This is part 2 of my copper report. In the first chapter, I argued why I expect higher copper prices for longer. Before I proceed with the Freeport McMoRan analysis, let`s recap the conclusions from part 1.

Copper demand will grow due to the following:

Green deal: renewable energy installations, EVs, and infrastructure require a staggering amount of resources, including copper.

Demography: The populations of India and Africa grow exponentially. India is also climbing up the S curve (GDP per capita passes $3,300), increasing consumption of goods and services.

Energy independence: energy independence is crucial. I am not talking only about fossil fuels. China dominates the extraction and processing of metals required to build power plants and infrastructure.

Copper supply declines due to:

Lack of significant discoveries: the gap between supply and demand is widening. The demand will steadily grow while supply stagnates and even falls. Discoveries, such as Escondida, are increasingly urgent.

Declining ore grade: The lower the ore grade, the higher the metal extraction cost. Consequently, the cut-off grade also grows. At one point, the deposit becomes uneconomical relative to the current spot price.

Shortage of personnel: Even if we have all the money to develop new mines, if we need more people, the mine's output remains limited by personnel shortage. Limited capacity means limited supply.

Unlike money, mines and engineers cannot be created from thin air. Finding and developing a new deposit and creating skilled personnel takes years. The shortage of mining engineers will significantly impact the supply of raw materials. On the other hand, the demand will continue to grow in the foreseeable future.

We have various tools at our disposal to bet on rising commodity prices. I like to use LEAPS options on major miners to play expected bull runs. Freeport McMoRan is the company in question. In the following sections, I will dissect its financials and discuss how I apply LEAPS calls.

Company Financial

Mining companies have a common feature—they prosper together when commodity prices rise but fail in solitude when the price is low. The bull market lifts even the shabby companies, while the bear market tests companies' survival skills. Those with excessive leverage go underwater, while those with robust balance sheets weather the storm.

Liquidity and solvency are the first metrics I look at when I pick mining companies. Even small shocks to the commodity's price without a solid balance sheet can prematurely take a company out of the game. At the same time, companies with solid financials survive the crisis and thrive in the next bull run.

Solvency, liquidity, and profitability

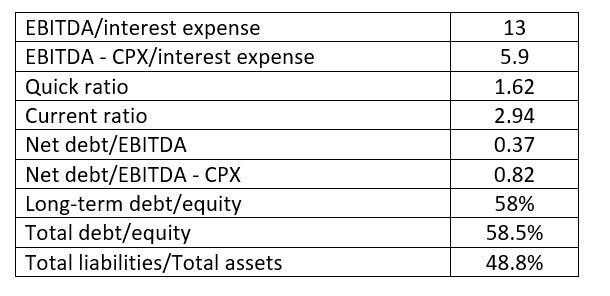

Freeport has a balance sheet with excellent liquidity to cover liabilities and develop new projects. The table below shows some metrics I use to measure the company's health. The data is from the company's most recent financial statement.

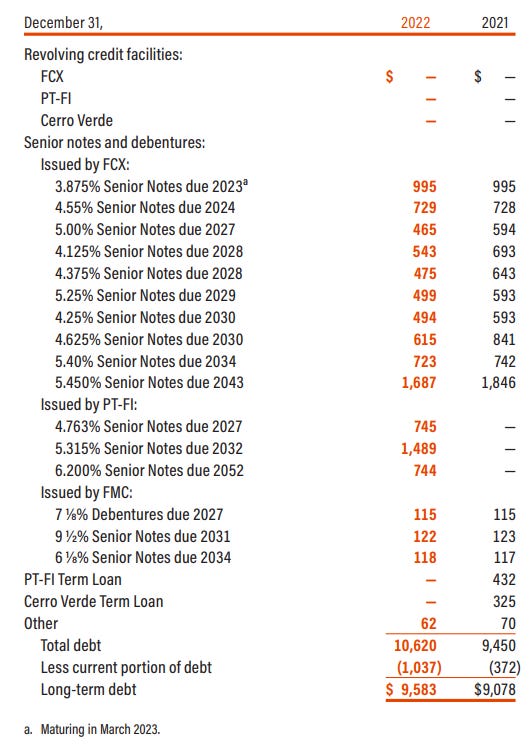

Freeport's debt is well distributed, as seen in the chart below. The company's credit rating from Fitch is BBB-, i.e., investment grade (the lower bound).

Over the next year, $729 million is due, representing 11% of FCX's current cash or 95% of the company's free cash flow. I don't expect any liquidity issues for FCX.

The success of a mining company depends on capital investment. They determine the company's long-term profitability or lack thereof. Every mining company adheres to the mantra: the reserve replenishment rate must exceed the reserve depletion rate.

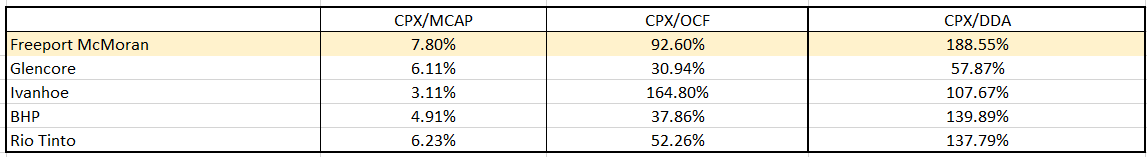

The company must invest in projects to maintain its reserves. In the following table, I compare FCX to a few major copper producers.

MCAP market capitalization

DDA Depletion, depreciation, amortization

OCF operational cash flows

Freeport is the undisputed leader in all three indicators. Despite a good CPX/DDA metric, the company still invests over 90% of its OCF. Only Ivanhoe exceeds this figure with a CAPEX/OCF of 164%.

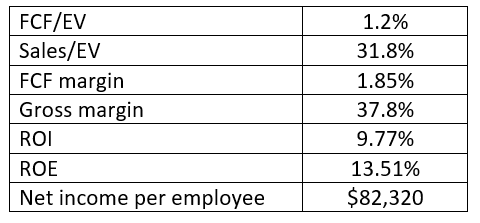

Despite lower copper prices, FCX remains profitable. The table below illustrates several metrics I use to evaluate a company's performance. The data is taken from the most recent financial report.

ROIC and ROE are higher than industry averages, while the latter have fallen below FCX's 5-year average. Net income per employee is much higher than that of FCX peers.

Freeport pays dividends with a mediocre yield compared to its major peers, as seen in the image below.

Glencore, for example, distributes dividends with a yield of 7.7%. BHP, RIO, and SCCO maintain yields of around 5.5%. For mining companies, I often prefer higher CAPEX over dividends. Over the long term, equity investment will boost company profits. Combined with the right macro situation, stock prices can rise exponentially.

What do I pay, and what do I get?

Freeport runs a capital-intensive and highly cyclical business. A cash flow-based valuation would, therefore, be misleading. Instead, I use the following methods to determine the fair value of the company:

· Net asset value based on the company's reserves, current assets, and total liabilities.

· Relative valuation using EV/Sales and Price/Cash Flow

I calculate net assets as follows:

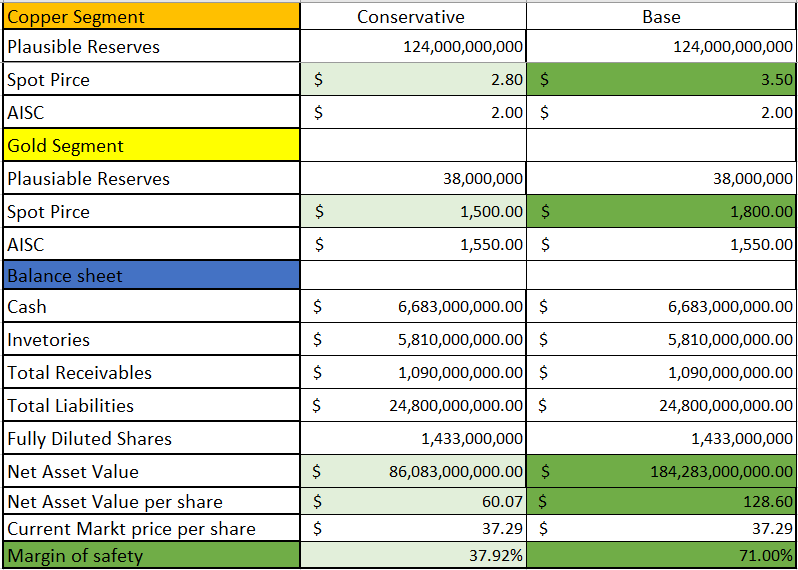

NAV = PR*(SP-AISC) + cash + inventory + total receivables - total liabilities

PR (Plausible reserves) = 100% P&P reserves + 50%M&I resources + 30%*resources

I consider two scenarios. One is conservative, with a copper price of $2.8 per pound and a gold price of $1,500 per ounce. The other is the base case, with a copper price of $3.5 per pound and a gold price of $1,800 per ounce. I assume a 15% higher AISC and deliberately exclude molybdenum production.

Conservative scenario NAV per share = $60.07

Underlying NAV per share = $128.6

Current market price = $36.41 (09 October 2023)

Although both scenarios bet lower than current spot prices, FCX offers a significant margin of safety, 38% and 71%, respectively.

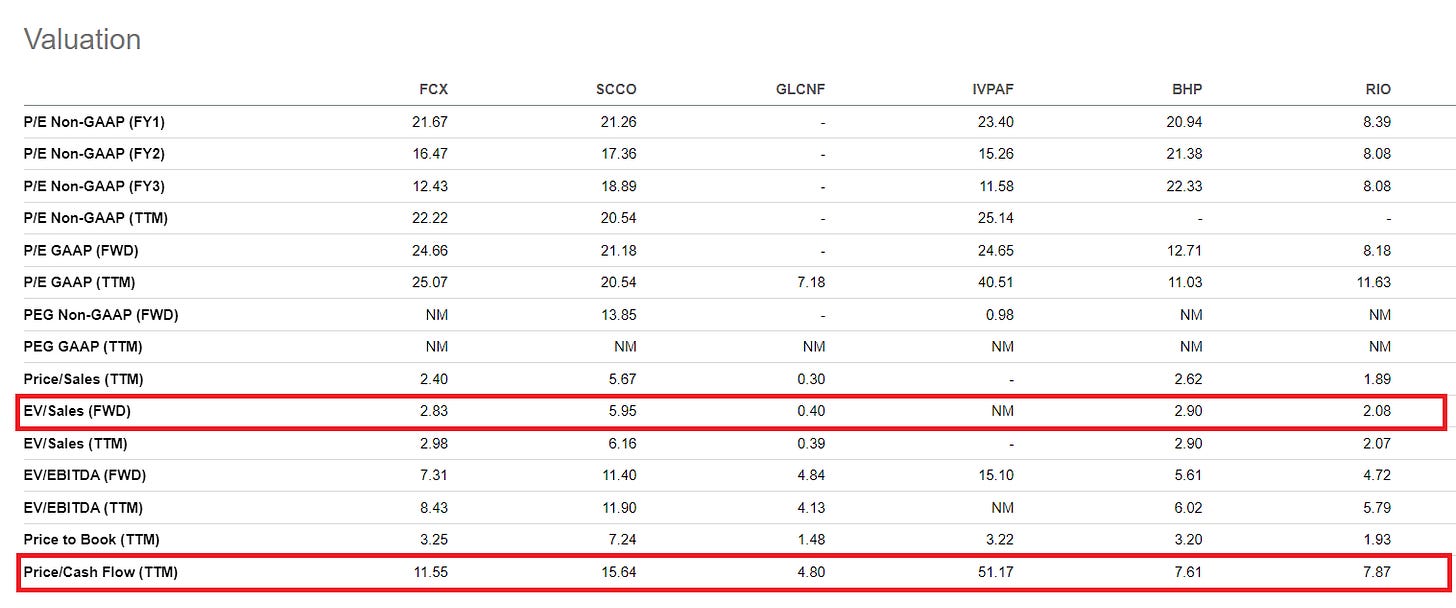

I determine FCX's relative valuation relative to the following companies:

· Southern Copper Corporation (SCCO)

· Glencore Plc (GLCNF)

· Ivanhoe Mines (IVPAF)

· BHP Group Limited (BHP)

· Rio Tinto (RIO)

I use the EV/Sales and Price/Cash Flow metrics to assess FCX's relative position. Freeport is in the middle using the parameters indicated. That is, the company has the potential to be overvalued relative to its peers.

How to play the idea?

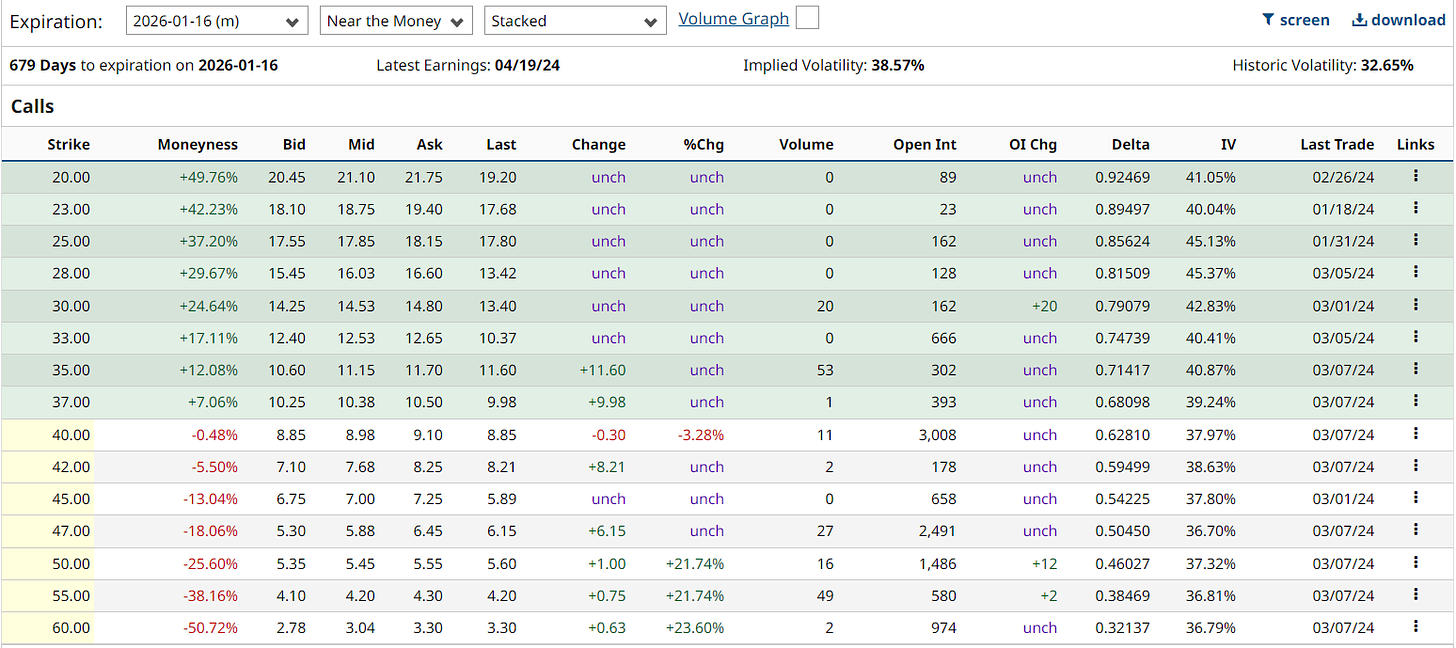

I use LEAPS options in situations with growing deficits over the next 12-24 months, as with copper and uranium. The growing deficit is the spark pushing the price north. On the way up, I expect high volatility. LEAPS options allow me to take advantage of not only the rising price but also rising volatility.

Major producers carry lower risk but have less growth potential than mid-size and junior miners. Junior miners can realize parabolic returns but are much riskier than mining majors. LEAPS options solve those problems.

By buying LEAPS options on majors, I get a junior miner's upside potential with a major miner's downside risk. Hence, I increase the bet asymmetry in my favor at a significantly lower risk of permanent loss.

Other considerations when buying options are liquidity, i.e., Open interest and volume. The volume is usually low or even zero for LEAPS, but the volume increases as the expiration date approaches. With less than a few months remaining, open interest reaches at least 1000 contracts. This way, I am sure I will have a buyer to buy my options when I want to exit the position.

Important reminder: options are complex instruments and should be treated as such. Buying options does not guarantee profits.

Risk

FCX, like any mining company, carries the following risks:

· Metallurgy and geology

· Financial

· Politically

· Operative

· Economic

Freeport primarily bears operational, market, and economic risks typical for major miners. Geological, metallurgical, and financial risks are more pronounced for small and medium-sized companies in the industry.

Operational risk arises from the complexity of running a multinational company. Freeport has mines in several countries and is thus exposed to country-specific peculiarities. On the positive side, FCX owns and operates assets in three countries: Peru, the US, and Indonesia. Simply put, the company`s operations are not spread across several countries.

Market risk is always present, given the bear market in bonds and the chaotic price action of equity indices. No matter how good a business is in the short term, major market shifts affect all companies. In a force majeure event, all stock prices fall regardless of the sector, region, or business behind them. In other words, a likely downturn will not invalidate my hypothesis. Instead, it will give a better entry price.

Conclusion

In the long term, I'm bullish on the price of copper. The lack of significant discoveries, declining ore grade, and a growing personnel deficit will irreversibly impact supply. On the other hand, demand is steadily increasing, driven by the transition to clean energy, infrastructure renewal in the US, and growing affluent populations in India, Indonesia, and Nigeria.

Higher demand and limited supply are a recipe for a looming deficit. I chose Freeport in combination with LEAPS options to bet on this hypothesis. FCX is among the largest producers of copper. In addition to copper, FCX mines gold and molybdenum. The company has a solid balance sheet with additive liquidity and well-structured debt maturities. Freeport is deeply undervalued based on NAV. I have set conservative assumptions for gold and copper prices in the accounts, which are well below current levels.

A reminder: no matter how well-argued a hypothesis is, it is always incomplete. The missing facts can be decisive for the outcome of a scenario. Today's hypothesis is no exception. It results from the author's research and analysis, automatically making it limited, biased, and incomplete. Anything described is for educational purposes only and does not constitute advice to buy or sell financial instruments.

FCX has been a part of my long-term portfolio as a synthetic covered call.

I also trade FCX for short-term profits to reduce my over all cost.

I don't have deep out of the money LEAPS on FCX, but it's an interesting idea. DOTM LEAPS lose less theta decay and they have a better ROI on the upside. If the share price goes down, it's possible to buy an at the money strike that's lost more dollar amount than the DOTM strike.