Global entropy is rising. Wars are the new normal. And not only that.

The world economy is anything but simple. Complexity breeds vulnerability. Weakness provides opportunities for high-risk reward measures without the necessity of a hot war. Consider critical mineral supply chains. Trade wars are in vogue again, and the periodic table is one of the most potent geoeconomic weapons.

Two weeks ago, I wrote about antimony. It is a tiny market dominated by a handful of participants. China, Tajikistan, and Russia control supply, while demand heavily depends on a few industries, such as defense and tech companies.

To recap, the antimony market has all the ingredients for a prolonged bull market: constrained supply, increasing demand, and catalyst events. It's time to discuss how to bet on the North American antimony industry today.

Our contenders are:

Perpetua Resources Corp (PPTA)

United States Antimony Corporation (UAMY)

First, let’s look at their performance for the last three years.

Antimony stocks have moved strongly for the last few quarters. Is this the end of the bull market? I don’t think so. We are the first third of the cycle; joining the party is not too late.

Perpetua Resources

The first name on the list is mixed Gold-antimony miner. Perpetua owns the largest antimony reserves and one of the most attractive gold projects in the US, Stibnite.

The project is located in Valley County, Idaho. Stibnite is currently in the advanced development stage, with Perpetua having completed basic engineering and recently commencing detailed engineering studies. The next step is the construction decision, which is anticipated later in 2025. Production is scheduled for 2028.

The Stibnite has competitive economics: all-in-sustaining costs (AISC) are expected to average $435 per gold ounce during the first four years of production and remain under $760 per ounce over Stibnite’s LOM. At nearly $3,000/oz, the company might become a money-printing machine.

The asset boasts 4.8 million gold ounces and is expected to produce approximately 300,000 ounces of gold annually over a 15-year LOM. However, it is projected to yield over 460,000 ounces annually during the initial four years.

Low AISC translates into impressive NPV and IRR. In its presentation, PPTA uses a 5.0% discount rate, which is absurd for developing assets. For reference, you can find Senior Secured First Lien bonds issued by robust EU banks with > 5.0% coupon. So, how can a junior miner use a 5.0% discount rate even though it is the US’s largest holder of antimony reserves?

That said, I made my own calculations for NPV and IRR. I use the following inputs: 10% discount rate, $2,600/oz gold price, 300,000 oz annual production, $1,000/oz AISC, 15 years LOM, 1% royalty, and 5.8% corporate tax.

Stibnite's after-tax royalty NPV is $3.3 billion, and its after-tax IRR exceeds 27%. At a $640 million market cap, the price-to-NPV ratio is about 20%, which is not bad for projects in Tier 1 jurisdictions.

Perpetua is not an antimony-pure play; it is a gold-antimony play. The likelihood of Stibnite going into production is significantly rising during the gold bull market. In addition, the importance of critical minerals independence will push the US government to support the industry. Perpetua won a $75 million award from DoD.

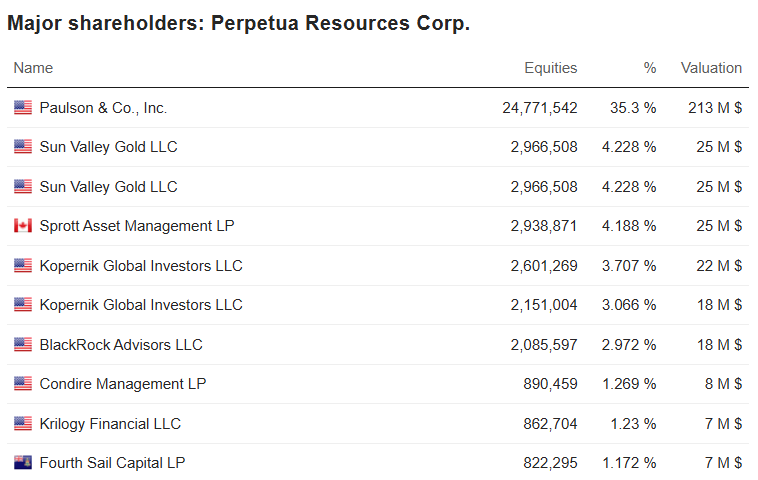

One shortcoming for PPTA is the lack of management skin in the game. Look at the list of the largest shareholders:

None of the managers owns more than 1% of the company. Aligning incentives between equity holders and the management team is vital for long-term success, and this is even truer for the mining business.

In summary, Perpetua is the intersection between gold and antimony bulls. Our next contender is the pure play bet. I present you with the United States Antimony Corporation.

United States Antimony Corporation

United States Antimony Corporation (UAMY) is a company that produces antimony. The company has a presence in the United States, Canada, and Mexico.

The company operates a smelting facility in Madero, Mexico, which is currently undergoing refurbishment. The Madero Smelter has an engineered capacity to process up to 200 tons of antimony ore per month, with initial plans to start at approximately 100 tons per month. The facility houses 17 furnaces, including three large and 14 small ones, with plans to repair and refurbish at least six furnaces over the next 30 days.

The smelter's restart is timed with the arrival of antimony ore shipments from Australia, scheduled for March 2025. As operations are optimized, the plan is to increase the throughput to up to 300 tons per month.

Unlike PPTA, we can’t rely on NPV to value UAMY. The company generates revenue streams; most importantly, it is not a developer. Therefore, I rely on EV multiples to estimate how cheap or expensive it is.

To find direct competitors for UAMY is like searching for a hen’s teeth. Hence, I picked enterprises from the critical minerals universe. The criteria is to be producers or miners. Prospectors or developers are excluded.

The competitors are:

Iluka Resources Limited (ilmenite miner)

MP Materials (REE miners)

Mandalay Resource Corporation (antinomy miner)

Almonty Industries (tungsten miner)

UAMY trades in the middle of the scale. Double-digit EV/Sales might seem scary, but this is a norm for critical mineral miners and producers. Look at MP Materials, the sole REE miner in the US. It trades at 19.8 EV/Sales.

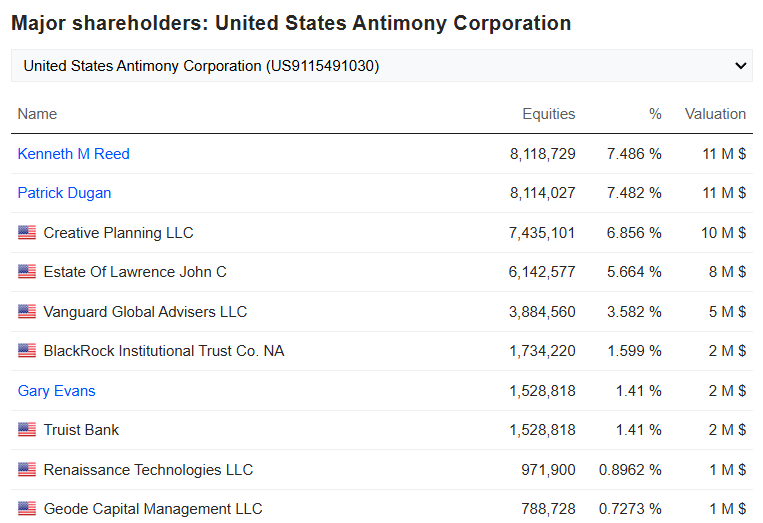

Unlike PPTA, the UAMY management team has skin in the game.

Stock ownership signs that the probability of shared interest between equity holders and executives grows significantly.

Both enterprises are attractive valuation-wise. Yet this is not enough to say yes. Excess leverage and systematic share dilution are too common for small-cap miners. So, let’s look at the capital structure and share count.

Financials

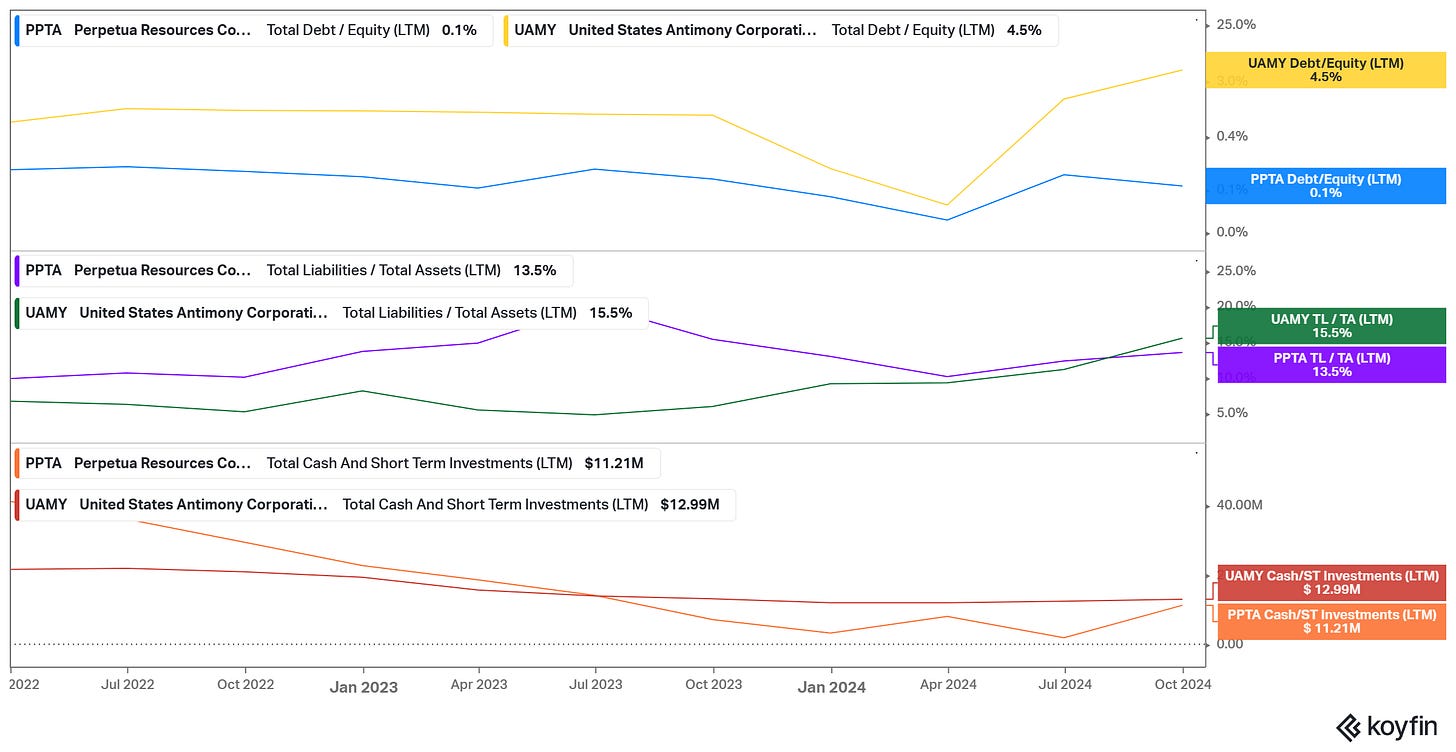

PPTA and UAMY are financially sound. Their Total Debt/Equity ratio is below 5.0%.

Mining is tough. Having an unleveraged balance sheet in turbulent times can be the difference between survival and extinction. Another positive sign is the ample cash reserves. Both enterprises have adequate liquidity.

Share dilution is the number one enemy of mining investors. In this case, both companies did well.

Even the PPTA has not issued a massive amount of shares for the last 36 months. However, that might change soon. I expect in the coming quarters, PPTA will issue new equity to finance the Stibnite project. The key is the amount. The distinction between medicine and poison is the dose. PPTA managers' lack of skin in the game means no (significant) constraints on share dilution.

Final Thoughts

Investing in junior miners is a sophisticated way to lose money. My favorite gimmicks are classics like share dilution, excess compensation, and deceiving valuations (5.0% discount rate, anyone?).

I stopped looking for junior miner plays long ago, except if they have attractive litigation claims in their balance sheets or represent a thematic play. Today’s suggestions are precisely thematic bets.

Antimony as the critical mineral is the theme, and PPTA and UAMY are the instruments. I would not invest in either PPTA or UAMY as individual positions. On the other hand, if I wanted to get exposure to the antimony bull market, I would create a basket of equal-weight positions. I would add Mandalay Resources, an Australian antimony producer, to the mix. The goal is to be exposed to the broader theme while reducing portfolio vulnerability due to the company’s specific risks through diversification.

The weaponization of chemical elements brings immense opportunities. In other words, Mendeley’s table has become the best friend of Alpha hunters. Position accordingly.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.