Uranium is back after this week's news from Russia. A potential ban on uranium exports has been on my bingo card since last September. The reason is simple: geopolitics.

And uranium is not alone. Critical minerals have become a powerful geoeconomic lever for exerting power over strategic enemies. World bifurcation is at full speed, and critical mineral export bans will become the new normal.

That being said, let’s move on today's agenda. This is Episode 3 of my adventures in the Uranium universe. After Chapter One, where I discuss market fundamentals, and Chapter Two, dedicated to top players in the game, it is time to go to an operational level. In other words, to give my answer to the question of how to ride the uranium bull?

But first, let’s discuss the basics of cyclical investing.

Cyclical investing 101

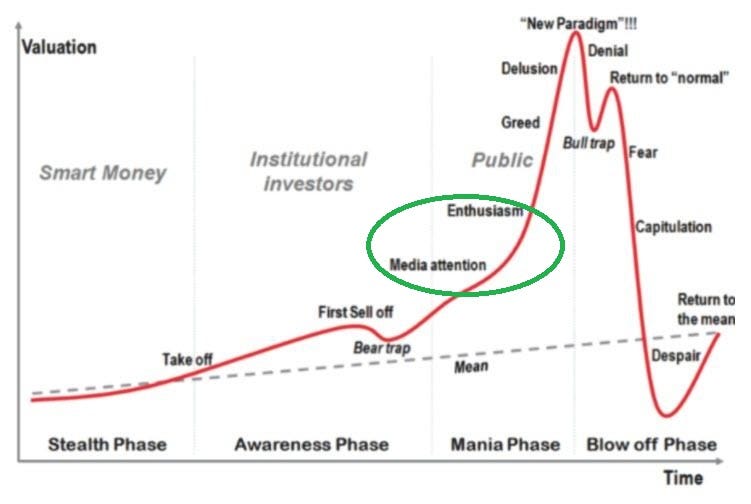

Any two cycles are not identical, yet they rhyme. In other words, they have well-defined stages with its peculiarities. Knowing each stage specification provides us with an edge. Here are the stages of any cyclical market:

Skimming the bottom or stealth phase: specialist funds only invest in the best (in their view), not the most liquid companies.

Emerging bull trends or awareness phase: institutional investors are entering the most liquid companies.

Parabolic phase or media attention: smaller institutional investors are getting into mid-cap companies and even small-cap stocks.

Mania to euphoria or blow-off phase: any company with “The New Hype Plc” in its name is bought, no matter its merits. The retail investors are joining the party. They buy from specialist funds and institutional investors who are already coming out.

First come the specialist funds. They often manage small books below $500 million AUM, giving them operational flexibility to pick small and nano-cap ideas. Among those funds are specialized companies investing in niche themes like distressed debt, shipping, uranium, etc. A common denominator is illiquidity and obscurity. Those funds provide the first injection of liquidity, leading to the first leg of a (potential) bull run. For uranium, this was the 2018-2021 period.

The small-big players are involved in the awareness phase. Mid-size generalist funds pour a small percentage of their portfolios, yet significant for niche markets. This causes another price increase. However, the bull run is far from over at that stage.

I believe uranium is between Awareness and Media attention; mid-size funds are already in the game, and media attention is emerging.

Large institutional investors are starting to pay attention to the uranium market. They will turn to the only adequate option for them, Cameco, because it is the most liquid. Kazatomprom is an option, too, for more adventurous fund managers. Next, interest will turn to major developers such as Denison, Nexgen, and Uranium Energy. The more curious among the general public get the uranium itch, so they enter the market, too. Nonetheless, retail hype is still far away.

We must remember that the uranium market is tiny compared to copper or gold. We have only two publicly traded major producers: Cameco and Kazatom. Unlike other mining segments, mid-size and emerging major producers do not exist. The next options are large project developers. Even here, the number of available names is limited to a few. The uranium industry does not have its Equinox Gold or Calibre mining. Instead, we hop from Barrick Gold straight to Caledonia Mining.

Moving down the funnel, we reach the most lucrative segment at first glance: uranium juniors. The junior universe has a lot to offer, yet the risk of failure is exceptionally high. In summary, investors have few alternatives for investing in mid-size uranium companies.

The lack of options pushes investors to venture into junior miners. However, they suffer from size issues. Junior miners are too small even for funds with a few billion AUM, which causes a considerable performance lag.

At some point, however, the uranium majors and large developers have gotten too far ahead of the small ones, meaning there is better RR in junior caps. So, smaller funds relocated capital from Cameco, Denison, and NexGen into small caps.

Then comes the next inflection point. It coincides with the media attention peak and transition to euphoria. The general public's interest will turn to all things "uranium." Then, any company with uranium in its name will be bought, no matter its qualities (or lack thereof). At this point, smart money starts to come out.

The icing on the cake will be a cover of The Economist promoting uranium investing as a generational opportunity. Barron’s last cover featured an NPP cooling tower.

However, nuances matter. The Economist scores the highest success ratio when discussing its cover utility as a predictor (in inverse). Moreover, Barron’s cover talks about nuclear power, not uranium mining. That said, use Barron’s as a soft narrative indicator, nothing more.

Dumb-smart money, i.e., the large mutual and pension funds, join the party at that stage. They are here for the momentum, extrapolating present price moves in the future. Their actions push the price north, attracting more market participants. The latter expects the price to have more room for growth, thus investing more capital. At this point, feedback loops start to reinforce each other rapidly.

Price changes become a self-fulfilling prophecy leading to parabolic moves. The reflexivity theory is an excellent guide. We have three variables: reality, our perception of reality, and the circumstances behind reality. Let’s bring them to the markets:

Reality = price

Perception of reality = current narrative

Circumstances behind reality = market fundamentals

The uranium market is an illustrious example. The narrative (perception of reality) begins to match the fundamentals (circumstances behind reality). Consequently, the new reality is higher uranium and uranium equity prices. Then, drink, rinse, and repeat…until the cycle’s blow-off phase.

The uranium cycle follows a template with a few tweaks, considering its small size compared to large mining industries like copper and gold. I expect media attention to pick up in the coming quarters, attracting more investors and liquidity to the uranium market.

Knowing how the market cycle evolves helps us with our investments. Cycle stages are signs on a map that tell us how to reach our desired destination. In the next chapter, I write about my tools of choice to bet on uranium.

How to ride the uranium bull?

My framework for playing commodities is simple. Bet on the most liquid names in the segment via LEAPS calls and get direct exposure to the asset via leveraged ETCs. I am not saying this is the best approach. My point is that this strategy fits my goals, skills, and risk tolerance. Remember, there is not one size that fits all.

I am investing via Denison and Cameco LEAPS calls. As far as I know, leveraged uranium ETC does not exist. Therefore, my opinion is limited to Yellow Cake plc.

Is it still worth it to buy CCJ and DNN calls? In my view, yes.

The tables below show CCJ and DNN call options with expiration on January 16, 2026.

Cameco Corporation option chain:

Denison Mines option chain:

The implied volatility for CCJ DOTM calls is still good at 43%- 45%, lower than the historic volatility of 55%. Of course, this is not enough to pick an option over equity. Tenor (expiration date) and strike price are crucial for the outcomes of our LEAPS trade.

Investing in the call option gives me peace of mind because I have to consider only three variables: direction, time, and volatility. Equity investing brings a fourth variable: path dependency. We have all experienced it when the price prematurely reaches our stop loss. Then, it reverses and shamelessly runs through our original take profit.

Let’s mention a few things about time. I know it sounds counterintuitive, but equity investing, too, is time-dependent. And we love to forget it.

Economics 101 could be summed in one line: resources are scarce and have alternative applications. Time is the most precious of our assets, and scarcity and opportunity cost are inherent characteristics.

Yet the majority still claim “buy and hold” is the ultimate approach and timing the market is for retards. Every legendary (value) investor times the market; only the tools they use differ.

By taking a long position in an option, we are pushed to think about time. The options' expiration date gives our trade a temporal dimension. Thus, market timing moves from the back seat into the driver's seat. We must answer the following question: When is my idea supposed to play out?

If the answer is no idea or it does not matter, investing is not our game.

I like options that expire at least after 18 months. The more days until expiration, the better. I am happy to pay high extrinsic value and suffer from time decay, knowing I can score a trade with RR>5 and be immune against path dependency.

To recap, I seek opportunities in options with expiration in 2026/2027 and strike at least 40% above the present stock price. Thus, I ensure that RR is >5 and give sufficient time for my thesis to play out.

A note on DNN’s volatility. DNN’s calls have implied volatility above 60% across all tenors. This value is far from my threshold of 40%. Despite that, I have long DNN calls. I made an exception because of DNN’s growth potential.

If uranium equities start to price market fundamentals, the DNN price will reach $5/share quicker than most investors anticipate. In November 2020, DNN traded below $0.4/share. In February 2021, the price peaked at $1.81/share, a 350% increase in a matter of months. The odds of repeating such a move in the next 24 months are significant. I would say more than 50% as a reference point. In that case, growth potential offsets the high extrinsic value I pay due to high implicit volatility. Simply, I trade a higher extrinsic value to get RR>7.

LEAPS calls on industry majors as a powerful strategy. It brings juniors’ upside potential with majors’ downside risk. Of course, this is not the only way to extract Alpha from uranium or any commodity market. Therefore, the original three episodes of the uranium series will get one more episode dedicated to equity investing in uranium.

Final thoughts

This was Episode 3 of my uranium adventures. I planned to publish a list of companies divided into categories with pros and cons. However, the plans are to be scrapped. Instead, I shared my mental framework about market cycles and how I apply LEAPS calls.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Hi Mihail, Thanks for this report. In general, I agee with your assessment that we are in the early stages of a uranium bull market. The supply/demand deficit dynamics, currently at about 40M lbs of U and growing, are too great for one not to believe that uranium prices will not rise substantially in the coming weeks and months. The past two months or so has resulted in quite a downdraft of uranium equities, some of which have fallen up to 50%. For the two equities you mentioned, DNN and CCJ, both have been hit very hard since July. DNN in particular has dropped about 45% from about $2.30 on July 12 to about $1.58 on Sep 13. I would suggest that such a drop in a well managed company under the leadership of David Cates, ready to have permitting in place next year and production start in 2027, would be an extremely attractive acquisition of the stock, not necessarily a long term call or LEAP. One is getting the stock at a relatively cheap price and one doesn't have to worry about the time value depreciation as well. One can say pretty much the same thing about Cameco. Personally, I would rather have the stock than the call, since I will own a piece of the company rather than the option derivative. Turning to Kazakhstan, with its U production problems and the more difficult transportation logistics due to the Ukraine war , Cameco has already stated that U production costs at JV project Inkai are about the same as in the Athabasca Basic in Saskatchewan. Therefore it does not make sense for Cameco to continue this JV project, given the headaches it has been receiving lately from Kazatomprom. I would not be surprised to see Cameco and its partner on Inkai, sell the project, and use the proceeds to develop a greenfield project in Canada. Kazakhstan is being pressured politically to divert production to Russia and China. It would also not surprise me to see Kazatomprom announce that they plan to delist from the London Stock Exchange and revert back to a private state-owned enterprise. In this manner they no longer have to deal with the burden of public company reporting requirements, able to make choices and management decisions better aligned with the interests of the government of Kazakhstan (also from pressure of China and Russia) rather than foreign shareholders abroad. This would certainly cause an upheaval in the uranium market. We could see another surge in uranium spot prices to $100 or more.