Market participants have been doing what they do best: forgetting the past and extrapolating the present into the future. The consensus is that the FED slayed the inflationary monster, so it's time for the printer to go BRRR.

The Black Monday 2024 edition abruptly swung the narrative pendulum into panic mode for a while. The recession narrative became trendy again. Sahm Rule was dusted from economic textbooks and cited as a 100% success rate indicator. After rapid market recovery, recession voices toned down and shelved again Sahm rule…until the next time.

Some analysts say the Fed is late in lowering interest rates, judging by rising unemployment. My view is different—holding rates higher is necessary to weed out the inefficient businesses from the profitable ones. Since 2008, cheap money has artificially kept inefficient enterprises alive.

In the long term, this is not economically viable. These companies borrow from the future. They do not create value but destroy capital because such businesses take a free ride at the expense of profitable enterprises.

Forestry can teach one or two things about business. Low-severity fires reduce the canopy in forests, allowing sunlight to reach the forest floor. The combination of new light, open space, and nutrient-rich ash for the soil creates the perfect conditions for new plants.

By letting questionable businesses go bankrupt, financing is made available for profitable companies. I admit that initially, it will be painful because of mass layoffs and bankruptcies. However, in the long term, it will pay off handsomely.

My view is not politically correct and thus has zero chance of becoming a reality. An election is coming, and the strong economy (at least on the surface) and bull markets are part of any politician’s PR campaign.

What does the past can teach us about interest rates?

Incentives and results

In the 1970s, the Fed raised the interest rate from 4.75% in December 1969 to 14% at the decade's end. There is no reason to reject a similar scenario in the years ahead. That cyclical inflation is relatively low does not counteract the secular trend.

The Fed's long-awaited interest rate cut will trigger inflationary processes again. The Fed assumes the fire has been extinguished, but it has not. Inflationary pressures are glowing under the surface, and lower interest rates will add fuel to the fire.

Today's FED decisions are a consequence of their past decisions. This is precisely why the Fed has fewer ways out of the situation. They have poured as much money into the system in the last five years as in the previous 200, while the economy hasn't grown much. FED policies remind me of the Cobra Effect.

In 19th-century India, cobras were an acute problem. To deal with them, the British authorities found a solution: to give a bounty to every cobra killed. People started hunting cobras to collect rewards. Initially, the program was a huge success—until someone thought of breeding snakes only to kill them later for the bounty.

Cobra farms sprung up all over India. The British authorities realized their mistake, but it was too late. They terminated the program, and the cobra farmers no longer had the incentives to breed snakes, so they released them into the wild, which led to the massive growth of the cobra population.

What is the moral of the story? Measures with good intentions can achieve negative results. The key word is incentives.

The FED and the Treasury are two sides of the same coin, as are the cobra farmers and the British administration. Killed cobras means more “free” money. Economist Horst Siebert coined the phrase "Cobra Effect." He describes it as a perverse incentive that inadvertently rewards people for worsening the problem.

With less wiggle room and being motivated by "free" money, the Fed has to make the least wrong decision. The choice is between the banking system and inflation. Bonds held to maturity still pose a severe risk to regional US banks, and another round of 2023-like defaults could trigger a cascade of unexpected effects.

On the surface, inflation seems undesirable. However, looking closer, the truth is different. Inflation is the borrowers' first friend. Nowadays, the biggest borrowers are the governments. Especially after the K19, "free" money is the new normal.

An example is the statement by Mario Draghi, the former governor of the ECB. In September, he said that €800 billion is needed to make the EU competitive with China and the US. Draghi's statement suggests the mood at the ECB and that “The printer is coming.”

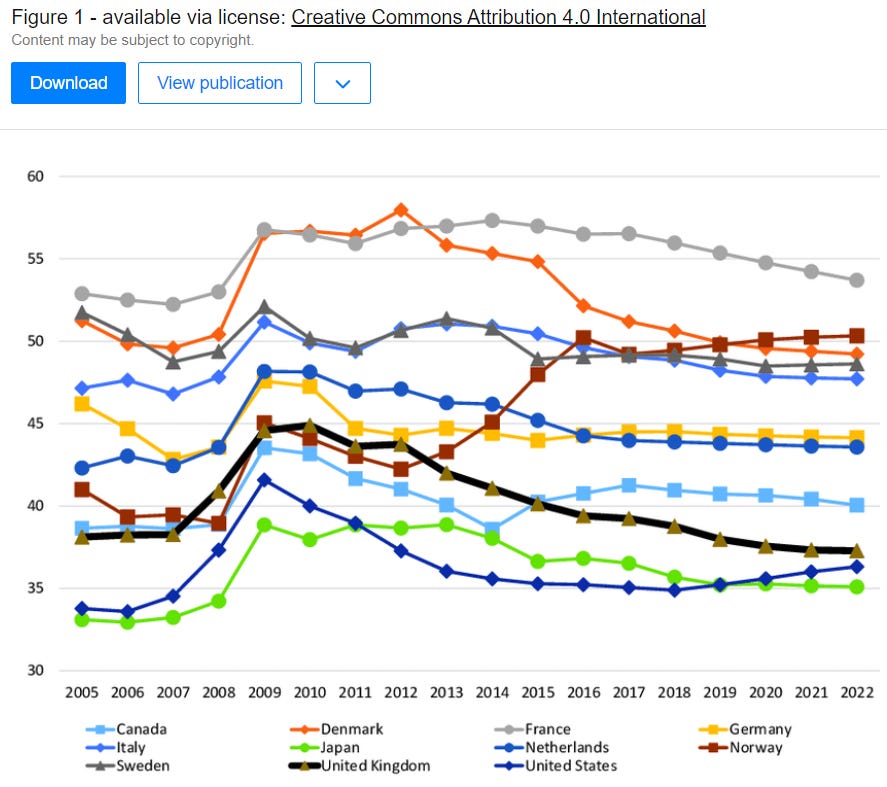

Governments will continue to be the biggest debtors. Debt is being transferred from the private to the public sector. Moreover, governments are playing an increasing role in the economy, as measured by GDP. The following graph shows that this percentage is as high as 50% among developed economies.

Governments are getting bigger, but that does not mean they are more efficient. As with any complex system, quantitative shifts stop bringing qualitatively positive changes after an inflection point. Governments are not excluded from that rule.

In the past two decades, we have witnessed extensive state apparatus growth in all Western countries. An increasing number of bureaucrats are appointed to create, implement, enforce, and control regulations. Endless regulations give scope for the cobra effect.

My thesis is that governments are becoming less reliable borrowers because politicians lack the right incentives, and the public debt is ever-growing.

In conclusion, I believe the Fed will kill two birds with one stone by lowering interest rates: first, it will mitigate banking system risk, and second, it will reduce government debt value in real terms. Rising inflation is a price the Fed must pay to achieve its goals.

How do I play the game?

Structural inflation is more persistent than the majority expects. A few lower CPI prints do not imply that inflation is gone. We have all the ingredients for reigniting inflation in the winter months.

How does that apply to my view on the markets?

The short answer is that I am long chaos. I see rising disorder in the economy, politics, and finance. That being said, I seek antifragile themes that thrive in turbulent times, which translates into four main themes.

LatAm revival: Argentinean and Brazilian equities

Floating assets: floating LNGs, Capesize bulkers, small LPG carriers, and ice-class LNG carriers

Fiat money devaluation: gold and silver

Those themes will play out in the coming 2-3 years. Let’s say a few words about every point.

China and Russia dominate critical minerals production and processing. It gives them strong hands in the geopolitical poker game. With rising global chaos, the role of export restrictions as a geoeconomic lever will only grow. I believe uranium and platinum are the best ways to bet on that theme.

South America has the lowest geopolitical risk. The reason is simple: one religion and two similar languages dominate the continent. In addition, LatAm has formidable oil and mineral reserves, an abundance of fertile land, and healthy demographics. In my opinion, Argentina and Brazil offer the best risk-reward.

Floating steel thrives in times of uncertainty and volatility. Yet, not all ships are equal. Considering supply fundamentals (order book, aging fleet, shipyard capacity) and growing tonne-mile demand, I find Capesiez bulkers, small LPG carriers, and ice-class LNGs the most lucrative ideas.

Floating LNGs deserve special mention. Global LNG demand is growing, and geopolitical chaos is rising. Having an asset capable of delivering liquefication as a service at any point in the world is a massive advantage. Most importantly, such assets are scarce and costly to build.

Fiat money devaluation became the norm. I believe we are approaching an inflection point in the next 10-15 years when economic systematic issues will become unrepairable. The reason is not a secret. For the last 16 years, the debt growth rate has been higher than the production growth rate. There is no cheat code to escape consequences. Owning gold/silver and gold/silver-based financial assets provides protection and the proverbial Alpha.

Position accordingly.

Everything described in this report has been created for educational purposes only. It does not constitute advice, recommendation, or counsel for investing in securities.

The opinions expressed in such publications are those of the author and are subject to change without notice. You are advised to do your own research and discuss your investments with financial advisers to understand whether any investment suits your needs and goals.

Full disclosure: I do not hold a position in any mentioned companies when publishing this article. Note that this is a disclosure, not a recommendation to buy or sell.