The green energy transition has significantly affected the PGMs (platinum group metals). Initially, the transition was expected to be swift, leading to the obsolescence of ICE cars and, consequently, PGMs. However, the role of PGMs in auto-catalytic converters has proven to be more resilient than anticipated. The transition to EVs, while significant, has not made PGMs redundant yet. ICE cars will stay with us for the foreseeable future.

Platinum and palladium are the more popular PGMs. The output of PGM mines is typically described using a format that equates to the sum of the metals extracted, such as 2E for platinum and palladium, 3E for 2E plus rhodium, 4E for 3E plus gold, and 6E for 4E plus osmium and ruthenium.

The last few years have been challenging for PGM miners and investors. Gold is an unsurprising exception. Gold is a monetary metal, unlike PGMs and silver, which are first industrial metals and then serve as investing assets. Accordingly, its price follows different factors.

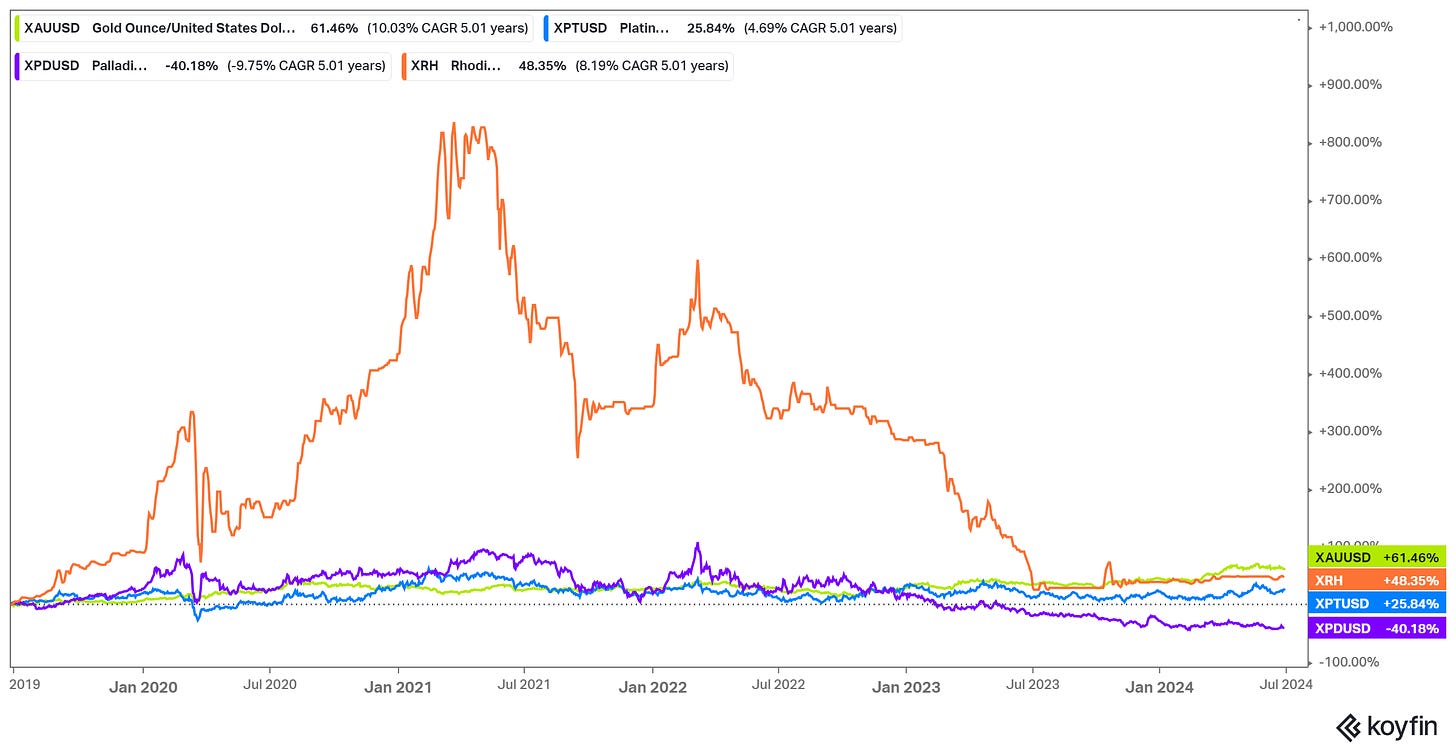

The chart below shows 5Y 4E performance.

Recently, palladium has hit record lows weekly but found support at $900/oz. Conversely, Platinum has failed several attempts to break out above $1,100/oz. Rhodium, too, has bottomed out at about $4,400/oz, significantly lower than its 2021 peak of $25,000/oz.

Supply

Releasing Russian above-ground inventories and record short positioning depressed platinum and palladium prices. However, above-ground stocks, especially in the West, are at a record low level, not seen since 1980, as per PGM analyst Wilma Swarts from Metals Focus. Wilma’s quote below:

“Given the significant deficit, above-ground stocks have declined to their lowest levels in our records (dating back to 1980) this year, with further deficits expected in 2024 and 2025.”

Platinum and palladium sources are mining recycling and above-ground inventory.

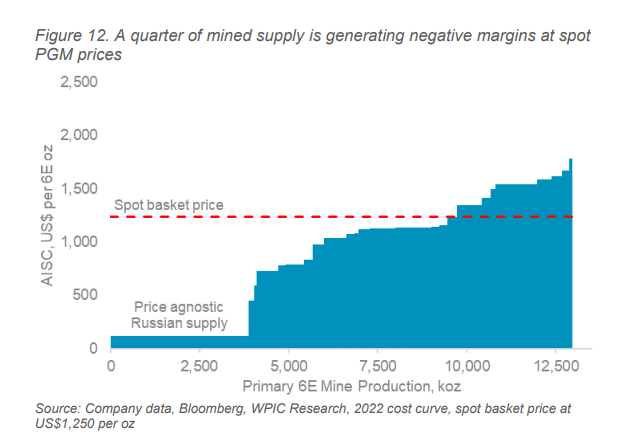

Major miners reduced output due to lower spot prices than AISC. About 25% of the miners’ AISC is above the present spot, resulting in negative margins. Chart via World Platinum Investing Council (WPIC).

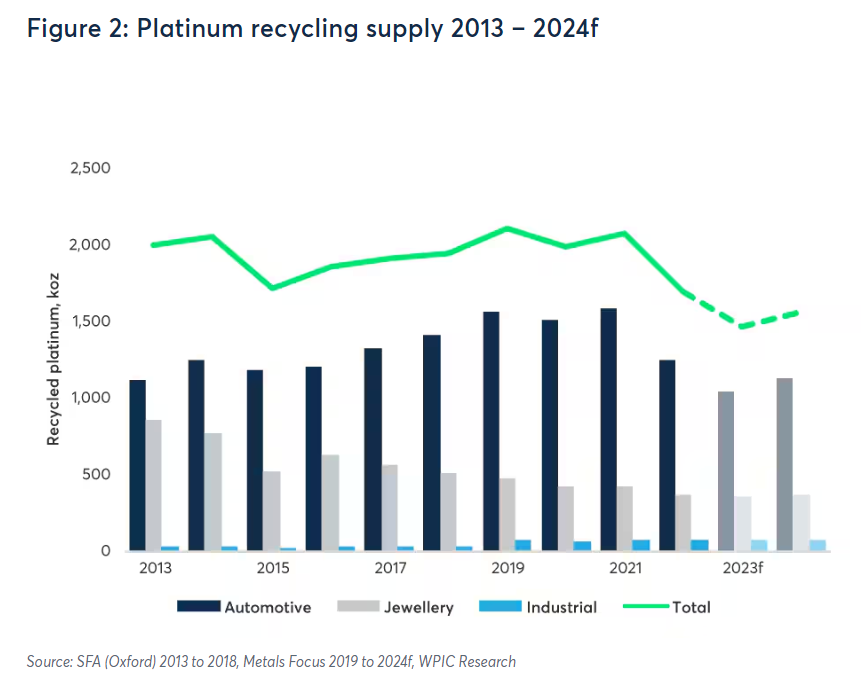

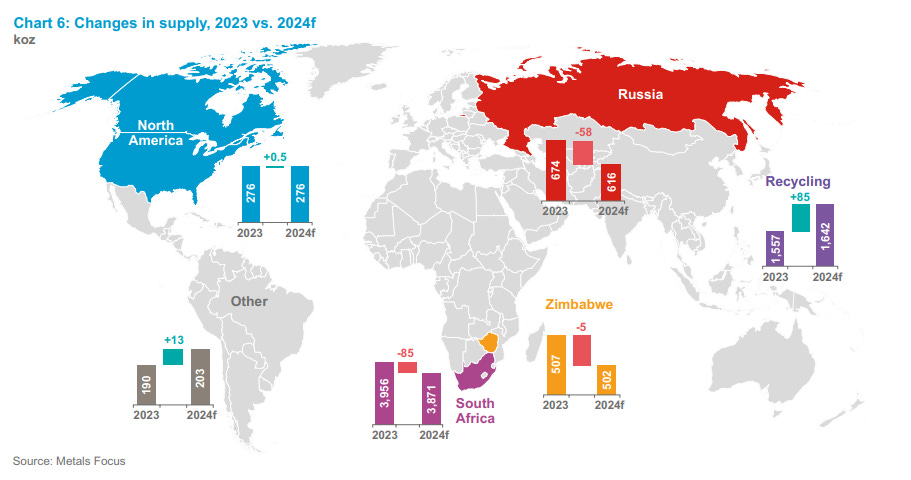

One-quarter of the platinum supply comes from recycling. Of the total 7,111 oz in FY24, recycling is projected to deliver 1,642 oz.

Recycling faces two headwinds:

Higher interest rates resulting in higher car payments, leading to extended ownership per vehicle and fewer catalytic converters recycled

Shift in lifestyle, more home office, less mileage, fewer catalytic converters recycled

Structural inflation keeps interest rates higher for longer. As a result, car payments have decreased significantly over the years. Lifestyle changes also adversely impact recycling. The shift to the home office has reduced cars' annual mileage. Combining more expensive vehicles and declining mileage results in fewer catalytic converters to scrap, i.e., decreased recycling output.

YoY is expected to increase recycling by 85k oz. Nevertheless, the long-term trend is bearish. 80% of the recycling supply comes from catalytic converters removed from end-of-life vehicles. The following chart illustrates the platinum recycling supply for 2013-2024. Chart via WPIC.

Between 2021 and 2023, the recycled supply dropped by 30%. The decline is due to fewer recycled catalytic converters and platinum jewelry.

The imbalance between supply and demand has already started to materialize. The deficit for 2023 is 983 thousand ounces, and another 476 thousand ounces are projected for 2024. Data from World Platinum Investment Council.

The deficit will continue to grow in the next 18-24 months. The question is how much and for how long. So far, the forecasts are diverging from reality.

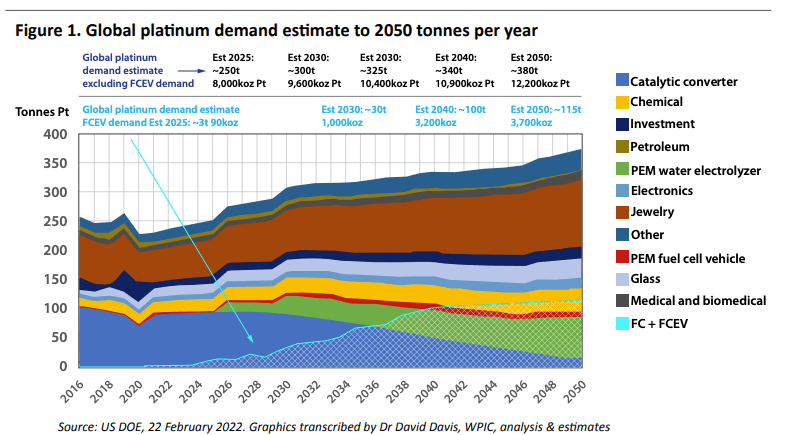

According to the chart above, prepared in February 2022, a deficit of 650 thousand ounces is expected for 2023. However, the shortfall is 50% more than projected at 983 thousand ounces. It is expected to reach 1900 ounces in 2030, about 30% of annual platinum production.

The uranium mining industry is dominated by four countries - Kazakhstan, Australia, Canada, and Russia. In PGMs, however, supply is even more concentrated—the leading player in South Africa and, to some extent, Russia (in palladium only).

Like all other metal mining industries, this one follows the CAPEX cycle. Over the past decade, the lack of investments has shown its consequences. Supply is steadily declining, and the need for new deposits to replenish the declining reserves is squeezing companies. Investments to renew depleted reserves are necessary for every miner.

The basic heuristic in the mining industry is as follows:

The reserves growth rate must exceed the reserve depletion rate.

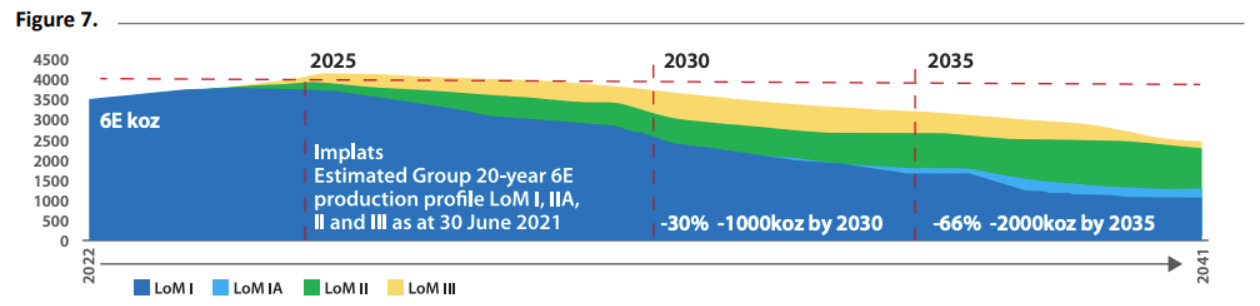

The following chart illustrates the steady decline in reserves of the major platinum mining companies (chart via Impala Platinum):

The reserves (blue) are part of the resource base (yellow and green). Converting resources into reserves requires time and capital, and little investment has been made in recent years. The chart presented is not the exception but the rule for mines producing PGMs.

The location of these deposits is a crucial factor, apart from the time it takes to discover, develop, and build a new mine. For every 100 ounces of platinum reserves, 90 are in South Africa, 6 in Russia, and 2 in Zimbabwe. The remaining two ounces are in North and Latin America.

South Africa is in an acute crisis, and Russia is partially isolated politically and economically. These two factors make discovering new deposits and building mines even more challenging.

Out of every four ounces of platinum, one is obtained through recycling. But even that cannot make up for the fact that one country dominates the platinum supply. The statistics clearly show it:

South Africa holds 90% of the world's reserves of platinum, palladium, and rhodium

South Africa produces 73% of the world's platinum and 42% of its palladium.

The map below from WPIC shows the 2023 vs 2024 platinum supply.

As discussed, recycling is expected to grow year over year. Nevertheless, annual recycling figures are below the 10-year averages. The big three, South Africa, Zimbabwe, and Russia, will mine less platinum in 2024 vs 2023. The growth from recycled metal can not offset the decline in mining.

Demand

As the EV hype cools down, auto manufacturers are adjusting their strategies. It's becoming increasingly clear that the old ICE vehicles will last longer than projected. This is evident from the announcements of major players like Mercedes, GM, Toyota, and others, who have revealed their plans to maintain ICE production lines for the foreseeable future.

Platinum is among the critical metals for the transition to clean energy. In recent years, a low-cost alternative to PGMs has been sought, and silver has led the way. Time will tell whether it or some other metal will prove a suitable replacement.

I intentionally use the following chart from 2022. At that time, EVs were the present and the future, while ICE cars were already part of history.

So, there is still demand for PGMs. Despite the doom-and-gloom future for ICE, platinum demand is projected to grow. Fuel cells, chemicals, and PEM electrolyze demand will replace catalytic converters demand. Now, we are in June 2024. ICE made its comeback while the EV craze cooled down. The need for catalytic converters is back; hence, it is for platinum and PGMs.

Setting zero carbon targets requires measures that go beyond catalysts. Fuel cells powering cars are becoming increasingly relevant. Platinum's role in the cells is that of a catalyst, which accelerates the chemical processes.

In fuel cells, however, there is (so far) no alternative metal to replace the role of platinum. For fuel cells alone, the market is expected to reach 10% of platinum demand after 2030 and 28% by 2040.

Summary

It's important to acknowledge the challenges the PGM market faces. With PGM production slowing down and weak spot prices leading South African miners to close their high-cost operations, the industry is under significant pressure. Power curtailments add to the companies' woes, resulting in higher AISC.

Russia is the big known unknown in the equation. Further sanctions on PGM exports to the EU enforced by the EU will act as a spark. Russia could, too, impose sanctions on PGM exports to the EU. The market's response will lead to a parabolic price move in PGMs. The prices may reach March/April 2022 levels. The EV craze was intact then, and the PGMs were left for dead. Now, the tide has turned, and the PGM deficit is deepening. Limiting 45% of palladium and 10% of platinum exports will cause exponential response from the market.

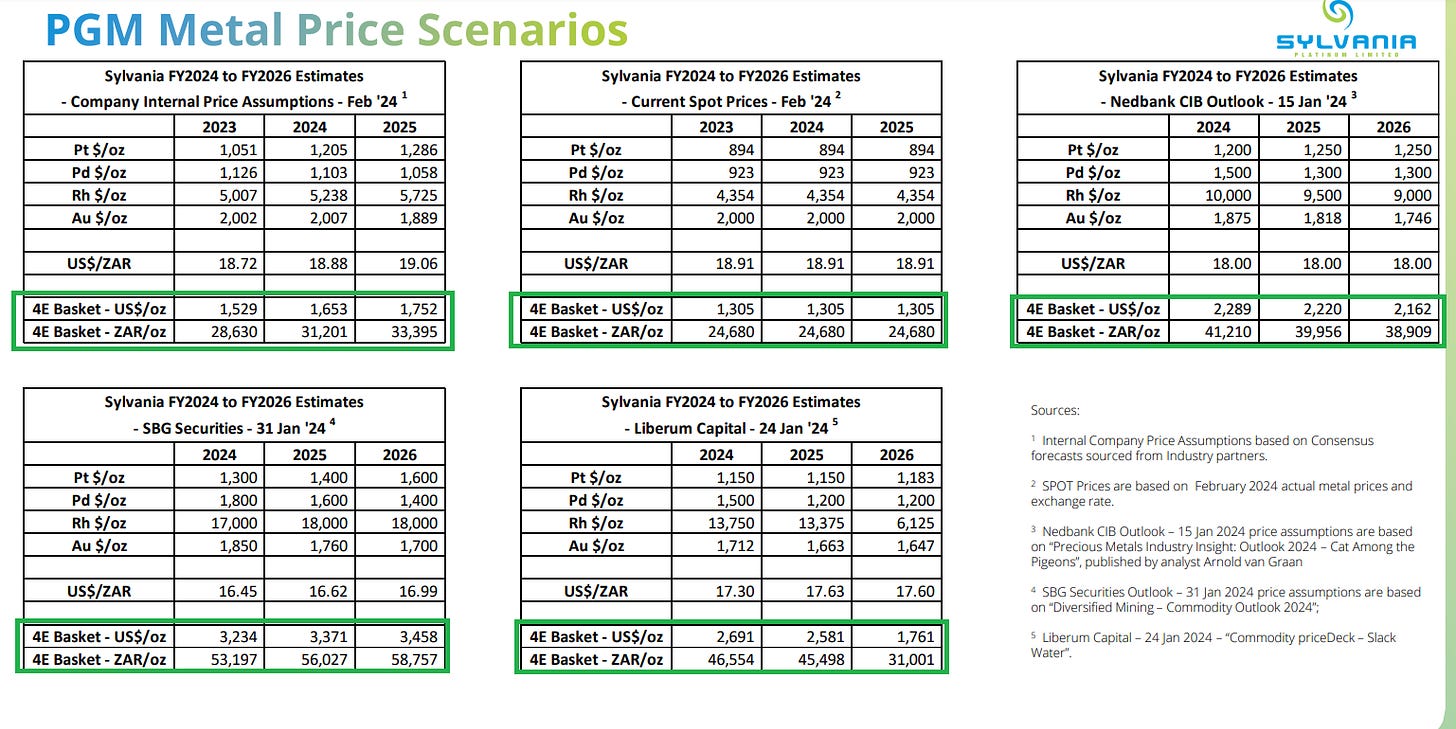

The deficit is a long-term driver of higher spot prices. In the next 12-18 months, I expect a stronger 4E basket price. The following charts from Sylvania Platinum show PGM price forecasts by prime South African banks.

The current 4E spot is $1,305/oz. Sylvania's most conservative forecast assumes a $1,529 4E basket price. Conversely, SBG securities’ $3,224/oz projection is the most outraging.

Given the macro/geopolitical factors and strong market foundations, my projections align with Nedbank’s $2,289/oz, 72% higher than the current spot price. I use the present spot price and Nedbanks’s figures in my estimates for companies’ PNAV.

Choose your player

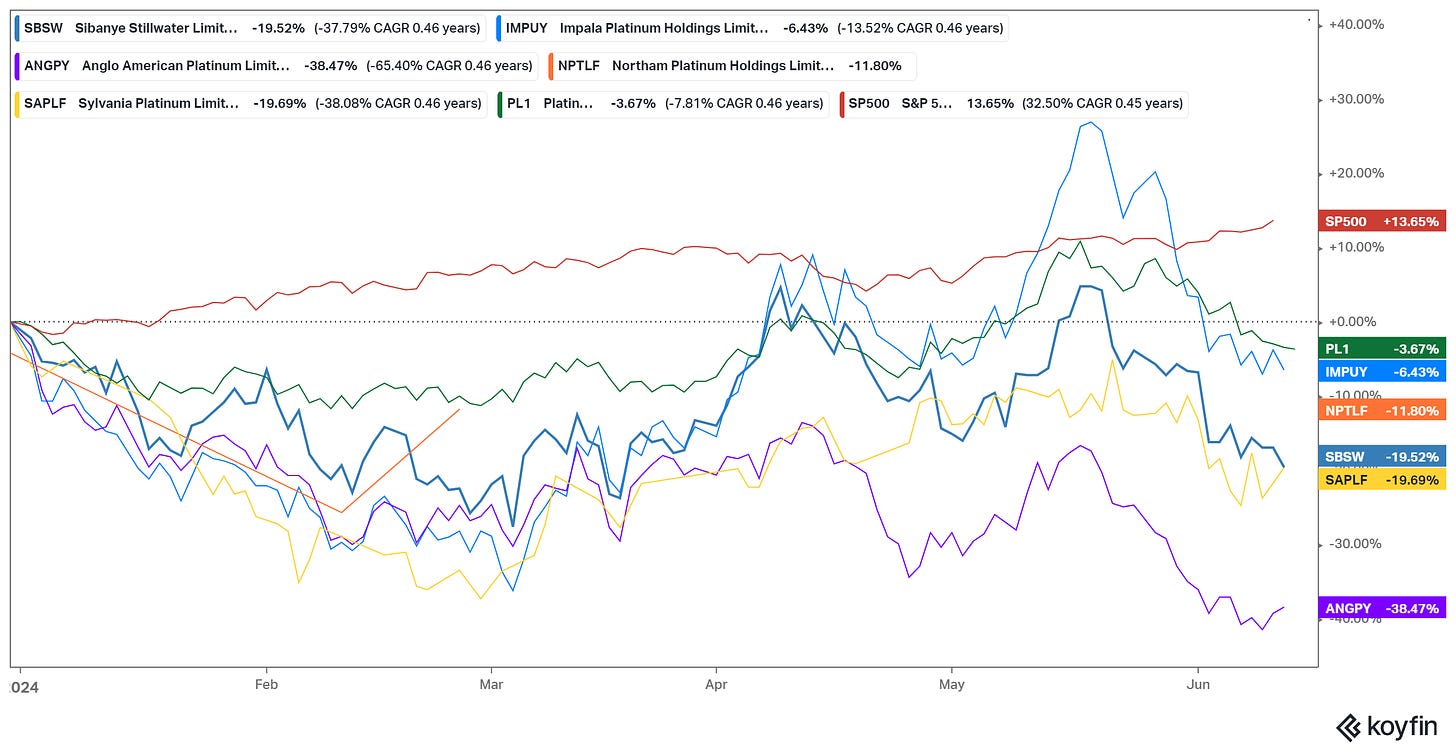

PGM miners are probably the most unpopular names in the mining universe. YTD, all of them “outperformed” the platinum spot price, as shown on the chart below:

Despite the weak PGM market, mining companies endured the crisis successfully. All maintain conservative balance sheets with adequate liquidity and prudent leverage.

Now, let’s analyze the major PGM miners. I follow a top-down approach in my investing process. First, I look for a tectonic shift at a macro level. Then, I measure its impact on the various sectors, industries, and regions. The last step is to filter the best players to express my investment thesis. Summarized, this is my analytical framework:

Balance sheet quality: solvency and liquidity

Company’s efficiency: margins, returns, and FCF yield

Shareholder returns: dividends and buybacks

Valuation: absolute (business) and relative (vs. peers and historical)

That being said, let’s move to our contenders:

Sibanye Stillwater, SBSW

Impala Platinum, IMPUY

Anglo American Platinum, ANGPY

Northam Platinum, NPTLF

Sylvania Platinum, SAPLF

All miners share one thing: they have operations in South Africa. Sibanye and Impala own assets in other countries, yet most of their revenue still comes from South Africa.

South Africa’s Bushveld Ingenious Complex (BIC) in Gauteng province is home to the largest reserves of platinum group metals. Moreover, eight of the largest platinum mines in the world are in BIC. Three companies own those mines: Sibanye Stillwater, Impala Platinum, and Anglo American Platinum.

Sibanye owns several mines in South Africa, Marikana and Rustenburg. Marikana is the second largest platinum mine globally, while Rustenburg is the fifth one.

Impala has mines in South Africa, Zimbabwe, and Canada. The Imala Rustenburg Mine in South Africa is the largest platinum mine in the world, with 667 k oz annual platinum production (excluding other PGMs). At the current annual production, the mine's life is estimated until 2035. The next flagship asset is Bafokeng-Rasimone, with LOM until 2052.

Anglo-American owns the largest platinum open-pit mine, Mogalakwena, in South Africa. Mogalakwena has been the company's flagship asset, with 75 years of LOM. Amandelbult mine is the sixth largest mine with LOM until 2040. Two smaller PGM producers in South Africa are worth mentioning: Sylvania Platinum and Northam Platinum Holdings.

Simply put, PGM producers are attractive yet not equal. My picks are Sibanye and Sylvania. They come with aces under their sleeve. Sylvania is a PGM producer, not a miner yet, while Sibanye owns massive uranium resources comparable to those of uranium miners like Denison and Nexgen.

Sylvania produces PGMs via dump operations. Sylvania Dump Operations (SDO) comprises six chrome beneficiation and PGM processing plants, treating a combination of ROM and current and historical chrome tailings at host mine sites. Explained simply, Sylvania goes to local chrome mines, collects tailings and waste rock, and then extracts PGMs. Due to the operation model, Sylvania's costs fall at the lowest end of the cost curve.

Sylvania has two exploration projects, Volspruit and Far Northern Limb. It is estimated they can deliver 160-220k oz per annum combined. They contain about 3.3 million oz 3E PGMs.

SBSW uranium resources are worth mentioning: 32 million pounds are in Cooke tailings, and another 27 million pounds are in the Beisa mine.

To estimate the value of uranium resources, I use the imperfect yet good enough approach: Resource Value = Resource Base * (Spot price—AISC). I assume uranium AISC is $60/lb, and the uranium sport price is $90/lb. So, the value of 59 million pounds is $1.77 billion, or 58% of the SBSW market cap on June 28, 2024. I used conservative figures for the inputs, AISC in the higher percentile and a spot price below $100/lb.

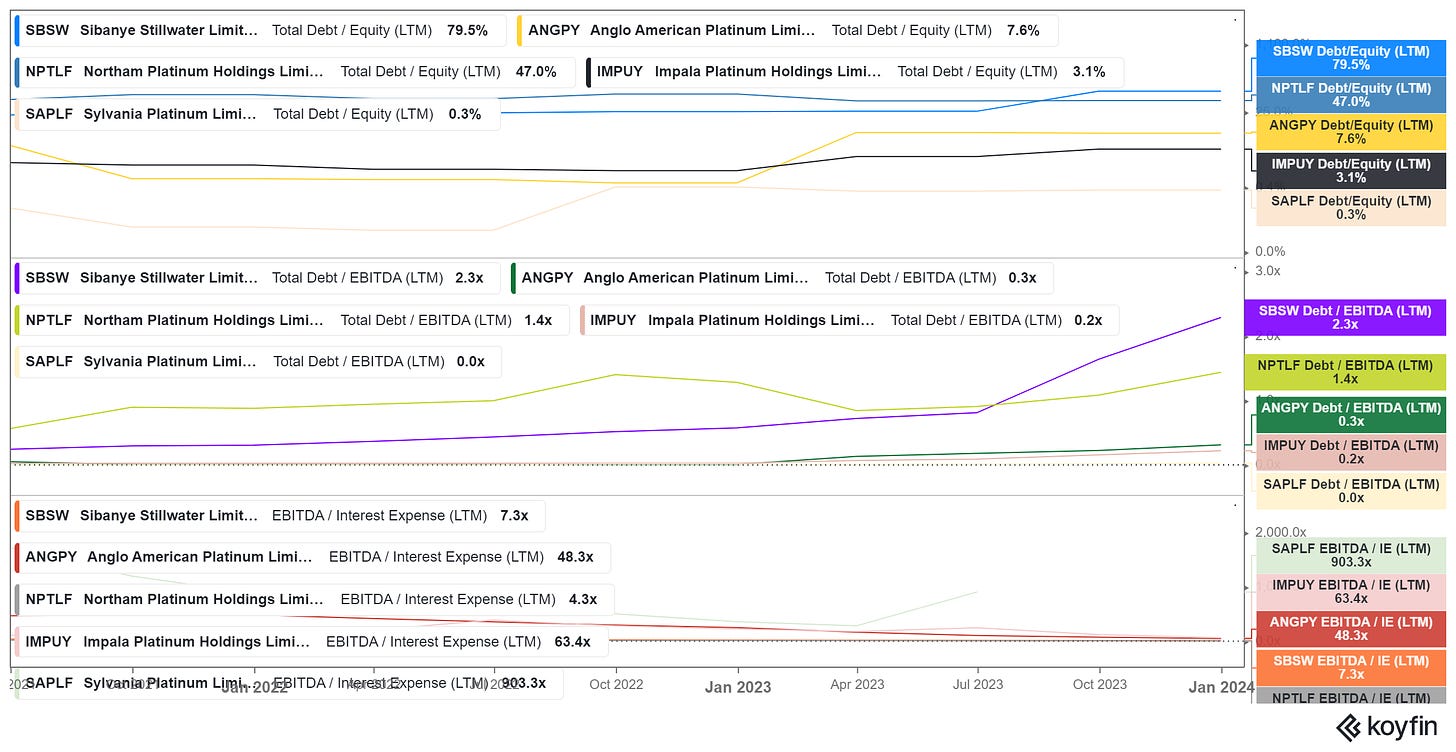

The following chart compares companies’ liquidity and solvency metrics.

As pointed out earlier, PGM miners keep their balance sheets clean. Total debt/Equity below 100% is proof of that. SBSW is the most leveraged, with 79.5% Total debt to Equity. Sylvania has no existing debt. Total debt/EBITDA and EBITDA/Interest Expenses paint a similar picture. Even at depressed PGM prices, the companies preserve excellent liquidity. Sylvania scores impressive EBITDA/IE due to zero debt and the lowest AISC in the peer group.

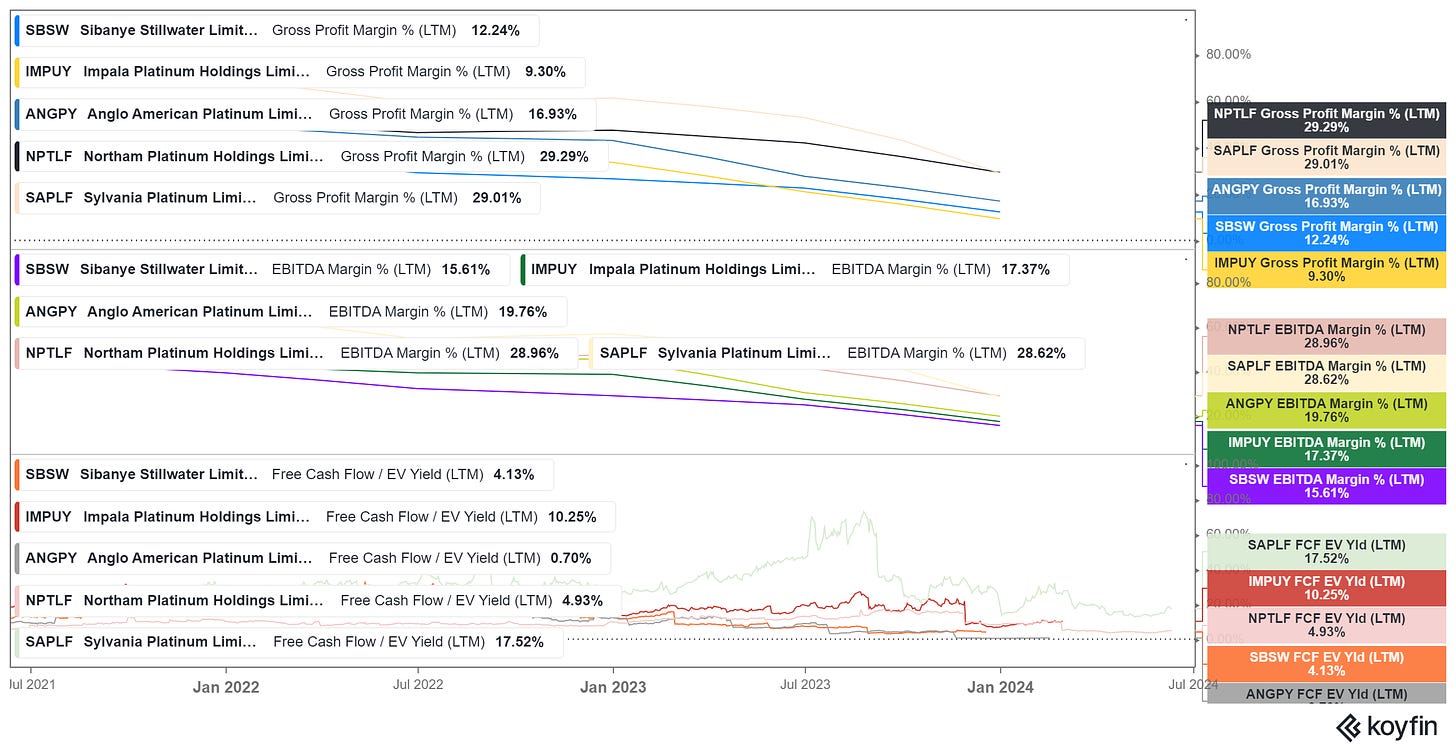

The following chart illustrates margins and FCF yield.

Unexpectedly, the company with the highest AISC, Northam, has the best margins. However, we must look at the company's revenue composition. Rhodium represents 46% of Northam's revenues, the highest percentage in the group. The rhodium spot price is more than four times higher than the palladium/platinum spot (as of June 28, it is $4,400/oz), resulting in wider margins despite the highest AISC. As expected, Sylvania scores the second-best margins. Having the best AISC pays off, especially in a depressed market. Sylvania’s high FCF yield is a second-order effect.

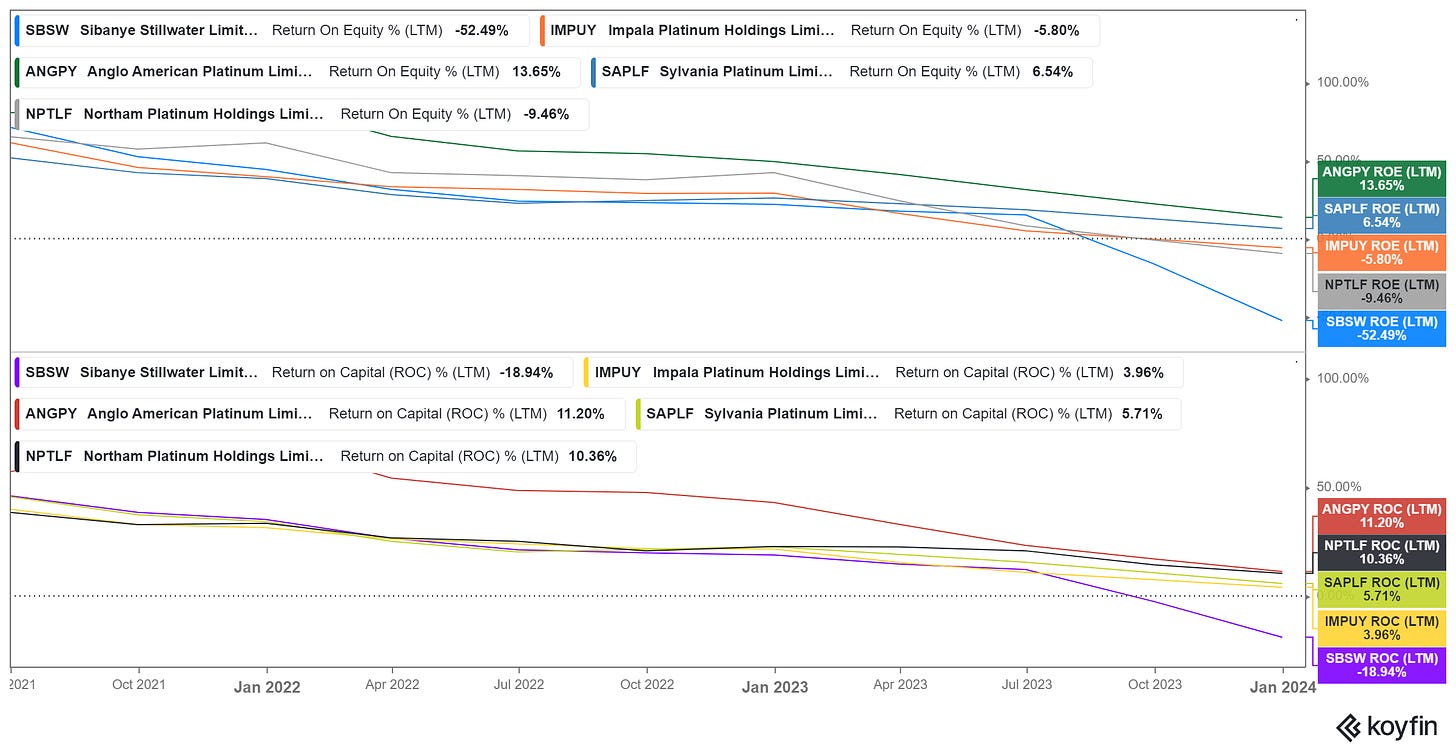

PGM miners have low debt levels, which means a high denominator in the ROE formula, hence unimpressive Return on Equity at first glance. Spot prices below or close to AISC squeezed companies' net profit, leading to a disappointing ROE. Nevertheless, Anglo-American Platinum delivers an impressive ROE of 13.6%. Sylvania follows with 6.5% ROE.

The following chart summarizes PGM producers' ROE and ROC.

Sibanye’s massive decline in ROE is due to a $2.1 billion impairment against its US platinum/palladium mine, Stillwater Mining Complex. 70% decline in palladium prices made the assets unprofitable. As per Sibanye’s CEO Neil Froneman, the mine will go into “care and maintenance” if the palladium price does not recover soon.

It is worth mentioning that the Stillwater complex shares similarities to BIC in South Africa. It contains massive reserves of PGMs and chromium. Moreover, Sibanye 's mine is the sole PGM operating mine in US territory.

Let’s look at its annual production. Stillwater delivered a 427 k oz 2E (78% palladium and 22% platinum) in 2023. If the mines go out of service, the global platinum supply will decline by 93k oz and the palladium supply by 333k oz.

FY24 palladium supply is estimated to reach 9.37 million oz, while demand is at 9.73 million oz, leading to a 358 k oz shortage. So, if Stillwater goes into “care and maintenance,” the palladium deficit will almost double from 358 k oz to 691 k oz.

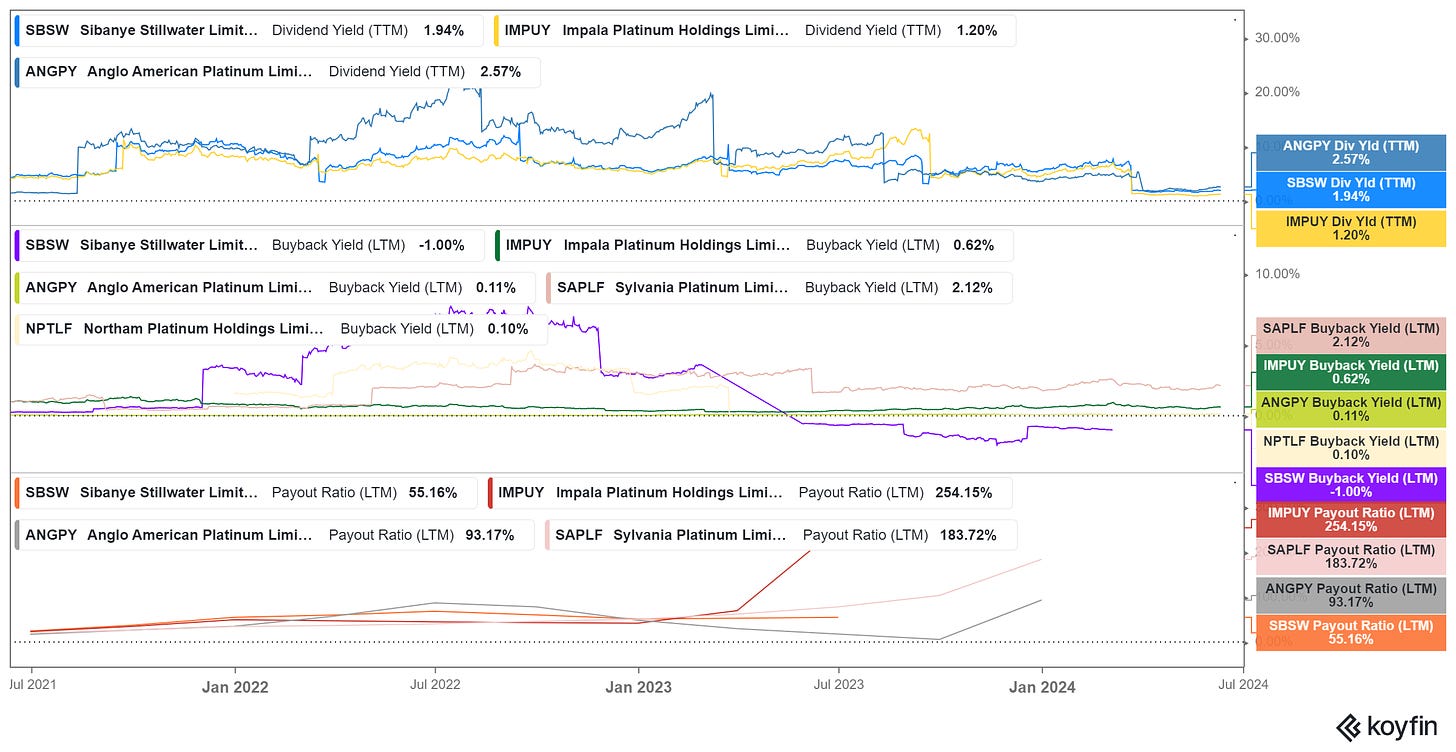

The following chart illustrates dividend yield, buyback yield, and payout ratio.

SBSW distributes dividends based on its normalized earnings. Considering the net losses, the company canceled the dividends for 2H23. Compared to Anglo American Platinum (ANGPY) and Impala Platinum (IMPUY), SBSW distributed higher yields while maintaining a healthy % payout ratio of 55%. Impala pays and distributes dividends based on 30% of adjusted free cash flow, pre-growth capital. For 2H23, it realized negative cash flow, so an intermediate dividend was not declared.

Sylvania returns capital to its shareholders via buybacks and dividends. The company scores the best buyback yield in the group. Opportunistic share repurchases at depressed prices are proof of the company's ability to allocate capital. Moreover, it is a token of loyalty to its shareholders.

The companies did not distribute dividends due to weak PGM prices in the last quarter nor initiated buybacks. Sylvania is an exception because it purchased stocks for $300,000 in 1Q24.

In summary, PGM producers are in a strong position despite the depressed PGM market. Liquidity and solvency are not an issue. Moreover, with improving PGM prices, margins and returns will recover. Accordingly, dividends and buybacks will come back.

Valuation

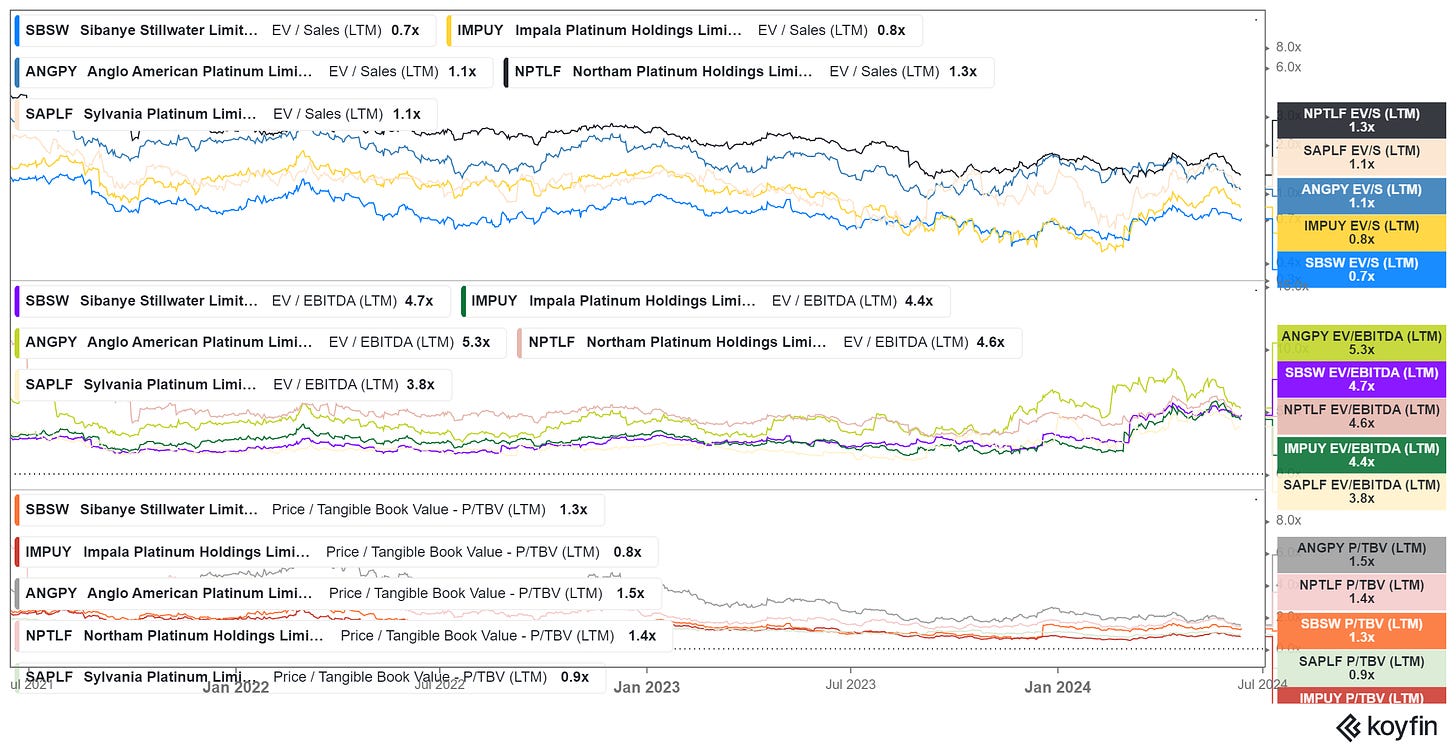

Let’s start with the comparative valuation. The following graph shows EV/Sales, EV/EBITDA, and P/TBV.

Anglo American commands higher multiples. The company has a vast reserve base, reasonable AISC, and rising annual production. Investors discounted those facts in the price. Nevertheless, Anglo is still an attractive proposition. Impala and Sibanye trade is the lowest EV/Sales. Meanwhile, Impala and Sylvania trade at the lowest EV/EBITDA and P/TBV.

Impala had a large-scale accident in November 2023. Shaft 11 of the Impala Rustenburg mine collapsed, causing the death of 13 employees and 73 injured. Shaft 11 tragedy significantly impacted Impala’s safety metrics in 2H23. FIFR (fatal injury frequency rate) increased from 0.032 in 1H23 to 0.209 per million man-hours in 2H23. Production losses caused by the tragedy are approximately 30,000 6E oz.

Sibanye, on the other hand, announced in November 2023 that it issued $500 million in convertible bonds with 4.25% interest and maturity in 2028. The proceeds were used to acquire Reldan, a US-based metal recycler with operations and JVs in Mexico and India. Reldan EV was estimated at $211 million. The deal's completion was announced on March 15, 2024, for $155.9 million cash consideration. The impairment of the Stillwater mine was another event that discouraged investors.

Those two factors made Sibanye and Impala less attractive than Anglo. Sylvania, on the other hand, is too esoteric even for metal investors. The company trades in the LSE and OTC markets and has a market cap below $200 million.

PGM miners are cheap, even relative to global materials. Market participants reached a stage where mentioning investing in PGMs equals the utmost stupidity. If you have NVIDIA, why bother investing money in an obscure company in a high-risk country extracting useless ore?

Never mind. Alpha resides in the overlooked corners. PGM miners are textbook examples. They bring robust fundamentals with solid tailwinds, all packed at attractive prices.

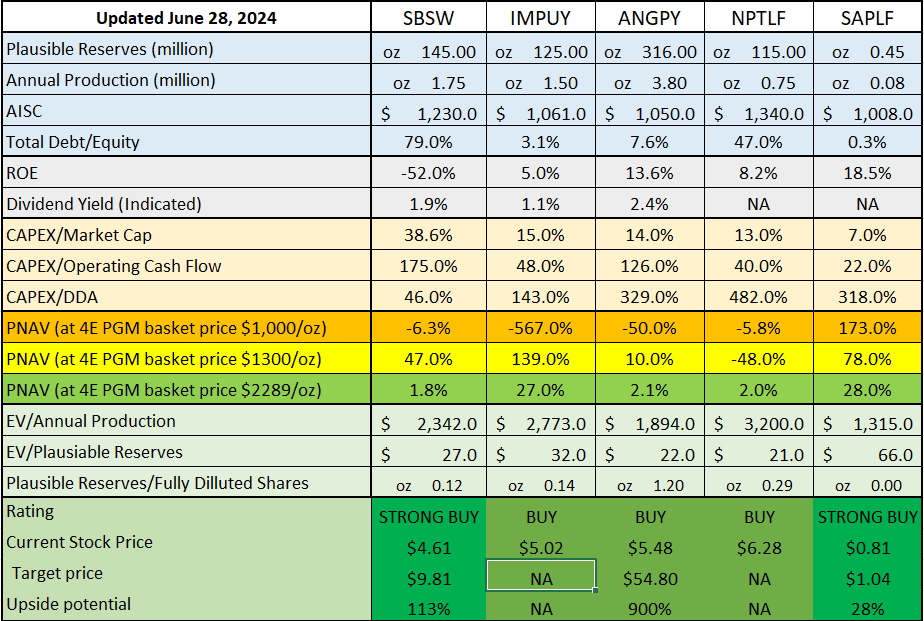

The following table summarizes everything. It is divided into a few sections.

The first section shows reserves, production, AISC, and leverage

Next is company efficiency and dividend yield

The third section presents companies' CAPEX vs various metrics.

PNAV valuation based on three scenarios

Mining valuations based on EV, reserves, and production

The scenarios I consider are:

Negative: 4EPGM basket price $1,000/oz

Base case: 4EPGM basket price $1,305/oz

Positive: 4EPGM basket price $2,289/oz

The third section, CAPEX, elaborates on how efficiently the company allocates its CAPEX.

The most crucial metric is CPX/DDA. It must be higher than 100%. That means the company's investments in Property, Plant, and Equipment exceed the depletion, depreciation, and amortization of the company’s assets. Sibanye is the only company with CAPEX/DDA below 100%. Northam scores the highest number, with 482%. Sibanye, on the other hand, holds a pole position in the other two categories: 38% CAPEX/Market Cap and 175% CAPEX/Operating Cash Flow.

EV metrics are helpful because they tell us how much we pay for annual production and plausible reserves. The last metric in this section tells us how many oz we get per share. To underline, those metrics are not decisive, not prerequisites for investing decisions. They just complement the big picture.

Sylvania and Anglo offer the most value, as measured by EV/Annual production. Sylvania is a top performer in the second category, EV/Plausible Reserves. Most PGM oz for the buck offers Anglo.

At the base case scenario (4E spot $1,305/oz), Sibanye, Anglo, and Sylvania trade at a discount to their NAV. Sibanye has an enormous advantage because of its gold mining operations. The company owns 32 million oz of gold as plausible reserves via DRD Gold. Robust gold prices exceed AISC, significantly boosting reserve replacement value. Impala, for comparison, owns similar PGM reserves and operates at lower AISC, yet trades 139% PNAV. Nevertheless, gold operations give Sibanye an advantage. Northam has a negative PNAV because its AISC exceeds the spot, so the reserve replacement cost is negative. All companies would trade significant discounts at a $2,289/oz PGM basket price.

In conclusion, I give a Strong Buy rating to Sibanye and Sylvania because they have distinct advantages, and even at present, PGM spots come with a discount. Nevertheless, all PGM producers are worth investing in, considering the strengths and the macro tailwinds.

Risks

My long PGM thesis carries a few risks. I divided them into two categories: systematic and idiosyncratic.

Systematic risks:

Global recession

PGM cheap alternatives

Complete ban on ICE/ Political stupidity

South Africa crisis

Release inventories

Idiosyncratic risks:

Financial risk

Operational risk

Recession risk

Similar to my shipping ideas, recession risks are present.

I am a long-term bull on chaos. This does not mean the world will end tomorrow. At least at first glance, I expect the next 12 months to have a stable economy. The fiscal measures pump liquidity into the global economy. The number of flights is an intuitive recession indicator. It is not perfect, but it is good enough. A record number of commercial flights were reported in 2024. So, there is still money in the system.

A recession risk is always on the table. One thing I can say with high conviction is when the recession will NOT come. This is the next 12-18 months.

PGM cheap alternatives

For many years, research has been underway to find cheap alternatives to PGMs. However, this is not an easy task because the properties of these metals are unique and very difficult to replicate at a low cost.

Platinum and palladium have distinct characteristics, making them the only viable solution for auto-catalytic converters. At least for now, consider the present stage of development of ICE and catalytic converter design. Both metals have pros and cons and are suitable for specific situations.

Palladium, however, has a few advantages over platinum.

It is cheaper than platinum (at least for now).

Catalytic qualities: palladium can be more efficient in the oxidation of hydrocarbons.

Temperature sensitivity: palladium works better under lower temperatures. This is perfect for vehicle cold starts.

Durability: palladium endures more contamination by particular chemicals in exhaust gases, resulting in an extended life span of the catalytic converter.

Below is a quote from the World Investing Platinum Council from the January 2024 report:

Platinum for palladium autocatalyst substitution is expected to reach 700 koz in 2024f, up from 620 koz in 2023f. Our analysis shows that reversing this process would require no economic incentives and carries a number of risks. Furthermore, the process of reverse substitution would be slow even if it did occur. Thus, existing substitution is largely embedded in annual automotive demand for the medium term.

Platinum and palladium can be substituted on an almost 1:1 basis in autocatalysis. Simple economics led to initial substitution in gasoline vehicles; palladium market deficits underpinned price increases, resulting in platinum prices trading at a significant discount to palladium since 2017. The impact of substitution on annual platinum demand takes time since it almost exclusively only occurs on new vehicle models, representing around 15% of the market in any given year. Once substitution occurs, it is typically locked in for the vehicle platform’s life of around seven years because of the cost and risk of substituting on a vehicle platform already in production.

Nevertheless, both metals are needed. Different compositions are used depending on the ICE type (diesel or gasoline). Gasoline-powered vehicle catalytic converters contain platinum, rhodium, and palladium, while diesel-powered vehicle catalytic converters only contain rhodium and platinum.

With the prices of both metals depressed, the final decision comes down to production lines. Manufacturers will keep them unchanged, regardless of whether they are built for platinum or palladium. Switching cost between palladium and platinum is low enough to ignore it.

The other PGMs are not viable options, either. Ruthenium is the cheapest PGM, trading at $410/oz today, while platinum is at $990/oz, palladium is at $934/oz, iridium is at $4,725/oz, and rhodium is at $4,650/oz. Yet, it does not possess the required characteristics for catalytic converters. Iridium and Rhodium are prohibitively expensive compared to platinum and palladium.

Gold is not a solution because their prices are often higher than platinum/palladium. Silver has been shown as the substitute with the highest potential so far. However, even if it proves to be a workable alternative, it will be several years before its introduction.

In conclusion, I do not expect a feasible alternative to platinum/palladium for catalytic converters until the end of the decade. Accordingly, PGM demand will not decline significantly.

Political stupidity

Green is the new red. Politicians and propagandists make decisions that are supposed to be made by engineers and economists. The results are stunningly obvious. A clean energy transition without energy and materials is impossible.

The world needs enormous amounts of energy. At the present stage of technical development, renewables/EVs are not the ultimate solution. They are a necessary step to long-term progress, but not the only one. ICE cars, NPP, LNG, and coal-fired plants will stay with us for the foreseeable future.

Fortunately, there have been sober voices among politicians. The trend started to shift toward nuclear power and LNG. ICE cars have also made a strong comeback. In simple words, demand for materials and energy is poised to grow. PGMs are part of the equation, so we will need tons of 6Es in the coming years.

South Africa crisis

South Africa is a well-known unknown. The ANC's questionable regime caused considerable social and economic issues. The last General Elections were probably the most important since 1994, when the ANC scored its first victory.

I had two scenarios: ANC victory will deepen the crisis further, and ANC/DA coalition may signal changes in the country's course. However, even if the second scenario becomes a reality, the issues will not be resolved overnight. DA victory could spark civil unrest in regions dominated by ANC and EFF supporters. So, regardless of who wins the elections, the above-discussed issues will persist for a while. This means constrained PGM supply for the foreseeable future.

Thankfully, the election delivered a positive outcome. ANC is no longer the single-handedly ruling party. It still holds the majority but must work together with the DA. The DA has governed the Western Cape province for 15 years. The difference compared to ANC-ruled provinces is staggering.

There are still uncertainties surrounding the coalition. ANC and DA agreed to create a Government of National Unity (GNU). However, negative news emerged in the past week, showing a rising discord between ANC and DA. The possible participation of EFF and MK is the reason for the increasing tensions. MK and EFF are ANC spin-offs that attracted some ANC supporters. Both fall in the radical left spectrum, proposing drastic measures such as land expropriation from the White farmers. EEF is a Marxist-Leninist party that became notorious with the song “Shoot the Boer.”

Two probable scenarios lie ahead:

GNU involving ANC, DA, and MK

GNU, excluding DA, consisting of ANC, MK, and EFF

In the context of event-driven investing, the second scenario is more favorable for long-term PGM prices. The logic is simple: the longer the ANC mandates, the deeper the crisis, hence more power curtailments, resulting in higher AISC and mine closures. The outcome is an intensifying shortage of PGM, leading to higher spot prices.

On the other hand, the ANC/DA coalition is also favorable for the mining business. The coalition is expected to take more pro-business and less populist measures, which South African mining companies urgently need. Decisive action toward an improved business environment and stronger PGM market may motivate the miners to restart their paused capacity.

More mine operations equal more supply. However, the PGM deficit is already acute, so restarted mines cannot offset it. Moreover, probable events such as banned exports of Russian PGMs and the potential closer of the Stillwater mine will be tailwinds for my thesis. So, PGM producers will thrive in that case, with an increased output plus (potentially) higher spot prices, which means growing profit margins and returns.

Even in the case of the ANC/DA coalition, South Africa’s path ahead is not rosy. Provinces dominated by EEF and ANC may experience civil unrest, leading to another social crisis. Success in negotiation is one step ahead of a long way toward prosperity for South Africa, yet not the last.

To elaborate, regardless of the outcome of GNU negotiations, the PGM deficit will not diminish. Depending on the GNU composition, the deficit may stabilize in the case of the ANC/DA coalition or may magnify in the case of the ANC/EFF/MK collation.

Financial and operational risk

Financially, all PGM producers are intact. Even at a bottom price below AISC, they preserve their balance sheets. However, this comes at a price. In the last 12 months, PGM producers have had to lay off thousands of workers.

During a crisis, every business has one priority: to survive. This is the only way to improve its long-term chances of success. The company has two options: to keep its labor force intact while having unbearable labor costs and endangering its survival or to lay off some workers to cut costs and weather the storm successfully. It is a trade-off between a few's short-term happiness and the majority's long-term happiness. This is the harsh truth of business. So, I accept layoffs as part of the company’s survival plan. The decisions pay off well, given the PGM producer's clean balance sheets.

Operational risk is related to South Africa's social and economic issues. Power curtailments and worker strikes are the norm. As pointed out in the previous section, I expect South Africa to move in the right direction. But this does not equal smooth sailing. The outcome of the dialogue between the ANC and DA paves the way for the country's future. Depending on the chosen direction, operating in South Africa may become more challenging if DA is out of the coalition, or the business climate may recover if DA remains in the collation. Nevertheless, even in the second scenario, before it gets better, it may get worse.

Running a mining business in South Africa is challenging. PGM producers are well-trained to navigate the country's intricacies. Hence, the PGM industry will keep facing difficulties. The point is whether they increase or decrease.

Financial and operational risks are not as significant as they seem. PGM producers are financially intact and used to South Africa’s turbulent business climate.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Full disclosure: I hold a position in Sibanye Stillwater. Note that this is a disclosure, not a recommendation to buy or sell.

Fantastic article, thank you for sharing.

Hello, what do you think about the possible impact of Ivanhoe's Platreef PGM mine ? It's expected to produce ~400k 3E+AU, which makes it one of the largest PGM mine in the world.