July Critical Minerals Market Report

Dr. Copper is gaining traction; the titanium market and potential export restrictions

Due to the longer weekend, I have adjusted this week’s schedule. Instead of publishing on Friday, I now post the Monthly Critical Minerals review on Wednesday. Next week, the schedule will go back to normal.

Investing in commodities is anything but easy. However, its principles are simple. Take, for example, the four categories of commodities:

Tier 1 (OPEX and simple): uranium

Tier 2 (CAPEX and simple): tin, PGMs, tungsten

Tier 3 (OPEX and complex): coal, LNG, crude oil

Tier 4 (CAPEX and complex): copper, zinc, bauxite, nickel

Simple commodities are those dominated by a small number of players. PGMs are a prime example of a simple commodity, as South Africa and Russia dominate the supply side, while automakers and renewables are the primary demand drivers. Oil is a perfect example of a complex commodity, with numerous moving parts on both sides of the market.

The more running parts in the system, the more challenging it is to forecast the outcome with plausible accuracy. Hence, our thesis is more prone to errors.

OPEX commodity is gasoline. Once you spend on CAPEX (a vehicle), you must top up the fuel tank to utilize the car. An empty tank means no utility. Another example is uranium. Building an NPP costs several billion. In that case, the OPEX commodity is uranium. No uranium, no GWh.

CAPEX commodities are optional (to a certain degree). It is not mandatory to invest in NPP or buy a new vehicle. OPEX commodities are not optional, nor are they subject to our wishes. Running a car or utilizing an NPP requires fuel. If we disregard them, our assets decay, losing the CAPEX.

The image below summarizes it all.

Of course, investing in PGMs is not the only way to make (or lose) money in the commodity market. Complex commodities have their strengths. During structural economic changes, copper is the place to be.

This is the July critical minerals overview. Since the last review, PGMs and copper have made a strong run. Platinum is the best-performing metal YTD.

Copper, palladium, and silver have also delivered attractive gains. The losers for the first half of 2025 are iron ore and zinc. Uranium has experienced a resurgence recently, following a prolonged deficit and positive news in the nuclear energy industry.

Is this the beginning of the commodity supercycle?

The ingredients are here: supply destruction and robust demand. Unlike the previous commodity bull run fueled by China's economic miracle, this one is driven by the market dynamics reminiscent of alligator jaws. Simply, rising demand and contracting supply.

The gap between the jaws is widening, thus indicating an increasing deficit. The capital cycle is a force to cope with. Depressed prices can not persist for too long because the miners cannot sell the ore below their subsistence costs.

PGM miners are a suitable example. The decade-long bear market pushed the miners to close some of their mines to reduce the burn rate and preserve cash. The result is a deepening deficit. And platinum miners are not an exception. Nearly all extractive companies faced the same fate: cut production due to low prices.

If the super cycle has started, not only will simple commodities like PGMs benefit. Take, for example, copper, classic complex, and CAPEX commodity. Since the beginning of 2025, copper has been on the move. The drawdown of inventories drives the recent surge in copper prices.

An article from Mining.com sums it up. Here is a quote:

There’s been a rapid drawdown in inventories on the London Metal Exchange and in China recently after traders moved record volumes to the US in a bid to front-run tariffs proposed by the White House.

LME stocks have dropped by about 65 % this year, while CME warehouse holdings more than doubled.

Spot copper contracts traded at steep premiums to those for later delivery, a market structure known as backwardation that indicates tight supply.

The so-called Tom/next spread, the premium of copper due for delivery in one day to contracts expiring a day later, widened again on Tuesday after peaking at $98 a tonne last week, the highest since 2021.

Declining inventories are a short-term factor. Adding copper structural deficit means the nascent bull market may transform into an extensive bull run. Copper and copper miners appear to agree.

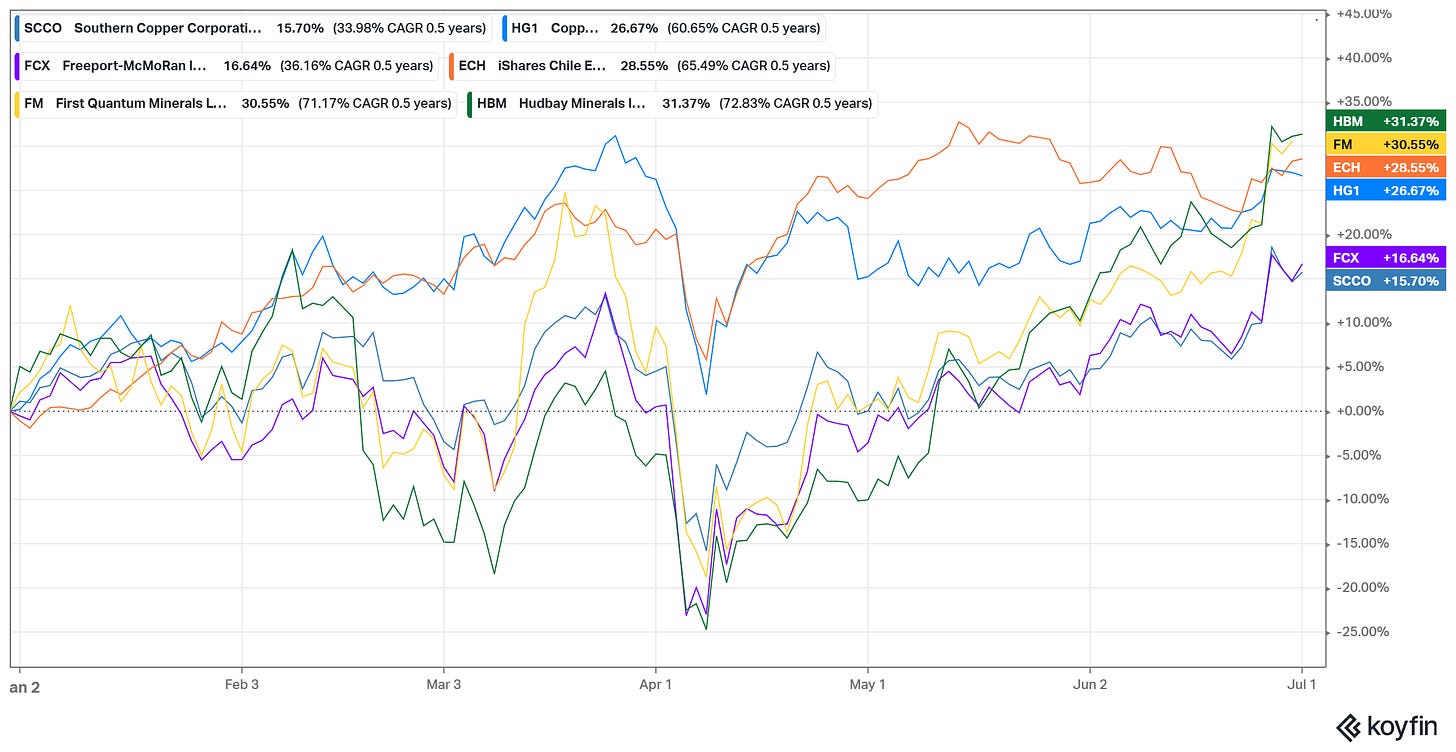

Freeport McMoran (NYSE: FCX) and Southern Copper (NYSE: SCCO) recorded double-digit gains. Hudbay Minerals (NYSE: HBM), a mid-size copper miner, is leading the pack with 31% gains YTD.

To bet on rising copper prices, investing in miners is not the only way. Think about Chile as the largest copper producer globally. Strong copper prices are a tailwind for the Chilean economy. Chilean equities have been among the best-performing markets for 1H25.

Price action remains supportive of higher copper prices.

The price held above the long-term support after the retracement, suggesting that the probabilities and payoffs are in the investor's favor.

Now let’s move into the arcane corner of the commodity market: antimony and titanium.

Antimony equities, Perpetua Resources (NYSE: PPTA) and US Antimony Corporation (NYSE: UAMY), experienced a surge in March and April; since then, their prices have retraced. This is a healthy pullback in a long-term bull market.

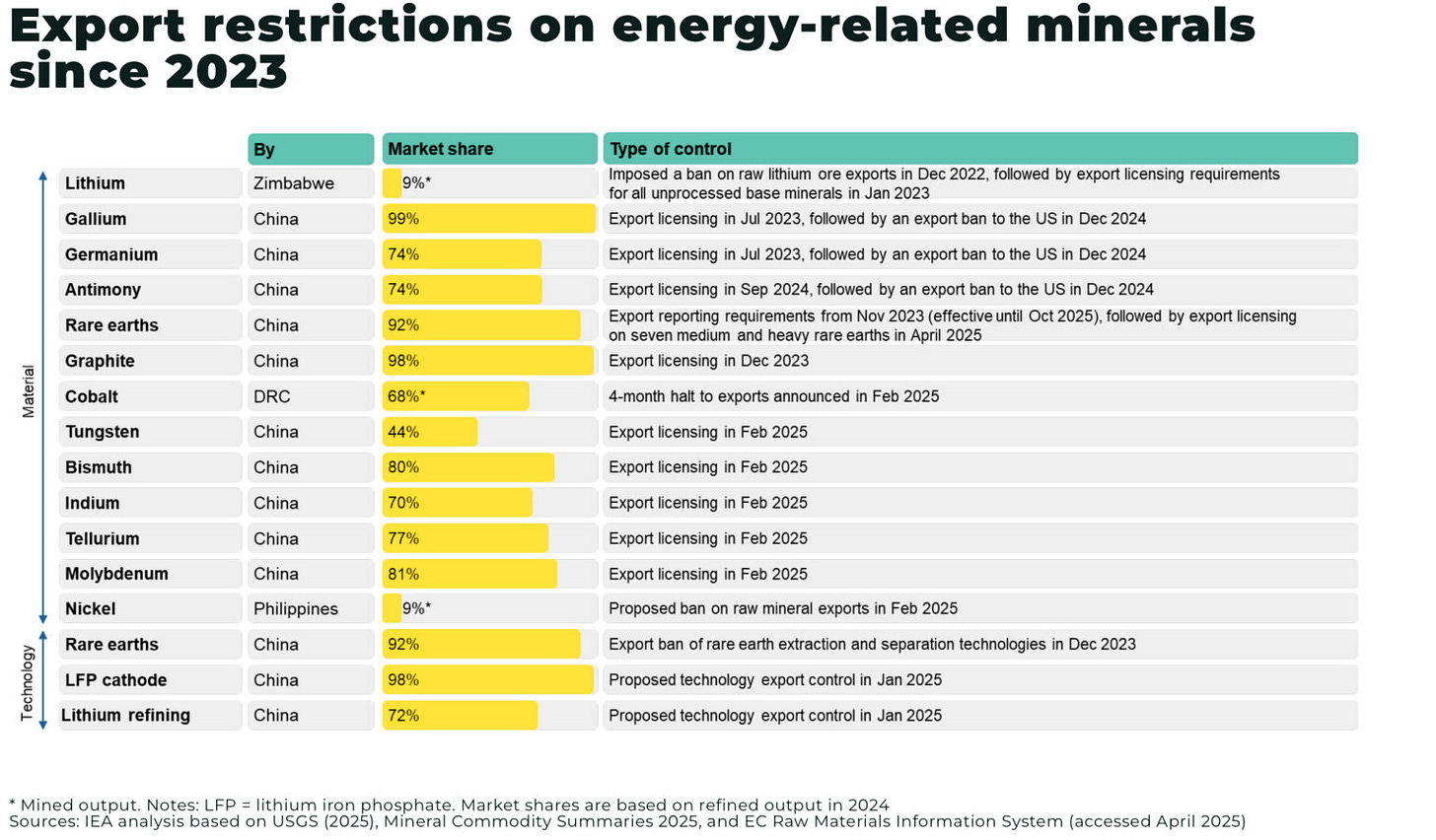

Antimony is one of the critical minerals essential for the defense industry. Its mining and production are concentrated in China. Critical minerals are a potent geoeconomic weapon, and they have been used as such. For reference, the table below (via Oregon Group):

China actively uses critical minerals to assert its economic power. The series of export restrictions is expected to continue rising.

Titanium equities are heading nowhere. The reason is that titanium is not subject to export restrictions, at least for the time being. I suggest that it will soon change.

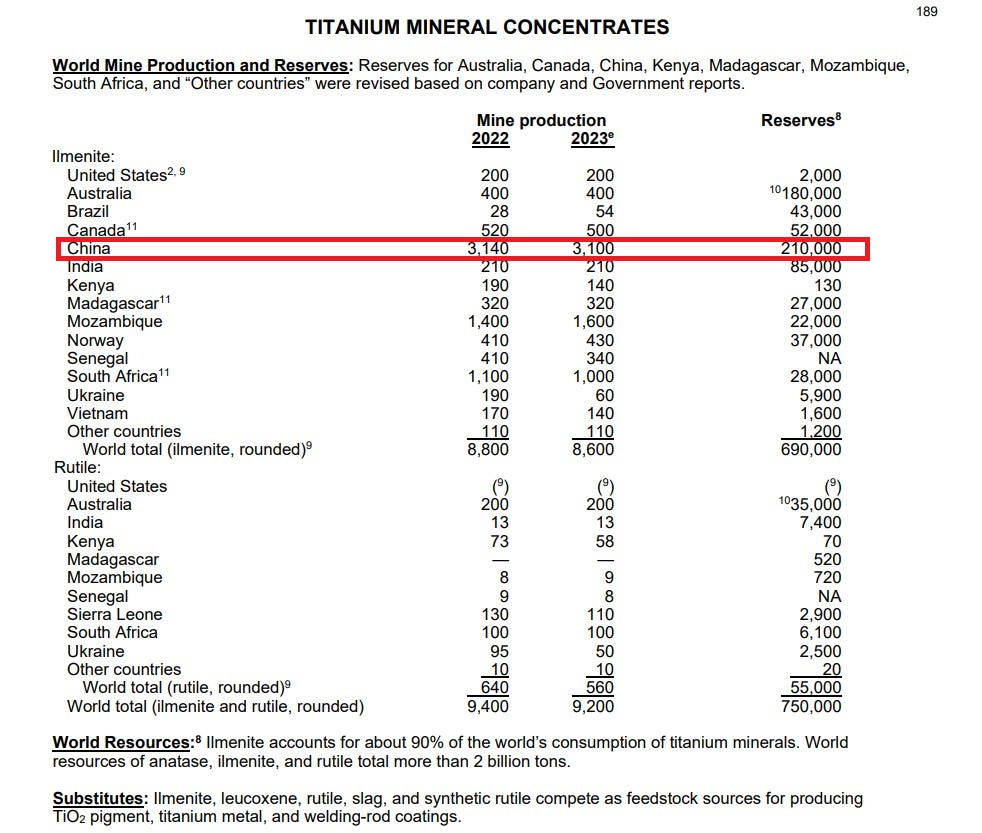

Titanium is critical to the defense industry, and China reigns supreme in the global titanium supply. Titanium is derived predominantly from the minerals ilmenite (FeTiO3) and rutile (TiO2). The largest known titanium reserves by country, in terms of ilmenite ores, are situated across a spectrum of regions. Primary ilmenite sources can be traced to the Panzhihua region in Sichuan province, China, which boasts the world's largest vanadium-titanium deposit.

The following table from USGS presents ilmenite and rutile annual production and reserves by country:

China is the undisputed leader, with a yearly output equal to the combined output of the following four contenders.

Titanium names such as Kenmare Resources (LSE: KMR), Iluka Resources (ASX: ILU), and Empire Metals Limited (ASX: EEE) are well-positioned to benefit from the titanium export restrictions imposed by China.

PS: For more actionable and asymmetric ideas on critical minerals and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.