Elections, material constraints, and gold

Before it gets worse it will get better

November 5th is the D-day of the year and probably of the decade. The election outcomes will predetermine the course of the US long-term (geo)political policy.

Elections are not discrete events. They are another link in the unfolding timeline. They are cause and effect simultaneously. The election’s outcome marks another phase transition. What does it mean?

Any complex system shifts between four states:

Stable balance

Unstable balance

Stable imbalance

Unstable imbalance

The US political system is in an unstable balance phase. November 5th results will determine which direction the system will take:

Unstable balance or keep status quo

Stable imbalance, internal political strife

Unstable imbalance, mass-scale civil unrest

Do not treat the scenarios in isolation. Number one can lead to two or directly to three. In other words, every bullet point represents a discrete point of a timeline.

This is a reminder that political order is a self-emerging social system. The sum of the parts is higher than the whole. Predicting outcomes and attributing precise probabilities is a fool's errand. What we can do is create a map.

To draw our map, we have to start with the landscape, i.e., the most significant objects that act as constraints.

Material Constraints

Material constraints result from the present and past political decisions. Thus, they define the limits of the game. As Marco Papic says:

Our preferences are optional and subject to material constraints, while the material constraints are neither optional nor subject to our preferences.

So, what are the US political system constraints now:

Ever-growing debt and budget deficit

Increasing internal political division

Transition from unipolar to multipolar world

Structural inflation as a higher-order consequence of the above

Those four variables are here, and game participants do not have the power to change them rapidly. Political players can ignore them, but the cost of a decision is unbearably high. This is not to say Harris or Trump will act most rationally. I guess their actions will swing between rational irrationality at best and irrational irrationality at worst.

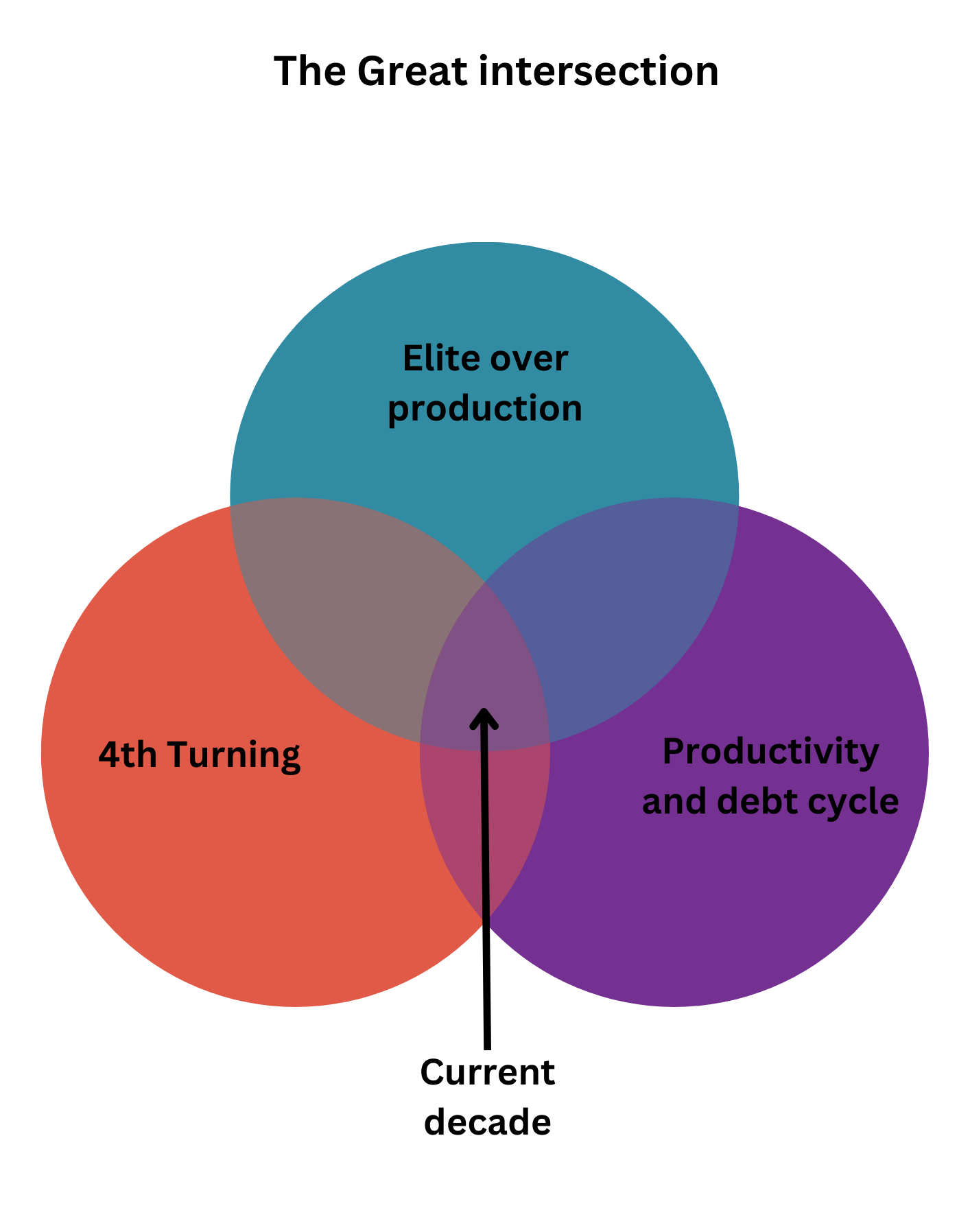

Every mentioned constraint is a symptom of our place in the macro-historical picture. In the 2020s, a few macro cycles reach inflection points:

The Fourth Turning, described by Strauss and Howe

The Elite Overproduction cycle described by Peter Turchin

Long Term deb cycle described by Ray Dalio

Their convergence point I call it The Great Intersection:

More on the macro-historical cycles can be read here.

The four variables—debt, division, multipolarity, and inflation—determine the game's material constraints. Regardless of who wins the elections, he or she must play according to those limitations.

However, there is an important detail. One of every several political games is won by individuals who do not care about material constraints. Such people live in the realm of ideas disconnected from physical reality.

A case in point is communist regimes. The rulers ignore the tangible world and take preposterous measures with horrendous outcomes. Think about Maoist China and the “Smash Sparrows Campaign.”

Eurasian tree sparrows were targeted because Mao believed they ate grain seeds, depriving people of food. This belief was based on an incomplete understanding of the sparrows' diet and ecological role.

The campaign was widespread and effective. Estimates suggest that hundreds of millions of sparrows were killed; some sources cite up to 1 billion.

Typical for every authoritarian regime is to create contests with perverse incentives. That story is not an exception. The government held contests and rewarded individuals, schools, and organizations that killed the most sparrows.

The consequences struck. The near extinction of sparrows led to a severe ecological imbalance. Without sparrows to control their population, insects like locusts multiplied rapidly, causing massive crop destruction.

The outcome was a widespread famine. The ecological disruption caused by the sparrow campaign, combined with other factors of the Great Leap Forward, contributed to the Great Chinese Famine from 1959 to 1961. Estimates of the death toll range from 15 to 45 million people.

The probabilities of the communist US scenario are neither too low to discard nor too high to estimate precisely. In conclusion, a scenario where the Democrats go full Marx has a probability below 20%. This figure does not imply the odds are one-fifth precisely. It is a reminder that political absurdities are among the possible outcomes, so we can not neglect them.

Democrats going hard-core commie falls into the category of known-unknown scenarios. For today’s article, I will focus on boring scenarios based on material constraints—in other words, known-known scenarios.

Potential Scenarios

Every outcome will impact the following:

The US internal politics

The US foreign affairs

The US financial markets

This is the simplistic view. In reality, the US election will affect global politics and markets. However, magnitude and intensity will differ depending on the winner.

In the next few paragraphs, I will present my limited, biased, and probably incorrect view of (geo)politics and markets.

Internal politics

Harris's win is the only scenario that may lead to the worst outcome: the US becoming a communist state. I bet Harris and her handlers will test how susceptible the population is. Nevertheless, they will face fierce resistance. This means a more profound division between blue and red states.

Unlike the majority of communist-raped countries, the US population possesses guns. This makes a huge difference.

This is a kind reminder of Western Europe's present state of affairs. A disarmed, conformist, and anointed society will accept anything politicians throw at it. Moreover, nothing can deter the elites from taking an authoritarian stance disguised as a protection of democracy.

Gun ownership was like nukes during the Cold War. Every player, the USSR, and the US knew the other could destroy him, so both respected each other's limits. The same is true with armed populations; the government knows, or at least is supposed to know, that after a certain point, the population can retaliate.

Treat gun ownership as another material constraint that limits all political players to taking extreme measures. One more reminder: a limitation does not equal eliminating such a scenario; it just reduces the probability of it happening.

Foreign Policy

Foreign policy will differ between Democrats and Republicans. Harris will maintain hawkish politics, which means proxy wars will intensify and multiply. Conversely, Trump may take another route, (slightly) reducing hot wars and instead focusing on measures like tariffs and export restrictions.

One commonality is that both candidates will continue the trade war with China. Harris is expected to take a softer approach, while Trump is expected to be more decisive.

In summary, global fragmentation and trade wars will continue despite who wins. What does it mean for the economy and markets?

Structural inflation. Financial markets love it.

Markets

To understand where the equities are going, we must look at bonds. I love the following quote from James Carville:

"I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a 400 baseball hitter. But now, I would like to come back to the bond market. You can intimidate everybody."

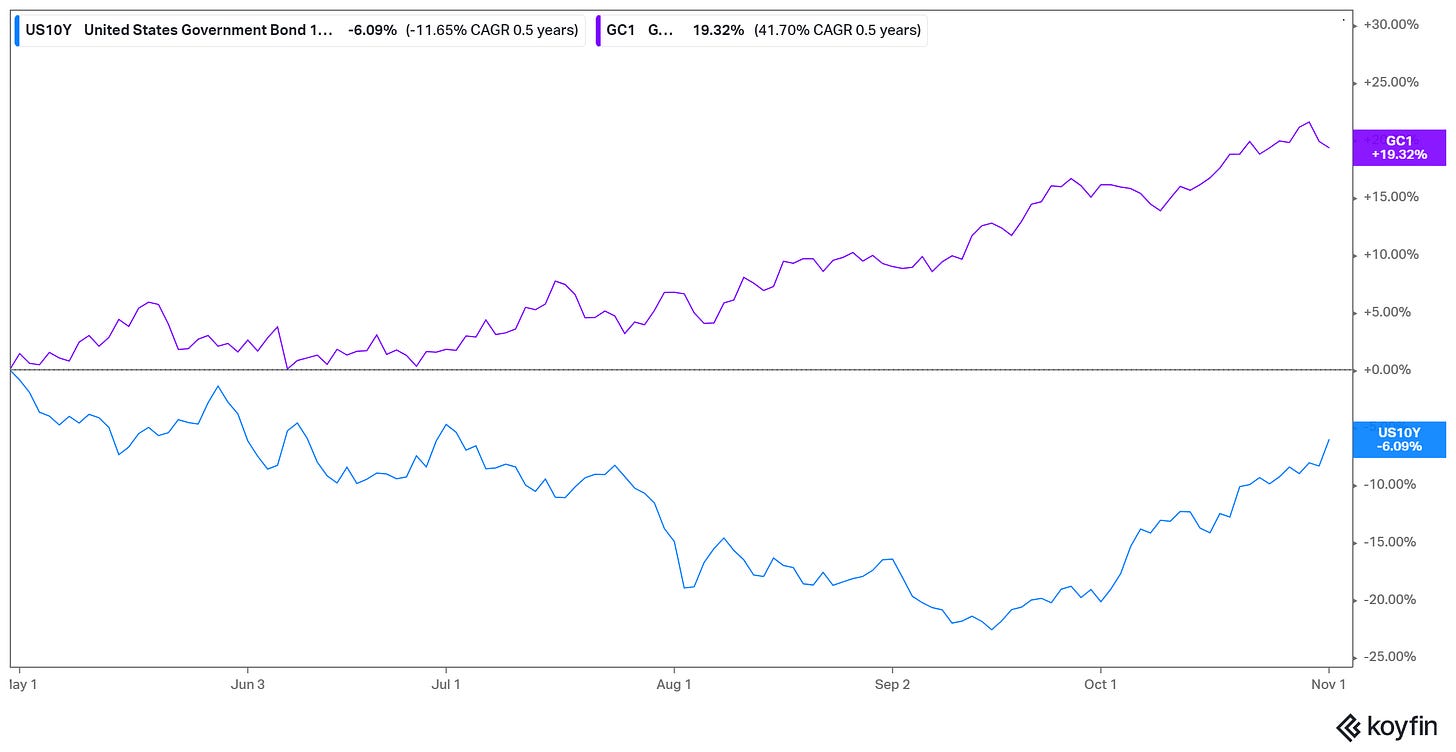

Look at the US gov bond yields. US10Y increased above 4.3% after the first rate cut in September. The US10Y tree monthly chart tells an interesting story.

Price action shows confirmed breakout and completed bottom. The odds of yields going higher are not to be ignored. The MOVE index confirms my observations.

Bond volatility has risen due to election uncertainty. The MOVE index measures implied yield volatility with an approximate 1-month duration. The MOVE has a close relationship with treasury market liquidity. Rising MOVE indicates potential issues with liquidity. The lower the liquidity, the lower the bond prices and the higher the yields.

The bond markets reflect not only election outcome uncertainty but also post-election disorder. Regardless of who wins with high confidence, I can say that elections will bring chaos—how intense and for how long we have to see it.

If Trump wins, Democrats will do everything possible to discredit him. The same is true for Republicans if Harris wins. However, the mainstream media is owned by Democrat donors. So, if Trump is the victor, I expect the MSM to be used as a tool of division. Marches, protests, and strikes against Trump will become a norm.

This is not to say the markets will tank. Counterintuitively, financial markets can thrive amid political uncertainty and structural inflation. Turkey is a case in point.

A nerdy note: The Iranian equity market has increased by over 1,000% since 2020.

When inflation and disorder rules, people run for assets as shelter from currency devaluation.

That said, I am a careful bull for the next two months, regardless of who wins. Both parties will keep the printer in BRRR mode. Market participants are well-trained Pavlov dogs responding to FED stimulus. I expect volatility in the recent weeks and then the market to continue to head north.

In the longer term, I am bear(ish). I mean a deeper correction in the next six months, not a trend reversal. Before it gets worse, it will get better.

Final Thoughts

Next week, I expect turbulence across all markets. Gold and yields will probably head north until the fog of war settles. After mid-November, I bet broad markets will continue their bull trend until the end of the year.

How to play an increasing uncertainty? Simply, stay long chaos. In its purest form, this means long gold.

One of the most resilient correlations broke in 2024: gold vs treasury yields. The following graph illustrates the gold/yield performance as a function of growing uncertainty.

All scenarios are probably wrong. Treat today’s article as a map, nothing else, because the map is not the territory.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Full disclosure: I do not hold a position in any mentioned companies when publishing this article. Note that this is a disclosure, not a recommendation to buy or sell.

Excellent analysis!! Thks much!!