About 70% of Uranium comes from the Eastern Hemisphere, while about 50% is consumed in the West.

It's time for Episode 4 of my advantages in the Uranium Universe. The agenda includes LatAm, uranium, and nano-junior caps.

When talking about LatAm, we can refer to the Portuguese and Spanish Empires. In the 15th century, the Treaty of Tordesillas divided the world between these maritime empires. Map via Wikipedia.

Look at the map above. Nowadays, the majority of uranium producers, Kazakhstan, Uzbekistan, Russia, Namibia, and Niger, fall in the Portuguese sphere of power, then. On the other hand, in the Spanish part of the world, only Canada is a significant uranium producer.

Why does uranium geography matter?

It is not about the Habsburg Empire and maritime supremacy. Nowadays, it is about energy sovereignty and geoeconomic power.

Considering global bifurcation and uranium's importance, I would look for opportunities in the Western Hemisphere. The reason is evident: the supply from the East becomes increasingly questionable.

Kazakhstan, the world's number one uranium producer, is landlocked between China and Russia. In my opinion, Kazatomprom concentrates on Moscow and Beijing's interests. Western customers are not a priority. If tensions between the Great Powers rise, I would not be surprised if Kazatom reduces or even cuts supplies for the West.

The same could be said for Namibia and Niger. The former falls in the Chinese sphere of influence, while the latter is in the Russian. Niger already revoked Orano’s permit for operating the Imouraren mine in northern Niger. On the other hand, China holds significant stakes in Namibia's uranium projects.

Only Canada and Australia are not subject to geopolitical risk among the top five uranium producers. Australia is the home of the Olympic Dam mine, one of the largest uranium mines in the world. Based on reserves, Australia ranks number one.

Canada is number three in the reserve rank list. In the coming years, a few promising projects are scheduled to come into production. NexGen and Denison Mines develop two of the largest uranium deposits, Rook I and Arrow. Both have decades of reserves and competitive AISC. The latter is crucial, especially considering the rising costs in Kazakhstan.

It’s all good for Canada and Australia, but they are not the biggest uranium consumers. The US is the leading uranium importer, but its annual uranium output looks like a statistical error. The US needs alternative supply lines. It is a matter of energy security and national defense.

In the Western Hemisphere, uranium could be sourced not only from Canada. South America has vast untapped uranium reserves.

Uranium mining in South America

South America, dubbed the Far West, has many advantages. It is the continent with the lowest geopolitical risk. The reason is simple: one religion, catholic Christianity, and two similar languages, Spanish and Portuguese, dominate the continent. LatAm has formidable oil and mineral reserves, abundant fertile land, and healthy demographics.

In summary, macro tailwinds favor LatAm. So, what about uranium in LatAm?

Argentina, Brazil, Peru, Colombia, and Paraguay have discovered uranium. Interestingly, Guyana also appears on the uranium map. Nowadays, only a few hundred tons of uranium are mined in Brazil. Argentina closed its uranium mines in 1997. Peru, Colombia, and Guyana have never operated uranium mines.

Argentina, Brazil, and Mexico currently use nuclear power. However, nuclear power is a meager part of their national energy mixes: 3% of the total electricity production in Mexico, about 3% in Brazil, and around 5% in Argentina. The three countries import uranium from Kazakhstan, Canada, and Russia. Enriched uranium, however, is still mostly imported from Russia.

Let’s say a few words about Argentina and Brazil's uranium industries.

Argentina

Argentina has three operable reactors and one under construction. The country is working to expand its nuclear energy sector further with additional reactors. The bottleneck is the lack of local uranium supply.

If Argentina develops its uranium reserves, it will reach two goals. First, it will boost its energy sovereignty by not relying on uranium imports. Second, if annual production is enough, it could become a significant exporter in the Western Hemisphere along with Canada.

The majority of uranium resources are located in Chubut and Mendoza provinces. In addition to conventional uranium resources, Argentina also possesses unconventional uranium resources, such as those associated with phosphate rocks.

Brazil

Brazil has two nuclear reactors in service. Recently, the Brazilian Ministry of Mines and Energy has expressed its intentions to expand nuclear power, but at least for now, without tangible results.

Brazil has a long history of uranium exploration. Three uranium deposits have been extensively explored: Lagoa Real, Pocos de Caldas, and Itataia/Santa Quiteria. Studies conducted 40 years ago found that Brazil holds significant uranium reserves. Some estimates say Brazil may have the eighth-largest uranium reserves globally.

Uranium has been mined in Brazil since 1982, but the only operating mine is the Lagoa Real mine, which has a capacity of 340 tU per year. Indústrias Nucleares do Brasil operates the mine.

Information about uranium mining in LatAm is scarce. I squeezed all the data I could from the WNA database, old articles from Mining.com, and a few corporate presentations. If someone among the readers knows the field, let‘s share this in the comments.

Safety instructions

Today's topic is equity uranium plays, but you will not find Cameco or Denison. Both companies are excellent LEAPS players. They have high Beta to uranium price changes, so having exposure via options adds the Alpha to the equation.

However, as equity plays, I am not excited. Especially Cameco. The company trades at high multiples and does not have significant catalysts ahead to push its share price x10.

Here come junior miners. At first glance, they are tempting. Yet, we must remember a few peculiarities about juniors:

Share dilution is a feature, not a bug (for management)

Generous compensations

Obscure reporting

It resembles the triangle of fire. To start combustion, we need a spark, oxygen, and heat. By replacing the side of the triangle with share dilution, juicy compensations, and questionable reporting, we obtain how junior miners burn capital.

More often than not, small-cap miners combine all three. Therefore, a significant percentage of mining juniors are simply uninvestable.

Therefore, use junior miners as leverage for the theme you like. I love the comparison with call options without expiration. Junior miners are call option on reserves in the ground. If those reserves are excavated one day, the option will go to DITM; otherwise, we will lose the premium.

Let’s move on to today’s contenders.

Yellow Cake in LatAm

Finding uranium miners with projects in Latin America is challenging. There are plenty of juniors exploring moose pastures in Canada. However, in South America, there are only a handful of names. Besides that, pure LatAm-uranium plays are almost nonexistent.

For example, Iso Energy owns the Laguna Salada project in Argentina as part of its global portfolio. However, Iso’s prime project is Larocque East in the Athabasca Basin, Canada. American Lithium Corp owns the Macusani project in Peru. As the company name suggests, its focus is not uranium but lithium. The Macusani project was part of Plateau Energy Metals' portfolio. In 2021, American Lithium and Plateau merged.

That said, the final contenders are:

Green Shift Commodities, GCOM

Blue Sky Uranium, BSK

Both enterprises fall into the nano-junior category because their market caps are below $10 million. This makes GCOM and BSK a call option on uranium assets. I would not treat them as investments but as extremely asymmetric bets with odds tilted against me.

The following table shows basic financial and valuation figures.

The top section shows companies’ plausible reserves calculated by the formula:

Plausible Reserves = 100%*Reserves + 50%*Measured and Indicated + 10%*Inferred

The following rows are for balance sheet numbers: market cap, EV, total assets/total liabilities, and fully diluted shares. The bottom rows compare GCOM and BSK valuations.

When discussing juniors, I like to use EV/Plausible Reserves and Plausible Reserves per share. The former tells me how much I pay per oz/lb/ton. GCOM is way cheaper because it holds $5.8 million in cash and a $6.1 million market cap. Plausible Reserves per share is self-explanatory: the higher, the better. BSK offers more uranium per share.

A few words on junior miners’ valuation. NPV and IRR are more delusional than valuable metrics when applied to junior miners. There are many reasons for this: ignoring political risk, applying low production costs, overestimating the reserve base, and underestimating CAPEX, to name a few. My all-time favorite is a discount rate just shy of US10Y. Using any discount lower than 10% for moose pasture or any exploration project is embarrassing, even for Canadian assets.

On the other hand, EV, plausible reserves, and share count are straightforward metrics without many assumptions. Therefore, they are good enough to value exploration companies.

Now let’s say a few words about every company.

Green Shift

One of the OGs of uranium exploration in South America is U308 Corp. The company explored uranium posts in Argentina, Colombia, and Guyana. In 2022, U308 changed its name to Green Shift Commodities.

To be precise, Green Shift is not a LatAm-uranium pure play. Its flagship project is Armstrong in Ontario, Canada, and the company’s focus is lithium, while uranium is in the back seat. Nevertheless, all other GCOM assets are in South America. The company has also taken the heritage of U308 Corp as an experienced explorer in LatAm.

GCOM's uranium asset is the Berlin Deposit in Colombia. In addition to uranium, the Berlin Deposit contains battery commodities for clean nuclear energy, including nickel, phosphate, and vanadium. Image via National Mining Agency Colombia.

What GCOM and BSK have in common is projects in Rio Negro Province, Argentina. GCOM recently acquired the district-scale Rio Negro lithium project in Argentina.

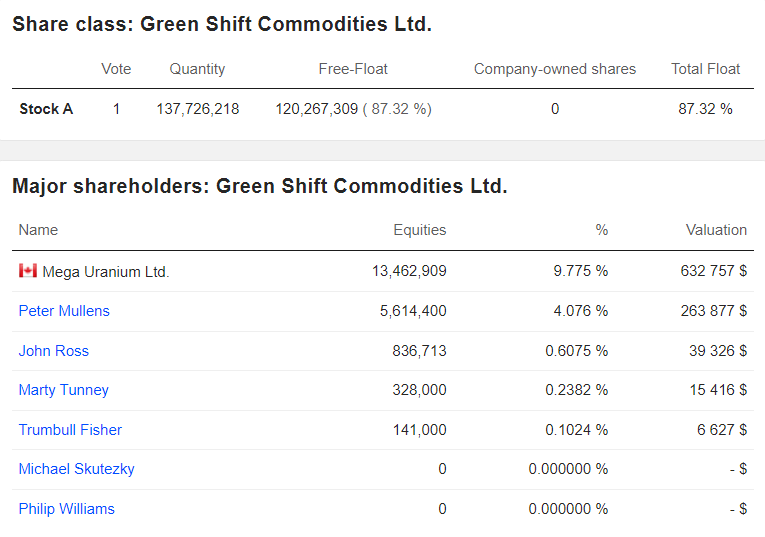

The largest shareholder in GCOM is Mega Uranium, a uranium miner with assets in Canada and Australia. Image via Market Screener.

Peter Mullerns, the company Chairman, owns 4.07% of the shares. It is disappointing that the other C-Cuiste members own a symbolic percentage of the shares.

Junior miners are like tech startups. High fail rate, packed in a promising pitch, or in that case, NIL report. Having a double-digit stake in the company you manage is a must-have for start-ups. It shows that the managers have the right incentives to act in the best way possible. Owning a tiny company slice usually means a divergence between managers' and investors’ interests.

Blue Sky

Blue Sky Uranium is a uranium & vanadium exploration company with assets in Argentina. It all started in 2007 with the discovery of a new uranium district in Rio Negro Province. Image via Blue Sky Uranium.

BSK's flagship project is Amarillo Grande, which has three significant properties, including the Ivana near-surface uranium deposit, which hosts the country's largest uranium resource. Considering Amarillo’s location and properties, the project is an excellent candidate for Argentina's first near-term uranium producer.

Over the last four years, BSK has made progress. The company drilled over 5,000m at Ivana, and as a result, a sufficient chunk of the inferred resources transformed into indicated resources.

BSK shareholders list is unimpressive. The C-Suite ownership is almost nonexistent. Image via Market Screener.

As discussed, a low single-digit stake does not guarantee that managers will act in investors’ best interest. In fact, the opposite is true.

Nevertheless, BSK is a curious proposition. It is the only uranium-Argentina pure play out there.

Final Thoughts

A long time ago, I stopped investing in junior miners. However, I love researching juniors. I learn a lot about discoveries, technological developments, and new geographies. Besides that, researching juniors (the same applies to shipping nano-caps) helps me better understand financial gimmicks.

You are probably asking yourself which stock I would pick, GCOM or BSK. My answer is no one. In my book, I play commodities with major miners' LEAPS calls. They offer junior miners upside potential with major miners' downside risk. Yet that comes at a price: the time dependency of options.

That said, juniors are the perfect tool for investors who like call options’ asymmetry but are unhappy with the time decay. Companies like BSK and GCOM match the requirements. Frankly, if I had to choose one, I would take BSK. Argentina is awakening, so investing in Argentina's mining revival is a lucrative idea.

As a reminder, bet on nano-juniors with a tiny fraction of your portfolio. Remember, the risk of losing the principal is higher than we assume.

This was the last chapter documenting my findings in the uranium universe. The next stop is the antimony mining industry.

Links to the previous articles you can find below:

Uranium Part 3: cycles 101 and Uranium majors

Uranium Part 2: Geography and Risks

Uranium Part 1: Market Overview

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Nice write up man, like you said, I’d also be very careful with Blue Sky, I honestly think it’s a proper shit co - but it won’t matter when Wall Street try to fit into any part of uranium sector they can - so an OTM call option for sure.

There are a couple of pumpers on Twitter, but to me it looks like they sold out all the upside to Ivanna meaning they’re only left with about 20% of that NPV if COEM exercise the full option from the agreement.

They’ve had to do some of the worse private placement offers (life offering) I’ve heard about in Canada, which means their warrants are off the charts with shitty brokers - these will likely continue since they didn’t get any money for the Ivanna deal.

Glad you mentioned Peter Mullens, I recently had dinner with him here anything he’s involved in is worth watching - one of Australia’s most famous geologists from his work in Argentina - Navidad deposit!

Keep up the good work!

I wrote a pretty extensive article about uranium and nuclear energy in Argentina (https://geocap.substack.com/p/uranium-in-argentina?r=1o0enm).

BSK has an attractive asset, does some further exploration in the Neuquén basin now and found an investor to bring Ivana into production.

But the dilution is just off the charts. I normally would add up to my position, but the constant dilution really makes me hesitant.

Green Shift sold its Berlin asset a few months ago, I thought? Their lithium projects are quite extensive, and I'm sure one could find something meaningful there. However, at current prices, hard rock lithium exploration in Argentina is not really interesting to me.