In August 2023 N.S. Savannah was for sale. What is so special about this ship?

N.S. stands for nuclear ship. Built in 1955 under the "Atoms for Peace" initiative, Savannah was the first merchant ship driven by nuclear power. It demonstrated the technical feasibility of nuclear propulsion for merchant vessels.

N.S. Savannah is pictured below (Image via Wikipedia).

Japan, Germany, and the USSR also built nuclear merchant ships. However, due to the complexity of maintenance and operations, nuclear propulsion was discarded as a viable solution. The Soviet icebreakers remained the only non-navy vessels utilizing nuclear propulsion.

Since N.S. Savannah, technologies have made significant progress. Now, we have Small Modular Reactors. Their simple design provides safe and efficient operations. Considering their advantages, they are a feasible option for merchant vessels. Despite that, the old-school two-stroke engines are here to stay when it comes to large cargo ships. Cruise liners and OSVs are another story.

Nevertheless, I expect a resurrection in interest in nuclear-powered ships in the coming decades. NS Savanah is an illustrious study case of nuclear power used for marine propulsion. She used a 74 MW pressurized water reactor typically found in nuclear submarines and aircraft carriers. Savannah's story, however, ended sooner than expected because of the overcomplicated service and maintenance of the nuclear power ship.

I bet we may see an operational nuclear-powered merchant vessel again in the next 10 years. Molten Salt Reactors (MSR) seem promising; they may bring marine propulsion into the 21st century. Their primary issue is the impact of radiation on reactor components because the nuclear fuel and the coolant are mixed, forming molten salt, which is highly radioactive.

Flexibility in power output management is a huge advantage. Only gas turbines can offer adaptability to erratic power demand. However, they are incredibly inefficient. Simply put, gas turbines are fuel-thirsty. So, MSR and steam turbines seem like a viable solution.

I assume the MSR, when (if) implemented, will be first installed in container vessels. These vessels are relatively inexpensive and not overly complex, like LNG carriers. I am curious about nuclear-powered offshore service vessels. They may follow the container ships as the first adopters of nuclear power.

It sounds interesting, but how can we play marine nuclear power revival? We have limited options, such as nuclear reactor builders and uranium miners. The former category is too small, even for my taste in investing adventures. Therefore, I stick to the easy choice, uranium.

So, it’s time to talk about yellow cake. This is the first of three parts covering the uranium market. Today, the topic is the big picture, i.e., demand, supply, and catalysts.

Uranium market preview

Uranium is the most mainstream esoteric investment theme. There are multiple analysts and media accounts dedicated to the uranium niche. Nevertheless, it is highly cryptic industry for most investors for several reasons:

The size of its physical market is about $10 billion.

The market capitalization of public companies mining and processing uranium is about $60 billion.

The physical uranium market is different from the rest of the commodity markets.

The most prominent players are state-corporate partnerships; many are not public companies.

Uranium is a strategic material not only for energy but also for defense.

As you can see, the uranium market size is cents compared to other industries. Even compared to other energy commodities like oil and coal, uranium is a dwarf. Separately, a handful of companies and states control the supply. The fact that many enterprises are private leads to strong information asymmetry, which is not in investors’ favor.

Uranium falls in the best category of commodities: simple and OPEX. Let’s briefly mention what it means. For more details on CAPEX vs OPEX and simple vs complex, follow that link.

Simple commodities mean a handful of participants dominate the supply, and demand is highly concentrated in a few industries. Uranium, PGMs, and tin are such markets. Most of the uranium is produced by four countries (Kazakhstan, Namibia, Australia, and Canada). In technical language, simple commodities mean markets with fewer running parts.

OPEX commodity is gasoline. Once you spend on CAPEX (a vehicle), you must top the fuel tank to utilize the car. An empty tank means no utility. Another example is uranium. Building an NPP costs several billion. OPEX commodity, in that case, is uranium. No uranium, no GWh.

The chart below shows where uranium stands.

Tier 1 includes only uranium. It is the only commodity with a relatively simple market (fewer running parts) and falls in the OPEX group.

In summary, uranium is an excellent place to be in the coming 24-36 months. In the following paragraphs, I answer why.

Big Picture

I divide the macro factors into two groups according to whether they influence the demand or supply. I also added a section discussing the known unknowns, i.e., events that would exacerbate the uranium shortage.

Supply

Political and economic fragmentation: the unipolar world dominated by the United States faces challenges from various countries, such as China, Russia, and the Global South. This does not necessarily mean the end of the United States, but it does mean that conflicts of all kinds, economic, political, and military, are becoming more acute.

A critical aspect of geopolitical factors is the political regimes in uranium mining countries. Authoritarian states dominate the supply side of uranium and nuclear fuel. Chart via Bloomberg.

A considerable part of uranium mining and enrichment depends on authoritarian regimes. This means the known unknowns, like resource nationalism, isolationism, or simply political stupidity, are always present.

Tangible assets capital cycle: CAPEX cycle and supply destruction sow the seeds of a new commodities supercycle. Uranium is no exception. After the Fukushima disaster, investments in the development of new deposits plummeted. In 2022, only $200 million was invested worldwide for this purpose.

The graph below (via Capital IQ) shows the uranium exploration budgets by region for 2023.

As you can see, in 2023, uranium miners invested 250 million dollars. The majority of exploration CAPEX went to North America. This is understandable, considering the US’s chronic dependence on imports from Russia and Kazakhstan.

Shortage of qualified personnel for the mining industry: According to surveys conducted in Australia and Canada, the next generation is not interested in engineering, creating a critical bottleneck. The chart below shows results from a poll organized in Canada.

The young talent voted “definitely would not” to consider the mining, oil, and gas industries. The lack of qualified and experienced personnel limits every complex industry's capacity (and utilization). Even if we have all the money required for new projects, there are no people to develop and operate them safely and efficiently. Unlike money, experienced engineers cannot be created with a few clicks or a party decree.

Demand

The Green Deal: the path to zero carbon emissions goes through base metals and energy. Nuclear energy is the cleanest of all energy sources, even compared to renewable energy.

The green cult deserves special mention. The propaganda about an easy and cheap transition to "clean" energy still dominates. However, this vision has nothing to do with physical reality. The CAPEX cycle is like gravity. It is a physical law influencing the supply of raw materials. Energy, unlike money, cannot be printed. Its production is an expensive and labor-intensive undertaking.

Renewables live the dream of the left - standing by, doing nothing, and getting subsidies. But the laws of physics are inexorable. The world needs energy and minerals, not subsidized virtue-signaling accessories.

For more politically incorrect rants, consider reading: Me against the idiocracy: green is the new red.

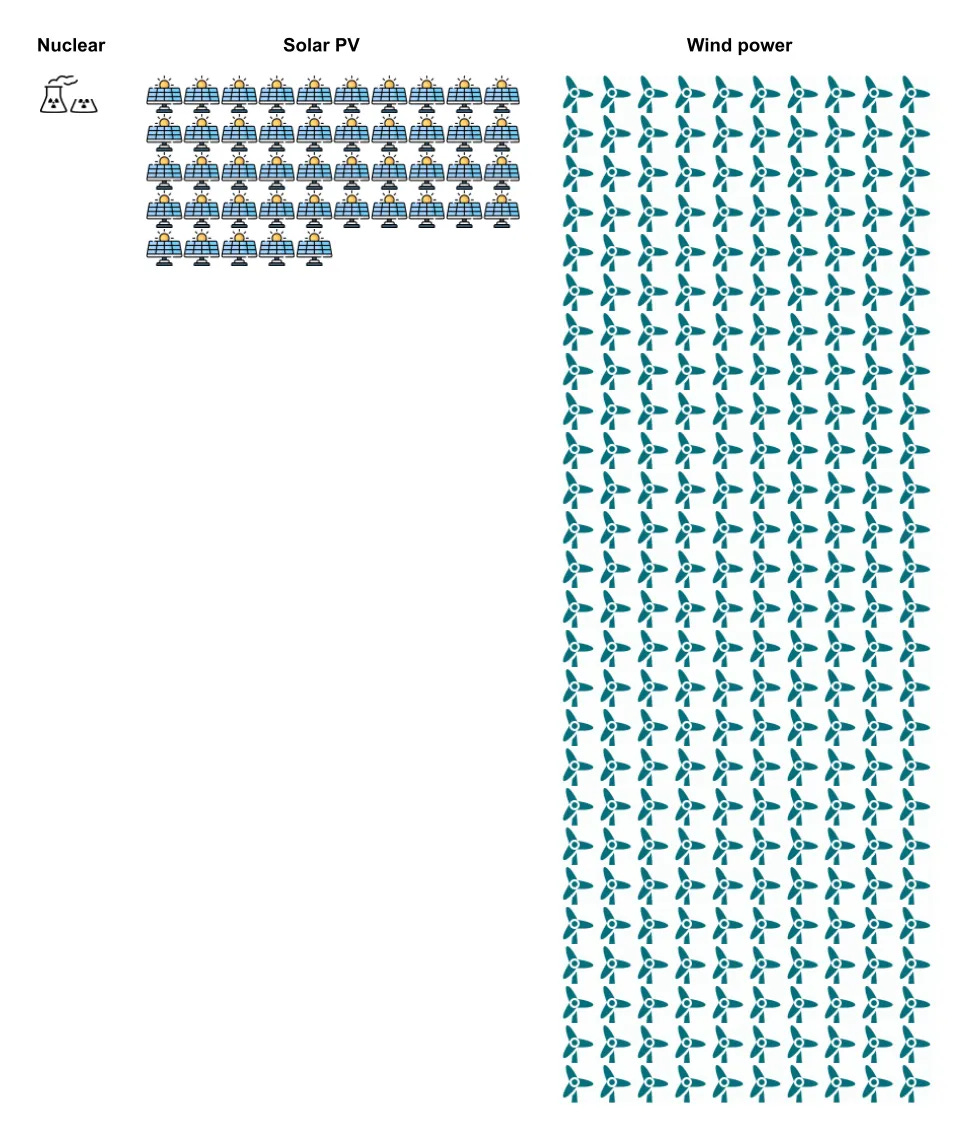

Two charts illustrate the undisputed (for a sane person) advantages of nuclear compared to renewables. The first chart represents the surface area required per TWh.

If we want to install wind turbine blades, the area required becomes downright absurd. I will compare the figures with those of Hinkley Point C NPP, which generates 26 TWh annually and occupies 430 acres. For the same output, a wind turbine plant would take up 250,000,000 acres, and a photovoltaic farm would take up 130,000.

The following chart shows the materials required per TWh.

As you can see, PV requires about 15,000 tons per terawatt hour of electricity, while nuclear requires under 1,000 tons.

Fortunately, in recent months, it has turned out that there are people with common sense. Action is being taken in Europe to revive nuclear power. Even in Germany, ideas about restarting their nuclear power stations are being raised.

However, China is the prime driver of NPP demand. This leads me to the next point: demography.

Demographics: The population of India and much of Africa is growing exponentially. Energy generation capacity must be increased to meet the population's energy needs. In addition, India is climbing up the S curve (GDP per capita passes $3,300), which means rising demand for goods and services. This population will have energy needs that must be met. Nuclear energy is part of the solution. In other words, more required energy leads to moderate uranium demand.

Political and economic fragmentation (again): As with supply, the emerging new geopolitical order impacts demand. Energy sovereignty is becoming an increasingly important factor, and it is directly related to energy independence. A country's ability to meet its energy needs independently changes its role in the geopolitical game. The more energy-independent a country is, the more freedom it has in making political and economic decisions.

Demand and supply are in noticeable imbalance. Nuclear energy and the defense sector are the primary uranium users. However, the former determines demand because it consumes significantly more uranium than the defense industry.

To recap why I believe a bull market in uranium is highly likely to stay:

Stagnant supply: lack of CAPEX for uranium projects; political and economic fragmentation; shortage of mining personnel.

Growing demand: transition to clean energy, Global South demography, and geopolitical tensions.

The catalysts

Besides structural deficit, we have a few catalysts that would deepen uranium shortage if they become a reality:

Sanctions

Sanctions on Russian uranium imports became a fact. Yet, US utilities have a window until 2028 to find our alternative supply. However, It is not only the US that can impose sanctions on Russian uranium.

The opposite is also possible—Russia imposing a complete or partial ban on uranium exports to the US. TENEX has already taken some actions in that direction. The Russian uranium exporter warned its US customers to secure waivers in May.

Despite the grace period until 2028 for Russian uranium imports and TENEX’s moderate actions, those steps show uranium’s potential as a geopolitical lever. Interestingly, the US needs more Russian uranium imports than Russia needs US utilities as customers for its uranium.

The US will try to maintain the grace period for Russian uranium imports. Meanwhile, TENEX can ban exports to the US at any time without significant repercussions. In other words, Russia's geopolitical benefits will outpace the financial cost borne by TENEX. However, that could not be said about US utilities and DoE.

Accidents

Large-scale accidents in the top five uranium mines globally. A list of the largest uranium mines is shown below (chart via WNA).

A case in point is the 2006 flooding of the Cigar Lake mine. This mine is responsible for 14% of the world’s uranium supply. Such a scenario would accelerate the already existing deficit.

Supply chain disruptions

The trans-Caspian route, shown on the map below (via Kazatomprom), is a critical lifeline for uranium exports to the EU and the US.

A latent bottleneck is a region between Armenia and Azerbaijan. The conflict between those states can further impact the uranium supply. Kazakhstan is the largest producer of uranium and is landlocked between US adversaries. Kazakh uranium passes through Azerbaijan to reach Poti or Batumi in Georgia, where it is exported to Europe and the US. Expanding tensions in the Caucasus would directly affect transportation links and uranium exports.

Production cuts

Two weeks ago, Kazatomprom announced its 2025 forecasts. FY25 production is expected to decline by about 13.65 million pounds, about 10% of the world's annual uranium production. Separately, Kazatom's AISC rose for another consecutive quarter. One reason is the unresolved sulfuric acid supply issue.

In mid-September 2023, Cameco Corporation announced 10% production cuts from the Cigar Lake and McArthur River mines. Remember, Cigar Lake produces 14% of the world's uranium. Cameco's decision removes 1.4% of the annual supply—a seemingly small amount. However, considering the shrinking supply and growing demand, this news is another catalyst pushing uranium prices higher. History remembers a similar scenario.

The best thing is that catalysts do not exist in isolation. A few can arise at any time. Let’s say Cameco announces further production cuts in September 2024, then TENEX completely bans exports to its US customers. Uranium price action in response will be wild. And this is only one of the potential scenarios.

Final Thoughts

In the long term, no market can operate in a chronic deficit. To have a balance demand between supply, one of three things must happen:

With a sudden increase in the supply, a few mines of Cigar Lake scale should suddenly appear. However, this can't happen overnight. Developing a mine takes years and sometimes decades.

A sharp drop in demand: the political decision to shut down nuclear capacity will reduce demand. This means power outages and rationing in many parts of the world. Economically and politically unacceptable. For reference, Germany.

Growing uranium price: a price below $65 a pound does not suit more than 30% of the miners. The price is currently $79.5 per pound. Prices above will motivate companies to develop new deposits, which will compensate for the shortfall in the long term. Finding a deposit with potential and turning it into a production mine takes years. The price of uranium must not just pass the breakeven level but stay there long enough.

Using the theory of constraints, the first two scenarios are (almost) impossible due to technical, economic, and political obstacles. The third scenario is the most feasible because it follows supply and demand dynamics.

Demand for uranium will continue to grow while supply will remain stagnant. If (when) some of the catalyst events enter the stage, the uranium price may reach epic levels. In my opinion, we are in the first third of the uranium bull market. So, the real fun has not started yet.

Moreover, uranium became a relatively known theme among investors. Of course, it’s not at the MAG7 level, but it’s pretty popular compared to the 2018-2021 times. At that time, there was no coverage except for niche newsletters and fancy sell-side reports. If my thesis is correct (in terms of direction and timing), Cameco may become Nvidia for mainstream nerds.

Rising investors’ attention means more capital flows. First will come the institutional investors. Uranium miners have a total market capitalization of under $60 billion. If major funds allocate a mere 0.1% of their assets to uranium equities, the latter might reach extreme valuations.

This was the first part of my adventures in the uranium universe. In the next article, I will discuss the major players on the chess board: the producers (Australia, Kazakhstan, Canada, Niger, and Namibia) and the Great Powers (the US, Russia, China, and the EU).

Links to the following chapters:

Uranium Part 2: Geography and Risks

Uranium Part 3: cycles 101 and uranium majors

Uranium Part 4: Yellow Cake in LatAm

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

I have been invested in the sector since 2020 (though mostly got in at 2021) - It is nice to hear a succinct summary of the market, at a time when I have had to unfollow almost every emotional basket case on Twitter/X in the uranium space.