It’s time to shift attention from shipping. Today, the focus is on Brazil. I firmly believe South America has enormous growth potential. Its GDP represents 6% of the global GDP, while its stock market capitalization is only 1%.

The region benefits from:

· Low geopolitical risk

· Abundant natural resources

· Healthy demography

Macroeconomic and geopolitical shifts—disrupted supply chains, proxy wars, and capital transfers—are the catalysts for the revaluation of LatAm equities.

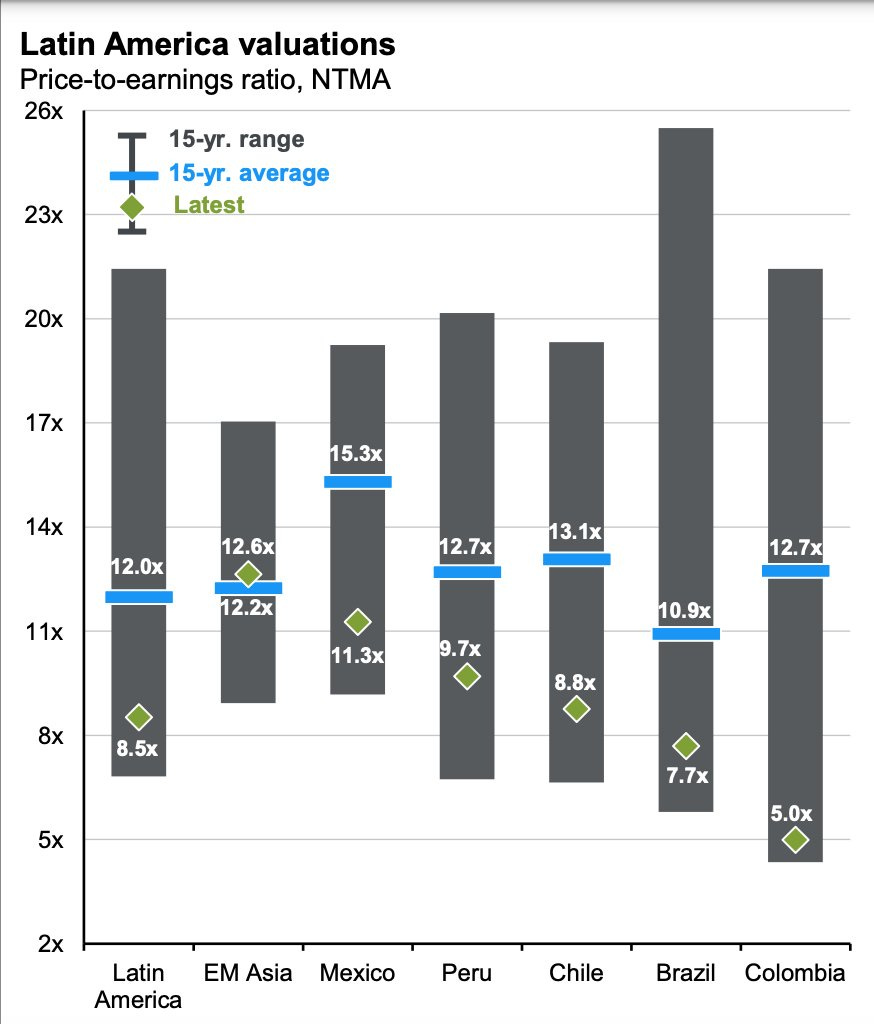

Most South American equities trade way below their 15-year average and close to the bottom of the 15-year range.

Simply put, considering its multiples, these countries offer more upside potential than downside risk. Brazil is a prime example.

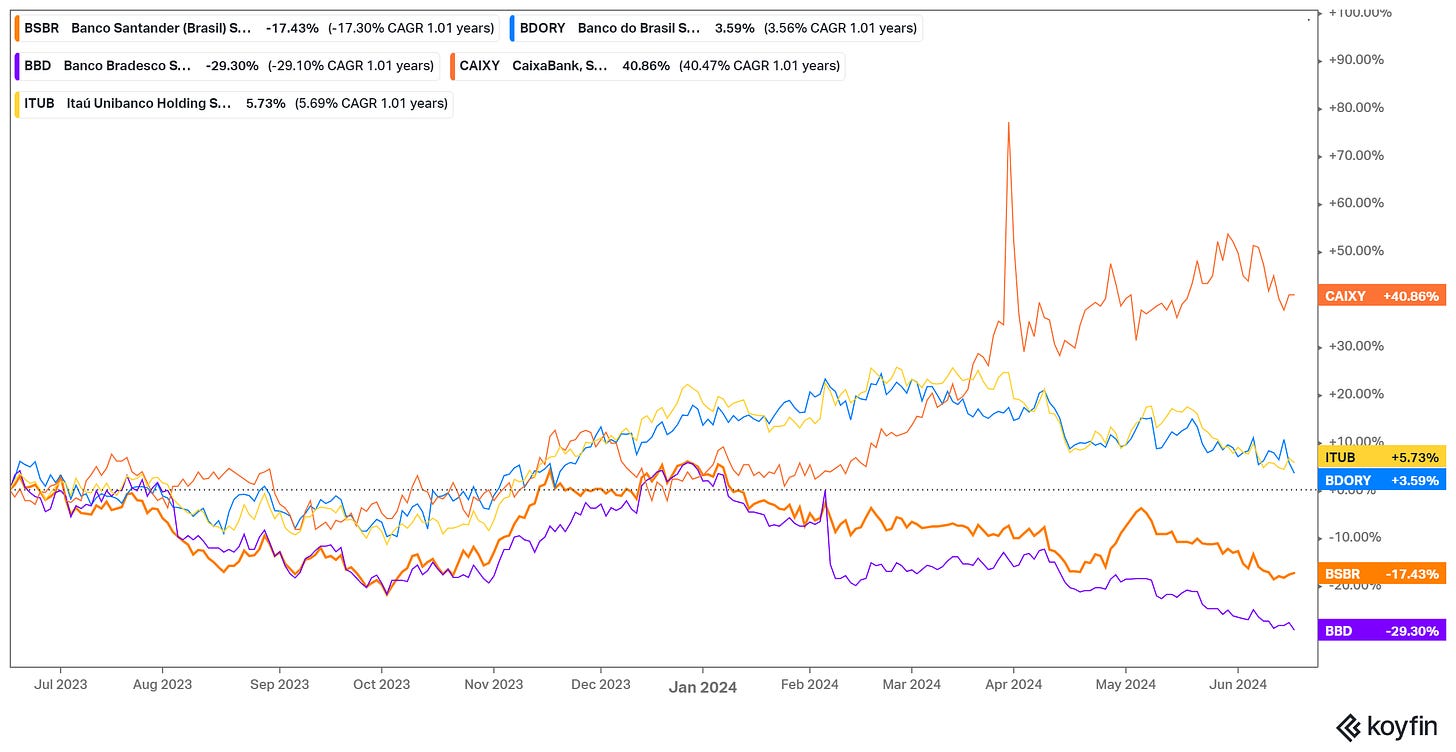

Brazilian stocks performed poorly in 1H24, and banks weren't spared.

The weakness of the real is the major contributor. On the positive side, the Brazilian Central Bank handled inflation well. It was one of the first Central Banks to implement rate cuts.

Growing exports are another constructive sign. Brazil is a leading sugar, orange, coffee, and iron ore exporter. Moreover, the country can potentially become one of the top five oil producers.

The Brazilian economy depends heavily on China. It is not exaggerated to say that Brazil may get sick when China coughs. The latter has chronic issues (poor demography and energy dependence) that will undermine export economies like Brazil.

Nevertheless, I expect China to maintain its standing as a strong (at a surface) economy in the next few years. CCP will kick the can down the road with exuberant fiscal measures, which will benefit Brazil, as one of the major trade partners.

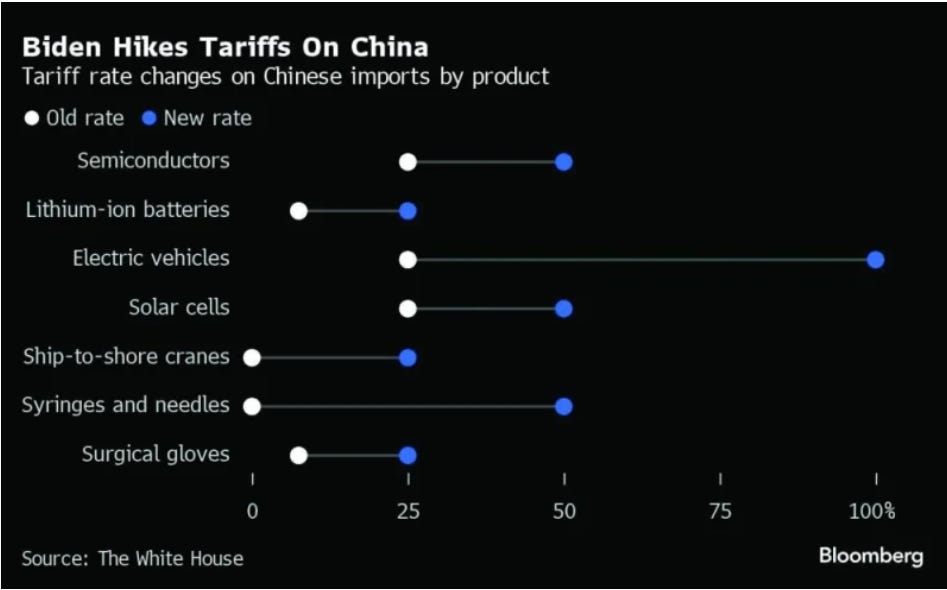

Counterintuitively, the new tariffs imposed on China a month ago may benefit LatAm and Brazil. The following chart provides more details:

The new tariffs, in addition to being inflationary, will positively impact the affected industries in the Western Hemisphere.

As pointed out, Brazil has alternatives for exporting its goods. The US and Argentina have much to offer as second and third trade partners. A case in point is Gerdau; 40% of its revenue comes from the US. The US infrastructure renewal plan creates considerable demand for materials, including steel.

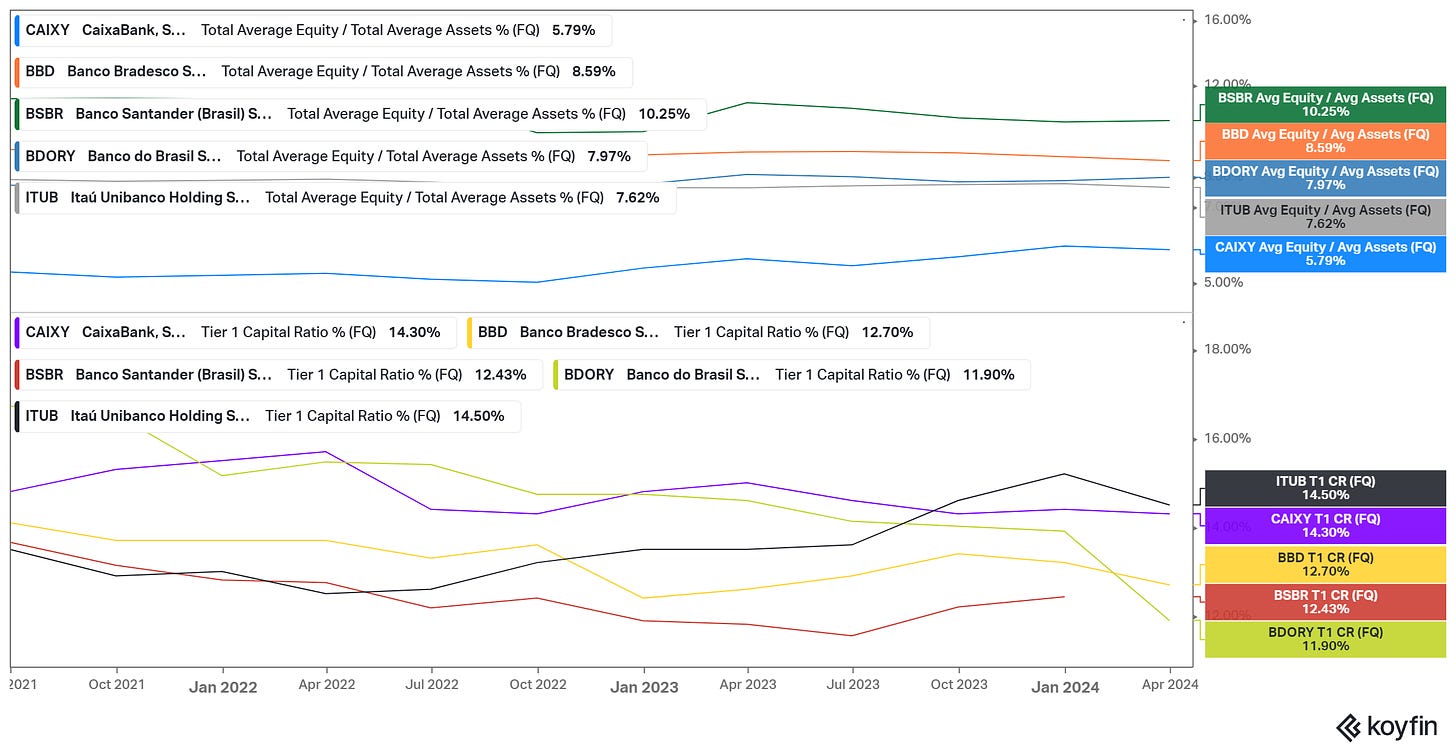

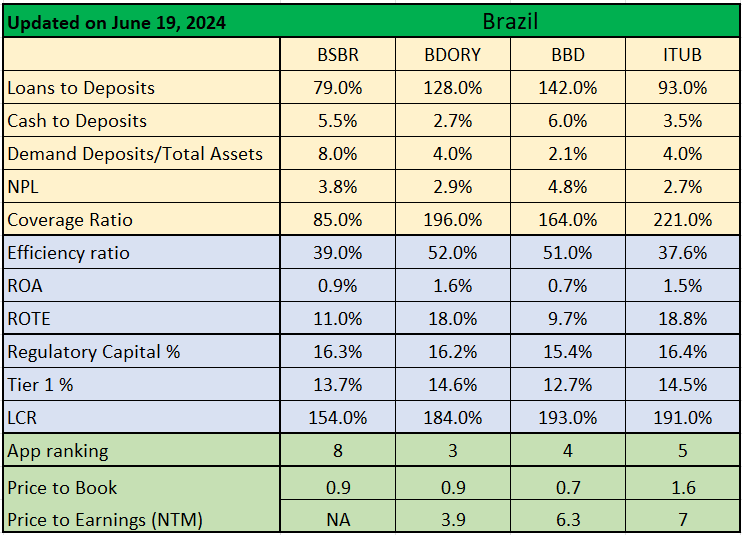

Now, let’s peek into major Brazilian bank figures. Local banks delivered good results over the last two quarters while maintaining a robust capital structure.

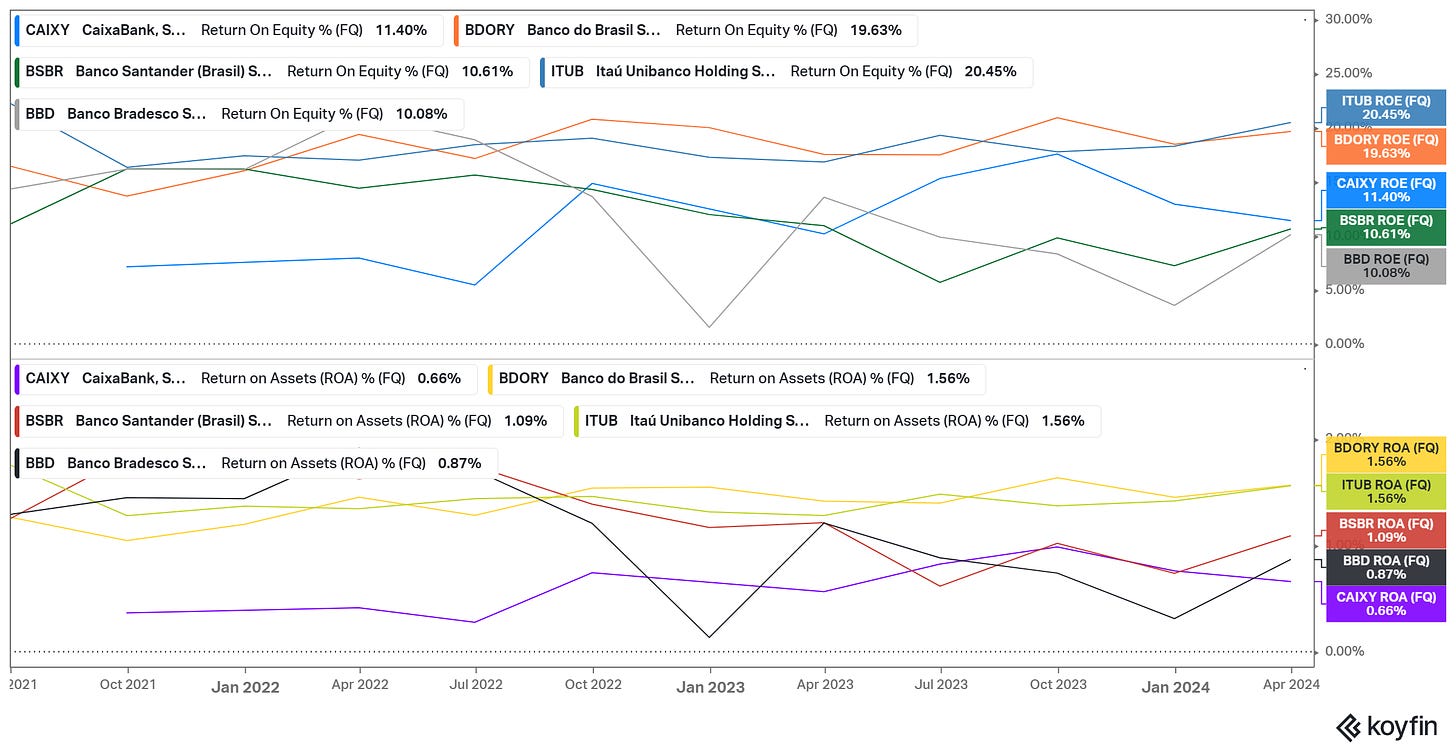

The charts below show the most liquid Brazilian banks’ solvency (Tier 1 Capital and Average Equity vs. Average Assets) and efficiency (ROA and ROE).

Analyzing banks seems deceptively simple because we have financial assets on both sides of the balance sheet. Of course, dissecting a bank report is not rocket science, either. The trick is to know which variables to focus on and which to discard.

The following table shows Banking Analysis 101:

· Balance sheet quality: Loans to Deposits, Cash to Deposits, Demand Deposits to Total Assets, NPL, and Coverage Ratio

· Efficiency: Efficiency Ratio, ROA, and RoTE

· Capital Adequacy (Basel III metrics): Regulatory Capital, Tier 1 Capital, and LCR

· Company’s digital banking app ranking

· Comparative valuation: Price to Book and Price to Earnings (NTM)

As a side note, app ranking is a simple yet efficient metric indicating bank popularity. Digital transformation is a massive challenge for all traditional banks. Hence, a popular banking app is a valuable indicator of a bank’s long-term performance.

The banks in question are:

· Banco do Brasil, BDORY

· Banco Bradesco, BBD

· ITAU Unibanco, ITUB

· Banco Santander Brasil, BSBR

All banks are traded on US stock exchanges.

I intentionally excluded Nu Bank from the list. NU is the largest neo bank in the world, with 100 million customers. However, its business model differs from traditional banking (despite many similarities).

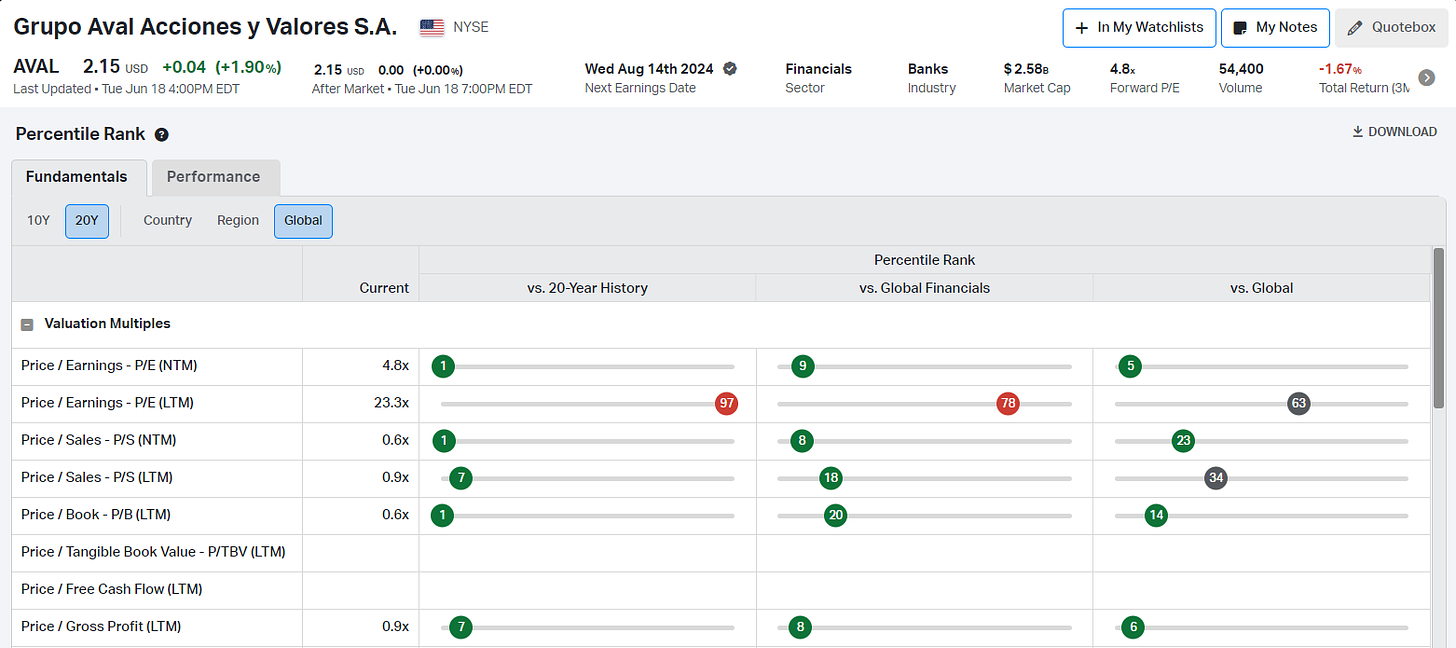

Brazil is not the only country in the region with attractive banking stocks. Chile and Colombia also have a lot to offer at reasonable prices. Especially Colombian banks are among the cheapest equities in the world.

A definition for a bottom fish:

Brazil and Colombia will hold General Elections in 2026. The incumbent presidents (Lula and Petro) are leftists. Milei's shocking victory in Argentina may signal that the Pink Tide has ended. The political pendulum swings to the right, suggesting an improving business environment. Banks, as superconductors of the economy. As such they are one of the best ways to play political changes.

More curious ideas are coming. Stay tuned.

Everything described in this article has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.