Banks are the superconductors of the economy. They are the first to sense ongoing political and economic change. This heuristic is particularly useful when considering investments in emerging markets. Latin America and its abrupt political changes are a notable case for banks as a leading indicator.

Think about Argentina at the beginning of the decade, when its capital markets were left for dead. The potential change was in the air, and shares of local banks, including Grupo Glaicia (NYSE: GGAL), Banco Macro (NYSE: BMA), and BBVA Argentina (NYSE: BBAR), began to move earlier.

Argentine equities are already in the middle of the cycle. So, the risk-reward is progressively diminishing. On the other hand, Brazil, Chile, Colombia, and Mexico bring significant upside potential at limited risk.

This is TheOldEconomy June LatAm edition. Today, the focus is on the banking industry in LatAm, and Colombia in particular. Since the last edition, Latin American equity markets have continued to perform well.

Mexico and Peru are leading the pack, with 12.6% and 9.5% gains. The YTD winner, Chile, is taking a breath.

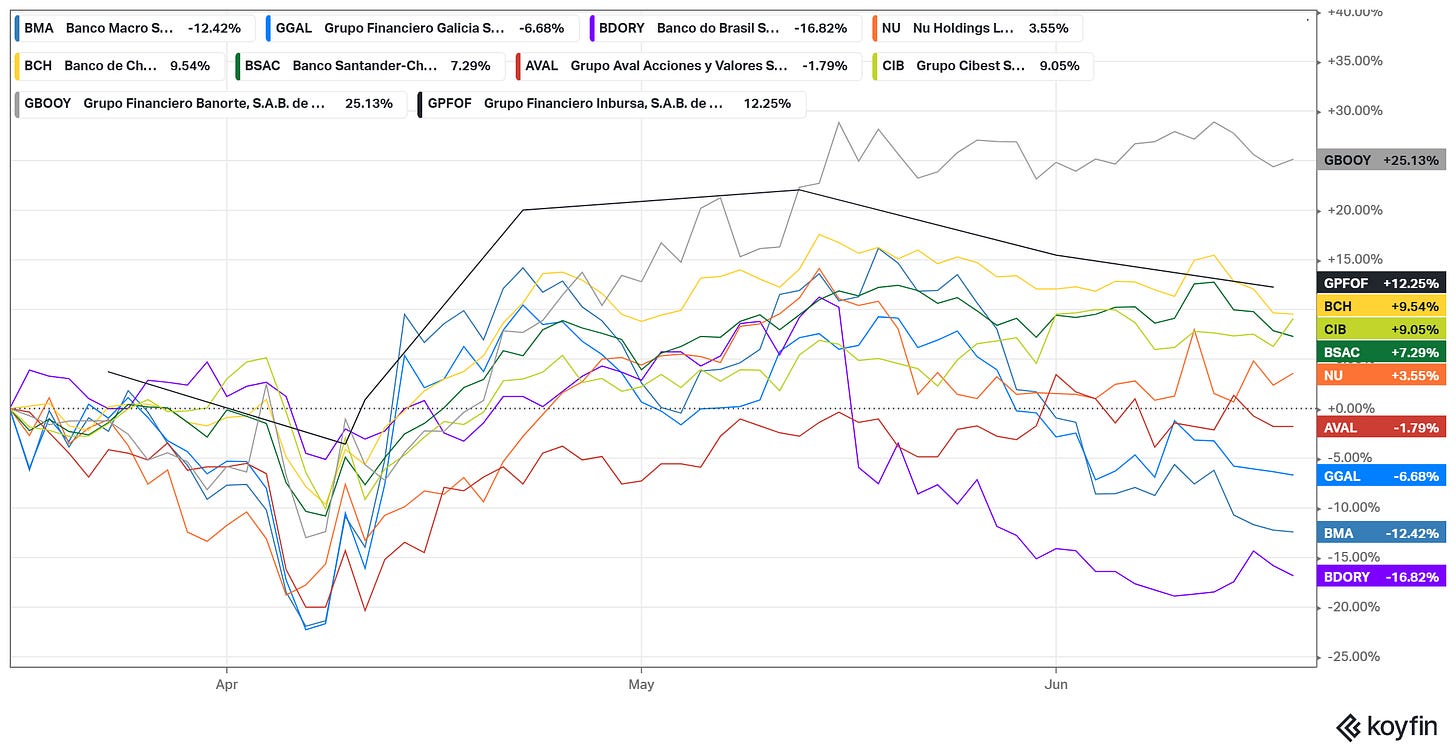

Digging deeper, the best-performing banks in the region are the Mexicans, Grupo Financiero Banorte (OTC: GBOOY) and Grupo Financiero Inbursa (OTC: GPFOF), followed by Banco De Chile (NYSE: BCH).

Argentine banks are falling behind. As pointed out earlier, Argie equities are in the second half of the cycle; hence, increasing volatility and extended corrections are the norm.

Brazil and Colombia are among the most undervalued markets as measured by EV and Price multiples. For value hunters, Brazilian and Colombian banks are bargains.

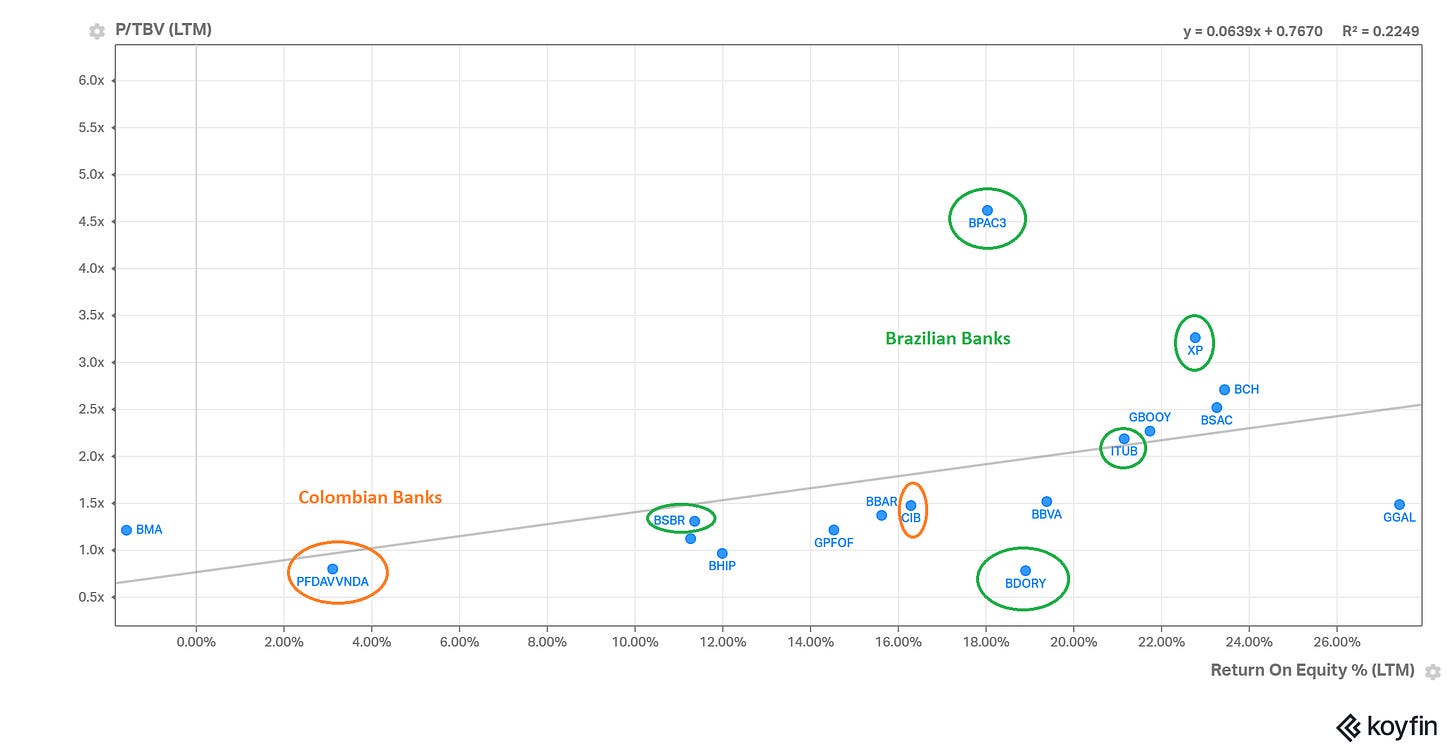

Based on P/TBV and P/E, Colombian banks, along with Banco do Brasil (OTC: BDORY), are trading at the lowest multiples, offering attractive risk-reward.

Let’s examine the TBVS (Tangible Book Value per Share) growth and ROE relationship.

TBVS's growth and return on equity (ROE) are highly correlated. The higher the TBVS’s CAGR, the higher the ROE. Lastly, there is the relationship between ROE and PTBV. The chart below shows major LatAm banks' ROE vs P/TBV:

As shown, banks with higher ROE tend to command higher PTBV. Higher returns suggest that the bank will remain profitable, reflected in stock prices and valuation multiples. Investors are happy to pay a premium for robust TBVS growth.

Colombian banks are not the best performers based on ROE and TBV. Nonetheless, (profitable) investing is not only about robust fundamentals. Fundamentals are part of the triad: reality, circumstances, and narrative. In financial parlance, paraphrased: price, fundamentals, consensus.

Abrupt political shifts, typical of South America, can switch the narrative in a matter of weeks. Colombia is an illustrious case. The first leftist president, Gustavo Petro, is losing popularity at an impressive rate. As per a recent article:

The most recent poll published by the CELAG exposed negative results for the left-wing mandatary. According to the survey 57,2% of Colombians disapprove Petros’ presidency and corruption scandals keep playing a major roll-on Colombians perception when referring to the current government.

The polls are showing head-to-head competition between a pro-business candidate, Vicky Davila, and a center-left candidate, Gustavo Bolivar. Chart via AS-COA.

Bolivar, who previously served as a senator and now heads Social Prosperity, tops the preference list with 12.6% support. Journalist Vicky Davila ranks second with 11.6%, while former Antioquia governor and previous presidential contender Sergio Fajardo follows closely with 11.4%.

I have said multiple times that Latin America is the region with the lowest geopolitical risk. But what about internal political risk? Internal affairs, on the other hand, never disappoint.

Two weeks ago, Colombian presidential candidate and senator Miguel Uribe Turbay was the target of a high-profile assassination attempt during a campaign rally in Bogotá. Uribe, a prominent opposition figure and member of the right-wing Centro Democrático party, was shot in the head by a 15-year-old assailant while addressing supporters. The attack occurred as Uribe was campaigning to become his party’s candidate for the 2026 presidential elections. He remains in critical condition in intensive care.

The assassination attempt is an indication of rising political tensions between the left and right. Despite the strong popularity of pro-business candidates, the left wing still has a chance to win the next elections in March 2026.

If a pro-business candidate wins, it's good for investors. But if another leftist president takes the helm, disaster. For now, Colombian banking stocks have signaled a long-anticipated change. Whether it will become a fact, time will tell. The odds and payoffs are skewed in investors' favor.

Colombian banks offer one hidden bonus: they give exposure to Central America. The image below (via Bancolombia 1Q25 presentation) shows CIB's presence in Central America.

Its subsidiaries are among the largest banks in Panama, El Salvador, and Guatemala. Direct investments, except in Panama, are almost impossible for retail investors to make. Colombian banks solve that issue.

A drawback is the handful of Colombian names available for trading in the US and the EU. The limited number of ADR leads to a lack of attractive options. In summary, to invest in Colombia, we have a few banks at our disposal: Grupo Cibest (formerly Bancolombia) and Grupo AVAL are listed via ADRs in US markets. Banco Davivienda is not available via ADRs. However, for income-oriented investors, banks offer attractive perpetual bonds (ISIN: USP0R11WAG52) with a 6.65% coupon and a 7.3% yield at the current price of 90.00 cents on the dollar.

PS: For more actionable and asymmetric ideas on critical minerals and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described on this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Great insight! Banks really do act as early barometers for political and economic shifts, especially in volatile regions like Latin America.