Trump, tariffs, China. The three buzzwords in the global news feed. What does this mean for investors?

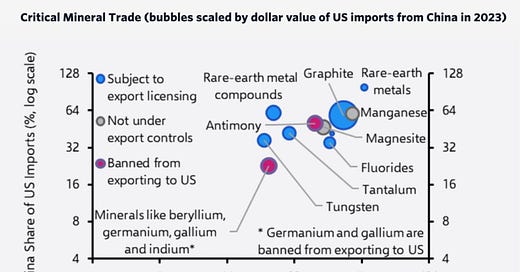

One chart tells it all. The image below shows China’s share of global critical minerals exports and China’s share of US critical mineral imports.

This is the most geostrategic graph of the decade because it encapsulates the critical minerals bull thesis. Regular readers know that I regularly cover arcane metals. I wrote a series of articles on uranium and rare earth elements (REE) and a deep-dive report on Platinum Group Metals (PGM).

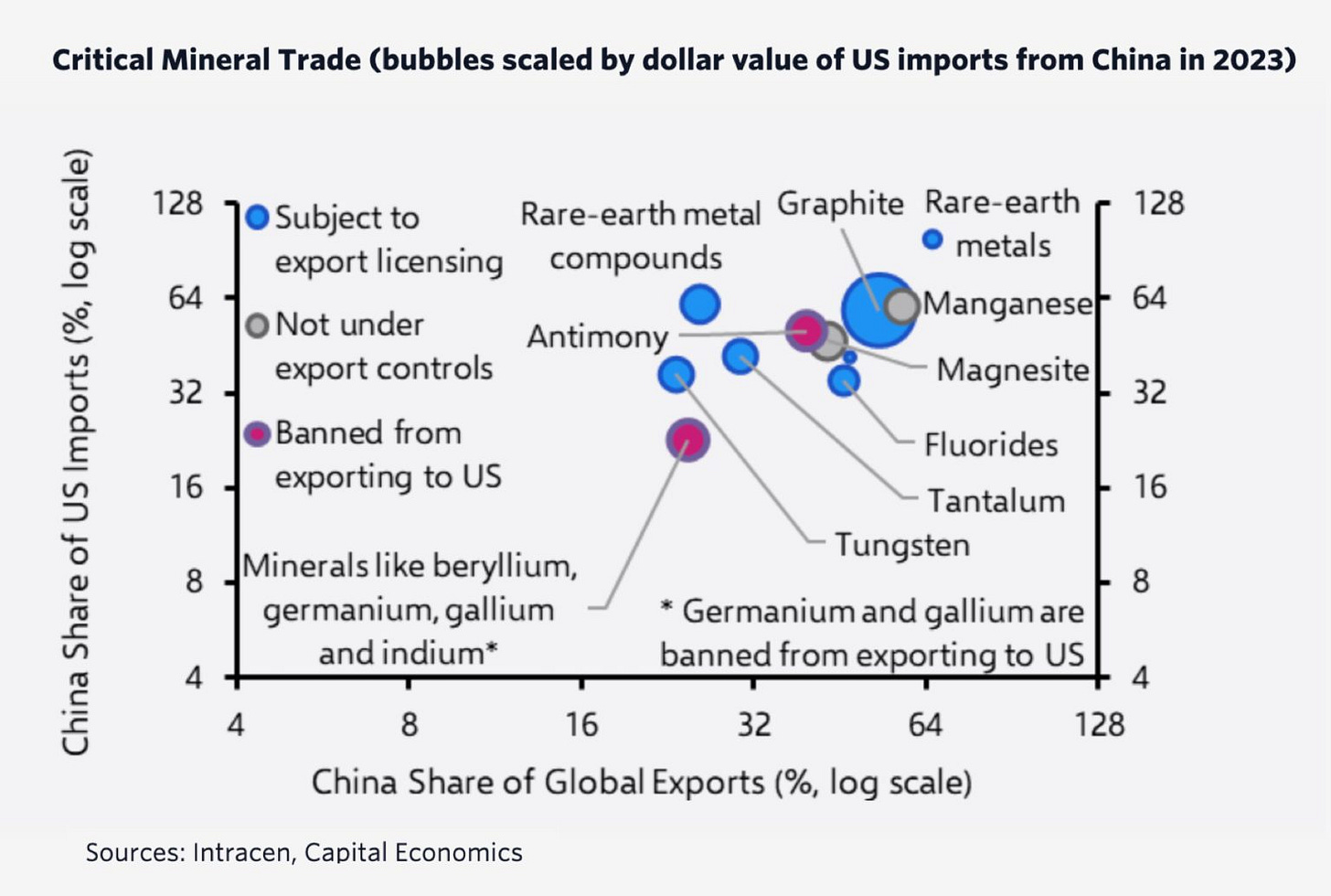

Today, it's time to talk about another arcane mineral, antimony. It falls in my favorite category of “simple” metals. What does it mean?

Look at one of my favorite charts:

Below is a quote from my article “Commodities under Unexpected Angle”:

The four categories of commodities:

· Tier 1 (OPEX and simple): uranium

· Tier 2 (CAPEX and simple): tin, PGMs, tungsten

· Tier 3 (OPEX and complex): coal, LNG, crude oil

· Tier 4 (CAPEX and complex): copper, zinc, bauxite, nickel

The chart does not represent all commodities. It aims to illustrate the framework I discuss today. I included those commodities I am interested in.

The more running parts in the system, the more challenging it is to forecast the outcome with plausible accuracy. Hence, our thesis is more prone to errors.

Antinomy belongs to the second quadrant, “simple” and CAPEX commodity. This means it is good enough to create a credible scenario for future demand and supply. So, let’s analyze both sides of the equation.

Supply & Demand

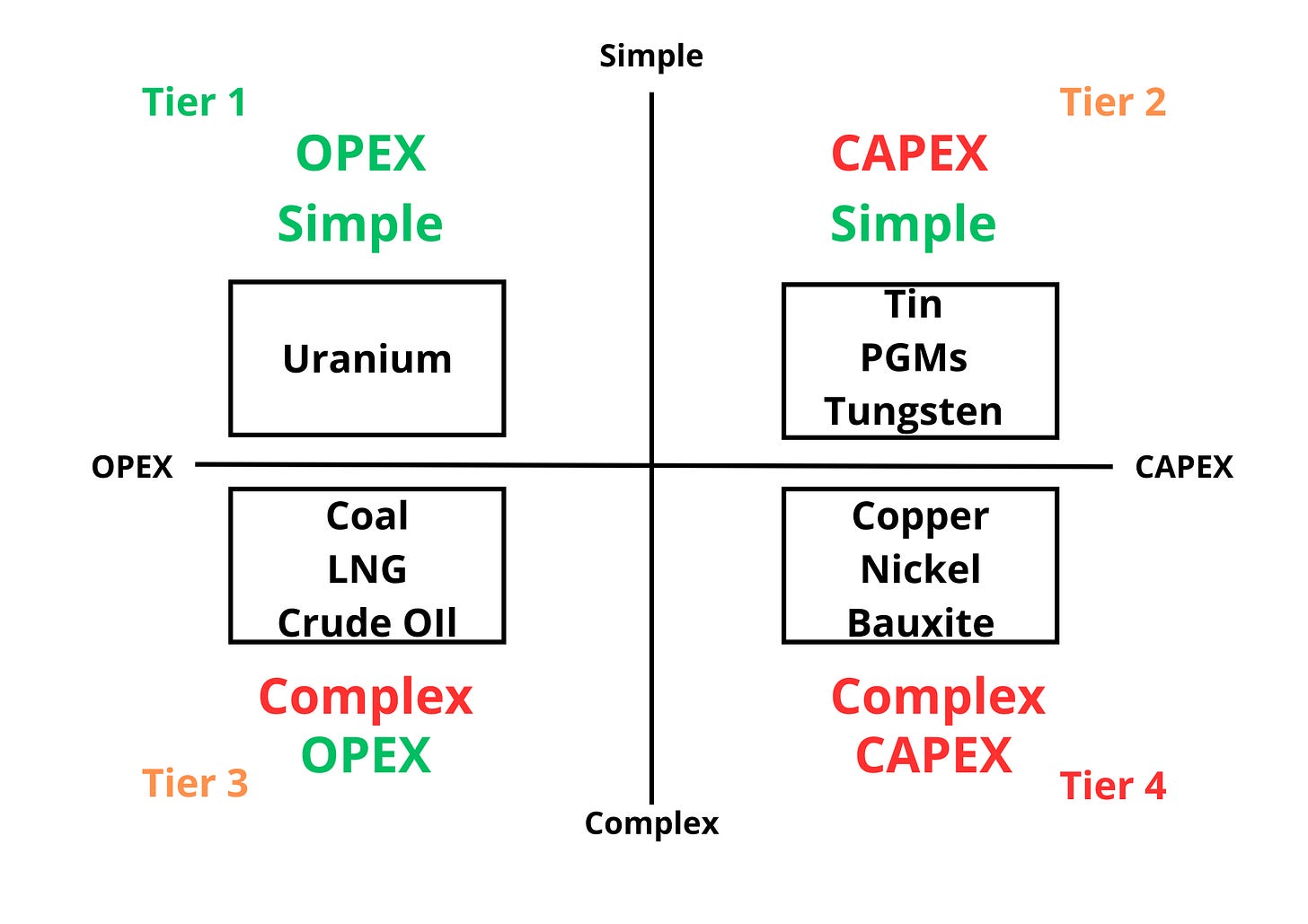

Antinomy production is concentrated in three countries and a few mines. Top producers based on a percentage of the global production are:

China: 48%

Tajikistan: 19%

Russia: 18.2%

Myanmar: 3.6%

Australia: 3.6%

Those production numbers are for 2022/2023. Unsurprisingly, five out of the ten largest mines are in China.

China's antimony production has declined recently, dropping from 60,000 MT in 2020-2021 to 40,000 MT in 2022-2023. Tajikistan has gained traction recently, becoming the world's second-largest producer in 2023. With China imposing export restrictions on antimony in 2024, Tajikistan's importance in the global market will likely increase. However, Tajik mines are far from enough to cover the increasing market imbalance. It’s all about the Great Powers and spheres of influence.

The story with Tajikistan is reminiscent of Kazakhstan and uranium. A significant part of Kazatomprom's uranium exports are going to China. The countries on the ancient Silk Road are in the sphere of influence of China and Russia. Kazakhstan and Tajikistan are illustrious examples.

Companies with significant Chinese interests operate antimony mines in Tajikistan. One exception is Anzob LLC, a subsidiary of Comsup Commodities Inc., a US mining company. To emphasize, Tajikistan is not here to save the day; in other words, to cover EU/US antimony imports.

To make things even more exciting, Russia is the third largest antimony producer. In summary, about 62% of the world's antimony supply comes from two US primary rivals, China and Russia. Another 18% derives from a country under their influence.

Furthermore, we are in the middle of a trade war. Critical minerals export cuts are potent geoeconomic weapons. CCP knows this and plays the game wisely. So, how do we select the perfect candidate for the export ban?

The material in question must cover two requirements:

China satisfies 100% of its needs with domestic production, i.e., does not rely on imports.

China consumes a significant portion of the production, i.e., export revenues do not play a crucial role here.

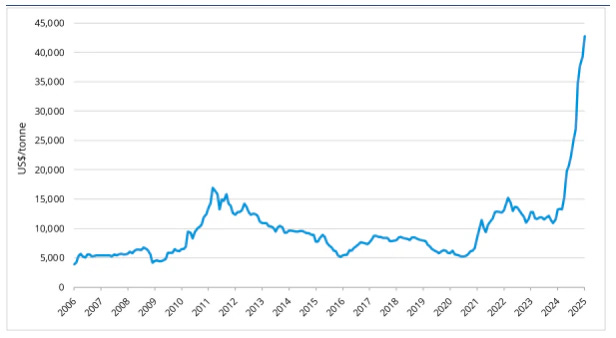

In that way, the CCP balances risk and reward. Antimony covers the requirements. In August 2024, China announced export restrictions on antimony and related products, which took effect on September 15, 2024. The price of antimony responded accordingly.

The market was tight due to China's controlled supply and strong global demand. Export restrictions are the proverbial catalyst.

Initially, antinomy surged to $26,500-27,000/tonne by mid-September 2024. This was a 115% increase YoY and a 12% jump since the announcement. In recent months, the price of antimony has moved even further. Following the tariffs drama, antimony reached almost $45,000/tonne in February 2025.

Curbing antimony exports is not the first action for CCP in that direction. China has already exerted control over graphite, germanium, and gallium exports. The timing is just perfect.

Limiting the supply of critical minerals during rising geopolitical entropy is an asymmetric bet for the CCP. The harm caused by the restriction on its rivals significantly exceeds the cost borne by the Chinese economy.

The supply story is straightforward: concentrated production in three countries and ongoing sanctions. The next step is to look at the demand.

The global antimony market, valued at $2.3 billion in 2024, is projected to grow significantly, with estimates ranging from 5.53% to 7.4% CAGR in the coming years.

A few industries drive antimony demand. Flame retardant producers are the largest consumers, accounting for nearly half of global antimony usage. Antimony is also used in the defense and automotive industries. Increased defense spending, EV penetration, and Global South demographics are the long-term tailwinds for antimony demand.

To recap, we got all three: limited supply, robust demand, and catalyst event.

Final Thoughts

Unlike base metals like copper or zinc, boutique plays like antimony are highly volatile. This is because such markets are anything but efficient. For me, this is a feature, not a bug. In market inefficiency, Alpha resides.

Antinomy is an unpopular yet practical way to bet on accelerating trade wars. Today, I laid out the foundation of my thesis. Next week, I will write about how to get exposure to the antimony market.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.