Cyclicality means volatility. Industries like shipping, mining, and energy are inherently turbulent. The MPT postulates that the risk is measured with standard deviation, i.e., the historic volatility of an asset. This is a misleading linear assumption in a non-linear world.

That said, volatility brings not the risk but the potential for outsized rewards. That’s why I like cyclical business. I chase double-digit Alpha, so I have to pay the price.

Besides the shipping triad, there is an investor triad. We can never achieve a double-digit Alpha, low volatility, and high liquidity at once. At best, we trade one to get two. My choice is strong performance, high volatility, and ample liquidity.

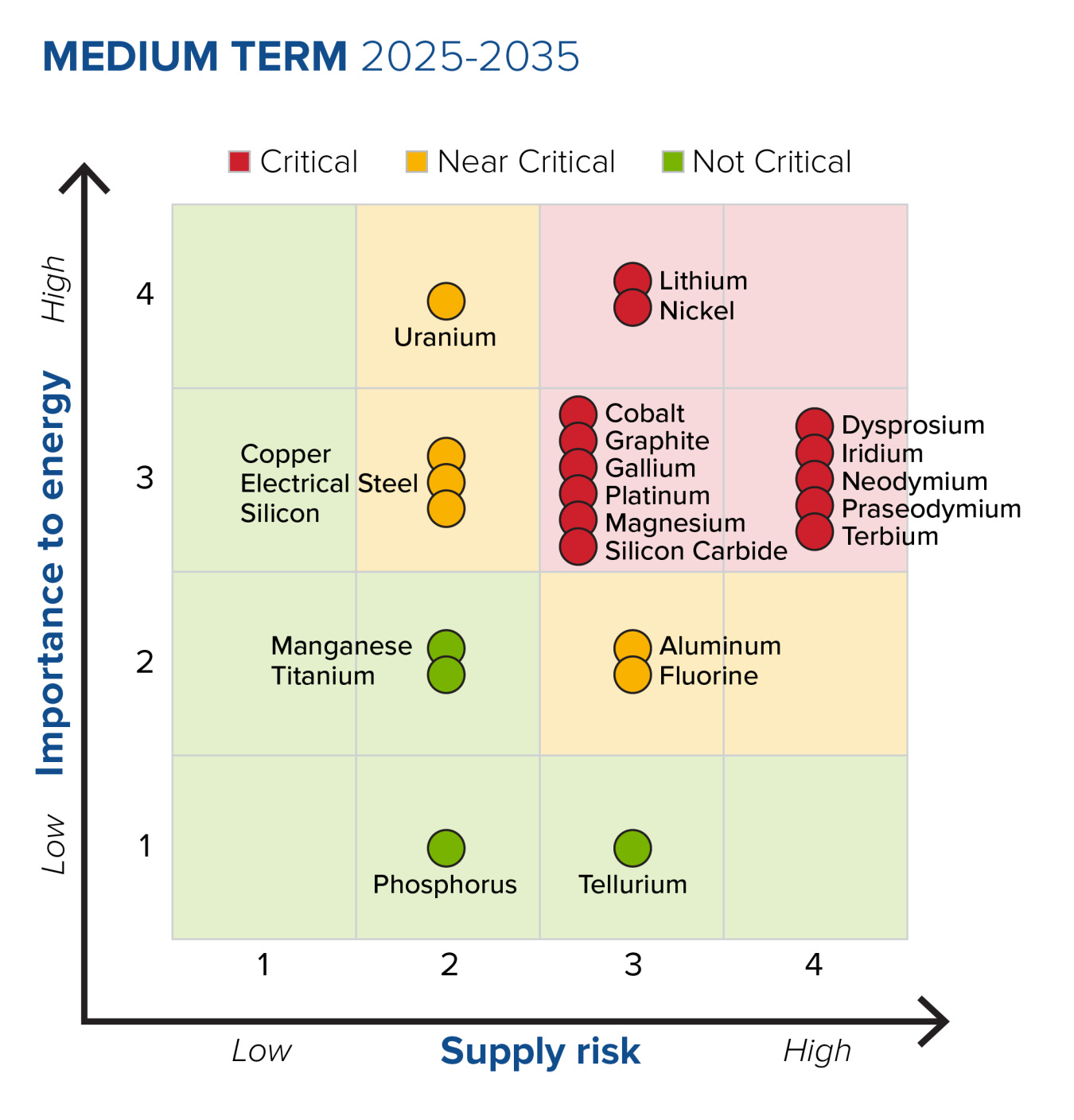

Discussing volatility, we cannot overlook one of the most volatile markets: critical minerals. This is a broad category of ores that includes everything from the boring copper to exotics like tungsten. Chart via DoE.

This is the June Critical Minerals edition. Today, I cover platinum, uranium, and copper.

Over the last few weeks, platinum investors have reaped substantial gains.

Meanwhile, REE, antimony, and tungsten investors realized mixed results. This dissonance is the charm of mining. This business is anything but homogeneous. At the same time, there is a monumental bull run along a ruinous bear market.

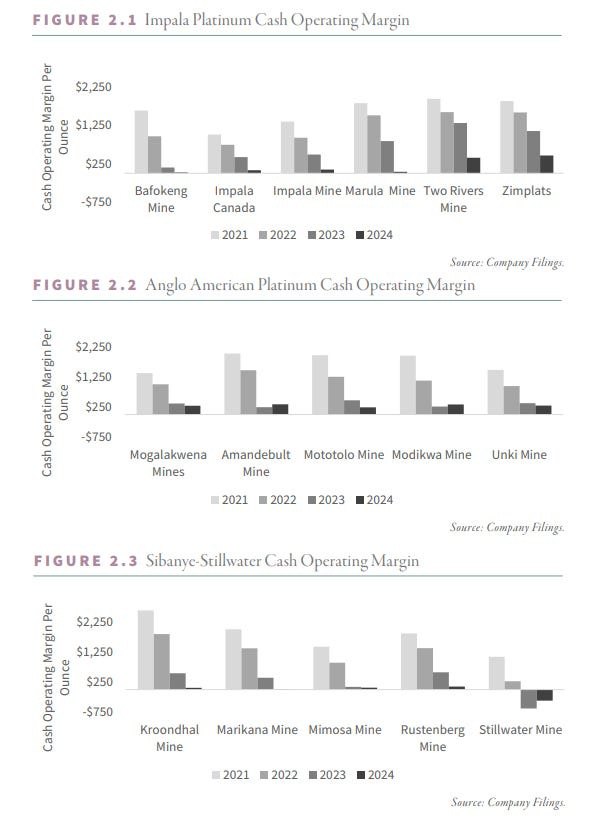

I wager that PGMs will continue to deliver robust results in the next few quarters. The platinum deficit has been deepening for the last two years. For PGM connoisseurs, the following chart tells it all. Source: Goehring & Rozencwajg 1Q25 report.

The logic is simple. Low prices sow the seeds of deficit, which ultimately leads to higher prices.

Since the beginning of 2025, the PGM prices have gained some traction:

Each of the platinum group metals has dynamics. Nevertheless, they share more similarities than differences.

In short, more than 70% of the world's platinum comes from five mines, managed by four companies, located in two provinces in South Africa. On the other hand, about 45% of the world's palladium comes from one mine, Norilsk Talnakh, in Siberia.

PGMs fall into my favorite category, simple commodities, because their supply depends on only two countries and several mines. Considering the escalation in Ukraine, sanctions on Russian PGM imports are back on the table. One more thing, Russia could also impose export restrictions on unfriendly countries. Like uranium and REE, PGMs are a geoeconomic weapon.

That said, let’s say a few words about uranium. The last few quarters were tough for uranium bulls.

During the first five months, uranium miners struggled to deliver. Then came May 23, 2025.

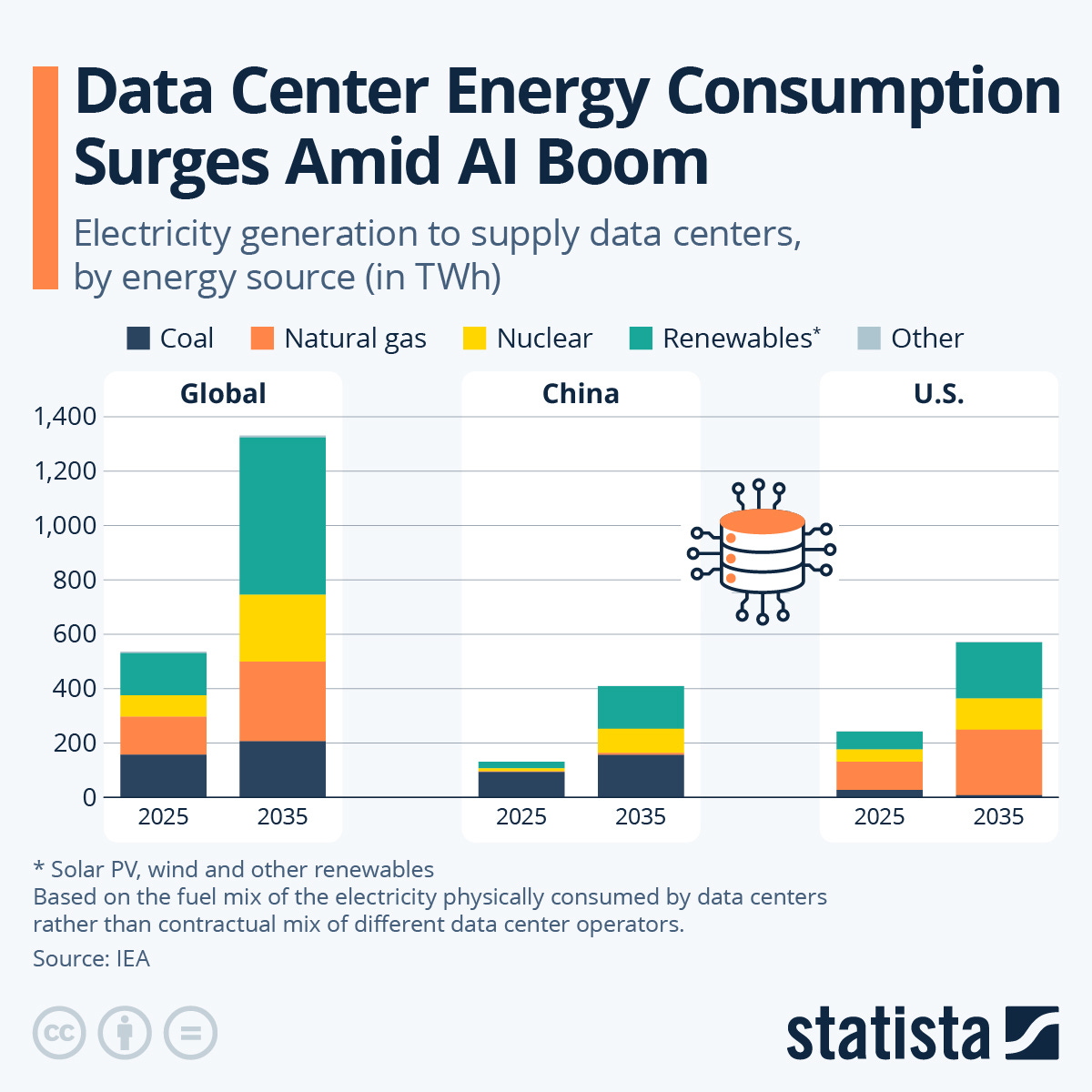

In summary, nuclear energy is cool again. The decree prioritizes the US nuclear industry as the core for security and defense. Consider data centers, nuclear triad, and energy infrastructure.

If you are long on AI, uranium is an asymmetric way to gain exposure. The equation is simple. The data centers consume enormous amounts of energy.

The portion delivered by NPPs is projected to double in the next several years. In my opinion, the projected size of the renewables supply is exaggerated at the expense of nuclear and LNG. My most plausible scenario is that the role of nuclear and LNG plants will grow significantly more than the IEA admits, or likes to admit.

After nearly a year of moving to nowhere, uranium miners responded accordingly. For uranium, like all critical minerals, such price action is so typical. In a matter of weeks, the price can double, then remain latent for quarters. Drink, rinse, repeat.

Like PGMs, Russia’s role in the nuclear fuel value chain is critical:

Conversion: 37% of all uranium is processed in Russia

Enrichment: 44% of all uranium is enriched in Russia

Bonus: Russia mines over 10% of the world's uranium

Depending on how the war in Ukraine develops, harsh export restrictions are back on the table.

Now let’s move on to one of the most underappreciated metals, Dr. Copper. This week brought good news for the Pebble project, the largest underdeveloped copper asset. The project is located in Alaska, and the EPA vetoed it a few years ago.

The Department of the Interior plans to lift some restrictions on the Arctic region. For mining and energy companies, this is more than welcome. Northern Dynasty Minerals (NYSE: NAK) is the owner of Pebble. One step at a time, the company moves closer to resolving the Pebble dispute.

Since the Trump victory, the NAK price has tripled, and YTD delivered more than a 100% gain:

For reference, big names like Freeport McMoran (NYSE: FCX) and Southern Copper (NYSE: SCCO) are scratching the surface with low single-digit gains.

I expect the majors to catch up in the coming quarters. Copper price action is constructive.

Price made a confirmed breakout above the inverted Head and Shoulders pattern on a monthly chart. The May candle was a correction following a breakout. Such configurations come with odds tilted in favor of investors. In other words, the likelihood of higher prices exceeds the odds of lower prices.

In conclusion, I will share one idea on how to bet on the copper bull market. FCX is one of the easiest ways to invest in copper. Plus, the company offers a variety of liquid options.

Price action is not constructive yet. The price is hovering below the 12-month moving average (MMA) and adjacent to a significant level of resistance.

Given those conditions, I would initiate a tiny position (below 30 bps risk) in January 2027 DOTM calls.

If the price successfully moves above the $48.00 level, I would also consider establishing an equity position.

This was the Critical Minerals report for June. Next week, we are back to deepwater oil fields, reviewing oil rigs and OSVs.

PS: For more actionable and asymmetric ideas on critical minerals and beyond, consider TheOldEconomy premium plans: Researcher and Strategist.

Thank you for being part of TheOldEconomy. Here’s to your continued growth and success, one wise decision at a time.

Invest wisely,

Mihail Stoyanov

Founder, TheOldEconomy

Everything described in this site, TheOldEconomy.substack.com, has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

https://open.substack.com/pub/triplesinvesting/p/northern-dynasty-minerals?utm_source=share&utm_medium=android&r=24u473