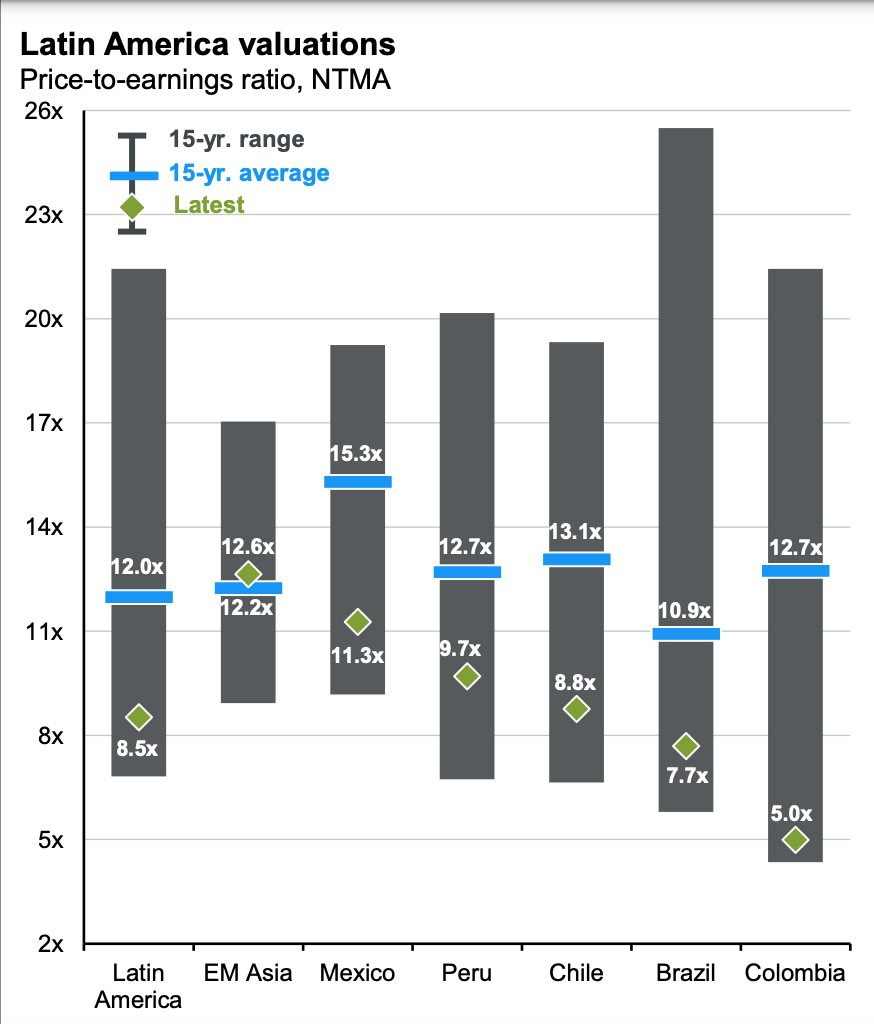

Today, I took a voyage to my favorite region as an investor and explorer, Latin America. Argentina has been one of the top themes in my portfolio for the past two years. Over the next two years, my focus will remain on South America. Along with Argentina and Brazil, I will look at Chile and Colombia. Colombian stocks are even more undervalued than Brazilian ones, as the following chart shows:

Colombian stocks are languishing at 5.0 PE NTM, 60% below the fifteen-year average (12.7) and matching the bottom range for the same period. For Colombian equities to reach their averages, they must rise by 150%. Colombia offers the most value among all the countries listed on this criterion.

South America has done the best with inflation in relative terms. Brazil and Chile have the best inflation performance in the region. Their central banks have already successfully lowered interest rates several times. Inflation in Colombia has yet to settle down.

Financial markets are not the economy; they are part of it. Let us look at how the Colombian economy has performed over the last four years. In the first quarter of this year, I expect the Colombian central bank to reduce the interest rates twice in 2024, reaching an 11.75% rate. The lower the rates, the more individuals and enterprises spend and invest. Thus, the economic wheel will start turning again at a higher rate, leading to GDP growth.

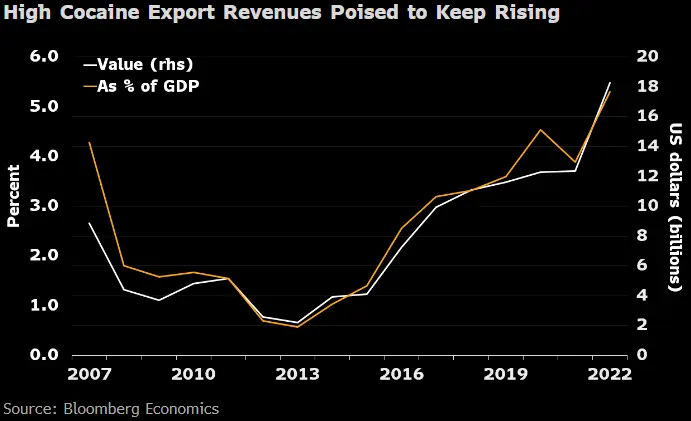

What the Colombian economy is based on - cocaine and oil. The graph below is based on officially available information. Most likely, the share of revenues from drug exports is twice as high.

Taking the cartels out of the equation, the mining and oil industries and the financial sector have been delivering strong growth over the past year. Colombia has abundant deposits of coal, oil, copper, and gold. Fossil fuels and petroleum products account for half the country's total exports.

The country holds a few aces to boost its economy: a healthy demography, abundant natural resources, and a strategic location in the middle of South America. However, is it still missing something? The catalytic event that will push the political pendulum from left to right.

We are two years from the next General Election. In my opinion, Colombian equities have already calculated the political risk, even the worst-case scenarios, such as expropriation and rampant inflation. The expectations from the next elections may attract investors' attention. An excellent case study is Argentina in 2021/2022. The investors abandoned the country. However, the most industrious market participants could foresee the potential swing from left to right.

So, I bet on the Argentine scenario for Colombia. The first leftist president, Gustavo Petro, will probably be replaced by a right-wing contender. The Pink tide from the last decade may shift to the other side of the spectrum. Javier Milei’s victory comes to mind.

I am a strong proponent of Latin America as a region with enormous investment potential. The continent has the lowest geopolitical risk rating, good demography, and plentiful resources. Adding the geopolitical shift and structural inflationary pressures, capital flows from the core (the US plus EU) will accelerate to the periphery (Global South). Colombia is perfectly positioned to benefit from such dynamics. Since the 2020 lows during the COVID-19 pandemic, foreign investors have shown increasing interest in the country.

I expect this trend to continue, with banks, mines, oil, and construction companies among the big winners. Over the next 18-24 months, I plan to make Colombia one of the main themes in the portfolio, alongside Brazil and, later, Chile.

Let's look at the following charts to illustrate my thesis: How attractive is Colombia from an investors' point of view?

Latin American banks are generally attractive, with robust Basel III metrics and improving efficiency. Moreover, they are competitively priced based on PB and PE. However, Colombian banking stocks are some of the cheapest among LATAM banks.

The following chart shows how cheap Ecopetrol, the national oil company, is. The company trades at bottom valuations compared to its 10Y averages, Global Energy, and Global Equity.

Tomorrow, I will drop another article on one of the most esoteric niches in the energy midstream segment. Stay tuned.

One of the monthly stock picks for 2024 is a Colombian stock with excellent financials and huge growth potential that trades at bottom valuations.

If you enjoy exploring obscure investing ideas, consider The Old Economy paid subscriptions. To find out what you miss, please visit the ”Test Drive” Section.

Good one! I am long $GPRK and $ CIB. Chile and Brasil both Very cheap.