Shipping is the lifeline of the global economy. Choke points, such as straits and canals, are the world’s economic throttle valves. They regulate the flow of goods, energy, and minerals moving from producers to consumers. Blocking one of these valves leads to a cascade of effects.

Here is the map of the major choke points (via EIA):

Last week, one of the chokepoints has taken center stage: the Strait of Hormuz in the Persian Gulf.

According to the talking heads on TV, a blockade of Hormuz was imminent. Even a partial blockade would have extremely high geopolitical and, therefore, geoeconomic costs for Iran.

Here are some of the arguments why closing Hormuz is not as simple as the media describes:

• By closing Hormuz, Iran would block its own economy, which is dependent on exports of fossil fuels and fertilizers. And not only that—a massive proportion of consumer goods for the Iranian population also enter through Hormuz. It is no coincidence that the strait is called “the lungs of Iran.”

• Iran shares the Persian Gulf with some of the major exporters of gas, crude oil, and petroleum products—Kuwait, Iraq, the UAE, Saudi Arabia, and Qatar. The exports of these countries depend to a large extent on the state of the Strait of Hormuz. Accordingly, its blockade would not be welcomed by these countries. Its closure would turn Iran into an even greater outsider in the region.

• Countries that depend on oil imports from Iran, such as China, would also not be among the happiest with such a decision.

• Iran is de jure a unitary presidential republic, but de facto it is a theocracy. The Iranian president and parliament are more decorative than functional institutions with power, especially over decisions concerning Iran's foreign policy. Key decisions are made by the Guardian Council, a religious institution created by Ayatollah Khomeini after the 1979 revolution. In other words, the final decision on whether or not to close the Strait of Hormuz will be made by the Guardian Council, not on the basis of the vote taken five days ago.

• Part of the Strait of Hormuz falls within the territorial waters of Oman. Therefore, completely closing the strait would mean entering Omani territory.

One image tells it all (via EIA):

Statistics from the last 46 years tell a curious story. Iran has systematically used the Hormuz rhetoric more than 10 times and has never closed it.

In conclusion, I do not rule out the possibility of a future closure of the Strait of Hormuz entirely. These paragraphs serve as a reminder that this would be much more difficult and costly for Iran than it may initially appear.

Even the sharp rhetoric about closing the strait is enough to provoke volatility in energy prices and shipping rates. Crude oil tankers and LNG carriers, in that case, would be the most affected.

This is the June Shipping Market Report. In May, I discussed the crude oil tanker market. Today, it is time to examine the other energy transportation segment – LNG carriers.

The connection between LNG carriers and the Strait of Hormuz is more than obvious. Qatar is one of the largest LNG exporters, currently ranking third behind the US and Australia. Accordingly, Qatar Gas Transport Company Limited (Nakilat) owns one of the largest fleets of LNG carriers.

Unlike crude oil tankers, the LNG tanker market is demand-driven. The demand for such ships is growing at a faster rate than the supply. To illustrate the abundant supply, the order book for LNG carriers exceeds 50%. A short-term disruption in demand for LNG carriers will have a dramatic impact on day rates.

The market is feeling the delicate balance between supply and demand, and rates for the latest generation of LNG carriers with MEGA/MEGI engines are lower than in previous years. Chart via Cool Company.

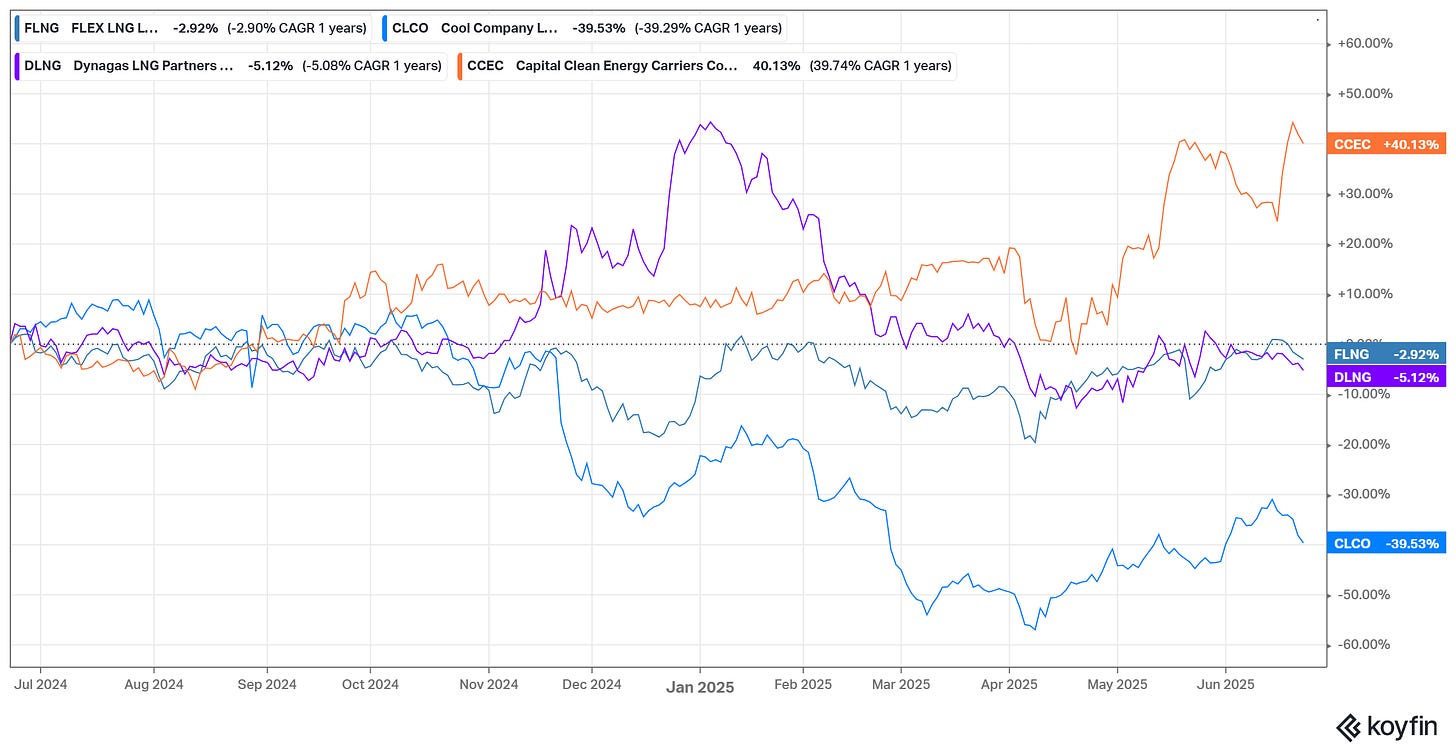

The shares of companies in the segment have been among the losers over the past 12 months.

The selection of companies that focus solely on LNG carriers is limited: Cool Company (NYSE: CLCO), FLEX LNG (NYSE: FLNG), Dynagas LNG LP (NYSE: DLNG), and Capital Clean Energy Carriers (NYSE: CCEC).

Only CCEC has achieved impressive growth over the past 12 months. Until recently, it operated a fleet of container ships and LNG carriers. In mid-2024, the company decided to focus on energy transportation and began ordering new gas carriers, while also selling its container ships.

The performance of its shares indicates that the market is betting on the company's successful transformation. I admit that I was skeptical about CCEC's attempt to enter a market that was already saturated. However, Mr. Market decides.

In this case, Mr. Market likes that CCEC is ordering the latest generation of ships, equipped with MEGA/MEGI engines. These are the most efficient engines suitable for LNG carriers. Vessels equipped with such engines are economically competitive compared to older generations with steam turbines or diesel electric propulsion.

The details matter. For example, FLNG has the most modern fleet in the group, which is reflected in the company's share price—it is performing relatively well (or less poorly) compared to its competitors.

The big loser is CLCO – the company owns ships that are neither here nor there. About 20% of its fleet consists of the latest-generation gas carriers. The remaining vessels are not the oldest (ships equipped with steam turbines), but they are old enough (ships equipped with diesel-electric propulsion) to start losing competitiveness.

DLNG is the hidden gem in the group. The company owns six ships, three of which are equipped with steam turbines, and the other three have diesel-electric propulsion. Despite its outdated ships, Dynagas is performing adequately, given the market situation. The reason is that five of the vessels are ice-class.

They transport gas along the Northern Sea Route (NSR) from the LNG terminals in the Yamal Peninsula to consumers in Asia. In recent years, the NSR has become a vital trade route, stimulated by geopolitical tensions between East and West. The following map compares shipping routes via the NSR and the Suez Canal.

Twenty-one Arc 7 ships (the highest ice class ships) are needed to meet the growing demand for LNG carriers transporting gas from Yamal to Asia. However, most of the existing ice-class fleet is already under long-term contracts.

How many ice-class LNG carriers are there in the world?

There are approximately 23 Arc 7 ships, along with a few vessels with lower specifications. Here is a table with all existing ice-class LNG carriers. Chart via the Author’s archive.

Dynagas ships are 1A FS ice class. This classification is almost identical to Arc 7 standards.

The driver behind the growing global demand for LNG carriers is the increasing role of gas as an energy source. The chart below shows the rising importance of LNG (via FLEX LNG).

So, how can we capitalize on this trend?

DLNG or FLNG, I would say.

The FLNG chart looks tempting. The price has been moving in an extended range.

A potential breakout above the upper limit could mean impulsive movement.

DLNG comes with significant geopolitical risk. Five of its six ships are chartered by companies affiliated with Gazprom. For now, the risks of sanctions being imposed on Dynagas ships are low, but far from zero. In the event of a potential escalation in Ukraine, LNG tankers are a prime target for sanctions.

Unlike the dark tanker fleet, the number of Arc 7 ships is small, which makes it easier to impose sanctions. Russia exports approximately 130 billion cubic meters of gas annually. 32% of this is transported by ship and 67% by pipeline. Yamal is the largest terminal for seaborne LNG exports. Its capacity is 24.19 billion cubic meters, or almost 18% of total exports.

Sanctioning Yamal appears to be a high RR idea for those imposing the sanctions (the US and the EU). With little effort, they could cause significant damage to Russia's revenues from natural gas exports. The easiest way to do this is to force restrictions on ice-class LNG carriers. This indirectly reduces the capacity of Russian LNG terminals and, consequently, the revenue generated.

In conclusion, FLNG is the better option, as the company offers an optimal risk-reward balance, considering the qualities of its fleet, price action, and geopolitical risks.

PS: For more actionable and asymmetric ideas on LatAm and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described on this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.