Adventures in REE universe, Part 1

Bet on China-US trade war and (long term) EV market strength

Uranium is already too popular. It is a mainstream niche investment idea. I am on a quest to find ideas like uranium, but where it was in 2020: heavily depressed prices and zero interest among investors. Platinum Group Metals is one of those themes, yet not the only one.

In a series of articles, I will decipher the mining industry's most peculiar corners. Today is the first episode dedicated to Rear Earth Elements (REE). They share similarities with PGMs because they are simple as per my classification metals and fall in the CAPEX category.

The REE market is highly concentrated. Only two companies outside China run producing REE mines, Lynas Rare Earths in Australia and MP Materials in the US.

Considering global fragmentation, REE-depressed prices, and ever-growing demand for REEs, it seems like another asymmetric idea.

REE 101

The group of elements on the row labeled "lanthanides" on the periodic table of details, marked in blue, are known as rare earth elements. Due to their similar chemical characteristics, yttrium (Y) and scandium (Sc) are also considered REEs.

These elements are collectively known as "rare earths" since they were initially discovered in uncommon minerals and were difficult to extract. Although they are not particularly rare in the Earth's crust, they are considered such because of the lack of concentrated deposits. Simply put, only a handful of projects are economically viable due to the sufficient quantity of REEs.

Many high-tech applications rely on rare earth elements, such as electronics, renewable energy technologies (including wind turbines and electric vehicle batteries), catalysts, and more. Because of their unique characteristics, REE is the only solution, at least for now. The image below shows the significant purposes of REE (chart via Arafura):

About a quarter of the REE supply is used for EV cars and drive trains. The next large consumers are the conventional vehicles and the defense industry. Due to their importance for the defense complex, the supply of rare earth elements might have strategic significance.

Not all REEs are equal. NdPr oxide is the main REE component of neodymium iron boron magnets, NdFeB. It is the prime value driver for the entire industry.

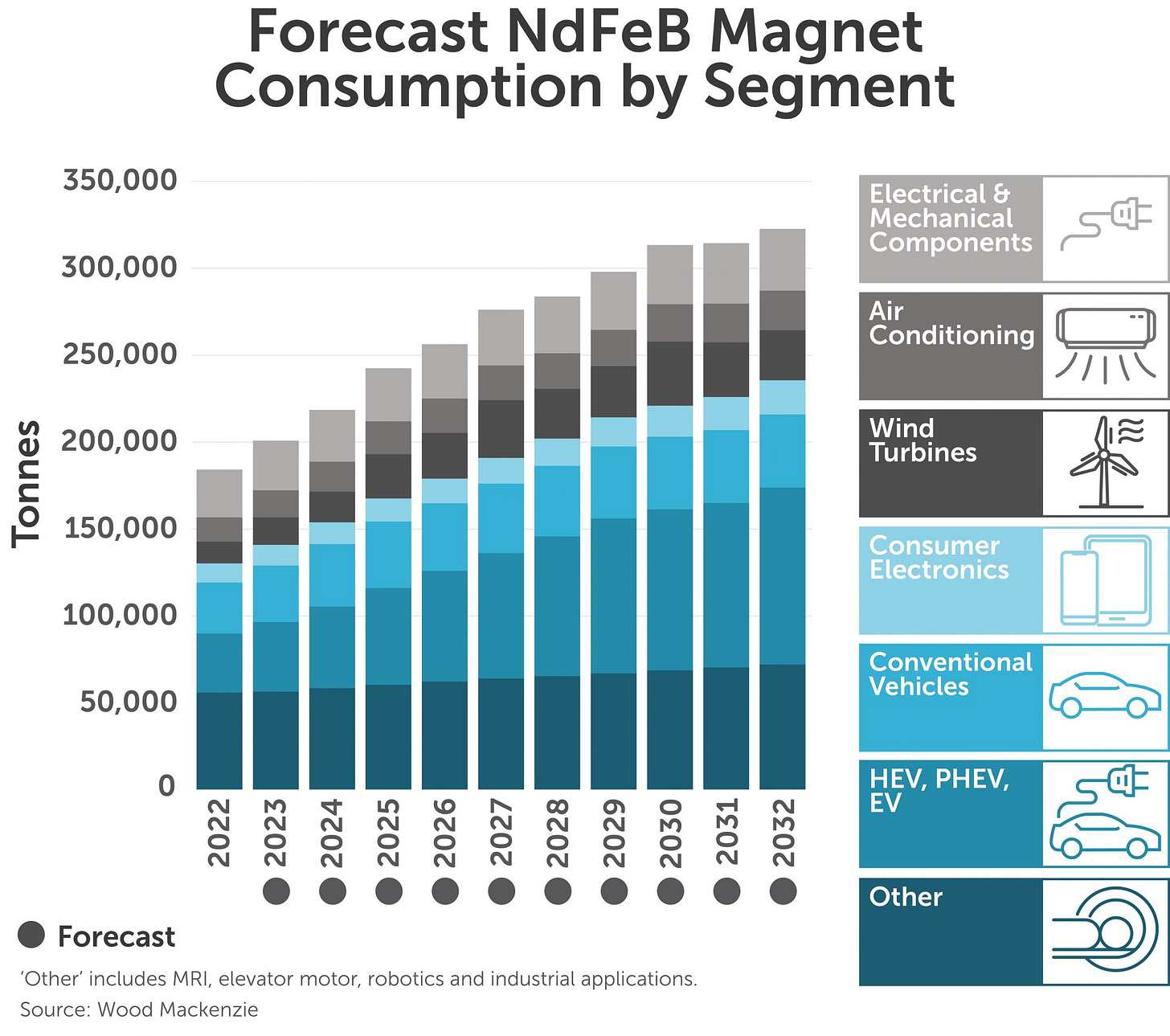

REEs used in NdFeB magnets account for 45% of the total rare earths production. NdFeB magnets are used in the automotive, wind turbines, and factory automation sectors. So, NdFeB demand is the prime driver behind NdPr oxide demand. Over the last two decades, NdFeB magnets have found applications in the automotive industry, such as electric drive trains, batteries, and electric steering.

The EV hype has toned down. Accordingly, ICE vehicles will stay with us longer than initially proposed. Hybrid vehicles, however, will remain the automaker’s focus. Hence, the demand for NdFeb will stay relatively intact. However, the expected growth rate would not be as initially projected.

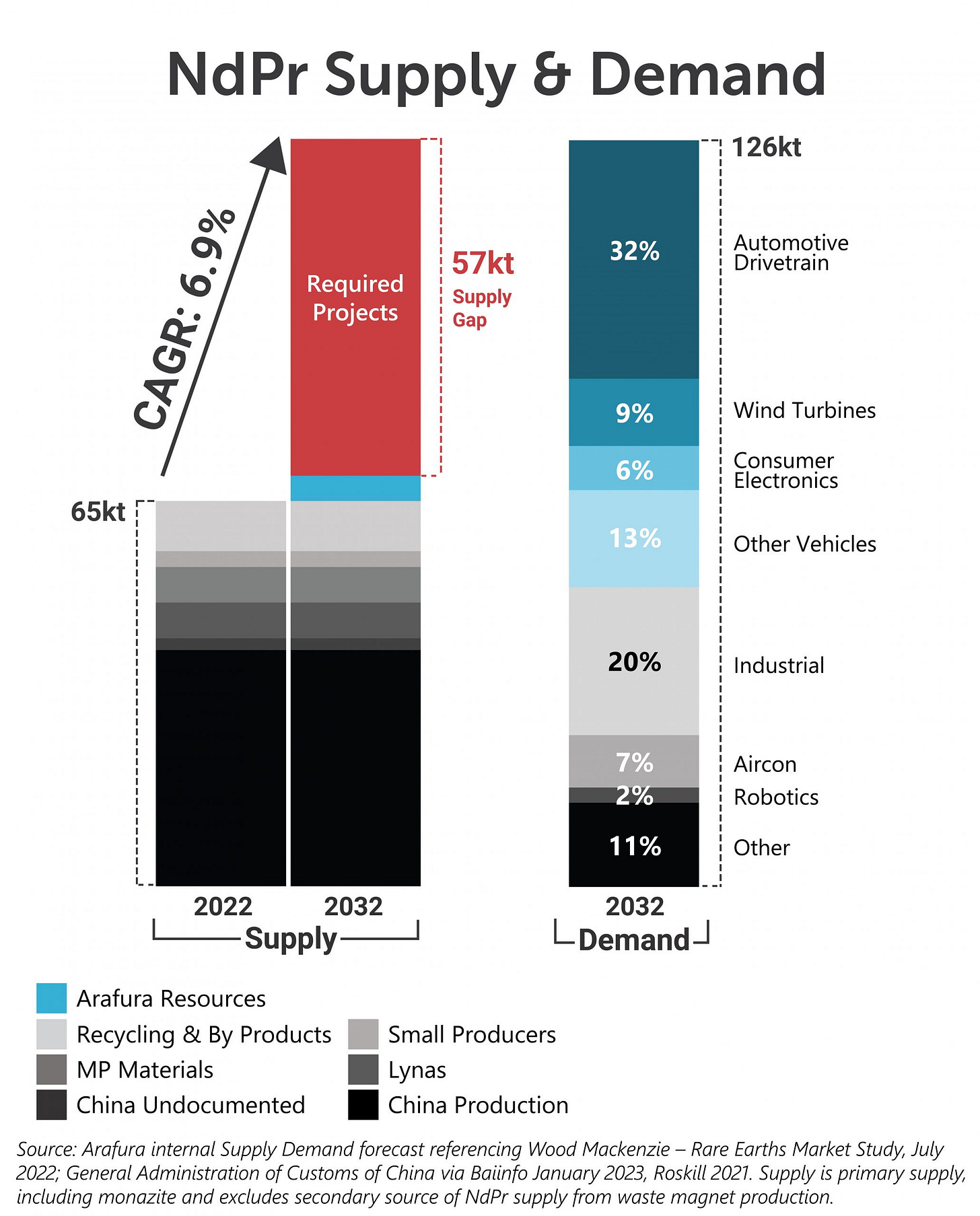

Let’s look at the projected NdPr demand and supply dynamics (chart via Arafura):

The left graph represents the projected supply gap. Assuming the same NdPr demand and supply rate, the forecasted deficit represents 88% of global supply today. This is equivalent to 12 large REE mines, the same size as Arafura’s Nolans project. REE is not different than other metals, considering the time needed to develop a mine. In REE’s case is about 18 years after discovering the first REE ore output.

REE Geography

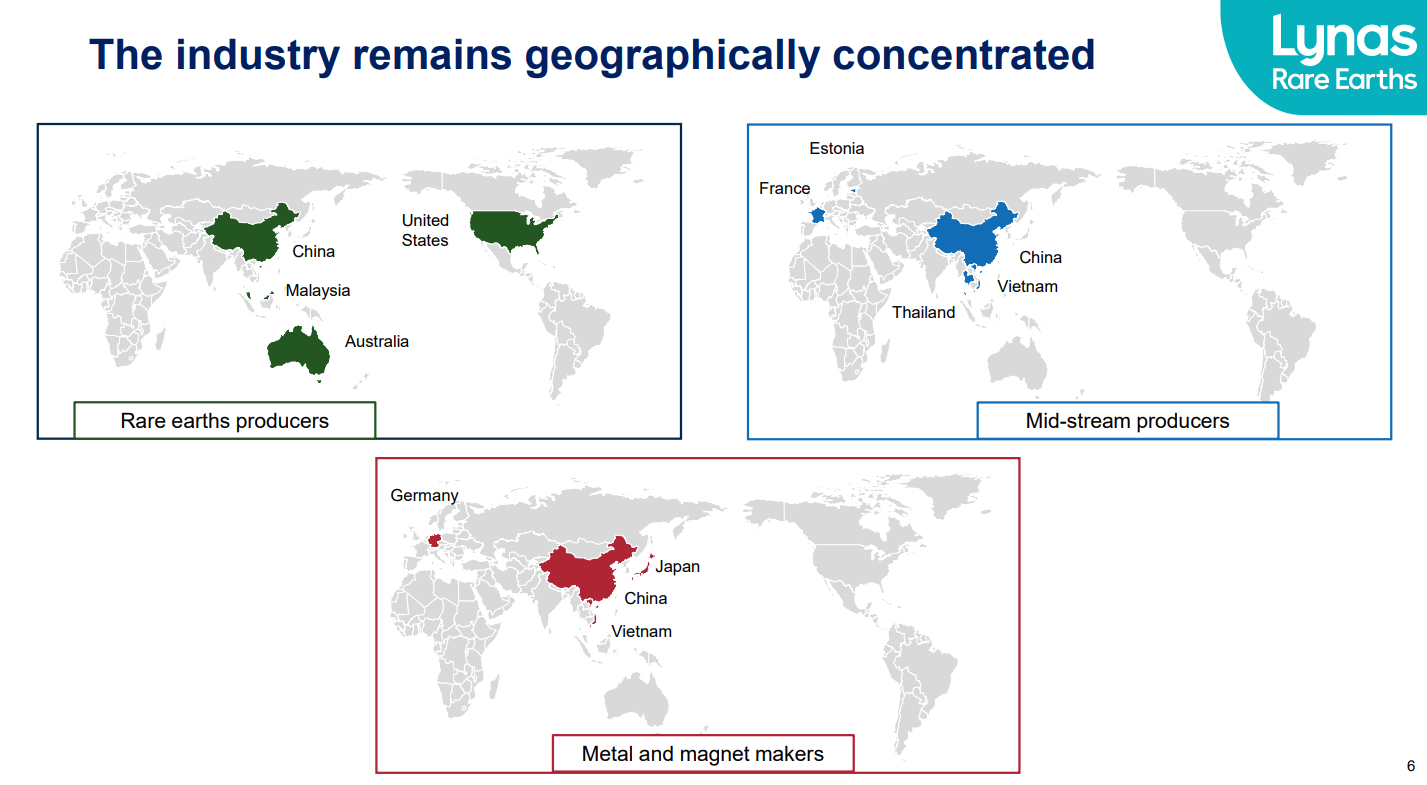

The Eastern Hemisphere dominates REE production. In addition to China, Vietnam, Australia, and Malaysia are rare earth producers. Chart via Lynas Rare Earths.

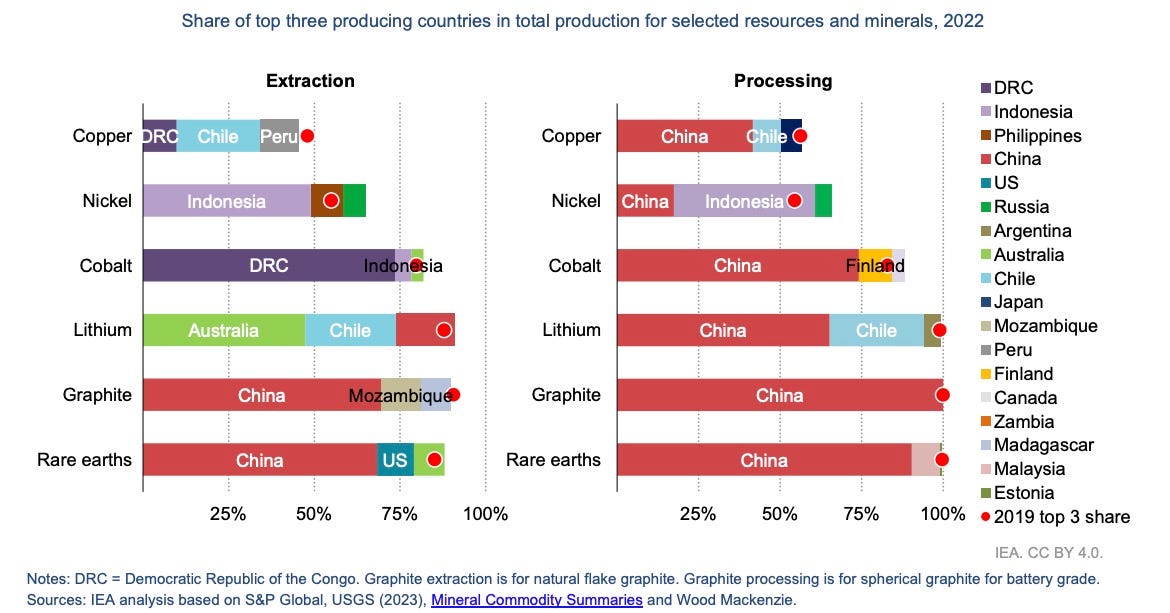

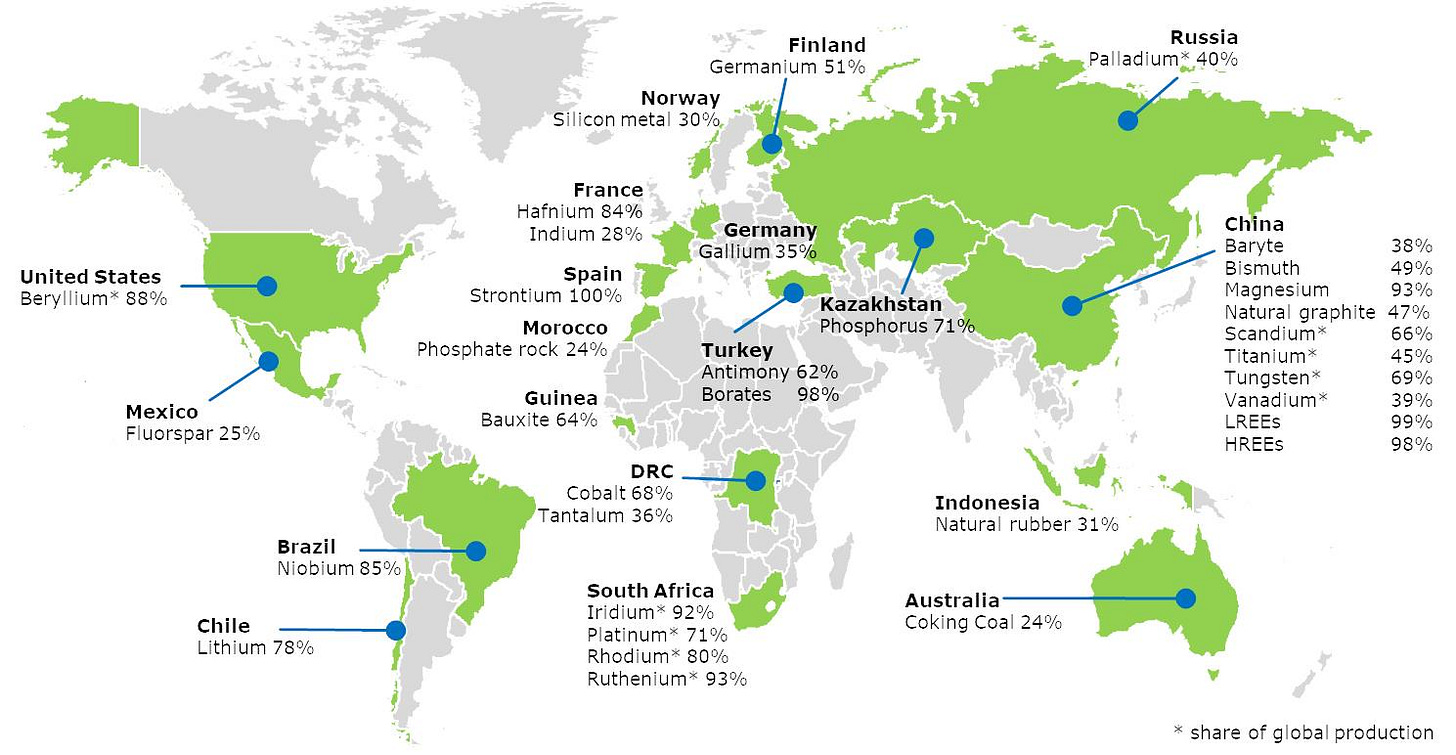

REE, like uranium, is truly a geopolitical bet. The new global order is disorder, and the world is already divided into two fractions led by China-Russia and the USA-EU. Both teams have strengths and weaknesses when talking about energy and critical metals. However, the Dragon-Bear alliance leads in many aspects concerning critical metals: palladium, uranium, and REE, just to name a few. Chart via IEA.

Today, China accounts for 63 percent of the world’s rare earth mining, 85 percent of rare earth processing, and 92 percent of rare earth magnet production.

The EU is the patsy on the table of the Great Powers. Look at the chart below:

EU is heavily dependent on energy and material imports.

The US has the geographical advantage of making dumb political decisions without significant material repercussions. Moreover, the US is the top global exporter of LNG and crude oil. On the other hand, The US fails to secure its critical metals supply chains.

For example, there is only one operating PGM mine in the country, Stillwater Mine. So, the US PGM domestic supply depends on one mine that can be closed soon due to depressed palladium and platinum prices. The REE supply situation is quite similar. Mountain Pass is the only producing mine in the States. MP Materials and Energy Fuels own the only two REE processing plants in the country, Mountain Pass Processing Facility and White Mesa Mill.

Nevertheless, MP Materials, which owns Mountain Pass, relies on China to process some of its REE ore output. Moreover, among MP’s largest shareholders is Shenghe Resource Holdings, a Chinese fully integrated REE producer. The US has a long way to go before decoupling itself from China's dependency on REEs.

Final Thoughts

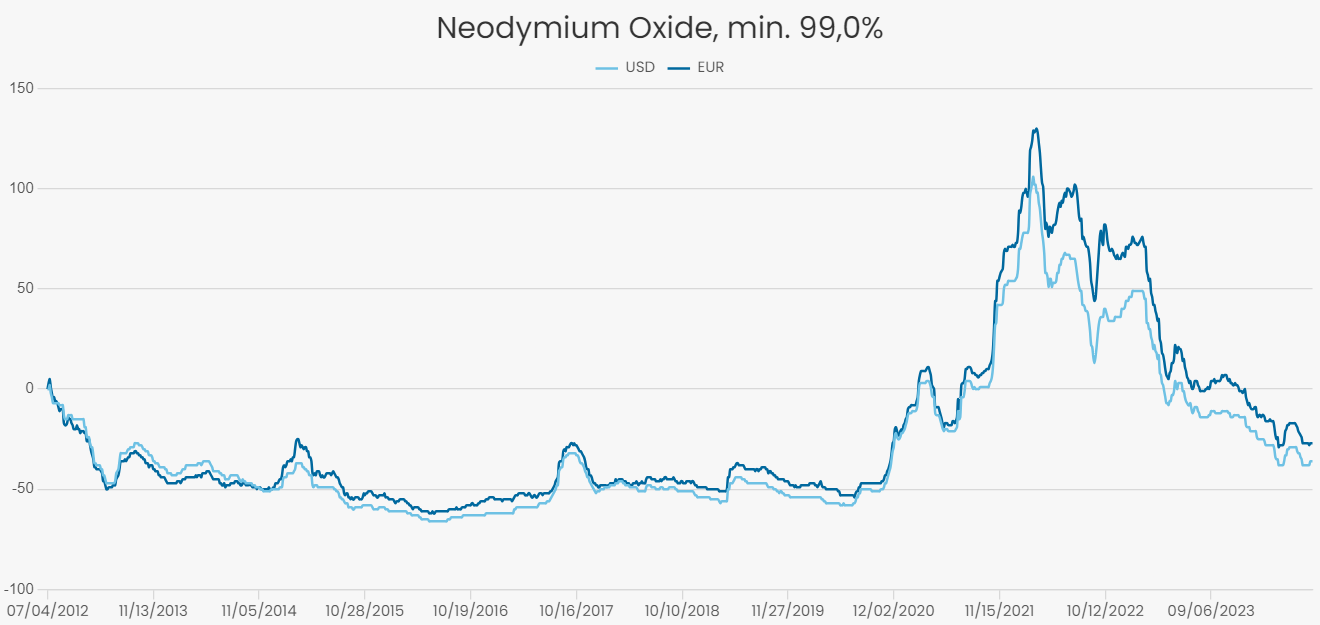

NdPr price has been in bear mode for the last 24 months. Chart via Strategic Metals Invest.

The peak in April 2022 was followed by a steep decline caused by oversupply from China, fears of a recession in early 2023, and declining EV demand. I expect NdPr prices to decrease even further in the following months before they form a base.

REEs are more a bet on EV progress, while PGMs are on ICE revival. Simply put, they are lowly correlated ideas based on mutually negating arguments. In the long term, both ideas will play well, I believe. That being said, I view PGMs as a higher conviction bet for the next 12-18 months. However, REEs may become hot again because of the trade war between the US and China.

Trump has the odds skewed in his favor. One of its plans is to sanction other tariffs on China. It is too early to project how that may impact REEs, yet I can brainstorm a few scenarios. In response, China may limit REE exports to the US and EU. The opposite can happen, too, as the EU and the US ban Chinese REE imports.

My REE idea is still in the making. Given the present circumstances, I believe it is too early to take a position. The US elections are the first milestone. The next president will most probably not be a Democrat. If Trump wins, the trade war between China and the US will go into full force. Accordingly, REE may become an instrument in the conflict. In other words, I expect November to be an excellent time to start building positions in REEs.

This is Part 1 of my adventures in exotic metals. In Parts 2 and 3, I will review a few REE exploration and production companies. You can find links to the following two parts below:

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Mihail, this was a good commentary on geopolitical implications of the REE industry, where by all accounts, China dominates. I would not be surprised if the next administration, which is likely to be Trump, will enact a ban on processed REE from China, similar to what has already been done with the ban on Russian enriched uranium imposed by the Biden administration. However, I do not share your enthusiasm for REEs being used in EVs and the renewable energy sector, with Ford recently announcing it will lose over $5B this year on EV production, and GM announcing that the company is deferring investments in EVs to ensure, as the Wall Street Journal put it, “the company doesn’t get ahead of demand.” Regarding renewables, we are starting to see many rejections of planned wind and solar farm installations. Big Wind is not only seeing lots of turbine failures onshore and offshore and a growing backlash across America — where local governments and landowners are rejecting the encroachment of their monstrous landscape-destroying-wildlife-killing-whale-endangering-and-property-value-shredding machines. Taken together, if we reduce demand by EVs, Solar, and Wind, that should have an impact on REE demand. So I think the real demand will come from electronics and the defense industry, which has seen a lot of push lately (look at Lockheed's 2Q splendid results).