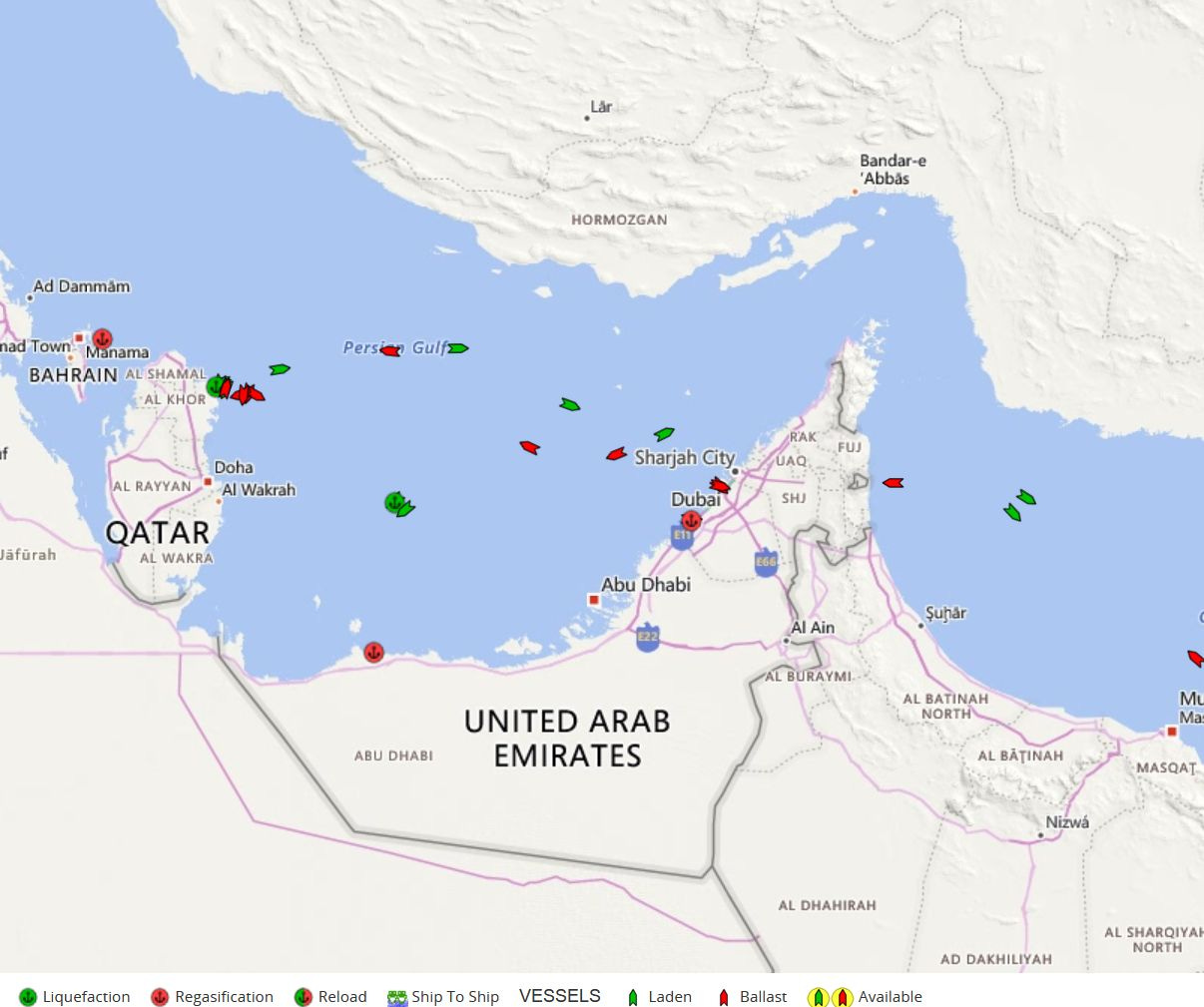

This advantage cannot be understated. However, depending on how the Middle East crisis develops, LNG exports from Qatar might be adversely impacted. The map below shows the southern section of the Persian Gulf.

Qatari LNG exports only have the option of sailing through the Hormuz Strait. Via Hormuz sails around 20% of the global LNG. The Iranian regime has used a Hormuz blockade as a threat multiple times in the past.

However, it is not as easy as it sounds—a part of the Hormuz is in Omani territorial waters. So, the complete blockade means invading foreign territorial waters. Another crucial factor is the importance of Hormuz for Iran. About 90% of Iranian crude oil exports sail through Hormuz. Meanwhile, more than a third of raw materials imported to Iran come through Hormuz, too. Hormuz is dubbed as Iran’s lungs.

I expect more aggressive rhetoric from the Iranian regime, but not followed by tangible actions. A total blockade on Hormuz is (almost) impossible. However, partial obstruction does not seem to be an unthinkable scenario. If it becomes a fact, it will inevitably impact LNG exports from the Gulf. Simply put, the world must diversify from the Middle East's dependence on fossil fuels.

These facts make West Africa a vital energy source for Europe. An example is the development of the Mopane field in Namibia by the Portuguese company Galp Energia. It contains around 10 billion barrels of oil. In comparison, Russia has around 80 billion barrels of crude oil reserves, and Saudi Arabia has 267 billion barrels.

The other attractive region for Europe is South America because of the same factors. European energy companies are attracting interest in the deep-water fields in Guyana, Brazil, Colombia, and Argentina. In summary, the demand for energy sources outside the geopolitical hotspots will grow increasingly.

This conclusion is 100% valid for Europe. European energy companies like Eni, Shell, and Equinor have started investing more in West Africa and South America fields, leading to increasing demand for FLNG installation.

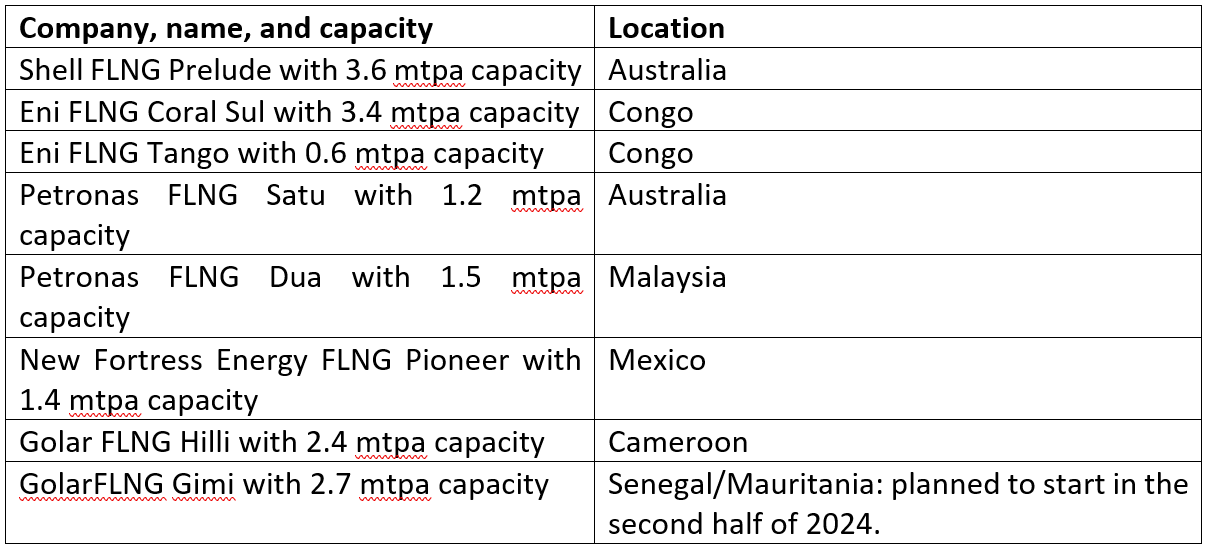

Let’s look at the other side of the equation – the supply. Currently, active FLNG installations are counted on the fingers of two hands:

In recent months, interest in FLNG installations has grown, judging by the number of projects awaiting FID (final investment decision). Samsung Heavy Industries and Wison Energy plan to build several FLNG plants in the coming years. The same applies to established players such as Shell, Eni, and Golar.

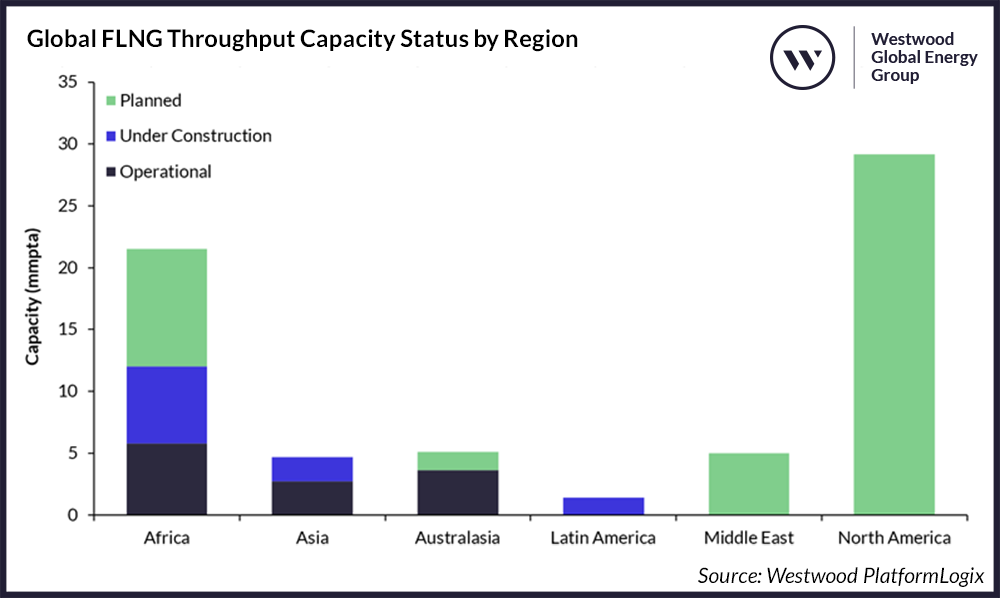

The focus is on Africa and North America:

At this stage, South America lags significantly behind. In my opinion, this will change in the next few years. The political pendulum is swinging from left to right. An excellent case study is the election of Javier Millay in Argentina. And this process means the business climate will improve significantly in the region. Considering Europe's disadvantaged position and growing geopolitical entropy, South America and West Africa will be a priority for European energy companies.

👏👏👏. Any names worths studying?