Grand Strategy for Industrious Investors, Diligent Traders, and Ordinary Market Participants

Synthesis of markets, strategies, and instruments

We overcomplicate simple things and oversimplify complex things. In investing, that maxim translates into deification of the analysis and valuation at the expense of execution.

Five-stage ESG-adjusted DCF valuation formula and a 187-point strategic bomber checklist on how to pick a stock and still lag the S&P 500 performance.

This is not a rant against a meticulously analytical process or utilizing a checklist. It is a rant against our inability to practice temporal and probabilistic thinking. We equate a quality analysis to winning trades.

A costly fallacy.

Between diligent analysis and winning trades lies the Mariana Trench of Execution, i.e., proverbial risk management. Let that sink in.

Therefore, a prudent investing process must incorporate a top-notch analysis and meticulous execution. How does that translate into my investing process?

I consider investing a three-dimensional activity. It is an intersection between market, strategy, and instruments. This is my way of avoiding the common traps we face in markets all the time, such as linear thinking, herd mentality, recency bias, loss aversion, and confirmation seeking, just to name a few.

This article has been pending for months. Finally, its time has come. The publication covers my investing process from a higher perspective—in geopolitical terms, my Grand Strategy. Now, let’s move down the rabbit hole.

Grand Strategy for Market Participants

Investing is not about focusing on one industry, strategy, or instrument. Overspecialization is no longer practical because markets, economy, and politics are not the same as they were 50 years or even 10 years ago.

To emphasize that one thing never changes: the inherent irrationality of the economic agents. Yet the details matter. Consider how widespread investing has become. With quantitative changes come qualitative transformations.

Instant information dissemination, democratized market access, and human innate irrationality transform the financial markets into ever-evolving complex systems. Besides our irrationality, one more thing remains unchanged: uncertainty is the only certainty in markets. Therefore, relying on one approach is not an option.

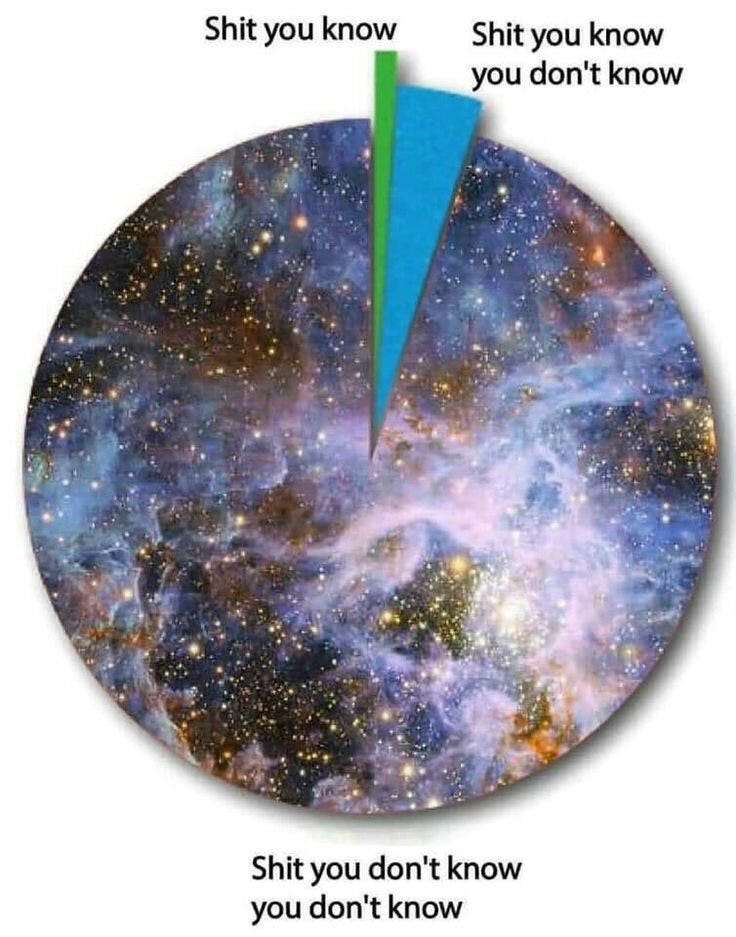

As market participants, we must nurture adaptability and resilience. Thus, we are transforming ourselves into high-order generalists. What does this mean?

Simply to be handy with various instruments, markets, and strategies. Of course, we must not seek to master everything. For reference, the image below:

This is a fool's errand. The goal is to pick a few low-correlated markets and strategies and execute them via appropriate instruments.

To recap, consider your investing process a blend of diverse markets, matching instruments, and low-correlated strategies. Combined, they lay out our Grand Strategy, or our goals as market participants, and the means to achieve them.

In statecraft, a Grand Strategy utilizes not only military but also economic and diplomatic means to advance and achieve national interests. The same is true in investing. Overrelying on one market or approach is not sustainable. Now, swap military, economy, and diplomacy with markets, strategies, and instruments. So, we get a Grand Strategy for investors.

Let’s examine each aspect. The first stop is the markets.

Markets

It is impossible to acquire a deep understanding of all markets. The magic is to be comfortable with just a few low-correlated industries and regions. This is good enough to provide lucrative ideas in every market regime.

My preferred markets are shipping, mining, and energy at the industry level. My favorite region is LatAm. This is the short answer. Let me elaborate more.

I am long chaos. I see rising disorder in the economy, politics, and finance. That being said, I seek antifragile themes that thrive in turbulent times. This is the Great Intersection Portfolio. It has five pillars:

Energy Independence: floating energy infrastructure and oil services

Transformed supply chains: VLCC tankers, Capesize bulkers, and smaller LPGs

Fiat money devaluation: Gold

The markets I am interested in are diverse. Each follows distinct cycles with varying amplitude and duration, exhibiting a low correlation.

To clarify, the markets I listed are my hunting fields for the next 18-24 months. Then, I will probably move to another segment of shipping, mining, energy, etc. For example, the LNG shipping segment is oversupplied. In other words, the supply growth rate exceeds the demand growth rate. Remember, the surplus sown the seeds of deficit. Eventually, the supply glut will lead to vessel shortages. Then LNG carriers might be attractive again.

This was about my preferred markets. Then, what about my strategies?

Strategies

It's the same story here: Seek low correlation strategies. However, there is one more nuance. Consider strategies that expose your book to low-correlation, high-gravity (LCHG) assets. LCHG became my favorite asset class.

The quote below from my Doomsday shopping list article tells it all;

Prolonged bear markets are an elevator to hell. However, there are exceptions. Such are unpopular and obscure industries and companies. A prime example is litigation cases.

These types of positions are not dependent on the performance of the indices. They do what they do without getting excited about the markets. Of course, it's a double-edged sword; these same ideas during a bull market also do what they know. If we don't have a catalyst event on the horizon, let's say a court decision, we can still incur losses even though the markets are performing well. In simple terms, the impact of the catalyst event outweighs that of the broader indices for such ideas.

The OldEconomy portfolio has two litigation cases, but they are not the only event-driven picks. Critical minerals and distressed debt are also on the list.

Fixed income and litigation cases share another advantage. They possess a center of gravity. What does it mean?

Think about the bond’s nominal value as the center of gravity. It does not matter what the bond price is before the maturity date. To clarify, this is true for bond investors who hold to maturity or redemption. On that day, the issuer must repay the bond at its par value. As maturity approaches, the bond price will move closer to its par value, i.e., the law of gravity in action.

Litigation cases have a predefined size. The claim is the center of gravity here. Depending on the progress of the case, the claimant's share price will fluctuate accordingly.

If the company's market capitalization is $50 million and the claim is valued at $500 million, the center of gravity is $500 million. So, if the court decision favors our company, its equity value will increase, chasing that $500 million.

Low-correlated ideas with a center of gravity are highly lucrative, particularly during times of increasing uncertainty.

The strategies I utilize are focused on such ideas, with some exceptions. My process relies on three strategies:

Thematic Bets: those positions are wagers on the anticipated performance of specific sectors, industries, or regions. Refer to the previous chapter. For example, I am long the Chilean economy. Thematic bets are not the perfect LCHG plays. Yet here lies their strength. Some are opposite; they are highly correlated with broad indices and do not have a predefined center of gravity. Refer to Chile again. On the other hand, thematic bets like Tungsten and REE are completely uninteresting in broad markets. They do as they are pleased. In summary, thematic bets are my most fluid strategy. The other two, however, follow strictly the LCHG codex.

Litigation Cases: This category is the embodiment of LCHG. Litigation cases (miss)perform independently from markets; the claim size is the center of gravity. My preferred litigation picks are mining and energy companies suing sovereign states. Occasionally, we can stumble across cases with massive asymmetry in our favor. For example, a company with a market cap of $50.0 million sues a state for $1.0 billion. This is not an exaggerated example. It simply shows the asymmetry of litigation cases.

Distressed debt: It is another classic for turbulent times. The Old Economy industries offer excellent HY bonds with higher-than-perceived odds for survival and good enough yields to compensate for the risk taken. Distressed debt also fits in the LCHG category. Except for broad market crashes, its performance shows low correlation to markets. The center of gravity here is self-explanatory; this is the bond par value.

The strategies I use have low correlations to markets (with some exceptions in the thematic bets category) and thrive in various market conditions.

For example, distressed debt is my favorite play during cyclical bottoms that follow extended bear markets. At the bottom, we can buy high-quality HY debt for a massive discount to par. On the other hand, thematic bets (with some exceptions) perform better when the market is in bull mode. The best thing is that litigation cases, most of the time, do not care about Mr. Market.

Each strategy requires a distinct analytical framework and risk management rules. Thematic bets resemble tactical trades based on macro analysis combined with price action. Company fundamentals carry less weight for thematic bets. Litigation cases depend first on company fundamentals and, to a lesser degree, on the macro picture. The situation with distressed debt is similar; the focus is on company fundamentals, then comes the macro. Price action does not matter for litigation cases and distressed debt.

That said, the strategies have one thing in common: the mandatory presence of a catalyst. The relationship is simple: no catalyst, no fun. The catalyst is the spark that would transform investors' perception of a company, industry, or region.

In the list below, I will share some catalysts depending on the strategy:

Thematic Bets: political change, supply lines disruption, sanctions, and tariffs

Litigation Cases: the name tells it all, the catalyst is the litigation process

Distressed Debt: same story here, the catalyst is the redemption of bonds.

Thematic category catalysts are diverse, while their name tells it all for litigation cases and distressed debt.

It's all good now. We know where to hunt for Alpha and how to harness it. Yet something is missing. Let’s move on to tactics, or how to execute our ideas.

Instruments

Universal strategies and instruments do not exist. A screwdriver does not hammer nails, and a hammer does not screw bolts. Depending on the task, we pick the instrument.

That said, equity is not the only way to express a view on a company, industry, or country. We have derivatives, fixed income, and hybrid instruments at our disposal. In some cases, the best instrument for the job is not common equity but a LEAPS call or a convertible bond.

Tool selection is part of risk management. Even a trade defined by a well-articulated analysis, adequate timing, and prudent sizing can fail if we neglect the instrument selection.

For example, we believe a shipping company XYZ will double its FCF in 4Q26 because of higher day rates. To express our view, we select a call option with an expiration in June 2026. Yes, the market will sense in advance that our company is doing well, yet our option will expire too early, and we will leave the party with nothing.

Another example is fixed income. Let’s assume company ABC has some financial issues. Its 2026 senior secured first lien debt and 2028 senior unsecured bonds trade at 30% and 45% discount to par, respectively. Both issues have an 8.5% coupon. At first glance, the 2028 edition looks better because of the higher discount to face value. Think twice. The 2028 bonds are senior unsecured, while the 2026 bonds are not only senior debt but also secured and, on top of that, first lien. Plus, 2026 bonds mature two years earlier. Do not forget the role of time as the ultimate equalizer.

As bond investors, we cannot significantly increase the upside. The only way to improve risk-reward is to reduce the downside risk. This means picking the safest bond issued by company ABC, in that case, the 2026 edition.

Those examples are not exhaustive. They illustrate the importance of skipping the wrong tools and selecting the proper ones.

Summary

Today’s article is a Statecraft for Investors 101. It presents my Grand Strategy, a synthesis between markets, strategies, and instruments.

Shipping, mining, and energy, plus LatAm; thematic bets, litigation cases, and distressed debt; equity, bonds, and options—that’s it. This line represents my investing process from a bird's-eye view. This approach keeps me relevant to all market regimes.

It's time for a disclaimer. My process is neither a zero fail rate nor guarantees double-digit Alpha. It simply reduces the likelihood of doom, thus increasing the odds of winning. Having an investing process does not guarantee success, but its absence guarantees failure.

Use today’s article as inspiration to ask questions, nothing more.

PS: If you wonder how TheOldEconomy Grand Strategy works in practice, read the following paragraphs.

TheOldEconomy portfolio mirrors the Grand Strategy. The book includes thematic-litigation-distressed plays, shipping-mining-energy-LatAm picks, and equity-bonds-option positions.

The image below shows part of the TOE portfolio:

As you can see, the TOE book is pretty eclectic: it includes a uranium miner, LNG infrastructure, Chilean banking, a gold miner, and REE and tungsten plays. The portfolio includes call options, corporate bonds, and equity.

Blending strategies, markets, and instruments pays off. Since its inception on January 1, 2023, the portfolio has achieved a 106.2% total return, or a 36.24% CAGR. For 2025, the TOE book has been performing well, with 11.1% YTD gains.

If you do not want to miss asymmetric ideas combined with meticulous execution, consider becoming a paid member of TheOldEconomy.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Also I don’t share your believe/interest in shipping, this piece is well thought out and nicely put together.

Hi Mihail.

Can you check the values in the Current price column in the Portfolio table. We share a couple of options and your values don't reflect the market prices.