The copper looming deficit as asymmetric investment opportunity Part 1

The holy trinity of copper deficit: declining ore grades, lack of significant discoveries, and shortage of mining engineers

The Grasberg mine in Papua, Indonesia, is one of the greatest engineering miracles of the last century. It is one of the largest copper mines globally, located above 4000 meters altitude in a region with nonexistent infrastructure. Developing such a project is a remarkable endeavor. The company behind it is Freeport McMoran (FCX).

Freeport is among the largest producers of copper. In addition, the company mines gold and molybdenum. Gold mining contributes 13.3% of revenue, and molybdenum mining contributes 5.8%. Besides Grasberg, FCX has other Tier 1 mines: the Morenci in Arizona and Cerro Verde in Peru.

FCX has excellent financial metrics and better CAPEX ratios than its peers. In addition, it offers attractive LEAPS call options expiring in more than 12 months. Even under conservative gold and copper price assumptions, FCX is highly undervalued and provides an ample margin of safety.

The FCX thesis represents my favorite approach to investing: event-driven macro combined with LEAPS options. I am looking for an event whose occurrence may cause a phase change in the system, i.e., a parabolic price growth. I use LEAPS options to exploit the bet's asymmetry.

I divided the publication into two parts. The first presents my copper thesis, while the second dissects Freeport financials and explains my approach with LEAPS calls.

Why copper?

Three factors contribute to the growing copper deficit: lack of significant discoveries, steadily declining ore grades, and an increasingly apparent shortage of mining engineers.

Lack of discoveries

The material foundations of industrial civilization are oil, copper, and iron ore. Without one of these components, our world can not exist. Today, we will talk about the copper. The entire extraction and processing sector suffers from supply destruction, and copper mining is no exception.

Copper combines characteristics that make it almost impossible to replace with another metal. The mind-blowing quantities required, its low cost, and its exceptional conductivity make it irreplaceable for now.

Rare earth elements are sought after for their specific qualities but are not used in quantities such as copper. Moreover, in recent years, their substitutes have been successfully developed. Unlike copper, rear earths are used in minuscule quantities; thus, implementing alternatives is relatively easy.

The alternative to copper must meet the following conditions: abundant quantities, high conductivity, and low cost. Silver is the only metal with a higher conductivity than copper (about 15%). However, its price is tens of times higher than that of copper. Silver's slightly higher conductivity cannot compensate for its many times higher price.

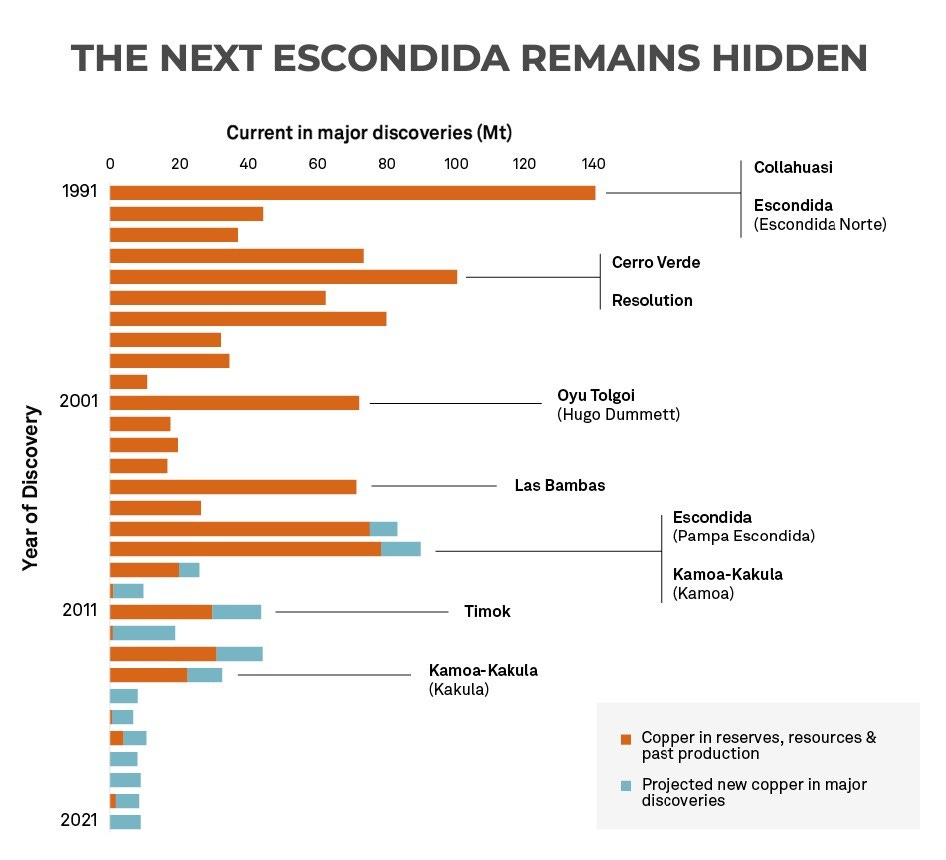

This does not mean we must stop looking for a better alternative to copper, but we must develop new copper deposits in parallel. In the graph below, we can see that these are almost disappearing.

The Escondida mine in Chile is the largest operating copper mine in the world. It was discovered in the 1980s and began operating in 1991. Several significant discoveries have since been made but on a smaller scale.

Only the Kamoa Kakuala mine in the Republic of Congo is worth mentioning for its exceptional grade and huge reserves. However, even Kamoa will not be sufficient to meet the ever-increasing demand for copper.

In 2022, the world needed 24 million tonnes of copper. The World Bank estimates that by 2030, it will need 30 million tonnes. 2025 is expected to be the first deficit year—more copper will be consumed than produced. And most probably, it will not be the last.

The gap between supply and demand is widening. The demand will steadily grow while supply stagnates and even falls. Discoveries, such as Escondida, are increasingly urgent.

From the exploration phase to the first production, it takes over ten years. At best, this period can be shortened to 7-8 years. This means that even if deposits containing enough copper are found today, they will start production after 2030 at the earliest.

Declining ore grades

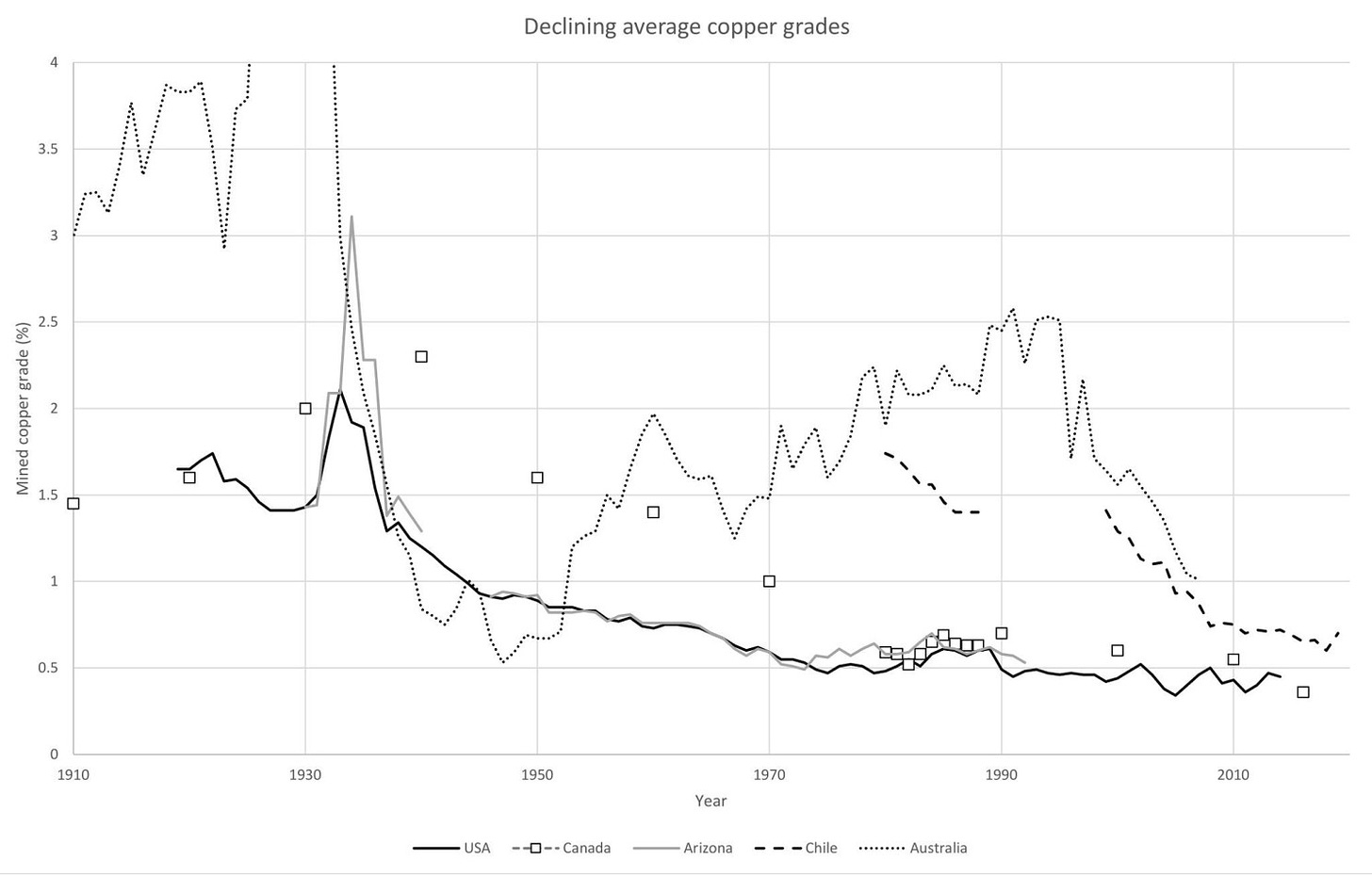

The second reason for the stagnating supply is the declining ore grades, as seen in the chart below.

Ever-declining copper ore grades undermine the future supply. Ore grade determines how economically viable it is to extract and process the ore.

The Cut-off grade describes the relation between cost per ton and ore grade. It indicates the minimum concentration that makes ore extraction economically viable. The price of copper contained in one ton of ore must exceed the cost of extracting and processing it.

Cut off grade > extraction and processing cost per unit/spot price per unit

The lower the ore grade, the higher the metal extraction cost. Consequently, the cut-off grade also grows. At one point, the deposit becomes uneconomical relative to the current spot price.

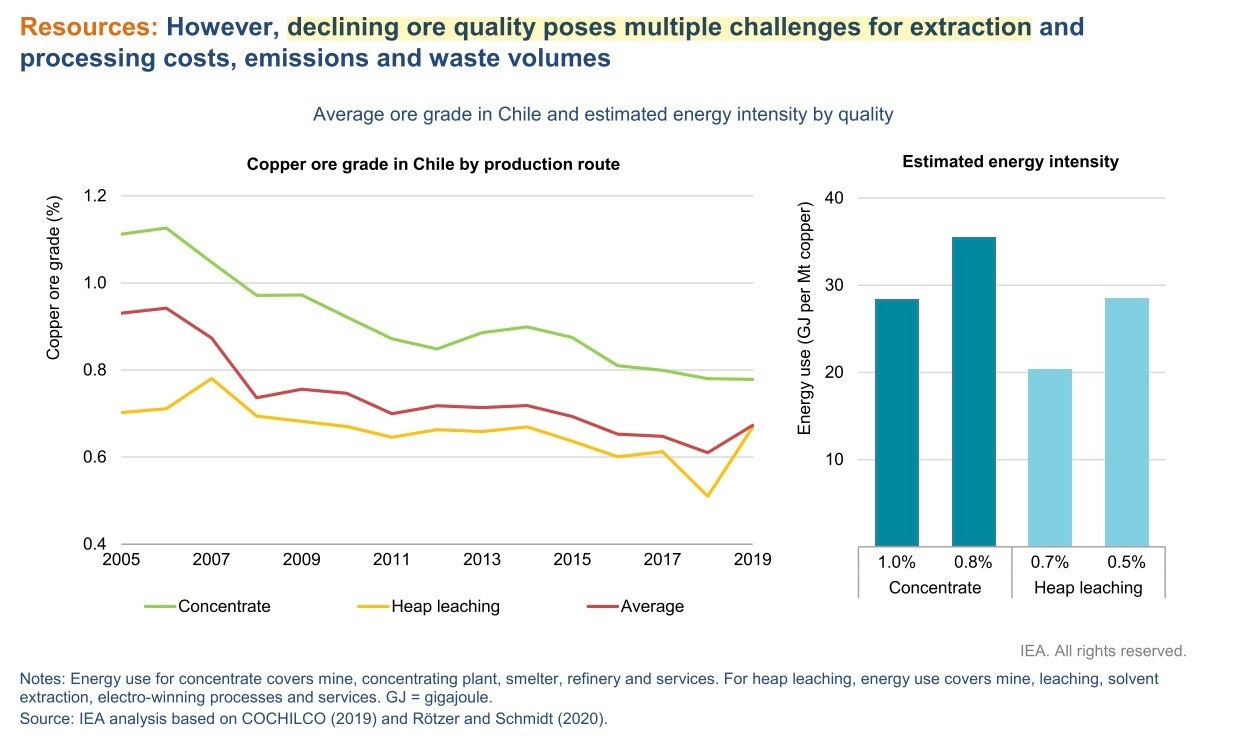

With declining ore concentrations, even deposits that were economically viable until recently will become a drag for mining companies. The following graph illustrates this process.

The relationships between the concentration and the energy required to extract a unit of raw material are shown on the right. A decrease in grade increases the energy necessary to extract an ore unit.

How can we increase the deposit cutoff grade while the ore grades decline? There are two ways:

· Increase investment in discovering deposits to find economically viable high-grade ore, even at current spot prices.

· Increase in the spot price of copper due to the imbalance between supply and demand. Thus, even deposits with low concentrations will become economically attractive because the cut-off grade will rise. The rising spot price will also stimulate investments in new projects.

Capital investments in new copper mines are past due. Furthermore, it takes a long time—it often takes 15 years from the deposit's discovery to the first copper ingots coming out of the mine.

The higher spot price is the only way to lower the cut-off grade without waiting 15 years. This will make even low-grade deposits economically attractive.

The lack of investment and the declining grade of copper ore severely constrain copper supply. However, one more profound limitation is the lack of skilled mining personnel.

Who wants to be a mining engineer?

The CAPEX cycle is the big driver behind the new commodities bull market. We have supply destruction in action. Unlike the demand side, which is controlled through monetary and fiscal measures with a short feedback loop, increasing supply is a prolonged process. The first discoveries and production are at least ten years apart.

The lack of personnel for the mining and processing industry is a significant issue. Mining engineering has long been out of fashion. The graph below clearly shows this trend. It presents the survey results conducted among Canada's largest mining companies.

The lack of interest in the industry is very pronounced. The problem is common for all extractive businesses: oil and gas, precious metals, and base metals. Besides that, it is not unique to Canada.

The major players in the industry are Australian and Canadian companies that operate worldwide. Their universities train highly skilled personnel. The declining number of mining graduates will have long-term adverse effects on the industry.

Unlike money, mines and engineers cannot be created from thin air. Finding and developing a new deposit and creating skilled personnel takes years. Until then, the shortage of mining engineers will significantly impact the supply of raw materials.

Even if we have all the money to develop new mines, if we do not have enough people, the mine's output will remain limited by personnel shortage. Limited capacity means limited supply.

The demand

In several publications, I discuss factors that impact supply/demand dynamics in commodities. The major drivers are:

· The Green Deal,

· Demographics.

· Energy independence.

One picture equals 1000 words. Following this cliché, I will tag each factor with a graphic and a brief description.

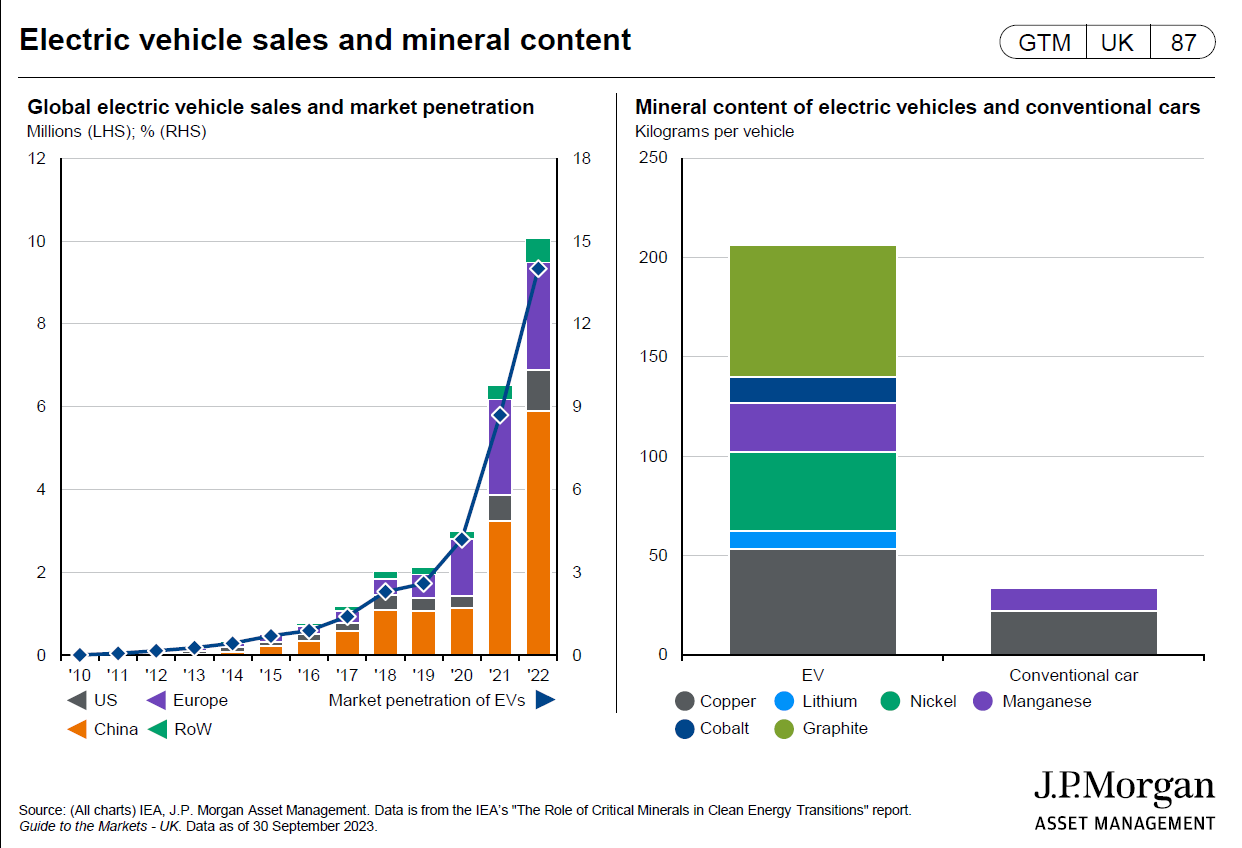

The Green Deal

The quantity of metals needed for an EV dramatically exceeds that of an ICE car. Let's extrapolate this to a new power grid infrastructure and generation capacity.

Demographics

The population of India and much of Africa is growing exponentially. The only way to meet the energy needs of more people is to increase energy capacity. The required quantities to complete the transition to clean energy are staggering.

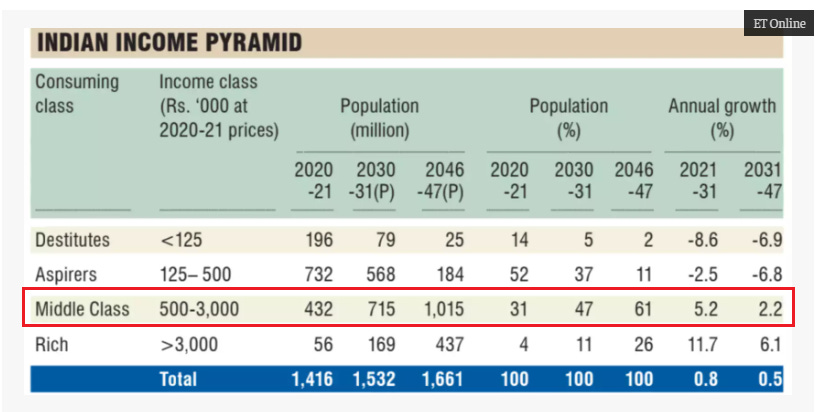

The population of India and Africa grows exponentially. Besides that, India is climbing up the S curve (GDP per capita passes $3,300), increasing consumption of goods and services.

India`s middle class will grow to 280 million people by 2030. Those people will demand higher standards of living, i.e., more resources.

The only way to satisfy the growing demand is to build more power plants, which means more copper will be needed.

Energy independence

Energy independence is crucial. I am not talking only about fossil fuels. China dominates the extraction and processing of metals required to build power plants and infrastructure. The following graph shows how dependent the world is on China.

I conclude this point by sharing the following graphic:

The upper half shows the copper price, and the lower half shows the available stock reserves measured in inventory days to cover. This is the catalyst event – record low stocks at the major exchanges and suppliers.

This is a consequence of everything described in the preceding paragraphs. Accordingly, these record lows mark the beginning of a new bull market in copper. Time will tell if "this time is different."

In today`s article, I present my arguments on why I expect copper prices to be much higher in the coming years. In the second chapter, I will dissect the Freeport balance sheet and explain how to play the copper theme with FCX LEAPS calls.