The Great Intersection Portfolio

Five themes to follow in 2025

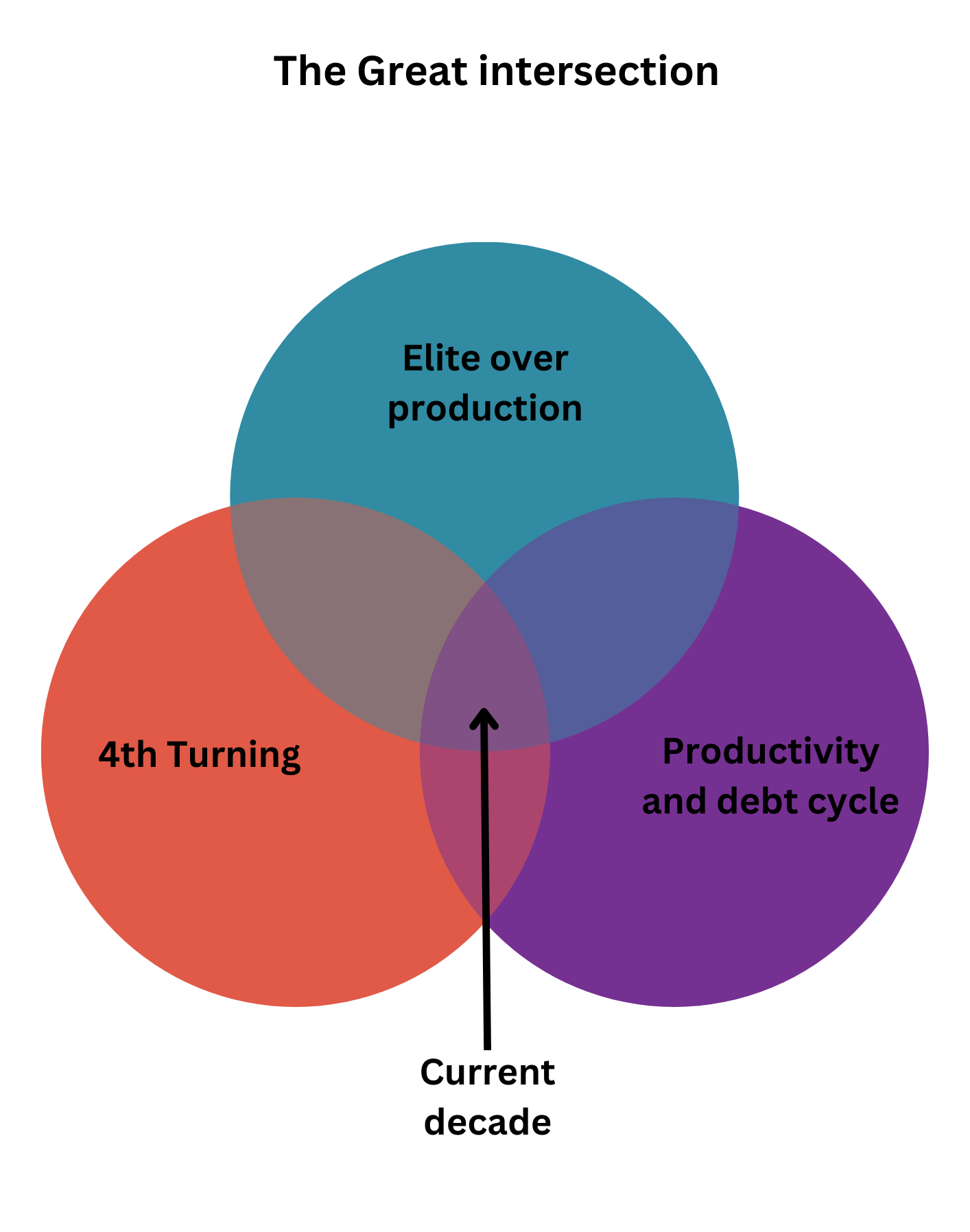

The inflection points of the 4th turning, the elite overproduction, and the productivity and debt cycles coincide with this decade, causing a profound global impact. Changes are inevitable. However, we do not know their polarity and magnitude.

Where are we today? There is increasing degradation and polarization of society, a growing number of incompetent elites, and growing debt relative to productivity.

The result is ever-growing isolationism, protectionism, and resource nationalism. All “isms” are cause and effect simultaneously. Hot and trade wars are the consequence.

How does that apply to my view on the markets?

The Great Intersection Portfolio

The short answer is I am long chaos. I see rising disorder in the economy, politics, and finance. That being said, I seek antifragile themes that thrive in turbulent times.

This is the Great Intersection Portfolio. It has five pillars:

Trade Wars and critical minerals: PGM, REE, and uranium

LatAm revival: Argentina, Brazil, Chile, Colombia

Energy Independence: floating energy infrastructure and oil services

Transformed supply chains: VLCC tankers, Capesize carriers, and smaller LPGs

Fiat money devaluation: precious metals and crypto

In the next 12-24 months, I expect each theme to reach an inflection point. In 2025/2026, I see intensifying trade wars between Great Powers, elections in LatAm, rising energy demand, shifting supply chains, and continued fiat depreciation.

Let’s say a few words about every theme.

Trade Wars

A vital part of trade wars between the Great Powers is cutting access to your enemies' materials and energy. China and Russia dominate critical minerals production and processing, which gives them strong hands in the geopolitical poker game.

With growing global chaos, the role of export restrictions as a geoeconomic lever will only grow. I believe uranium, REE, and PGMs are the best ways to bet on that theme.

We have seen how that scenario has unfolded in REE and uranium. China restricted germanium, gallium, and antimuonium exports to the US, and Russia did the same with uranium. PGMs and palladium, in particular, could become another subject of trade restrictions.

LATAM resurrection

South America has the lowest geopolitical risk. The reason is simple: one religion and two similar languages dominate the continent. In addition, LatAm has formidable oil and mineral reserves, an abundance of fertile land, and healthy demographics.

Argentina is leading the pack. Milei’s presidency successfully challenged the status quo. MERVAL is the top-performing index. Two catalytic events, the anticipated removal of currency controls and legislative elections, would spark further run in Argentinean equities in 2025.

Regarding elections, Chile will hold presidential elections in November 2025, while Colombia and Brazil will in 2026. Chile can benefit from a rising copper deficit and political shift. Colombia is in a similar position as Argentina in 2021/2022. So, the election may spark investors’ interest. Brazil, too, may benefit from a political change.

Energy independence

The world has been spoiled with cheap and easily accessible energy from Russia and the Middle East. We are not in Kansas anymore. New alliances emerge, and the old are destroyed. Having access to cheap and reliable energy sources is crucial for every country's role in the global chess game.

The beneficiaries are companies that operate floating energy assets and oil services. They will follow the money. From FLNGs to OSVs, the Atlantic is the new hot spot for fossil fuel projects. It's all about low geopolitical risk and proximity. For the EU mainly, the latter implies no dependency on global choke points like Suez/Bab-el-Mandeb.

Reshuffled supply chains

Global bifurcation brings supply chain shifts. Some of the changes will be gradual, while others will be unexpected. The Red Sea crisis is an example of the latter. In other scenarios, the change will be slow yet imminent. A good example is the regionalization of trade due to extensive trade wars.

A heuristic: The higher the global entropy, the higher the regionalization, and the higher the demand for smaller vessels.

Yet, not all ships are equal, and not only smaller cargo vessels are lucrative. Considering supply fundamentals (order book, aging fleet, shipyard capacity) and growing tonne-mile demand, I find Capesiez bulkers, VLCC tankers, smaller LPG carriers, and ice-class LNGs the most attractive.

Fiat money devaluation

Fiat money devaluation became the norm. I believe we are approaching an inflection point in the next 10-15 years when economic systematic issues will become unrepairable. The reason is not a secret. For the last 16 years, the debt growth rate has been higher than the production growth rate. There is no cheat code to escape consequences.

Gold started to move to the East, not the first time in human history. India and China have a long-standing affinity with gold. Sooner rather than later, the West will wake up and appreciate gold for what it is: the ultimate store of value. Consider gold and silver miners and call options for major miners.

NewEconomy idea is cryptocurrencies and the required software/hardware. I am neither a proponent nor an opponent of crypto as a safe haven. However, I see asymmetric opportunities in companies that provide “picks and shovels” for crypto miners.

As you can see, the selection of themes is eclectic: emerging markets, shipping, energy, mining, and crypto “picks and shovels.” Thus, we have endless opportunities to build the Great Intersection Portfolio.

Another tip: for BeyondEquity investors, the more liquid names also offer attractive options and bonds. So, depending on investors' goals, skills, and tolerance, they can pick the right idea coupled with the optimal tool.

Final Thoughts

Successful market participants often have an innate curiosity about the surrounding world. Stay open to unexpected opportunities in overlooked corners.

I hint where to dig deeper: REEs, real estate in Argentina, offshore supply vessels, smaller LPG carriers, and crypto “pick and shovels.”

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.