The shipping industry is diverse. Tankers and bulk carriers are the most popular, but that doesn’t mean they are the only ones to consider. Think about LNG and LPG carriers, containers, car carriers, and offshore support vessels.

I covered tankers (Part 1 and Part 2) and bulk carriers (Part 1 and Part 2) and discussed nanocap ideas. Now, it’s time for a trip into the LNG nano universe. The LNG write-ups follow the usual pattern: Part 1 covers market dynamics, and Part 2 reviews investing ideas.

LNG carriers supply

In shipping, the supply side is defined by the current order book, average fleet age, and shipyard availability. VLCCs, capsize bulkers, and offshore supply vessels have a single-digit order book. Car carriers, containers, and LPG/LNG carriers are on the other side of the scale. The LNG order book is at 51%, significantly exceeding the second and third in the list of containers and car carriers.

Now, let’s examine the details more closely. The following chart is from the FlexLNG presentation. It shows future deliveries and orders by year and propulsion type.

Two LNGs were already delivered in 2024, while 67 are expected to be delivered. An important detail is that 93% of all new builds are already committed. If I extrapolate that figure, this makes about five vessels available for 2024.

Another decisive factor for LNG carrier supply is propulsion. Unlike conventional cargo ships like bulkers and tankers, which rely on classic propulsion (two-stroke marine diesel engines), LNGs use sophisticated propulsion plants. These plants share some similarities with passenger ship plants, like diesel-electric installations.

Until early 2000, steam turbines were the only viable solution for propelling LNG ships. However, steamers have fallen out of favor in the last several years. The reason is EEXI, Energy Efficiency Existing Ship Index. It measures ships' power plant efficiency. Despite their advantages, like simple design, steam turbines are among the most inefficient power plants. LNG carriers with steam turbines can’t meet EEXI requirements and have been redelivered from contracts.

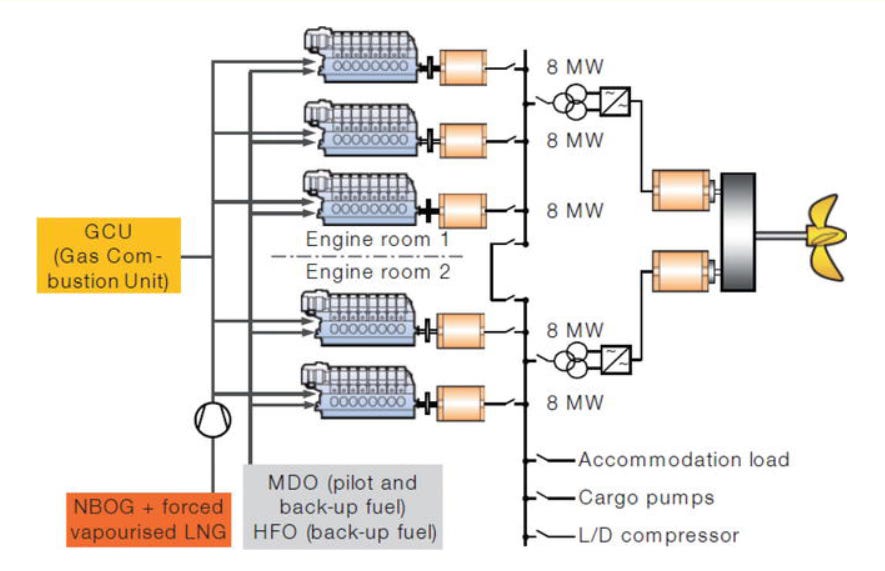

Dual Fuel Diesel Electric (DFDE) propulsion plants gained traction at the beginning of the century. They consist of four-stroke diesel engines coupled with alternators that generate electricity for electric motors that drive the ship's propeller. The graph below shows a DFDE propulsion design.

DFDE can run on HFO, MGO, or BOG, so they are sometimes referred to as TFDE. BOG stands for boiling gas. It is the losses occurring during the storage of LNG. Due to the external heat, some evaporation occurs in the cargo, equal to 0.10%- 0.15% per day. BOG is reliquefied and used as fuel for the main engines.

XDF and MEGI/MEGA have become more prevalent in the last decade. XDF means low-pressure dual-fuel diesel engine. It is a two-stroke engine that runs on HFO/MGO/BOG. MEGI (mechanically operated, electronically controlled gas injection) is an updated version of XDF. The difference is in the injection pressure of BOG. MEGA engines are the newest modification of MEGI. They are 41% of the total orders. MEGA/MEGI engines emit 40% less Nitrogen oxide (NOx emissions) than the engines running on HFO. Greenhouse emissions are also lower (by 22%) compared to HFO power plants.

MEGI/MEGA engines are more favorable than those with DFDE or steam turbine power plants. At the end of 2023, there were 709 LNGs globally and around 370 in the order book. 61 steam turbine vessels, 8.6% of the existing fleet, are expected to be redelivered in the next three years (24 only in 2024). The extinction of steam turbine LNGs will boost the demand for MEGA/MEGI LNG carriers.

LNG demand

LNG demand in Europe declined due to mild winter. On the other hand, it grew East of Suez due to cheap LNG prices. The graph below shows 1Q24 top LNG export/import shifts.

The US holds the pole position in absolute terms. However, Russia and Malaysia scored the highest YTD growth in exports.

Along with nuclear energy, LNG is vital in the clean energy transition. LNG power plants are cheaper and easier to build than NPPs. LNG has many advantages, especially in the Global South. It is the bridge between coal-fired plants and NPPs. In the coming few years, I expect robust LNG demand. Meanwhile, the big exporters are investing in CAPEX to meet the demand. The chart below from the FlexLNG 1Q24 presentation shows that we are approaching the third LNG wave.

Liquefaction capacity will grow by 300 MTPA, or 60%, over the next six years. Cool Company's last presentation provided an excellent preview of future LNG demand and its impact on LNG carriers.

LNG supply is projected to grow by 110 mtpa in only two years (2024-2026). Every mtpa requires 2-3 new LNG vessels. Simply put, the LNG demand growth rate exceeds the LNG carriers’ supply growth rate.

Unlike crude oil, where the supply grows quicker in the West, LNG exports are scattered across the globe. The top five exporters cover the world: the US, Australia, Qatar, Russia, and Malaysia.

Over the last ten years, Qatar, Russia, and the US have improved breakeven costs. The US has also experienced significant production growth due to the shale revolution. Permian Basin started to get “gassier.” Simply put, more LNG comes out than crude.

The Panama Canal is worth mentioning when discussing the US. More than 95% of US LNG export terminals are in the Gulf of Mexico. To head East, ships must cross the Panama Canal. Except for Q-Max LNG, LNG carriers can sail via the Panama Canal.

The canal was a decisive factor due to the unprecedented drought in Gatun Lake. In recent weeks, the level has increased, reaching 82.1 ft, just below the 5Y June average of 82.8 ft. As a result, daily transits have partially recovered.

Despite the easing situation with the Panama Canal, the Red Sea crisis continues to impact supply chains. LNG carriers stopped transiting via Suez/Bab el Mandeb, resulting in a decline of 90% of LNG transits.

The Red Sea will be out of the trade routes in the foreseeable future. Constrained supply chains will impact tonne-mile demand across all shipping segments, and LNG is no exception.

Final Thoughts

Unlike tankers and bulk carriers, LNG ships have a high order book. Our edge as investors is hidden elsewhere. We have to consider a ship propulsion plant. Except for ice-class vessels, steamers will go extinct, resulting in fewer available ships.

We have LNG demand tailwind in the face of energy transition and AI. Following nuclear power, LNG is another feasible alternative for clean energy production. Simply put, being long AI and green energy means long uranium and LNG.

LNG carriers are viable investment ideas under one precondition: the LNG demand growth rate must surpass the LNG carrier's supply growth rate. Given demand-side tailwinds and the impact of propulsion, I expect a strong LNG carriers market in the coming years.

Tomorrow, it's another episode of my Greek shipping wonderland adventures. The companies in question are two nanocaps (Awilco LNG and Dynagas LNG Partners) and two not-so-nano (Hoegh LNG Partners and GasLog Partners). Stay tuned.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Good overview. What are your thoughts about the use of molten salt reactors (MSRs) for maritime shipping? The MSR concept has been around since the 60's, when it was invented by Dr. Alvin Weinberg at Oak Ridge National Labs. In recent years, the MSR concept has gained some traction as a separate design for SMRs. According to the Maritime Executive, The modular molten MSR delivers up to 100 MW of thermal energy at sufficient temperature to generate steam to activate turbines, which drive electrical generators. Unlike earlier nuclear technology that has to operate continually at constant power output, the molten salt reactor can rapidly adjust its power output and adapt to external demand. A single module could deliver between 4,000 and 26,000 horsepower. A three module system connected to steam power conversion could provide sufficient power to sail the largest bulk carriers and the largest container ships (or LNG) ships economically at elevated speeds, at much reduced emission levels. Bulk carriers have to reduce speed in order to limit emissions. This would not be the case with an MSR powered vessel. I understand the Chinese have already launched an MSR-powered vessel using Thorium as a fuel. https://bit.ly/3SoipHF